Lahontan Acquires Strategic Claims South of The York Pit, Expanding The Santa Fe Mine Project

Lahontan Gold Corp. (OTCQB:LGCXF) has signed a binding term sheet to acquire 27 unpatented lode mineral claims, known as the York Claims, from Emergent Metals Corp. The acquisition adds approximately 2.1 km² of strategic mineral rights to the Santa Fe Mine Project in Nevada, specifically adjacent to the York open pit.

The transaction terms include a US$10,000 initial payment, a US$50,000 promissory note with 1% monthly interest, 2,000,000 common shares of Lahontan, and a 1% NSR royalty that can be purchased back for US$500,000 within three years or US$1,000,000 between the third and seventh anniversary.

The strategic acquisition is expected to allow for significant expansion of the York pit and potential increase in mineral resources, as recent PEA modeling showed gold-silver mineral resources extending toward the newly acquired claims.

Lahontan Gold Corp. (OTCQB:LGCXF) ha stipulato un accordo vincolante per acquisire 27 concessioni minerarie lode non brevettate, note come York Claims, da Emergent Metals Corp. L'operazione aggiunge circa 2,1 km² di diritti minerari strategici al progetto della miniera Santa Fe in Nevada, adiacenti alla cava a cielo aperto di York.

I termini prevedono un pagamento iniziale di 10.000 USD, una cambiale da 50.000 USD con interesse dell'1% mensile, 2.000.000 azioni ordinarie di Lahontan e una royalty NSR dell'1%, riscattabile per 500.000 USD entro tre anni o per 1.000.000 USD dal terzo al settimo anniversario.

Questa acquisizione strategica dovrebbe permettere un'espansione significativa della cava York e un potenziale incremento delle risorse minerarie, poiché recenti modelli di PEA indicano che le risorse oro-argento si estendono verso le concessioni appena acquisite.

Lahontan Gold Corp. (OTCQB:LGCXF) ha firmado una hoja de términos vinculante para adquirir 27 reclamaciones minerales lode no patentadas, conocidas como York Claims, de Emergent Metals Corp. La adquisición añade aproximadamente 2,1 km² de derechos mineros estratégicos al proyecto de la mina Santa Fe en Nevada, contiguo a la cantera a cielo abierto de York.

Los términos de la transacción incluyen un pago inicial de 10.000 USD, una pagaré de 50.000 USD con un interés mensual del 1%, 2.000.000 acciones ordinarias de Lahontan y una regalía NSR del 1% que puede recomprarse por 500.000 USD dentro de tres años o por 1.000.000 USD entre el tercer y el séptimo aniversario.

Se espera que esta adquisición estratégica permita una expansión significativa de la explotación York y un posible aumento de los recursos minerales, ya que los recientes modelos de PEA mostraron que los recursos de oro-plata se extienden hacia las reclamaciones recién adquiridas.

Lahontan Gold Corp. (OTCQB:LGCXF)는 Emergent Metals Corp.로부터 York Claims로 알려진 27개의 특허 미등록 로드 채굴권을 인수하기 위한 구속력 있는 조건확약서에 서명했습니다. 이번 인수로 네바다의 산타페(Santa Fe) 광산 프로젝트에 약 2.1 km²의 전략적 광권이 추가되며, 이는 York 노천광 인접 지역입니다.

거래 조건은 미화 10,000달러 선지급, 월 1% 이자의 미화 50,000달러 약속어음, Lahontan의 보통주 2,000,000주, 그리고 1% NSR 로열티를 포함하며, 이 로열티는 3년 이내에 미화 500,000달러로 환매하거나 3주년에서 7주년 사이에 미화 1,000,000달러로 환매할 수 있습니다.

이 전략적 인수는 York 채광장 확대와 광물자원 증가 가능성을 높일 것으로 기대되며, 최근 PEA 모델링은 금-은 광물자원이 새로 인수된 채굴권 쪽으로 확장되고 있음을 보여줍니다.

Lahontan Gold Corp. (OTCQB:LGCXF) a signé une lettre d'intention contraignante pour acquérir 27 concessions minières lode non brevetées, appelées York Claims, auprès d'Emergent Metals Corp. Cette acquisition ajoute environ 2,1 km² de droits miniers stratégiques au projet de la mine Santa Fe au Nevada, adjacents à la fosse à ciel ouvert de York.

Les modalités comprennent un paiement initial de 10 000 USD, un billet à ordre de 50 000 USD portant 1% d'intérêt mensuel, 2 000 000 d'actions ordinaires de Lahontan et une redevance NSR de 1% pouvant être rachetée pour 500 000 USD dans les trois ans ou pour 1 000 000 USD entre le troisième et le septième anniversaire.

Cette acquisition stratégique devrait permettre une extension significative de la fosse de York et une augmentation potentielle des ressources minérales, des modélisations récentes de l'EPB montrant que les ressources or-argent s'étendent vers les concessions nouvellement acquises.

Lahontan Gold Corp. (OTCQB:LGCXF) hat ein verbindliches Term Sheet unterzeichnet, um 27 nicht patentierte Lode-Mineralansprüche, bekannt als York Claims, von Emergent Metals Corp. zu erwerben. Der Erwerb ergänzt das Santa Fe Mine Project in Nevada um rund 2,1 km² strategische Bergbaurechte, gelegen angrenzend an den York-Tagebau.

Die Konditionen sehen eine Anzahlung von 10.000 USD, eine Schuldverschreibung über 50.000 USD mit 1% monatlichen Zinsen, 2.000.000 Stammaktien von Lahontan sowie eine 1% NSR-Royalty vor, die innerhalb von drei Jahren für 500.000 USD oder zwischen dem dritten und siebten Jahr für 1.000.000 USD zurückgekauft werden kann.

Die strategische Übernahme soll eine bedeutende Erweiterung der York-Grube und eine mögliche Erhöhung der Mineralressourcen ermöglichen, da aktuelle PEA-Modelle zeigen, dass sich Gold-Silber-Ressourcen in Richtung der neu erworbenen Claims erstrecken.

- Strategic acquisition of 2.1 km² mineral rights adjacent to existing York open pit

- Potential for substantial increase in mineral resources through pit expansion

- Flexibility to purchase back the 1% NSR royalty within 7 years

- Recent PEA confirms gold-silver mineralization extending toward new claims

- Additional debt through US$50,000 promissory note at 1% monthly interest

- Share dilution from issuance of 2,000,000 new common shares

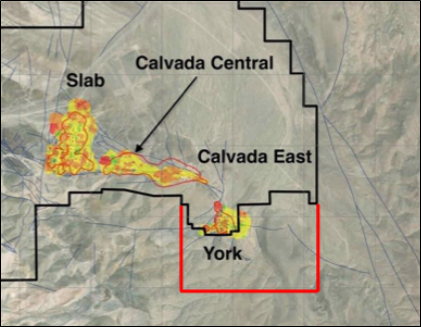

- Scientific data from previous claimants cannot be verified by QP

TORONTO, ON / ACCESS Newswire / August 19, 2025 / Lahontan Gold Corp. (TSXV:LG)(OTCQB:LGCXF)(FSE:Y2F) (the "Company" or "Lahontan") is pleased to announce that the Company signed a binding term sheet (the "Term Sheet") on August 18, 2025 to acquire 27 unpatented lode mineral claims (the "YorkClaims") from Emergent Metals Corp. ("Emergent"),adding approximately 2.1 km2 of strategic mineral rights to the Santa Fe Mine Project. The claims adjoin the Santa Fe Mine Project immediately south and southeast of the York open pit and gold mineral resource* (please see map below). Resource modeling completed as part of the recent Preliminary Economic Assessment ("PEA") of the Santa Fe Mine Project* demonstrated that gold-silver mineral resources extended in the direction of the York Claims. The acquisition of the York claims will allow the expansion of the York open pit and potentially, a substantial increase of mineral resources in the York area.

Kimberly Ann, Lahontan Gold Corp CEO, Executive Chair, and Founder commented: "Lahontan is very excited to acquire the York Claims that are directly adjacent to the York gold mineral resource*. The newly acquired claims will allow a considerable layback of the York pit during mine planning and in mineral resource estimation. Modeling of gold and silver mineralization at York in the Santa Fe Mine Project PEA was constrained by a pit shell that must honor the property boundary*. With the addition of the York Claims, that pit can be greatly expanded, potentially adding resource ounces plus opening up compelling targets for further gold and silver mineral resource expansion. Coupled with recently completed exploration drilling, the Company continues its path of growing size and scale of the Santa Fe Mine Project and enhancing shareholder value".

Emergent and Lahontan contemplate completing a Definitive Agreement (the "Agreement") within 30 days of signing the Term Sheet. The transaction (the "Transaction") is subject to all necessary approvals, including regulatory approval. Terms of the Transaction include:

On signing the Term Sheet, Lahontan will pay Emergent's U.S. subsidiary, Golden Arrow Mining Corporation ("GAMC"), a sum of US

$10,000. On signing the Agreement, Lahontan will issue GAMC a US

$50,000 promissory note, with a1% per month interest rate, and payable within six months of signing the Agreement.On signing the Agreement, Lahontan will issue 2,000,000 common shares of Lahontan Gold Corp. to GAMC or its designee.

On signing of the Agreement, payment of the cash, issuance of the shares, and issuance of the promissory note outlined above, GAMC will facilitate the transfer of the York Claims to Lahontan or its designee, to be completed within 30 days.

As part of the transfer, Lahontan will grant GAMC a

1% NSR royalty (the "Royalty") on the York Claims. At any time before the third anniversary of the Agreement, Lahontan may purchase the Royalty for US$500,000. After the third and before the seventh anniversary of the Agreement, Lahontan may purchase the Royalty for US$1,000,000. T he terms and conditions of the Royalty will be defined in the Agreement.

Regarding scientific data on the York Claims by provided previous claimants, the QP has been unable to verify the information and that the information is not necessarily indicative to the mineralization on the York Claims property that is subject to the disclosure.

About Lahontan Gold Corp.

Lahontan Gold Corp. is a Canadian mine development and mineral exploration company that holds, through its US subsidiaries, four top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 26.4 km2 Santa Fe Mine project, had past production of 359,202 ounces of gold and 702,067 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing. The Santa Fe Mine has a Canadian National Instrument 43-101 compliant Indicated Mineral Resource of 1,539,000 oz Au Eq(48,393,000 tonnes grading 0.92 g/t Au and 7.18 g/t Ag, together grading 0.99 g/t Au Eq) and an Inferred Mineral Resource of 411,000 oz Au Eq (16,760,000 grading 0.74 g/t Au and 3.25 g/t Ag, together grading 0.76 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report and note below*). The Company plans to continue advancing the Santa Fe Mine project towards production, update the Santa Fe Preliminary Economic Assessment, and drill test its satellite West Santa Fe project during 2025. The technical content of this news release and the Company's technical disclosure has been reviewed and approved by Michael Lindholm, CPG, Independent Consulting Geologist to Lahontan Gold Corp., who is a Qualified Person as defined in National Instrument 43-101 -- Standards of Disclosure for Mineral Projects. Mr. Lindholm was not an author for the Technical Report* and does not take responsibility for the resource calculation but can confirm that the grade and ounces in this press release are the same as those given in the Technical Report. For more information, please visit our website: www.lahontangoldcorp.com

* Please see the "Preliminary Economic Assessment, NI 43-101 Technical Report, Santa Fe Project", Authors: Kenji Umeno, P. Eng., Thomas Dyer, PE, Kyle Murphy, PE, Trevor Rabb, P. Geo, Darcy Baker, PhD, P. Geo., and John M. Young, SME-RM; Effective Date: December 10, 2024, Report Date: January 24, 2025. The Technical Report is available on the Company's website and SEDAR+. Mineral resources are reported using a cut-off grade of 0.15 g/t AuEq for oxide resources and 0.60 g/t AuEq for non-oxide resources. AuEq for the purpose of cut-off grade and reporting the Mineral Resources is based on the following assumptions gold price of US

On behalf of the Board of Directors

Kimberly Ann

Founder, CEO, President, and Executive Chair

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, and Executive Chair

Phone: 1-530-414-4400

Email: Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange("TSXV") nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedarplus.com

SOURCE: Lahontan Gold Corp

View the original press release on ACCESS Newswire