Lithium Argentina and Ganfeng Announce PPG Scoping Study Results and Stage 1 Environmental Approval

Rhea-AI Summary

Lithium Argentina (TSX: LAR, NYSE: LAR) and Ganfeng announced the PPG Scoping Study and that Salta Province issued the DIA Stage 1 environmental approval on Nov 7, 2025. PPG targets 150,000 tpa LCE over a 30-year life delivered in three 50,000 tpa stages, with Stage 1 at 50,000 tpa. Key economics: after-tax NPV8% $8.1B and IRR 32.7% at $18,000/t LCE; operating cash cost $5,027/t; Stage 1 capital cost $1.1B; life‑of‑project capex $3.3B. A NI 43-101/SK-1300 technical report will be filed within 45 days.

Positive

- Production planned at 150,000 tpa LCE over 30 years

- Stage 1 permitted with DIA issued on Nov 7, 2025

- Strong economics: NPV8% $8.1B and IRR 32.7% at $18,000/t LCE

- Low operating cost estimated at $5,027 per tonne LCE

- Measured & Indicated resource ~15.1 Mt LCE (consolidated)

Negative

- High upfront capex: Stage 1 $1.1B; life‑of‑project $3.3B

- Payback ~7 years in base case at $18,000/t LCE

- RIGI eligibility is not guaranteed and affects value (+$0.9B if approved)

News Market Reaction

On the day this news was published, LAR gained 9.25%, reflecting a notable positive market reaction. Argus tracked a peak move of +2.2% during that session. Our momentum scanner triggered 6 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $58M to the company's valuation, bringing the market cap to $688M at that time.

Data tracked by StockTitan Argus on the day of publication.

ZUG, Switzerland, Nov. 10, 2025 (GLOBE NEWSWIRE) -- Lithium Argentina AG. (“Lithium Argentina” or the “Company”) (TSX: LAR) (NYSE: LAR) is pleased to announce the results of the Scoping Study (“Scoping Study”) for the Pozuelos-Pastos Grandes lithium brine project (“PPG” or the “PPG Project”) in Salta Province, Argentina. PPG integrates three projects owned by Ganfeng Lithium Group Co., Ltd (“Ganfeng”) and Lithium Argentina into a single development platform in the Pozuelos and Pastos Grandes basins. Upon closing of the new joint venture (the “New JV”)1, Ganfeng and Lithium Argentina will own

The Company and Ganfeng are pleased to announce that on Friday, November 7, 2025, the Secretariat of Mining and Energy of the Province of Salta, Argentina, has issued the Environmental Impact Statement, Declaración de Impacto Ambiental, (“DIA”) for Stage 1 of the PPG Project.

Highlights:

- Scalable platform: Production capacity of approximately 150,000 tpa of LCE in three stages of 50,000 tpa of LCE each with a 30-year project life.

- Globally significant resource: 15.1 Mt LCE measured and indicated resource across consolidated basins, placing PPG among one of the largest undeveloped lithium brine resources.

- Hybrid processing approach: Uses hybrid solar evaporation and Direct Lithium Extraction (“DLE”) process designed to improve efficiency and reduce freshwater use.

- Low-cost profile: Operating cash cost2 of

$5,027 /t with an all-in sustaining cost (“AISC”)3 of$5,351 /t over project life. - Competitive capital cost: Stage 1 initial capital cost estimated at

$1.1 billion (including16% contingency). Total capital cost of$3.3 billion over life of project. - Compelling economics: At

$18,000 /t lithium carbonate, after-tax NPV8% of$8.1 billion and IRR of33% ; Even at$12,000 /t, PPG has an IRR of21% . - Proven partnership: Combines Ganfeng’s processing expertise with Lithium Argentina’s upstream experience and in-country team with track record of developing nearby Cauchari-Olaroz.

- Financing pathway: Jointly advancing financing process considering debt, offtake and minority equity investments.

- Stage 1 permitted: DIA approval Stage 1 received; RIGI application targeted for H1 2026.

Sam Pigott, President and CEO of Lithium Argentina, commented:

“Together with Ganfeng, we are building on the success of Cauchari-Olaroz to advance Argentina’s next major lithium operation. PPG represents a continuation of our proven partnership - combining disciplined execution, technical excellence and next-generation processing technology designed to enhance efficiency and minimize environmental impact.

We are very pleased to have received environmental approval for Stage 1 from the Salta government, following a 14-month, rigorous review that reinforces our focus on sustainability and adoption of new processing technologies. With strong support from the Province of Salta and the federal government’s RIGI investment regime, PPG highlights our contribution to Argentina’s growing role in advancing a diversified and competitive global supply chain for lithium chemicals that enable electric mobility and large-scale energy storage.”

A technical report, prepared by Golder Associates (“Golder”), in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and Subpart 1300 of Regulation S-K (“SK 1300”), will be filled within 45 days. Unless otherwise indicated, all figures are in U.S. dollars and on a

Scoping Study Results - Summary4

| Key Results | ||

| Operating Profile | ||

| Annual Production | 150,000 tpa LCE | |

| Annual Production – Stage 1 | 50,000 tpa LCE | |

| Project life | 30 years | |

| Economic Parameters5 | ||

| Lithium Carbonate Price | ||

| NPV | ||

| NPV | ||

| IRR | ||

| Payback | 7 years | |

| Financial Metrics | ||

| Capital Costs | ||

| Capital Costs – Stage 1 | ||

| Operating Costs | ||

| Sustaining Capex | ||

The Company will host a webcast and conference call on Monday, November 10, 2025 at 8:00 am ET to discuss the PPG Scoping Study and third quarter 2025 results. Sam Pigott, President and CEO of Lithium Argentina, Wang Xiaoshen, CEO of Ganfeng, Carlos Galli, Vice President of Growth and Innovation at Lithium Argentina and Jason Luo, President of Ganfeng South America will join the call to discuss the results of the PPG Scoping Study and development plans in Argentina.

Webcast Details:

Event Title: Lithium Argentina Third Quarter 2025 Earnings Call and PPG Scoping Study Results

Event Date: November 10, 2025

Revised Start Time: 8:00 am Eastern Standard Time

Attendee URL:

https://events.q4inc.com/attendee/384750377

Project Summary

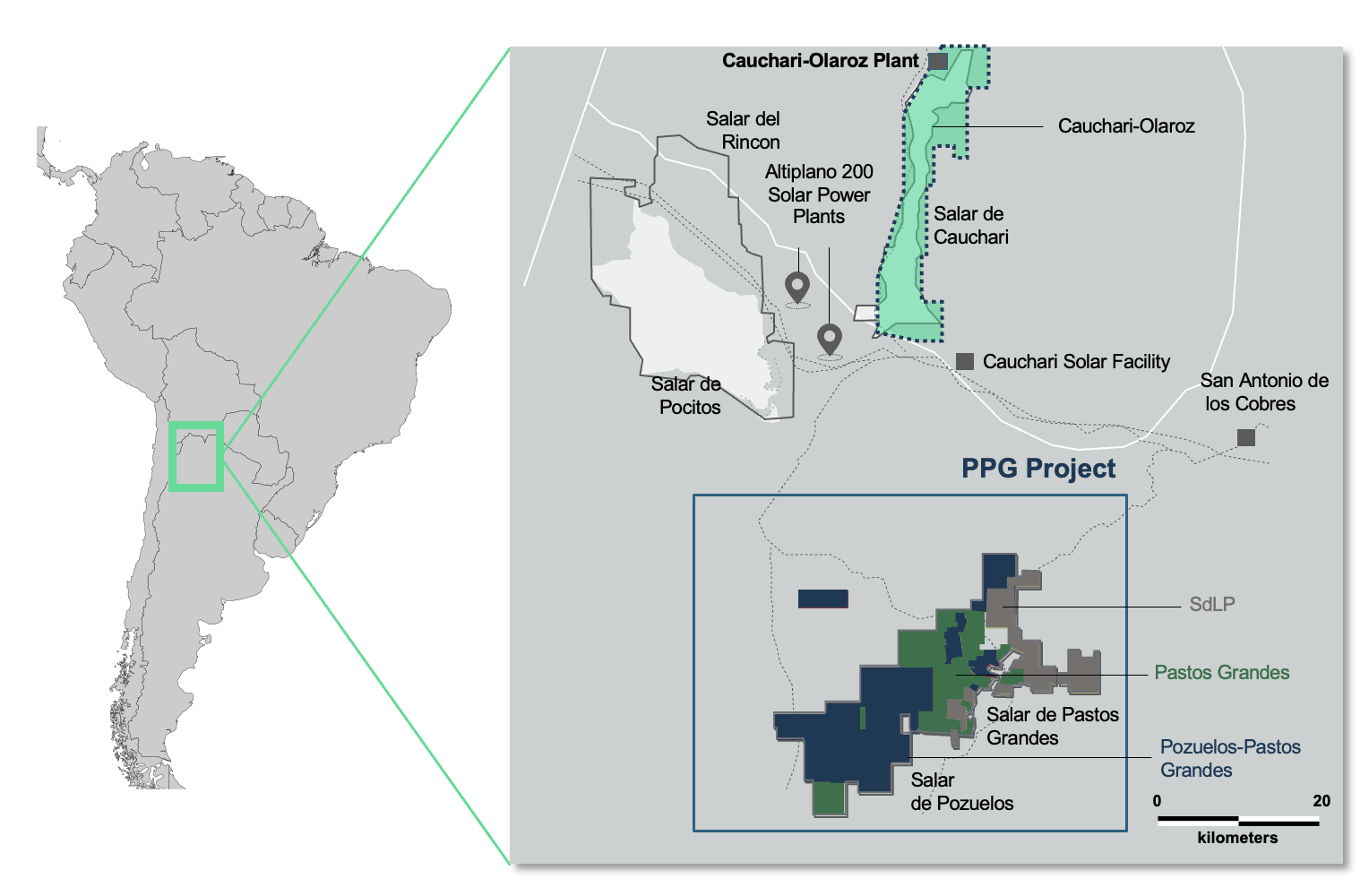

PPG is located in the province of Salta, Argentina. The PPG Project is surrounded by Salar de Rincon to the northwest, Cauchari to the north, and Salar de Centenario to the south. The PPG Project incorporates the adjacent Pozuelos and Pastos Grandes salars in the Puna (Altiplano) region of northwestern Argentina, Salta Province, approximately 600 km to the port of Antofagasta, Chile, where PPG’s lithium products could be shipped to international customers.

PPG is a consolidated lithium-brine development in Salta that integrates three previously distinct projects in the Pozuelos–Pastos Grandes basins under one plan, capturing shared infrastructure and operating synergies. The salars are considered as a single production system within the Scoping Study, reflecting their shared geological connection.

The Scoping Study outlines a phased development - with initial 50,000 tpa of LCE increasing to 150,000 tpa over three stages using a hybrid DLE flowsheet that pre-concentrates brine in ponds using solar evaporation, then selectively recovers lithium from concentrated brine using solvent extraction (SX) before final purification and production of primarily lithium carbonate. The technical approach is designed to lower reagent and environmental impact versus alternative processes and is expected to improve product consistency and quality, while reducing costs at a large production scale.

The PPG Project is designed to produce primarily lithium carbonate but preserves flexibility on the product mix, including lithium hydroxide and lithium chloride to align the final lithium product with customer feedback and market conditions. Development will be executed stage by stage, leveraging existing on-site infrastructure and sequencing permits, community engagement and financing ahead of major commitments.

The Secretariat of Mining and Energy of the Province of Salta, Argentina, issued the Environmental Impact Statement, Declaración de Impacto Ambiental, (“DIA”) for Stage 1 of the PPG Project, closing a 14-month review of the project and the technology.

Ganfeng and Lithium Argentina have entered into a framework agreement with respect to the New JV6 to develop the consolidated PPG Project. The PPG Project comprises Ganfeng’s wholly owned Pozuelos-Pastos Grandes project with Lithium Argentina’s Pastos Grandes project (

Property Location — Pozuelos–Pastos Grandes Basins, Salta Province (see map below).

Operating Costs

The operating cost estimates have been reviewed and confirmed by Golder in accordance with applicable Canadian Institute of Mining, Metallurgy and Petroleum (CIM) standards and NI 43-101 and Subpart 1300 of Regulation S-K.

The average operating costs calculated for life of project of 150,000 tpa of LCE are presented in the table below.

| Operating Costs – Full Project | ($ per tonne) | |

| Category | ||

| Reagents | ||

| Energy | ||

| Labour | ||

| Maintenance | ||

| Salts harvesting | ||

| G&A | ||

| Others | ||

| Sub-Total | $4,788 | |

| Contingency | ||

| Total | $5,027 | |

The average operating costs were calculated for a Stage 1 production of 50,000 tpa of LCE and are presented in the table below.

| Operating Costs – Stage 1 | ($ per tonne) | |

| Category | ||

| Reagents | ||

| Energy | ||

| Labour | ||

| Maintenance | ||

| Salts Harvesting | ||

| G&A | ||

| Others | ||

| Sub-Total | $5,089 | |

| Contingency | ||

| Total | $5,344 | |

RIGI

Argentina’s Régimen de Incentivo para Grandes Inversiones (RIGI) is a government framework designed to attract large-scale investment by providing stable, long-term tax, regulatory and foreign exchange benefits. PPG will seek access to Argentina’s RIGI framework to enhance long-term competitiveness and support ongoing financing efforts. Opting into this regime is subject to securing RIGI eligibility and approvals and is expected to materially improve after-tax cash flow through a series of fiscal incentives, including but not limited to (1) a

Capital Costs

The capital cost for life of project at PPG is estimated at

| Capital Cost – Life of Project | ($ millions) | |

| Total Direct Costs (including contingency) | ||

| Wellfield, Ponds and Brine Systems | ||

| Plants Capital Costs | ||

| Infrastructure/Power/TMA Costs | ||

| Sub-Total | ||

| Total Indirect Costs | ||

| Owner Costs | ||

| VAT | ||

| Total Capital Costs (including | ||

The capital costs for Stage 1 development at PPG is estimated at

| Capital Cost – Stage 1 | ($ millions) | |

| Total Direct Costs (including contingency) | ||

| Wellfield, Ponds and Brine Systems | ||

| Plants Capital Costs | ||

| Infrastructure/Power/TMA Costs | ||

| Sub-Total | ||

| Total Indirect Costs | ||

| Owner Costs | ||

| VAT | ||

| Total Capital Costs (including | ||

The Scoping Study contemplates a staged development underpinned by both existing site infrastructure and new process facilities. Wellfield, ponds and brine system infrastructure are largely related to the construction of these items. Plants capital costs include all the capital for the lithium plant, including: DLE plant, purification plant, utilities and LCE processing facilities.

Infrastructure, Power/Tailing Management Area (“TMA”) and energy costs relate to water supply, transformers, warehouse office buildings, camps, effluent plant, and waste yard infrastructure, power lines, fuel plant and emergency generation and salts disposal costs.

The sustaining capital requirement for the life of project is estimated at an average of approximately

PPG Project Valuation Price Sensitivities and Returns

The financial results are derived from inputs based on an annual production schedule included in the Scoping Study. The PPG Scoping Study estimates strong returns with incremental after-tax NPV

| Key Parameters | Scenario 1 | Scenario 2 | Scenario 3 (Base Case) | Scenario 4 | ||||

| Lithium Carbonate Price | ||||||||

| After-Tax NPV | ||||||||

| After-Tax NPV | ||||||||

| After-Tax IRR | ||||||||

| Payback (years) | 10.0 | 7.8 | 7.0 | 6.7 | ||||

Mineral Resource

Golder and Atacama Waters were engaged to prepare the Scoping Study, including the mineral resource estimation in brine for the consolidated PPG Project in accordance with the guidelines for lithium brines set forth by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM 2012), NI 43-101 and SK-1300.

Mineral Resource Estimation

The Mineral Resources for PPG as described in the Scoping Study are summarized in the table below. Prior to the consolidation, Lithium Argentina’s proportionate interest in PPG’s Measured and Indicated resource is

| Resource Category | Pozuelos | Pastos Grandes | Subtotal | ||

| Li (mg/L) | LCE (tonnes) | Li (mg/L) | LCE (tonnes) | LCE (tonnes) | |

| Measured | 491 | 5,836,244 | 451 | 7,406,000 | 13,242,244 |

| Indicated | 529 | 1,180,383 | 78 | 654,000 | 1,834,383 |

| Inferred | 581 | 3,920,437 | 456 | 2,793,000 | 6,713,437 |

Notes:

1) Lithium carbonate equivalent (“LCE”) is calculated using the Li:LCE factor = 5.322785 multiplied by the mass of Lithium

2) Mineral Resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resource will be converted to mineral reserves.

3) The Mineral Resource Estimate represented as LCE for the Pozuelos Salar has an effective date of December 20, 2024, and it is expressed relative to the delineated resource area.

4) The Mineral Resource Estimate represented as LCE for the Pastos Grandes Salar has an effective date of August 15, 2024, and it is expressed relative to the delineated resource area.

5) The qualified person for the Mineral Resource Estimate is James Wang, P.E., Director, Golder, a “qualified person” as defined in National Instrument 43-101, who is independent of the Company. The qualified person is not aware of any known legal, political, environmental or other risks that could materially affect the potential development of the Mineral Resources.

6) No cut-off values have been applied to the resource estimate.

7) PPG Project economics are not based on Inferred Mineral Resources.

Next Steps

With the receipt of the environmental permit application, the RIGI application is expected during the first half of 2026. The Company and Ganfeng are exploring financing options including debt offtake and minority equity investments to support funding for Stage 1 of PPG.

Ganfeng and Lithium Argentina continue to advance optimization efforts and integration of the resources into a unified hydrological model. The results of the integration and optimization efforts will support further technical information used to support Stage 1 development.

Non-IFRS Measures

All-in sustaining cost per tonne and operating cash costs per tonne are non-IFRS measures or ratios and do not have a standardized meaning under IFRS and may not be comparable to similar financial measures used by other issuers. The Company believes that this measure provides investors with an improved ability to evaluate the prospects of the Company and the PPG Project. As the PPG Project is not in production, all-in sustaining cost and operating cash cost may not be reconciled to the nearest comparable measures under IFRS and the equivalent historical non-IFRS measure discussed herein is $nil.

| Operating Cash Cost | $ per tonne of LCE | |

| Projected Operating Cash Cost – Stage 1 | ||

| Projected Operating Cash Cost | ||

| Projected AISC8 | ||

Scientific & Technical Information and Qualified Persons

The scientific and technical information in this news release has been reviewed and approved by the independent qualified persons (“QPs”) listed below, each of whom is a “qualified person” as defined in NI 43-101.

- James Wang, P.E., Director, Golder.

- Frederik Reidel, Managing Director, Atacama Water SpA.

Report Filing

The Company will file an NI 43-101 compliant technical report with respect to the Scoping Study on SEDAR+ (http://www.sedarplus.ca) and on the Company's website (http://www.lithium-argentina.com) within 45 days of this news release. The technical report will be authored by Golder and signed by the QPs named above.

For U.S. reporting purposes, the Company intends to furnish this news release on Form 6-K and to file a Technical Report Summary (TRS) prepared in accordance with Subpart 1300 of Regulation S-K. The TRS will be prepared by, or under the supervision of, a qualified person as defined in S-K 1300 and will summarize the material scientific and technical information supporting the Scoping Study.

ABOUT LITHIUM ARGENTINA

Lithium Argentina is an emerging producer of lithium carbonate for use primarily in lithium-ion batteries and electric vehicles. The Company, in partnership with Ganfeng operates the Cauchari-Olaroz lithium brine operation in the Jujuy province of Argentina and is advancing PPG in the Salta province of Argentina. Lithium Argentina currently trades on the TSX and on the NYSE under the ticker “LAR”.

For further information contact:

Investor Relations

Telephone: +1 778-653-8092

Email: kelly.obrien@lithium-argentina.com

Website: http://www.lithium-argentina.com

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking information” and “forward-looking statements” (which we refer to collectively as forward-looking information) under the provisions of applicable securities legislation. Forward-looking information can be identified by the use of words such as seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “propose”, “potential”, “target”, “intend”, “could”, “might”, “should”, “believe”, “scheduled”, “implement” and similar words or expressions. All statements, other than statements of historical fact, are forward-looking information. Forward-looking information in this news release include, without limitation, information with respect to the following matters or the Company’s expectations relating to such matters: the timing of the filing of the technical report for the Scoping Study and TRS; the timing of the filing of the RIGI application and the anticipated benefits therefrom; the formation of the New JV and the value derivable therefrom; the Company’s economic interest in PPG; financing of the development of PPG, including the involvement of third-party investors, offtakers and local lenders; the timing and filing of applicable permitting applications; the use and effects of DLE technology; the results of the Scoping Study, including, without limitation, expected project life, production, capital and operating costs, IRR, NPV and other economic and operating parameters of PPG; mineral resource estimates; and the timing and amount of future production and expected capacity of production of PPG.

Forward-looking information may involve known and unknown risks, assumptions and uncertainties which may cause the Company’s actual results or performance to differ materially. This information reflects the Company’s current views with respect to future events and is necessarily based upon a number of assumptions that, while considered reasonable by the Company today, are inherently subject to significant uncertainties and contingences, and accordingly, the Company can give no assurance that these assumptions and expectations will prove to be correct. With respect to forward-looking information included in this news release, the Company has made assumptions regarding, among other things: current technological trends; the business relationship between the Company and Ganfeng; ability to fund its operations; the ability to operate in a safe and effective manner; uncertainties relating to obtaining and/or maintaining mining, exploration, development, environmental and other permits or approvals in Argentina; demand for lithium; impact of increasing competition in the lithium business, including the Company’s competitive position in the industry; general economic conditions; stability and support of legislative, regulatory and community environment in the jurisdiction where it operates; estimates of and changes to market prices for lithium and commodities; estimates costs for the project or operation; estimates of mineral resources and mineral reserves, including whether mineral resources will ever be developed into mineral reserves; reliability of technical data; and the ability to achieve full production; and accuracy of budget and estimates.Forward-looking information also involves known and unknown risks that may cause actual results to differ materially, these risks include, among others: risk inherent to studies such as the Scoping Study, which are subject to significant assumptions and a high degree of uncertainty; risk that the Company may not be able to form the New JV and derive value therefrom as anticipated, or at all; risk that the Company may not be able to file the RIGI application and obtain the anticipated benefits therefrom as anticipated, or at all; risk that the Company may not be able to finance the development of PPG as contemplated, or at all; risk that the Company may not be able to attract third party investors for the development of PPG as contemplated, or at all; risk that the Company will not be able to implement DLE technology; the operations may not operate and produce as planned; cost overruns; market prices affecting development of the operation; risks associated with co-ownership arrangements; risks with ability to successfully secure adequate financing if necessary; risks to the growth of the lithium markets; lithium prices; inability to obtain any future required governmental permits and that operations may be limited by government-imposed limitations; technology risk; inability to achieve and manage expected growth; political risk associated with foreign operations, including co-ownership arrangements with foreign domiciled partners; emerging and developing market risks; operational risks; changes in government regulations; changes in environmental requirements; failure to obtain or maintain necessary licenses, permits or approvals; insurance risk; receipt and security of mineral property titles and mineral tenure risk; changes in project or operation parameters; uncertainties associated with estimating mineral resources and mineral reserves, including uncertainties regarding assumptions underlying such estimates; whether mineral resources will ever be converted into mineral reserves; opposition to the; geological or technical or processing problems; liabilities and risks; health and safety risks; unanticipated results; unpredictable weather; unanticipated delays; reduction in demand for lithium; inability to generate profitable operations; restrictive covenants in debt instruments; intellectual property risks; dependency on key personnel; currency and interest rate fluctuations; and volatility in general market and industry conditions. Additional risks, assumptions and other factors are set out in the Company’s management discussion analysis and most recent Annual Report on Form 20-F, copies of which are available on SEDAR+ at www.sedarplus.ca

Although the Company has attempted to identify important risks and assumptions, given the inherent uncertainties in such forward-looking information, there may be other factors that cause results to differ materially. Forward-looking information is made as of the date hereof and the Company does not intend, and expressly disclaims any obligation to, update or revise the forward-looking information contained in this news release, except as required by law. Accordingly, readers are cautioned not to place undue reliance on forward-looking information.

1 For more information, please see press release filed on August 12, 2025.

2 Refer to section titled “Non-IFRS and Other Financial Measures” below.

3 AISC includes sustaining capex, tailings management area (TMA) and closing costs. Provincial royalties represent an additional

4 All dollar figures are in United States dollars and are on a

5 After-tax economic results.

6 For more information, please see press release filed on August 12, 2025.

7 Operating cost is defined as the net direct cash cost, or simply the cost of production including the costs of mining, processing, transportation, marketing, and onsite administration.

8 AISC includes sustaining capex, tailings management area (TMA) and closing costs. Provincial royalties represent an additional

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a84242ca-c9a7-4c98-b226-4bcdce4fdbc8