INmune Bio Inc. Announces Second Quarter 2025 Results, Provides Business Update and Announces Management Changes

Rhea-AI Summary

INmune Bio (NASDAQ: INMB) reported Q2 2025 financial results and announced significant management changes. The company's MINDFuL phase 2 trial for Alzheimer's missed its primary cognitive endpoints in the overall population but showed positive trends in a pre-defined subset of patients with inflammation biomarkers. The company reported a net loss of $24.5 million for Q2 2025, compared to $9.7 million in Q2 2024.

Key developments include CEO RJ Tesi's retirement, with David Moss appointed as President & CEO, Cory Ellspermann as Interim CFO, and Kelly Ganjei as Board Chairman. The company successfully closed a $19 million registered direct offering and ended the quarter with $33.4 million in cash. INmune Bio plans to file MAA and BLA applications for CORDStrom™ in RDEB by mid-2026.

Positive

- Secured $19 million through registered direct offering

- Maintained strong cash position of $33.4 million as of Q2 2025

- XPro™ showed positive trends in pre-defined subset of Alzheimer's patients with inflammation biomarkers

- Successful partnership with CGT Catapult for commercial-ready manufacturing

- Met primary endpoint in phase I CARE-PC trial with INKmune®

Negative

- MINDFuL phase 2 trial missed primary cognitive endpoints in overall population

- Net loss increased to $24.5 million in Q2 2025 from $9.7 million in Q2 2024

- $16.5 million impairment charge on acquired research and development assets

- CEO transition could create temporary leadership uncertainty

News Market Reaction

On the day this news was published, INMB declined 8.24%, reflecting a notable negative market reaction. Argus tracked a trough of -18.0% from its starting point during tracking. Our momentum scanner triggered 22 alerts that day, indicating elevated trading interest and price volatility. This price movement removed approximately $7M from the company's valuation, bringing the market cap to $74M at that time.

Data tracked by StockTitan Argus on the day of publication.

Company to Host Conference Call Today, August 7th, at 4:30pm ET

BOCA RATON, Fla., Aug. 07, 2025 (GLOBE NEWSWIRE) -- INmune Bio Inc. (NASDAQ: INMB) (the “Company”), a clinical-stage immunology company focused on developing treatments that harness the patient’s innate immune system to fight disease, today announces its financial results for the quarter ended June 30, 2025 and provides a business update.

Q2 2025 and Recent Corporate Highlights

DN-TNF Platform Highlights (XPro™):

- Released top-line data from the MINDFuL phase 2 trial in 208 patients with MCI and early Alzheimer’s.

- The trial missed its primary cognitive endpoints in the 200 modified mITT patients enrolled, however;

- XPro™ demonstrated a positive impact on the primary cognitive endpoint EMACC in a pre-defined subset of 100 patients (

50% ) with two or more biomarkers of inflammation, defined as the enriched population.

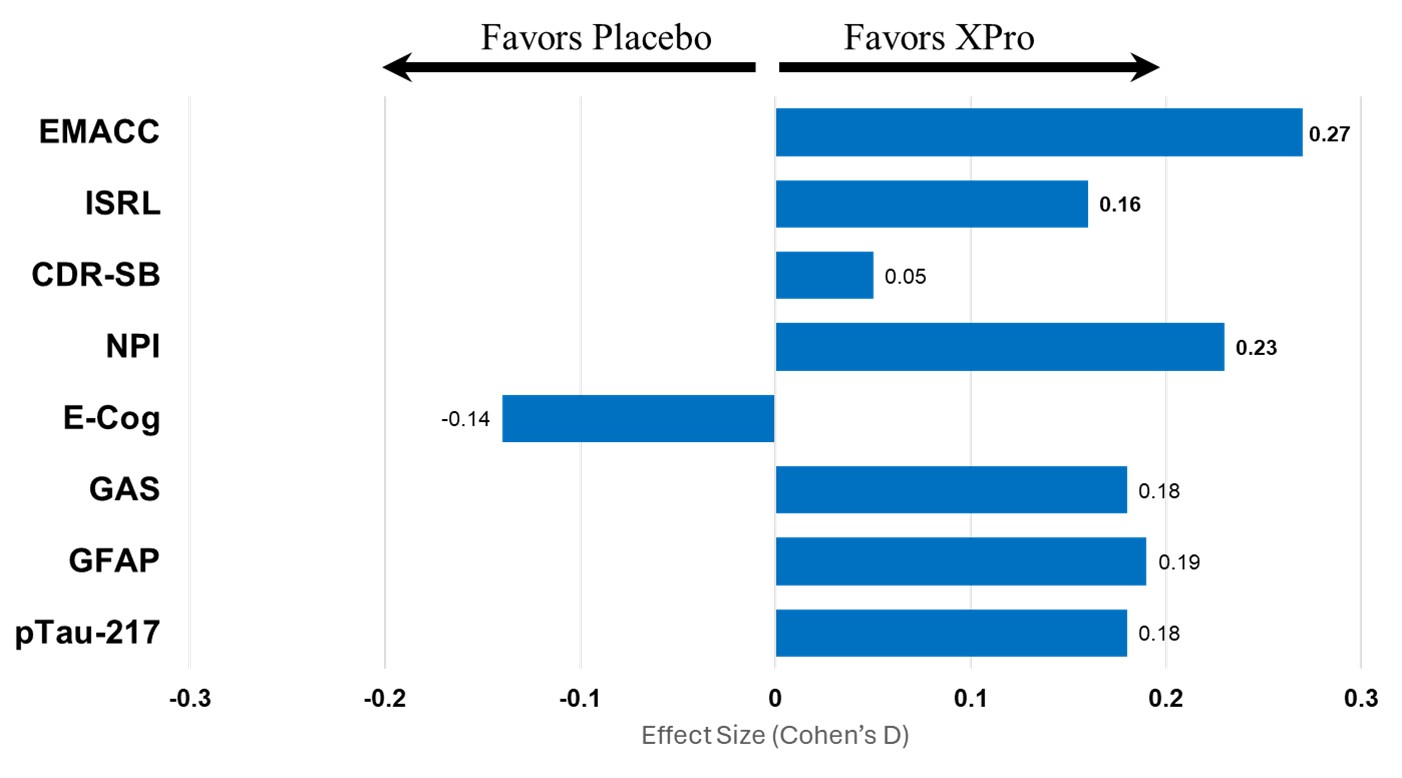

- Additional data from the MINDFuL trial was presented by a Key Opinion Leader, Dr. Sharon Cohen of the Toronto Memory Program, at the Alzheimer’s Association International Conference (AAIC) on July 29th. This data is summarized in the forest plot below.

Figure Legend: With the enriched population underpowered for detecting statistically significant changes, the Company and third-party statisticians relied on Cohen’s d effect sizes to evaluate the meaningfulness of observed changes. These effect sizes, though small, consistently favored XPro™ over placebo on the primary endpoint and multiple secondary and exploratory endpoints (see figure). Across most endpoints, XPro™ showed favorable trends, with effect sizes approaching the 0.2 threshold for clinical relevance.

The clinical endpoints shown in the forest plot include:

- EMACC (Early Mild Alzheimer's Cognitive Composite)-Performance-based measure of Cognition: empirically derived composite of neuropsychological tests that are widely used in clinics.

- ISRL (International Shopping List Test, delayed recall) – Performance-based measure of Memory. Delayed recall component of widely used word-list learning test.

- CDR-SB (Clinical Dementia Rating Scale – Sum of Boxes) – Clinician-rated measure that combines Cognition and Function: interview with study partner and patient as well as some performance-based items completed by patient.

- NPI (Neuropsychiatric Interview) - Caregiver-reported measure of the patient's psychiatric symptoms.

- ECog (Everyday Cognition) - Caregiver reported questionnaire: caregiver rates the patient's change in cognition (skills now as compared to 10 years ago – prior to cognitive decline)

- GAS (Goal Attainment Scale) Personalized Patient and caregiver-rated scale where the specific goals and items are chosen by patient and caregiver and they rate change on the goals over the course of the study.

- Presented a poster at the Keystone Symposia that showed that XPro™ significantly reduces amyloid formation and improves clinical measures of brain function in patients with TBI (Traumatic Brain Injury).

CORDStrom™ Platform:

- Received a favorable written opinion from The United States Patent and Trademark Office (USPTO), acting as the International Search Authority, on all claims in INmune Bio’s international patent application PCT/US25/17028, titled “THERAPEUTIC COMPOSITIONS COMPRISING POOLED, CULTURE-EXPANDED HUMAN UMBILICAL CORD DERIVED MESENCHYMAL STROMAL CELLS.”

- Partnered with the Cell and Gene Therapy Catapult (CGT Catapult) to establish large-scale, commercial-ready manufacturing for CORDStrom™ and the Company's other cell therapy platforms. This is an essential part of our ambitious timeline to transfer the manufacturing site, validate the large-scale manufacturing process and all of the analytical assays in time for MAA and BLA submissions next year. Much of this work continues to provide data to strengthen our existing IP position portfolio.

- The complete database of clinical data from the randomized, double-blind trial of CORDStrom™ in Recessive Dystrophic Epidermolysis Bullosa (RDEB) has now been delivered from the trial sponsor to an independent statistical analysis company which is applying a statistical analysis plan devised by INmuneBio. We believe this will enrich the data presented by the Sponsor previously and we anticipate the data being available in Q4.

INKmune® Platform:

- Following success in meeting the primary endpoint at completion of the phase I aspect of the CARE-PC trial we opened the phase II in Q1 this year and quickly enrolled the first three patients. Early analysis of blood samples for the biomarkers of interest demonstrated that both secondary endpoints of NK activation and NK cell proliferation in vivo had been met.

- Determined that patients with low NK cell function responded better to treatment, with substantial increases in NK cell potency. This allows us to screen patients in future trials to direct treatment only to those with the ability to respond, in the same way that patients have been screened for suitability for treatment with checkpoint inhibitor drugs.

- We await receipt of results of PSMA-PET scans for most of the trial subjects, although initial results from the phase I patients showed reduction or control of individual lesions in a background of worsening disease.

- Having reviewed the current data, we concluded that the CARE-PC trial has provided all the data needed to design a future randomized trial and we have closed the trial to further recruitment to ensure completion of follow-up by end of Q4 of 2025 as planned.

Corporate:

- Dr. RJ Tesi retires as CEO.

- David Moss appointed President & CEO and to the Board of Directors.

- Cory Ellspermann appointed as Interim CFO.

- Kelly Ganjei appointed as Chairman of the Board.

- Closed a

$19 million registered direct offering.

Upcoming Events and Milestones:

- End of phase 2 meeting regarding the MINDFuL trial with the FDA expected to take place in the fourth quarter.

- The Company will file a publication on the MINDFuL trial results expected to be available this month.

- The Company remains on track to file a Marketing Authorization Application (MAA) in the UK and Biologic License Application (BLA) for CORDStrom™ in RDEB by mid-2026.

- We have ambitious plans to develop a pipeline of additional indications for CORDStrom™ which we will pursue with non-dilutive funding or partnerships.

- Additional data from Greater Orman Street Hospital on RDEB patients treated with CORDStrom™ expected in the fourth quarter.

- More patient data from the INKmune® ongoing phase 2 trial in metastatic castration-resistant prostate cancer will be released as it becomes available.

Financial Results for the Second Quarter Ended June 30, 2025:

- Net loss attributable to common stockholders for the quarter ended June 30, 2025 was approximately

$24.5 million , compared to approximately$9.7 million during the quarter ended June 30, 2024.

- Research and development expenses totaled approximately

$5.8 million for the quarter ended June 30, 2025, compared to approximately$7.1 million during the quarter ended June 30, 2024.

- General and administrative expenses were approximately

$2.3 million for the quarter ended June 30, 2025, compared to approximately$2.8 million during the quarter ended June 30, 2024.

- Impairment of acquired in-process research and development intangible assets was

$16.5 million during the quarter ended June 30, 2025 compared to none recorded during the quarter ended June 30, 2024.

- Other income, net was approximately

$0.1 million for the quarter ended June 30, 2025, compared to approximately$0.1 million during the quarter ended June 30, 2024.

- As of June 30, 2025, the Company had cash and cash equivalents of approximately

$33.4 million .

- As of August 7, 2025, the Company had approximately 26.6 million common shares outstanding.

Earnings Call Information

To participate in this event, dial approximately 5 to 10 minutes before the beginning of the call. Please ask for the INmune Bio First Quarter Conference Call when reaching the operator.

Date: August 7th, 2025

Time: 4:30 PM Eastern Time

Participant Dial-in: 1-800-225-9448 Participant Dial-in (international): +1-203-518-9783

Conference ID: INMUNE

A live audio webcast of the call can be accessed by clicking here or using this link:

https://viavid.webcasts.com/starthere.jsp?ei=1719932&tp_key=2300519883

A transcript will follow approximately 24 hours from the scheduled call. A replay will also be available through August 21, 2025 by dialing 1-844-512-2921 or 1-412-317-6671 (international) and entering pin no. 11159128.

About XPro™

XPro™ is a next-generation inhibitor of tumor necrosis factor (TNF) that acts differently than currently available TNF inhibitors in that it neutralizes soluble TNF (sTNF), without affecting trans-membrane TNF (tmTNF) or TNF receptors. XPro™ could have potential substantial beneficial effects in patients with neurologic disease by decreasing neuroinflammation. For more information about the importance of targeting neuroinflammation in the brain to improve cognitive function and restore neuronal communication visit this section of the INmune Bio’s website.

About CORDStrom™

CORDStrom™ is a patent-pending cell medicine comprising aseptic, allogeneic, pooled human umbilical cord-derived mesenchymal stromal cells (hucMSCs) in suspension for injection or infusion. The CORDStrom™ platform leverages, among other things, proprietary screening, pooling and expansion techniques to create off-the-shelf, allogeneic, pooled hucMSCs as medicines to treat complex inflammatory diseases. CORDStrom™ products are designed to provide high-quality, off-the-shelf, batch-to-batch consistent, scalable, cGMP manufactured, potent cellular medicines that can be produced at low cost and with repeatable specification independent of donor characteristics. The CORDStrom™ product platform shares many similarities, including reagents, equipment, and procedures, with the Company’s INKmune® oncology product, enabling the Company to leverage economies of scale, experienced staff, and other resources to strategically manufacture both products in a rotational campaign with resource and environmental efficiencies.

Initially developed at the INKmune® manufacturing facilities utilizing UK academic grant funding, CORDStrom™ is an MSC product platform that shows promise as a first systemic therapy for potentially treating RDEB and many other debilitating conditions. While the first generation CORDStrom™ product is agnostic to disease indication, the platform enables creation of indication-specific products, which can be tuned for optimization of anti-inflammatory, immunomodulatory, wound healing, and other characteristics.

About INKmune®

INKmune® is a pharmaceutical-grade, replication-incompetent human tumor cell line which conjugates to resting NK cells and delivers multiple, essential priming signals to convert the cancer patient’s resting NK cells into tumor killing memory-like NK cells (mlNK cells). INKmune® treatment converts the patient’s own NK cells into mlNK cells. In patients, INKmune® primed tumor killing NK cells have persisted for more than 100 days. These cells function in the hypoxic TME because due to upregulated nutrient receptors and mitochondrial survival proteins.

INKmune® is a patient friendly drug treatment that does not require pre-medication, conditioning or additional cytokine therapy to be given to the patients. INKmune® is easily transported, stored and delivered to the patient by a simple intravenous infusion as an out-patient. INKmune® is tumor agnostic; it can be used to treat many types of NK-resistant tumors including leukemia, lymphoma, myeloma, lung, ovarian, breast, renal and nasopharyngeal cancer. INKmune® is treating patients in an open label Phase I/II trial in metastatic castration-resistant prostate cancer in the US this year.

About INmune Bio Inc.

INmune Bio Inc. is a publicly traded (NASDAQ: INMB), clinical-stage biotechnology company focused on developing treatments that target the innate immune system to fight disease. INmune Bio has three product platforms: the Dominant-Negative Tumor Necrosis Factor (DN-TNF) product platform utilizes dominant-negative technology to selectively neutralize soluble TNF, a key driver of innate immune dysfunction and a mechanistic driver of many diseases. DN-TNF product candidates are in clinical development to determine if they can treat Alzheimer’s disease and other indications (XPro™). The Natural Killer Cell Priming Platform includes INKmune® developed to prime a patient’s NK cells to eliminate minimal residual disease in patients with cancer and is currently in trials in metastatic castration-resistance prostate cancer. The third program, CORDStrom™, is a proprietary allogeneic, pooled, human umbilical cord-derived mesenchymal Stromal cell (hucMSCs) platform that recently completed a blinded randomized trial in recessive dystrophic epidermolysis bullosa. INmune Bio’s product platforms utilize a precision medicine approach for diseases driven by chronic inflammation and cancer.

Forward Looking Statements

Clinical trials are in early stages and there is no assurance that any specific outcome will be achieved. Any statements contained in this press release related to the development or commercialization of product candidates and other business and financial matters, including without limitation, trial results and data, including the results of the Phase 2 MINDFuL trial, the timing of key milestones, future plans or expectations for the treatment of XPro™, and the prospects for receiving regulatory approval or commercializing or selling any product or drug candidates may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein are based on current expectations but are subject to several risks and uncertainties. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements because of these risks and uncertainties. CORDStrom™, XPro1595 (XPro™, pegipanermin), and INKmune® have either finished clinical trials, are still in clinical trials or are preparing to start clinical trials and have not been approved by the US Food and Drug Administration (FDA) or any regulatory body and there cannot be any assurance that they will be approved by the FDA or any regulatory body or that any specific results will be achieved. The factors that could cause actual future results to differ materially from current expectations include, but are not limited to, risks and uncertainties relating to the Company’s ability to produce more drug for clinical trials; the availability of substantial additional funding for the Company to continue its operations through 2026 and to conduct research and development, clinical studies and future product commercialization; and, the Company’s business, research, product development, regulatory approval, marketing and distribution plans and strategies. These and other factors are identified and described in more detail in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q and the Company’s Current Reports on Form 8-K. The Company assumes no obligation to update any forward-looking statements to reflect any event or circumstance that may arise after the date of this release.

Company Contact:

David Moss

(561) 710-0512

info@inmunebio.com

Daniel Carlson

Head of Investor Relations

(415) 509-4590

dcarlson@inmunebio.com

The following tables summarize our results of operations for the periods indicated:

| INMUNE BIO INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except share and per share amounts) (Unaudited) | |||||||

| June 30, 2025 | December 31, 2024 | ||||||

| ASSETS | |||||||

| CURRENT ASSETS | |||||||

| Cash and cash equivalents | $ | 33,374 | $ | 20,922 | |||

| Research and development tax credit receivable | 1,605 | 1,181 | |||||

| Other tax receivable | 550 | 228 | |||||

| Prepaid expenses and other current assets | 505 | 331 | |||||

| TOTAL CURRENT ASSETS | 36,034 | 22,662 | |||||

| Equipment | 706 | - | |||||

| Operating lease – right of use asset | 374 | 307 | |||||

| Other assets | 570 | 79 | |||||

| Acquired in-process research and development intangible assets | - | 16,514 | |||||

| TOTAL ASSETS | $ | 37,684 | $ | 39,562 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

| CURRENT LIABILITIES | |||||||

| Accounts payable and accrued liabilities | $ | 7,671 | $ | 6,539 | |||

| Accounts payable and accrued liabilities – related parties | 184 | 25 | |||||

| Deferred liabilities | 511 | 517 | |||||

| Operating lease, current liabilities | 220 | 140 | |||||

| TOTAL CURRENT LIABILITIES | 8,586 | 7,221 | |||||

| Long-term operating lease liabilities | 231 | 244 | |||||

| TOTAL LIABILITIES | 8,817 | 7,465 | |||||

| COMMITMENTS AND CONTINGENCIES | |||||||

| STOCKHOLDERS’ EQUITY | |||||||

| Preferred stock, | - | - | |||||

| Common stock, | 27 | 22 | |||||

| Additional paid-in capital | 226,904 | 195,754 | |||||

| Accumulated other comprehensive loss | (763 | ) | (575 | ) | |||

| Accumulated deficit | (197,301 | ) | (163,104 | ) | |||

| TOTAL STOCKHOLDERS’ EQUITY | 28,867 | 32,097 | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 37,684 | $ | 39,562 | |||

| INMUNE BIO INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (In thousands, except share and per share amounts) (Unaudited) | |||||||||||||||

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | ||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||

| REVENUE | $ | - | $ | - | $ | 50 | $ | 14 | |||||||

| OPERATING EXPENSES | |||||||||||||||

| General and administrative | 2,253 | 2,812 | 4,569 | 5,150 | |||||||||||

| Research and development | 5,804 | 7,053 | 13,443 | 15,746 | |||||||||||

| Impairment of acquired in-process research and development intangible assets | 16,514 | - | 16,514 | - | |||||||||||

| Total operating expenses | 24,571 | 9,865 | 34,526 | 20,896 | |||||||||||

| LOSS FROM OPERATIONS | (24,571 | ) | (9,865 | ) | (34,476 | ) | (20,882 | ) | |||||||

| OTHER INCOME, NET | 113 | 119 | 279 | 111 | |||||||||||

| NET LOSS | $ | (24,458 | ) | $ | (9,746 | ) | $ | (34,197 | ) | $ | (20,771 | ) | |||

| Net loss per common share – basic and diluted | $ | (1.05 | ) | $ | (0.50 | ) | $ | (1.49 | ) | $ | (1.11 | ) | |||

| Weighted average common shares outstanding – basic and diluted | 23,298,455 | 19,307,323 | 22,899,539 | 18,666,898 | |||||||||||

| COMPREHENSIVE LOSS | |||||||||||||||

| Net loss | $ | (24,458 | ) | $ | (9,746 | ) | $ | (34,197 | ) | $ | (20,771 | ) | |||

| Other comprehensive income (loss) – foreign currency translation | (153 | ) | (44 | ) | (188 | ) | 86 | ||||||||

| Total comprehensive loss | $ | (24,611 | ) | $ | (9,790 | ) | $ | (34,385 | ) | $ | (20,685 | ) | |||

| INMUNE BIO INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) | |||||||

| For the Six Months Ended June 30, | |||||||

| 2025 | 2024 | ||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||

| Net loss | $ | (34,197 | ) | $ | (20,771 | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

| Stock-based compensation | 3,610 | 4,129 | |||||

| Accretion of debt discount | - | 58 | |||||

| Impairment of acquired in-process research and development intangible assets | 16,514 | - | |||||

| Changes in operating assets and liabilities: | |||||||

| Research and development tax credit receivable | (424 | ) | (1,238 | ) | |||

| Other tax receivable | (322 | ) | 267 | ||||

| Prepaid expenses | (174 | ) | 497 | ||||

| Prepaid expenses – related party | - | 142 | |||||

| Other assets | (491 | ) | 50 | ||||

| Accounts payable and accrued liabilities | 1,132 | 1,381 | |||||

| Accounts payable and accrued liabilities – related parties | 159 | 104 | |||||

| Deferred liabilities | (6 | ) | 32 | ||||

| Operating lease liabilities | 32 | (13 | ) | ||||

| Net cash used in operating activities | (14,199 | ) | (15,362 | ) | |||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||

| Purchase of equipment | (706 | ) | - | ||||

| Net cash used in investing activities | (706 | ) | - | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||

| Net proceeds from sale of common stock and warrants | 27,544 | 15,497 | |||||

| Exercise of warrants for cash | 1 | - | |||||

| Repayments of debt | - | (5,000 | ) | ||||

| Net cash provided by financing activities | 27,545 | 10,497 | |||||

| Impact on cash from foreign currency translation | (188 | ) | 86 | ||||

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 12,452 | (4,779 | ) | ||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 20,922 | 35,848 | |||||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 33,374 | $ | 31,069 | |||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOWS INFORMATION: | |||||||

| Cash paid for income taxes | $ | - | $ | - | |||

| Cash paid for interest expense | $ | - | $ | 523 | |||

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/94325c73-f84f-4833-9b4b-f742dbf07911