Lianhe Sowell Debuts on Nasdaq, Accelerating Business Growth Ambitions and Industry Revolution

Rhea-AI Summary

Lianhe Sowell International Group (NASDAQ: LHSW) made its Nasdaq debut on April 3, 2025, raising $8 million in gross proceeds. The machine vision solutions provider leverages nine foundational technologies, including advanced image processing, sound imaging, and video analysis capabilities.

The company's key technologies include micron-level defect detection with 0.1mm accuracy, phased-array sound field mapping, and neural network-based real-time behavior analysis. Their flagship Nine-Axis Linkage Spray Painting Robots demonstrate versatile applications in automotive and industrial settings.

Financially, LHSW reported strong performance with revenue of $36.6 million for fiscal year ended March 2024, marking a 180% year-over-year increase. Net income grew by 75% in the same period. The company plans to allocate 45% of IPO proceeds to expand its spray-painting robot business, aiming to achieve an annual production capacity of 4,000-8,000 robotic units by 2028.

Positive

- Successful IPO raising $8 million in gross proceeds

- Strong revenue growth of 180% YoY to $36.6 million

- Net income growth of 75% YoY

- Planned production capacity expansion to 4,000-8,000 robots annually by 2028

Negative

- Relatively small IPO size of $8 million may limit growth potential

- Heavy dependence on automotive sector poses concentration risk

News Market Reaction – LHSW

On the day this news was published, LHSW declined 31.93%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

SHENZHEN, China, April 03, 2025 (GLOBE NEWSWIRE) -- Lianhe Sowell International Group Ltd (NASDAQ: LHSW), a company providing machine vision solutions, officially went public on the Nasdaq stock exchange on April 3, 2025, raising total gross proceeds of

Technological Excellence Anchored in Innovation

Serving industrial clients for more than 17 years, Lianhe Sowell’s achievements in the industrial machine vision sector is rooted in its nine foundational technologies, which integrate advanced algorithms and hardware-software synergies to deliver precision-driven solutions. The company’s core expertise spans:

- Image Processing Technology: Enabling micron-level defect detection in electronics manufacturing through real-time analysis of surface imperfections, achieving accuracy down to 0.1mm with inspection speeds as rapid as 0.5 second.

- Sound Imaging Technology: Deploying phased-array principles to map spatial sound fields, enhancing safety monitoring in industrial settings by detecting anomalies like equipment malfunctions or hazardous noises.

- Video Analysis and Recognition Technology: Utilizing neural networks for real-time behavior analysis in high-risk environments, such as identifying safety violations in chemical plants or optimizing traffic flow via intelligent transportation systems.

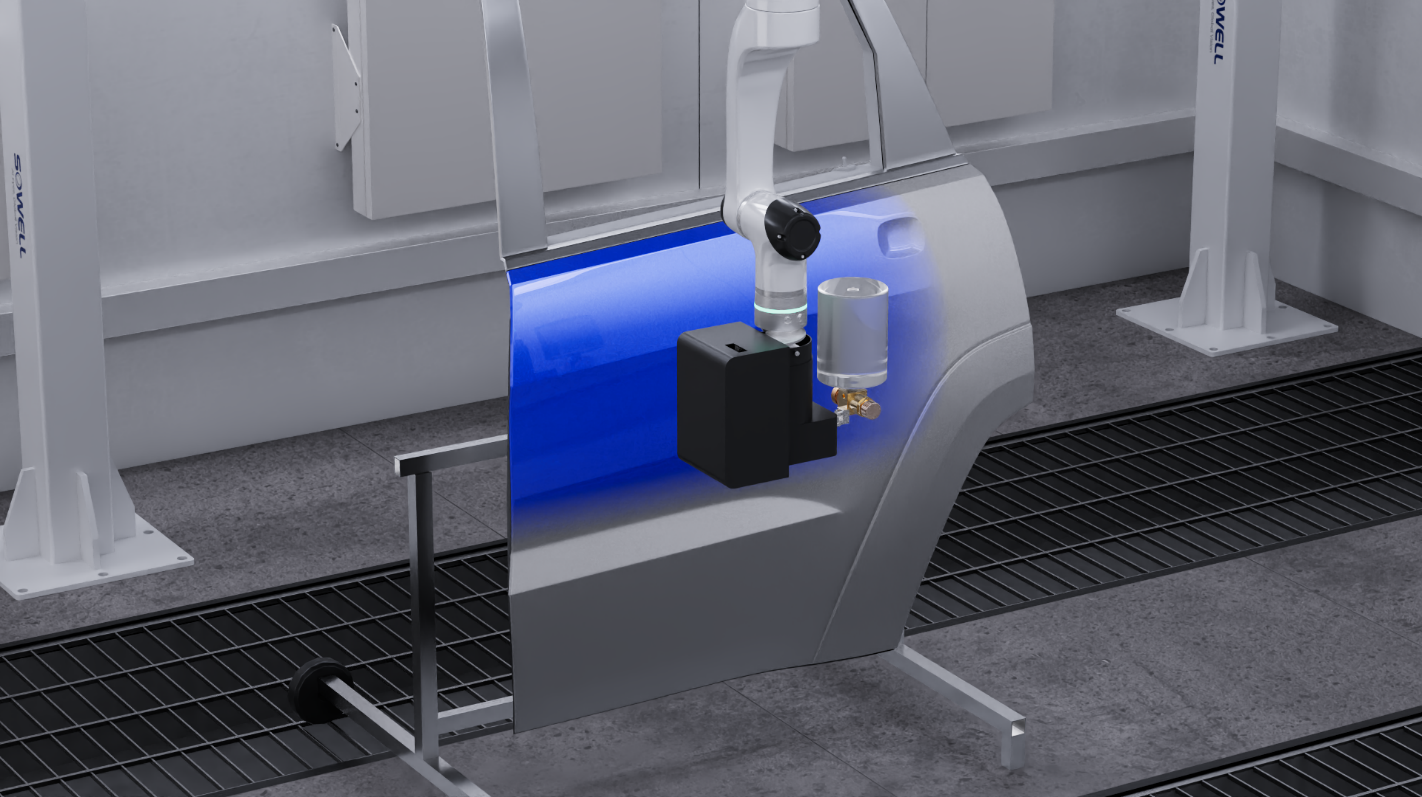

- Nine-Axis Robotic Integration: Combining machine vision with agile 6-axis robotics for applications like automotive spray painting, the company’s flagship Nine-Axis Linkage Spray Painting Robots achieve great precision. The technology's versatile capabilities can potentially be applied to various industrial spray-painting scenarios, enabling automation across multiple production processes.

Strategic Growth Fueled by US IPO Proceeds

The company’s recent US IPO has injected critical capital to accelerate its growth roadmap. A significant portion of the proceeds is earmarked for scaling production of its Nine-Axis robots, which will contribute to the plan to complete the set-up and assembling of the robot production line. This planned facility aims to produce 4,000 – 8,000 robotic units annually by 2028, targeting the automotive repair industry and adjacent sectors like welding and polishing.

In addition, Lianhe Sowell also plans to use proceeds raised from the IPO to invest in its machine vision business including industrial machine vision, face recognition, AI behavior analysis, weak current intelligence and electronic customs clearance, in order to fund research and development of new products and market expansion, according to its filing.

Financial Strengths and Future Expansion

Lianhe Sowell’s IPO marks a pivotal step in its development. The company has demonstrated robust financial performance, sustaining rapid growth during the fiscal year ended March 31, 2024. From March 2023 to March 2024, it achieved revenue of

Post-IPO, Lianhe Sowell plans to allocate

Company: Lianhe Sowell International Limited

Contact Person: Iris Wu

Email: sowellrobot@sowellrobot.com

Website: http://www.sowellrobot.com/

Telephone: +86 19154951787

City: Shenzhen, China

Photos accompanying this announcement are available at :

https://www.globenewswire.com/NewsRoom/AttachmentNg/96234652-530e-4c47-b398-10a630316c24

https://www.globenewswire.com/NewsRoom/AttachmentNg/f83e5629-cc2c-46c4-ba70-8f73073c5f60