LaFleur Minerals Provides Update on PEA for the Restart of Beacon Gold Mill Sourcing Material from Its Swanson Gold Deposit, Val d'Or, Québec

Rhea-AI Summary

LaFleur Minerals (OTCQB: LFLRF) engaged Environmental Resources Management (ERM) to complete a Preliminary Economic Assessment (PEA) to restart the Beacon Gold Mill using mineralized material from the 100%-owned Swanson Gold Deposit in Val d'Or, Québec.

Key facts: Beacon was refurbished for C$20M in 2022, the PEA is managed by ERM's Technical Mining Services Group, a 100,000-tonne bulk sample is planned, ore-sorting work is underway with SRC and metallurgical testing with SGS, and a site visit is scheduled for Oct 7-8, 2025. The company approved 1,000,000 stock options at $0.75.

Positive

- Beacon mill refurbished for C$20 million in 2022, reducing restart CAPEX

- Engaged ERM to deliver a multidisciplinary PEA under experienced technical team

- Planned 100,000-tonne bulk sample to de-risk costs and recoveries

- Ore-sorting study with SRC and metallurgical testing by SGS to optimize feed

Negative

- Mineral resource confirmation pending; definition "twinning" drilling is ongoing

- PEA will provide an AACE class 5 cost estimate, reflecting early-stage accuracy limits

News Market Reaction

On the day this news was published, LFLRF gained 4.84%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - October 6, 2025) - LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) ("LaFleur Minerals" or the "Company") is pleased to announce the engagement of global mining, sustainability, and environmental consultant firm Environmental Resources Management ("ERM") for the completion of a Preliminary Economic Assessment ("PEA") for the purpose of restarting gold production at the Company's wholly-owned Beacon Gold Mill using mineralized material from its Swanson Gold Deposit ("Swanson"). Both the Swanson Gold Project and Beacon Gold Mill are located in proximity to one another and strategically positioned in one of the world's largest and most established gold-producing regions, the Abitibi Greenstone Belt. On the back of recent news of the ongoing drilling program that is delivering encouraging high-grade assay results that suggest continuity and scale of the mineralized system, and potential for further expansion at the Swanson Gold Deposit (refer to press release dated September 24, 2025), ERM now brings a highly experienced technical team to deliver a robust mining and economic study for the restart of the Beacon Gold Mill using mineralized material primarily supplied from the Company's Swanson Gold Deposit.

LAFLEUR MINERALS IS AIMING TO RESTART THE BEACON GOLD MILL USING MINERALIZED MATERIAL PRIMARILY SUPPLIED FROM THE COMPANY'S

Kal Malhi, Chairman of LaFleur Minerals, comments, "Advancing the Beacon Gold Mill to restart gold production with gold prices at record levels above US

Preliminary Economic Assessment Study

The Company is working diligently with ERM to complete the PEA in the coming weeks. The PEA will be managed by ERM's Technical Mining Services Group, based in Toronto, Ontario, which operates as the technical services arm of ERM. ERM acquired CSA Global in 2019 to strengthen its capabilities in mineral resource/reserve evaluation, mining and metallurgical engineering, and to complement its established business in environmental stewardship and sustainable development across the mining sector. ERM's Technical Mining Services Group will oversee and disclose technical study results as part of the PEA, including the mineral resource estimate update, open-pit mine plan, and ore-sorting and metallurgical testing programs and Beacon Gold Mill restart costs. The ERM team includes highly experienced mining engineers, metallurgists, resource geologists, and environmental and sustainability specialists, ensuring a comprehensive and multidisciplinary evaluation. This collaboration underscores LaFleur Minerals' commitment to responsible resource development and positions the Company to capitalize on the current gold market momentum.

The PEA will serve as the basis for the restart of Beacon Mill, which was recently refurbished with over

Regulations require companies to define initial mineral resources on a project via a PEA, and this applies to the Beacon Gold Mill production restart and the Swanson Gold Deposit. The Company believes that there are three reasons why the PEA, which includes restarting the Beacon Gold Mill with mineralized material supply from the Swanson Gold Deposit, will be a sufficient and comprehensive plan for gold production restart.

Realistic Costing: The PEA will provide a AACE class 5 estimate understanding of costs, from blasting, mining, moving a tonne of material to milling, and to operating the tailings treatment facility. Additionally, the mill was operational as recent as two years ago, so costs for that facility are also well understood. Most PEA studies rely on rough estimates for milling costs; the inclusion of the Beacon Mill in the PEA will have realized operating costs from when the mill last operated in 2022, at a time when the price of gold was US

$1,600 per ounce.The Beacon Gold Mill was recently refurbished by Monarch Mining for C

$20 million in 2022 and is already built with a state of readiness to restart. Most PEA studies include as-yet unanswered questions on essential aspects; examples include a full definition of processing flowsheets, mining methods, tailings facility design, or human resource requirements. With the Beacon Mill having operated only a few years ago and with the Company having studied and remedied many of the issues from that period over the last 18 months, there are very few outstanding engineering questions at the Beacon Mill aside from equipment upgrades. A Mining Model for the restart has been reviewed and refined by LaFleur and Consultants and will form a strong part of the PEA, maintenance and repairs.Open Pit life-of-mine plan with a bulk sample verification: PEA studies are conventionally completed before the definition drilling into a deposit is complete. For mineralized feed to a mill, this means a PEA predates a detailed mine design, and stope-defined targeted mining areas with engineered access will define a reasonable prospect for eventual economic extraction (RPEEE). Previous operators have undertaken past scoping studies and life-of-mine plans for open-pit mining at the Swanson Gold Deposit, and LaFleur Minerals also envisions an open-pit mining project. The first 100,000 tonnes of the open pit material will be mined and processed as a bulk sample taken from the mining lease that covers the Swanson Gold Deposit. The bulk sample and its processing at the Beacon Gold Mill will reduce project risk related to costs and recovery and bring the project nearer to operational readiness.

Tailings Dam Lift

As part of the PEA disclosure, LaFleur Minerals has conducted technical studies to support upgrades to the Tailing Pond located at the Beacon Mill, providing complete details of the required upgrades and associated costs.

Definition Drilling

Definition drilling at the Swanson Gold Deposit is currently underway with "twinning" of mineralized holes at the Swanson Deposit. This effort is expected to provide confident updated mineral resource confirmation at the Swanson Gold Deposit using a diamond drill.

The twinned holes are planned to confirm and refine the spacing between historical intercepts, thereby confirming the existing geological model and analytical results that define the Mineral Resource Estimate (MRE) at the Swanson Project.

Open-Pit Mining Scenario at Swanson Gold Deposit

The entirety of the MRE at the Swanson Gold Deposit is located on an existing mining lease, and permitting is in progress to extract mineralization destined for the Beacon Gold Mill. The mining lease permits the extraction of a large bulk sample of mineralized material with minimal permitting requirements.

As part of the PEA, LaFleur Minerals has commissioned an ore-sorting study using Swanson Gold Deposit material in partnership with the Saskatchewan Research Council (SRC). The ore-sorting technology will concentrate the mineralized material prior shipment by truck to the Beacon Gold Mill, reducing trucking costs and minimizing waste rock processing at the Beacon Gold Mill. The ore-sorted material will also undergo metallurgical testing by SGS Minerals in Lakefield to simulate metallurgical results at the Beacon Gold Mill.

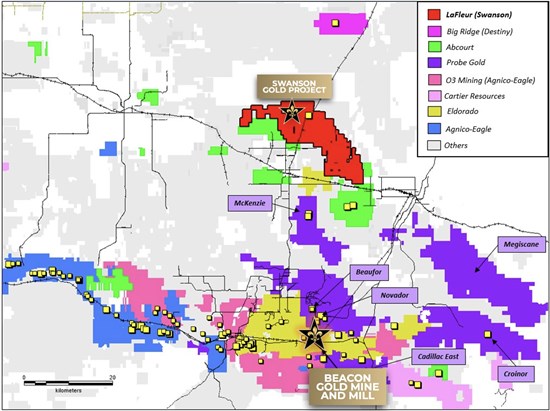

The Swanson Gold Deposit is easily road accessible with minimal infrastructure improvements required and only ~60 kilometres from the Beacon Gold Mill, making it an ideal source of mineralized material to be trucked over for processing. LaFleur Minerals is currently receiving detailed quotation for trucking concentrate material from the Swanson Gold Deposit to the Beacon Gold Mill, and these costs will form part of the market studies and contracts section of the PEA. The Abitibi region is otherwise flush with nearby deposits that could be potential sources of material for custom milling purposes (refer to Figure 1).

Figure 1: Regional Deposits Surrounding LaFleur's Swanson and Beacon Assets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/269252_3812b9d3f4211b73_002full.jpg

Paul Ténière, CEO of LaFleur Minerals, commented, "Engaging a consulting firm of the caliber and reputation of ERM to complete our PEA marks a significant milestone for LaFleur Minerals. By combining our district-scale exploration and resource potential with the fully-permitted Beacon Gold Mill, we are advancing a near-term, sustainable production pathway in one of the world's most prolific gold camps. This is an exciting step that positions us to unlock significant value for shareholders. We think we are strongly aligned with both strong investor appetite for safe, secure, and high-quality assets and favorable market timing with gold trading near record levels, as we advance the Swanson Gold Deposit with near-term production potential."

Figure 2: Beacon Gold Mill in Val d'Or, Québec

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/269252_lafleur2en.jpg

Site Visit

The Company held a Beacon Gold Mill site visit for analysts, investors and consultants in Val d'Or, Québec during August 2025 and received very positive feedback and appreciation in the Company's stock price following the mill visit. LaFleur will be holding a second site visit at the Beacon Gold Mill and Swanson Gold Project on October 7-8, 2025, for prospective investors and financiers, as well as ERM. ERM will attend to begin investigations for the purpose of assessing the state of readiness and infrastructure at the Beacon Mine and Mill, including equipment and tailing storage facility, and the quality of mineralized material and access at the Swanson Gold Project to gather detailed information required to complete the PEA.

Figure 3: Inside the Beacon Gold Mill in Val d'Or, Québec

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/269252_3812b9d3f4211b73_004full.jpg

Stock Options Issued:

Lafleur Minerals has approved the issuance of 1,000,000 stock options (the "Options") pursuant to the Company's incentive stock option plan (the "Stock Option Plan"). The Options provide for the purchase of an aggregate of 1,000,000 common shares of the Company (the "Common Shares") at an exercise price of

About LaFleur Minerals Inc.

LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) is focused on the restart of gold production at its

ON BEHALF OF LAFLEUR MINERALS INC.

Paul Ténière, M.Sc., P.Geo.

Chief Executive Officer

E: info@lafleurminerals.com LaFleur Minerals Inc.

1500-1055 West Georgia Street Vancouver, BC V6E 4N7

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding "Forward-Looking" Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this news release include, without limitation, statements related to the use of proceeds from the Offering. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward- looking statements include market prices, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward- looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269252