Antimony Stocks and the Global Battle for Critical Minerals

Rhea-AI Summary

Locksley Resources (OTCQX: LKYRF) is advancing a U.S. mine-to-market plan at the Desert Antimony Mine (DAM) with workstreams aimed at pilot production in 2026. Key technical milestones include LiDAR mapping of ~236m of historical workings, a JORC 2012 Exploration Target of 19,400–67,700 tonnes of antimony metal, and a 325 kg bulk sample averaging 7.6–7.8% Sb that produced a 68.1% Sb concentrate in testwork. Locksley has signed an MoU with Hazen Research and a collaboration with Rice University on extraction technology, and is assessing underground access and permitting pathways.

Sector context: Permitting and export-policy shifts from China and large financings and revenue moves at U.S. peers underline market opportunity and near-term policy risk for antimony supply chains.

Positive

- Exploration Target: 19,400–67,700 tonnes antimony metal

- Bulk sample head grade 7.6–7.8% Sb

- Testwork produced 68.1% Sb concentrate

- Pilot processing facility planned for 2026

- MoU with Hazen and Rice University collaboration

Negative

- China export-rule changes create near-term policy uncertainty

- U.S. peer operating expenses rose to $11.76M (nine months)

News Market Reaction 1 Alert

On the day this news was published, LKYRF gained 0.80%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Critical Mineral Company Locksley Resources Limited Advances Towards U.S. Antimony Production

Vancouver, Kelowna, and Delta, British Columbia--(Newsfile Corp. - November 13, 2025) - Investorideas.com (www.investorideas.com) a go-to platform for big investing ideas for traders, including mining and defense stocks, reports on the rollercoaster ride for Antimony and related stocks as the US and China battle it out, featuring Locksley Resources Ltd. (ASX: LKY) (OTCQX: LKYRF) (FSE: X5L), a company that specializes in critical minerals development within the United States. The Company is actively advancing the Mojave Project in California, targeting rare earth elements (REEs) and antimony.

Critical Mineral Company Locksley Resources Limited Advances Towards U.S. Antimony Production

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6292/274307_620fd2c344616a44_001full.jpg

Antimony's critical role in defense has it in high demand globally as geopolitical unrest narratives shift and unfold. Antimony has been on a rollercoaster ride with the narratives and the trade deals being announced (and altered) just as quickly, but the long term demand remains unchanged.

According to StraitsResearch.com, "The global antimony market size was valued at USD 2.5 billion in 2024 and is projected to grow from USD 2.62 billion in 2025 to USD 4.83 billion by 2033."

A major trade deal was announced November 1st between the US and China that impacted antimony stocks as Reuters reported, "China agreed to a one-year pause on export controls it unveiled this month on rare earth minerals and magnets, which have vital roles in cars, planes and weapons and have become Beijing's most potent source of leverage in its trade war with Washington. Those controls would have required export licenses for products with even trace amounts of a larger list of elements and were aimed at preventing their use in military products.

The White House said China will also issue general licenses for exports of rare earths, gallium, germanium, antimony and graphite for the benefit of U.S. end users and their suppliers. The White House said that amounted to "the de facto removal of controls China imposed in April 2025 and October 2022."

Days later the game changed. According to Globaltimes, "Chinese Ministry of Commerce (MOFCOM) has issued new rules governing the state-traded exports of tungsten, antimony and silver exports for 2026-27 with the aim to step up the protection of resources and the environment, according to a statement published on the MOFCOM's website."

"The document was proposed by the Department of Foreign Trade of MOFCOM, based on the regulations outlined by the Foreign Trade Law of and the Regulations on the Administration of Import and Export of Goods. It aims to protect resources and the environment and enhance the export management of rare metals, said the MOFCOM."

Betting big on the future of antimony, Locksley Resources Ltd. (ASX: LKY) (OTCQX: LKYRF) (FSE: X5L) just announced advancements with its US Mine-to-Market strategy. The Company has delivered numerous key technical milestones including LiDAR based underground modelling, metallurgical processing updates, a Bulk Sample, underground workings assessment and maiden Exploration Target (JORC 2012). These milestones have provided Locksley with the confidence to fast track the redevelopment plans and initiate extraction studies of mineralisation at the Desert Antimony Mine (DAM) Prospect.

From Target Validation to Extraction

The Company has advanced planning for a targeted, integrated work plan designed to fast-track extraction of mineralisation for Locksley's Phase 1 pilot processing facility, planned for 2026. These results have collectively provided the Company sufficient confidence to progress plans towards re-development of the historical mine. With enhanced knowledge of the geology, metallurgy, and underground access now in place and continually developing, Locksley has commenced early-stage small scale production planning.

Geological Targeting at DAM

Underground LiDAR surveying has mapped ¬236m of historical workings confirming Sb vein continuity, supported by 3D geological modelling, structural mapping, and sampling sequencing that have enabled the Company to establish an Exploration Target (JORC 2012) at DAM containing between 19,400 to 67,700 tonnes of antimony metal (see basis for the exploration target below). This provides a framework to establish a conceptual development plan to provide feed for a pilot plant which is envisaged in 2026. This initial work provides a basis for the scale of operation which would be required and allows conceptual planning and design to be undertaken.

Metallurgy (Bulk Sample)

The recently completed 325 kg bulk sampling has delivered a head grade averaging

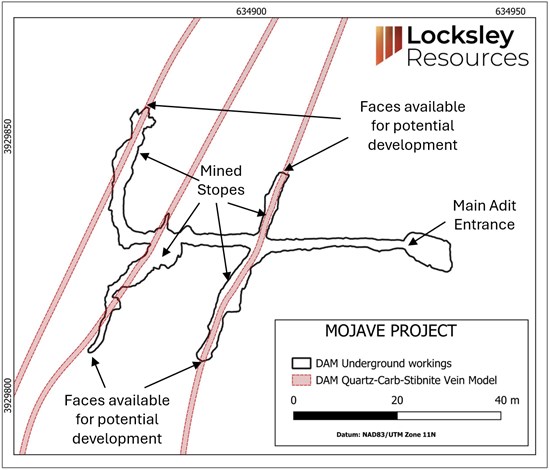

Underground Assessment

With an increasing and developing understanding in the geology and metallurgy, Locksley liaised with a specialist U.S. based underground development consultant to provide an opinion of the historical DAM workings. The assessment indicates the structural stability and accessibility of the workings, providing a potential plan for future re-entry and development of the mineralisation exposed in the underground faces (Figure 1).

Downstream Capability (Processing & Refining)

The restart pathway complements Locksley's downstream strategy, including its collaboration with Rice University to develop advanced antimony extraction technology using DeepSolvTM. Together with the MoU signed with Hazen Research for U.S. based processing capability, Locksley is building a fully integrated mine-to-market platform aligned with American industrial, defence, and energy sectors.

The advancement of the Desert Antimony Mine Prospect comes at a pivotal time for the United States, with antimony confirmed as a priority under federal supply chain resilience frameworks. Locksley's progress directly supports US objectives to rebuild domestic sources of defence-essential materials.

Kerrie Matthews, Managing Director CEO, commented:

"This is a pivotal moment for Locksley, marking the rapid advancement towards the Company becoming a Developer, with an end-to-end supply chain strategy from Mine-to-Metal. All technical steps, from establishing the exploration target, to achieving the

"The successful execution of these three integrated phases has significantly advanced the Company towards mitigating the key uncertainties associated with planning for recommencing operations. We are focused on further enhancing our understanding of DAM and working in parallel with US government on permitting, finance, and ultimately physically delivering antimony product into the US market."

Perpetua Resources (NASDAQ: PPTA), another US based antimony stock, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho. The Company just announced a

From the news:

The Company expects to use the net proceeds of the Offering and the Concurrent Private Placement to fund the construction and development of the Stibnite Gold Project, working capital costs in excess of the Project capital costs, continuing exploration and development activities, restoration and reclamation work, and for general corporate purposes.

Well known antimony stock, United States Antimony Corporation (NYSE American: UAMY) (NYSE Texas: UAMY) reported its third quarter and nine months ended September 30, 2025 financial and operational results. Antimony sales were up significantly.

From the news:

Revenues for the first nine months of 2025 increased to

Our antimony sales were

Research more mining stocks with Investorideas.com free stock directory

https://www.investorideas.com/Gold_Stocks/stocks_list.asp

About Investorideas.com - Big Investing Ideas

Investorideas.com is the go-to platform for big investing ideas. From breaking stock news to top-rated investing podcasts, we cover it all.

Disclaimer/Disclosure: Locksley Resources Limited is a paid featured mining stock on Investorideas.com.This is not investment opinion. Investorideas.com is a digital publisher of third party sourced news, articles and equity research as well as creates original content, including video, interviews and articles. Our site does not make recommendations for purchases or sale of stocks, services or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities. All investing involves risk and possible losses. This site is currently compensated for news publication and distribution, social media and marketing, content creation and more. Contact management and IR of each company directly regarding specific questions. More disclaimer and disclosure info:

https://www.investorideas.com/About/Disclaimer.asp Learn more about publishing your news release and our other news services on the Investorideas.com newswire https://www.investorideas.com/News-Upload/

Global investors must adhere to regulations of each country. Please read Investorideas.com privacy policy: https://www.investorideas.com/About/Private_Policy.asp

Follow us on X @investorideas @stocknewsbites

Follow us on Facebook https://www.facebook.com/Investorideas

Follow us on YouTube https://www.youtube.com/c/Investorideas

Contact Investorideas.com

800 665 0411

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/274307