DeFi Development Corp. Introduces New Treasury Strategy Compensation Plan Tied to SOL Per Share (SPS)

Rhea-AI Summary

DeFi Development Corp. (NASDAQ: DFDV) has introduced a groundbreaking compensation framework that directly links executive and core team bonuses to growth in SOL per Share (SPS). The plan, effective until April 30, 2026, features four performance tiers: NGMI, SOLid, LFG, and WAGMI. Executive officers can earn up to 200% of their target bonus if they achieve 1.0 SOL/share.

The compensation structure uniquely focuses on increasing per-share SOL exposure rather than traditional market cap expansion. No bonuses will be paid if the minimum SOLid tier threshold isn't met. This innovative approach makes DFDV the first public company to tie compensation directly to per-share crypto asset accumulation, demonstrating its commitment to aligning management incentives with shareholder value.

Positive

- First public company to link compensation to crypto asset accumulation per share

- Strong alignment between management and shareholder interests through SPS-based incentives

- Clear performance metrics with four-tier structure ensuring accountability

- No bonus payouts if minimum performance threshold isn't met, protecting shareholder interests

Negative

- Potential high bonus payouts of up to 200% of target could impact company finances

- Performance solely measured by SOL accumulation might lead to overlooking other important business aspects

- Exposure to cryptocurrency volatility could affect compensation outcomes

Insights

DFDV introduces first-ever executive compensation plan tied directly to Solana accumulation per share, aligning management with shareholder interests.

DeFi Development Corp has implemented a groundbreaking compensation structure that directly links executive bonuses to the company's success in accumulating Solana (SOL) on a per-share basis. This represents a significant innovation in corporate governance for public crypto-focused companies, as it's the first compensation plan explicitly tied to per-share crypto asset accumulation.

The structure features four performance tiers with increasing bonus payouts: NGMI (no bonus), SOLid (minimum threshold), LFG, and WAGMI (maximum payout). The executive team, including CEO Joseph Onorati, CFO John Han, and CIO Parker White, can earn up to 200% of their target bonuses if they achieve the ambitious goal of 1.0 SOL per share by April 2026.

What makes this approach particularly shareholder-friendly is how it penalizes dilution. Unlike traditional public company compensation models that often reward market cap growth regardless of share dilution, DFDV's framework only rewards management when the actual per-share SOL value increases. As Parker White noted, they "only win when shareholders hold more SOL per share."

This alignment mechanism shows sophisticated treasury management thinking. It creates a powerful incentive for capital discipline and efficient SOL accumulation strategies rather than growth at any cost. For investors, this signals that management's interests are structurally aligned with increasing the underlying crypto asset value per share – a rare guarantee in the volatile crypto sector where dilution often occurs through secondary offerings and equity-based compensation.

BOCA RATON, FL, May 14, 2025 (GLOBE NEWSWIRE) -- DeFi Development Corp. (Nasdaq: DFDV) (the “Company”) the first public company with a treasury strategy built to accumulate and compound Solana (“SOL”), announced today that its Board of Directors has approved a new compensation framework for the Company’s executives and core treasury strategy team, directly tying bonus outcomes to growth in SOL per Share (“SPS”). With this plan, DFDV becomes the first public company to directly link compensation to per-share crypto asset accumulation.

The new framework is designed to closely align management incentives with long-term shareholder value. Bonus payouts for executive officers and non-executive employees will be based on achieving specific SPS targets as of April 30, 2026, with payouts increasing in proportion to growth in per-share SOL exposure.

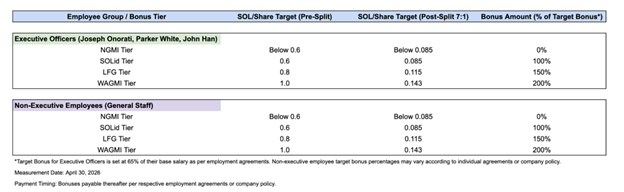

The structure has four tiers corresponding to a respective SOL/share target: (1) NGMI Tier, (2) SOLid Tier, (3) LFG Tier, and (4) WAGMI Tier. Crucially, the SOLid Tier represents the minimum performance threshold required to trigger any bonus payout. If the Company falls into the NGMI Tier, no bonuses are paid. The structure is designed to reward disciplined capital allocation that increases per-share SOL exposure.

"Most public companies reward market cap expansion — even if it comes at the cost of shareholder dilution," said Parker White, COO and CIO. "Our structure flips that model. We only win when our shareholders hold more SOL per share."

A summary of the SPS tiers and corresponding bonus multipliers is shown below:

Bonus payouts for executives and treasury team scale with SOL Per Share performance. No bonuses are paid if the SOLid tier is not met

Bonus payouts for executives and treasury team scale with SOL Per Share performance. No bonuses are paid if the SOLid tier is not met

Under this structure, executive officers — including CEO Joseph Onorati, CFO John Han, and CIO Parker White — are eligible for up to

The company believes this alignment reinforces its commitment to transparency, accountability, and long-term compounding.

For more information, visit defidevcorp.com. Details of the compensation plan will be included in a forthcoming Current Report on Form 8-K, which the Company expects to file with the U.S. Securities and Exchange Commission in due course. To stay up-to-date with the latest company developments, subscribe to our blog.

About DeFi Development Corp.

DeFi Development Corp. (Nasdaq: DFDV) has adopted a treasury policy under which the principal holding in its treasury reserve on the balance sheet will be allocated to Solana (SOL). In adopting its new treasury policy, the Company intends to provide investors a way to access the Solana ecosystem. The Company’s treasury policy is expected to provide investors economic exposure to SOL investment.

We are an AI-powered online platform that connects the commercial real estate industry by providing data and software subscriptions as well as value-add services to multifamily and commercial property professionals as we connect the increasingly complex ecosystem that stakeholders have to manage.

We currently serve more than one million web users annually, including multifamily and commercial property owners and developers applying for billions of dollars of debt financing per year, professional service providers, and thousands of multifamily and commercial property lenders including more than

Forward-Looking Statements

This release contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "believe," "project," "estimate," "expect," strategy," "future," "likely," "may,", "should," "will" and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: (i) fluctuations in the market price of SOL and any associated impairment charges that the Company may incur as a result of a decrease in the market price of SOL below the value at which the Company’s SOL are carried on its balance sheet; (ii) the effect of and uncertainties related the ongoing volatility in interest rates; (iii) our ability to achieve and maintain profitability in the future; (iv) the impact on our business of the regulatory environment and complexities with compliance related to such environment including changes in securities laws or other laws or regulations; (v) changes in the accounting treatment relating to the Company’s SOL holdings; (vi) our ability to respond to general economic conditions; (vii) our ability to manage our growth effectively and our expectations regarding the development and expansion of our business; (viii) our ability to access sources of capital, including debt financing and other sources of capital to finance operations and growth and (ix) other risks and uncertainties more fully in the section captioned "Risk Factors" in the Company's most recent Annual Report on Form 10-K and other reports we file with the SEC. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, the Company's actual results may differ materially from the expected results discussed in the forward-looking statements contained in this press release. Forward-looking statements contained in this announcement are made as of this date, and the Company undertakes no duty to update such information except as required under applicable law.

Investor Contact:

ir@defidevcorp.com

Media Contact:

Prosek Partners

pro-ddc@prosek.com

Attachment