LFL Releases Strong Second Quarter Financial Results and Announces 20% Increase to the Quarterly Dividend

Rhea-AI Summary

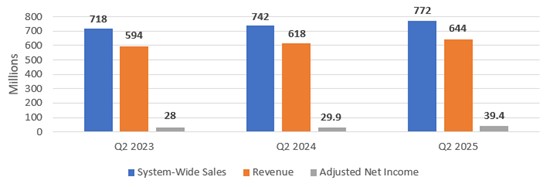

Leon's Furniture Limited (TSX: LNF) reported strong Q2 2025 financial results, with system-wide sales increasing 4.0% to $771.5 million and revenue growing 4.3% to $644.1 million. The company achieved significant improvements in profitability, with adjusted net income rising 31.8% to $39.4 million and adjusted diluted EPS increasing 29.5% to $0.57.

Key performance metrics include a 4.3% increase in same-store sales, gross profit margin improvement of 92 basis points to 44.82%, and SG&A rate improvement of 53 basis points. The company maintained strong liquidity of $454.5 million and announced a 20% increase in quarterly dividend to $0.24 per share.

Growth was primarily driven by a 6.5% increase in furniture sales and 10.5% growth in commercial appliance business, supported by improved inventory position and effective promotions.

Positive

- Adjusted net income increased 31.8% to $39.4 million

- System-wide sales grew 4.0% to $771.5 million

- Gross profit margin improved by 92 basis points to 44.82%

- Strong liquidity position of $454.5 million

- 20% increase in quarterly dividend to $0.24 per share

- Credit facility extended to May 31, 2027

Negative

- Mattress and electronics categories experienced low single-digit declines

- Higher recycling fees and minimum wage impacts affected expenses

- $7.6 million after-tax mark-to-market loss on foreign exchange derivatives

News Market Reaction

On the day this news was published, LEFUF gained 1.24%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Toronto, Ontario--(Newsfile Corp. - August 7, 2025) - Leon's Furniture Limited (TSX: LNF) ("LFL" or the "Company"), today announced financial results for the quarter ended June 30, 2025.

Financial Highlights - Q2-2025

These comparisons are with Q2-2024 unless stated otherwise.

- System-wide sales for the quarter were

$771.5 million , an increase of4.0% . - Q2 Revenue was recorded at

$644.1 million , an increase of4.3% , driven by strong performance in the furniture category and commercial appliance business. - Same store sales increased (1)

4.3% . - Gross profit margin rate was

44.82% , a 92-basis points improvement driven by favourable retail category sales mix, improved furniture margin rate and favourable FX impacts on the settlement of US dollar payables. - SG&A rate improved by 53 bps as a result of lower retail financing fees and improved operational leverage.

- Adjusted net income(1) for the quarter totaled

$39.4 million , an increase of31.8% . - Adjusted Diluted EPS for the quarter was

$0.57 , an increase of29.5% . - On June 30, 2025, unrestricted liquidity was

$454.5 million , comprised of cash, cash equivalents, debt and equity instruments and the undrawn revolving credit facility. - Subsequent to the quarter end June 30, 2025 the Company completed an amendment to its existing credit agreement to extend the term to May 31, 2027.

Second Quarter 3-Year Financial Performance of LFL

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4576/261551_image1.jpg

(1) For a full explanation of the Company's use of non-IFRS and supplementary financial measures, please refer to the sections of this press release with the headings "Non-IFRS Financial Measures" and "Supplementary Financial Measures".

Mike Walsh, President and CEO of LFL, commented, "Our team delivered another solid performance in Q2, with system-wide sales increasing

Summary financial highlights for the three months ended June 30, 2025 and June 30, 2024

| For the | Three months ended | |||||||||||

| (C$ in millions except %, share and per share amounts) | June 30, 2025 | June 30, 2024 | $ Increase (Decrease) | % Increase (Decrease) | ||||||||

| Total system-wide sales (1) | 771.5 | 742.1 | 29.4 | |||||||||

| Franchise sales (1) | 127.4 | 124.4 | 3.0 | |||||||||

| Revenue | 644.1 | 617.7 | 26.4 | |||||||||

| Cost of sales | 355.4 | 346.5 | 8.9 | |||||||||

| Gross profit | 288.7 | 271.2 | 17.5 | |||||||||

| Gross profit margin as a percentage of revenue | ||||||||||||

| Selling, general and administrative expenses (2) | 234.3 | 228.0 | 6.3 | |||||||||

| SG&A as a percentage of revenue | ||||||||||||

| Other income | (1.4 | ) | - | (1.4 | ) | |||||||

| Income before net finance costs and income tax expense | 55.8 | 43.1 | 12.7 | |||||||||

| Net finance costs | (3.2 | ) | (3.1 | ) | (0.1 | ) | ||||||

| Income before income taxes | 52.6 | 40.0 | 12.6 | |||||||||

| Income tax expense | 13.2 | 10.1 | 3.1 | |||||||||

| Adjusted net income (1) | 39.4 | 29.9 | 9.5 | |||||||||

| Adjusted net income as a percentage of revenue (1) | ||||||||||||

| After-tax mark-to-market loss (gain) on financial derivative instruments (1) | 7.6 | (0.3 | ) | 7.9 | ( | |||||||

| Net income | 31.8 | 30.2 | 1.6 | |||||||||

| Basic weighted average number of common shares | 68,252,117 | 68,144,456 | ||||||||||

| Basic earnings per share | $ | 0.47 | $ | 0.44 | $ | 0.03 | ||||||

| Adjusted basic earnings per share (1) | $ | 0.58 | $ | 0.44 | $ | 0.14 | ||||||

| Diluted weighted average number of common shares | 68,639,781 | 68,646,870 | ||||||||||

| Diluted earnings per share | $ | 0.46 | $ | 0.44 | $ | 0.02 | ||||||

| Adjusted diluted earnings per share (1) | $ | 0.57 | $ | 0.44 | $ | 0.13 | ||||||

| Common share dividends declared | $ | 0.20 | $ | 0.18 | $ | 0.02 | ||||||

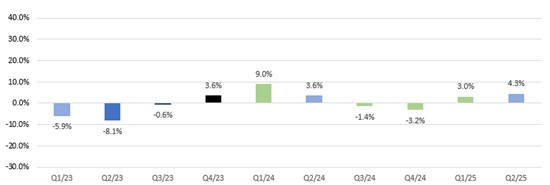

Same Store Sales (1)

| For the | Three months ended | |||||||||||

| (C$ in millions, except %) | June 30, 2025 | June 30, 2024 | $ | Increase | % Increase | |||||||

| Same store sales (1) | 627.8 | 601.9 | 25.9 | |||||||||

Historical Same Store Sales (1) as previously reported based on comparable quarters

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4576/261551_image1_550.jpg

(1) Please refer to the sections of this press release with the headings "Non-IFRS Financial Measures" and "Supplementary Financial Measures".

(2) Selling, general and administrative expenses ("SG&A")

Revenue

For the three months ended June 30, 2025, revenue was

Same Store Sales (1)

Same store sales in the quarter increased by

Gross Profit

The gross profit margin for the second quarter of 2025 was at

Selling, General and Administrative Expenses ("SG&A")

The Company's SG&A as a percentage of revenue for the second quarter of 2025 was

Adjusted Net Income (1) and Adjusted Diluted Earnings Per Share (1)

Adjusted net income for the quarter totaled

The adjusted diluted earnings per share in the first quarter of 2025 was

Net Income and Diluted Earnings Per Share

Net income for the second quarter of 2025 was

(1) Please refer to the sections of this press release with the headings "Non-IFRS Financial Measures" and "Supplementary Financial Measures".

Dividends

As previously announced, the Company paid a quarterly dividend of

Outlook

Given the Company's strong and continuously improving financial position, our principal objective is to increase our market share and profitability. We remain focused on our commitment to effectively manage our costs but to also continuously invest in the business to drive growth initiatives that will drive more customers to both our online eCommerce sites and our 300 store locations across Canada.

Non-IFRS Financial Measures

The Company uses financial measures that do not have standardized meaning under IFRS and may not be comparable to similar measures presented by other entities. The Company calculates the non-IFRS financial measures by adjusting certain IFRS measures for specific items the Company believes are significant, but not reflective of underlying operations in the period, as detailed below:

| Non-IFRS Measure | IFRS Measure |

| Adjusted net income | Net income |

| Adjusted income before income taxes | Income before income taxes |

| Adjusted earnings per share - basic | Earnings per share - basic |

| Adjusted earnings per share - diluted | Earnings per share - diluted |

| Adjusted EBITDA | Net income |

Adjusted Net Income

The Company calculates comparable measures by excluding the effect of changes in fair value of derivative instruments, related to the net effect of USD-denominated forward contracts. The Company uses derivative instruments to manage its financial risk in accordance with the Company's corporate treasury policy. Management believes that excluding from income the effect of these mark-to-market valuations and changes thereto, until settlement, better aligns the intent and financial effect of these contracts with the underlying cash flows.

Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation and amortization, mark-to-market adjustment due to the changes in the fair value of the Company's financial derivative instruments and any non-recurring charges to income ("Adjusted EBITDA") is a non-IFRS financial measure used by the Company. The Company considers adjusted EBITDA to be an effective measure of profitability on an operational basis and is commonly regarded as an indirect measure of operating cash flow, a significant indicator of success for many businesses. The Company's Adjusted EBITDA may not be comparable to the Adjusted EBITDA measure of other companies, but in management's view appropriately reflects the Company's specific financial condition. This measure is not intended to replace net income, which, as determined in accordance with IFRS, is an indicator of operating performance.

The following is a reconciliation of reported net income to adjusted EBITDA:

| For the | Three months ended | Six months ended | ||||||||||

| (C$ in millions) | June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | ||||||||

| Net income | 31.8 | 30.2 | 55.7 | 49.0 | ||||||||

| Income tax expense | 10.8 | 10.2 | 18.3 | 15.6 | ||||||||

| Net finance costs | 3.2 | 3.1 | 5.8 | 7.7 | ||||||||

| Depreciation and amortization | 27.3 | 26.6 | 54.6 | 53.9 | ||||||||

| Gain on settlement | (1.4 | ) | - | (2.8 | ) | - | ||||||

| Mark-to-market loss (gain) on financial derivative instruments | 10.1 | (0.3 | ) | 10.5 | (3.6 | ) | ||||||

| Adjusted EBITDA | 81.8 | 69.8 | 142.1 | 122.6 | ||||||||

Total System Wide Sales

Total system wide sales refer to the aggregation of revenue recognized in the Company's consolidated financial statements plus the franchise sales occurring at franchise stores to their customers which are not included in the revenue figure presented in the Company's consolidated financial statements. Total system wide sales is not a measure recognized by IFRS and does not have a standardized meaning prescribed by IFRS, but it is a key indicator used by the Company to measure performance against prior period results. Therefore, total system wide sales as discussed in this MD&A may not be comparable to similar measures presented by other issuers. We believe that disclosing this measure is meaningful to investors because it serves as an indicator of the strength of the Company's overall store network, which ultimately impacts financial performance.

Franchise Sales

Franchise sales figures refer to sales occurring at franchise stores to their customers which are not included in the revenue figures presented in the Company's consolidated financial statements, or in the same store sales figures in this MD&A. Franchise sales is not a measure recognized by IFRS, and does not have a standardized meaning prescribed by IFRS, but it is a key indicator used by the Company to measure performance against prior period results. Therefore, franchise sales as discussed in this MD&A may not be comparable to similar measures presented by other issuers. Once again, we believe that disclosing this measure is meaningful to investors because it serves as an indicator of the strength of the Company's brands, which ultimately impacts financial performance.

Supplementary Financial Measures

The Company uses supplementary financial measures to disclose financial measures that are not (a) presented in the financial statements and (b) is, or is intended to be, disclosed periodically to depict the historical or expected future financial performance, financial position or cash flow, that is not a non-IFRS financial measure as detailed above.

Same Store Sales

Same store sales are defined as sales generated by stores, both in store and through online transactions, that have been open for more than 12 months on a fiscal basis. Same store sales as discussed in this MD&A may not be comparable to similar measures presented by other issuers, however this measure is commonly used in the retail industry. We believe that disclosing this measure is meaningful to investors because it enables them to better understand the level of growth of our business.

About Leon's Furniture Limited

Leon's Furniture Limited is the largest retailer of furniture, appliances and electronics in Canada. Our retail banners include: Leon's; The Brick; Brick Outlet; and The Brick Mattress Store. Finally, with The Brick's Midnorthern Appliance banner alongside with Leon's Appliance Canada banner, this makes the Company the country's largest commercial retailer of appliances to builders, developers, hotels and property management companies. The Company has 300 retail stores from coast to coast in Canada under various banners. The Company operates six websites: leons.ca, thebrick.com, furniture.ca, midnorthern.com, transglobalservice.com and appliancecanada.com.

Cautionary Statement

This press release may contain forward-looking statements that are subject to known and unknown risks and uncertainties that could cause actual results to vary materially from targeted results. Such risks and uncertainties include those described in Leon's Furniture Limited's periodic reports including the annual report or in the filings made by Leon's Furniture Limited from time to time with securities regulatory authorities.

This News Release may include certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify beneficial business opportunities, failure to convert the potential in the pursued business opportunities to tangible benefits to the Company or its shareholders, the ability of the Company to counteract the potential impact of pandemics on factors relevant to the Company's business, delays in obtaining or failures to obtain required shareholder and TSX approvals, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, tariffs and other external economic changes, delays in the development of projects, and those risks set out in the Company's public documents filed on SEDAR+. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

| For further information, please contact: | |

Victor Diab | Jonathan Ross LodeRock Advisors, Leon's Investor Relations jon.ross@loderockadvisors.com Tel: (416) 283-0178 |

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/261551