Lara Reports Results of Preliminary Economic Assessment for its Planalto Copper-Gold Project

Rhea-AI Summary

Lara (OTC: LRAXF) released a Preliminary Economic Assessment for the 100% owned Planalto copper‑gold project (effective date: 15 Oct 2025) in Carajás, Pará, Brazil.

Key metrics: 560 kt Cu and 111 koz Au production over an 18‑year LoM; plant 8 Mtpa; copper recovery 91%, gold recovery 51%. Financials show after‑tax NPV US$378M (8%), IRR 21%, payback 3.5 years, initial capex US$546M, sustaining capex US$170M, and AISC US$5,920/t Cu payable. Project benefits from 4 km access to highway, nearby high‑tension powerlines, and a low‑carbon Brazilian grid. PEA is preliminary and includes ~76% Inferred resources; further drilling and studies required.

Positive

- After‑tax NPV of US$378 million (8% discount)

- After‑tax IRR of 21%

- Payback period of 3.5 years from production

- Life‑of‑mine production of 560 kt Cu and 111 koz Au

- Plant capacity of 8 Mtpa with 91% Cu recovery

- Located 4 km from highway and adjacent high‑tension powerlines

Negative

- Initial capital expenditure of US$546 million

- Life‑of‑mine sustaining capital of US$170 million

- Average LoM AISC US$5,920/t Cu payable

- ~76% of MRE is Inferred, making the PEA speculative

- Processing complexity: pyrite‑rich material needs dedicated tailings handling

News Market Reaction

On the day this news was published, LRAXF gained 2.16%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - October 21, 2025) - Lara Exploration Ltd. (TSXV: LRA) (OTC Pink: LRAXF), ("Lara" or the "Company") is pleased to announce results of an independent Preliminary Economic Assessment ("PEA" or the "Study") on its

Planalto PEA highlights include1:

- Estimated production of 560 kt(2) (1.2 billion lb(2)) of copper and 111 koz(2) gold over an 18-year life of mine ("LoM").

- During the first 6 years, the PEA production schedule produces on average 36 kt (79 million lb(2)) of copper and 7.2 koz of gold per year.

- Open pit mining of shallow dipping copper-gold mineralisation with a LoM strip ratio of 2:1 (1.36:1 Years 1-6).

- Industry standard crush - grind - flotation processing plant operating at an annual rate of 8 Mt(2) of run of mine ("RoM") feed, recovering

91% copper and51% gold. - Producing a clean chalcopyrite concentrate grading

28% copper to be smelted internationally. - Site access by a 4 km(2) road from the state highway with high tension powerlines alongside.

- Project located on private farmland between two major Carajás mining towns and within excellent infrastructure.

- Preliminary Economic Analysis:

- After-tax net present value ("NPV") of US

$378 million , at8% discount rate - After-tax internal rate of return ("IRR") of

21% - Payback period post-tax of 3.5 years from the start of production

- Initial capital expenditures of US

$546 million and sustaining capital (including closure) of US$170 million - Average LoM all-in sustaining costs ("AISC") of US

$5,920 /t Cu payable - Metals price assumptions used: copper price of US

$9,500 /t, gold price of US$2,500 /oz

- After-tax net present value ("NPV") of US

- Mining district infrastructure development advantage

- Planalto is located within excellent infrastructure, which will support the Project development and operation, having access to low-cost grid power via high tension power lines, a state highway passing through the Project licence area and mining skilled labour and industry service providers located close by.

- Renewable and low carbon energy sources dominate the Brazilian grid generation mix. This will contribute to lowering the carbon footprint of the Project. In addition, the current regulatory framework would allow Planalto to sign virtual power purchase agreements for renewable energy supply.

- Pará state has a strong track record of supporting and permitting new mining projects, particularly within the Carajás mining district. Regional and federal agencies have provided various types of economic support to mining projects in the region including taxation relief (SUDAM) which should extend to and have been assumed for Planalto and the PEA.

"The Lara team has a track record of discovery and value creation for shareholders, and we are pleased to be able to demonstrate through this Study, that Planalto has the key technical and economic elements at a scoping level to become a mine.", said Simon Ingram, CEO. "Furthermore, new copper mines are hard to find and often challenging to permit and build, Planalto's excellent local infrastructure and a positive state permitting environment will benefit Planalto as it moves through technical studies towards a potential production decision. The accelerating digitalisation and energy transition megatrends are compounding increasing copper demand and improving the long-term fundamentals of the copper market, which are expected to further benefit Planalto and Lara."

Lara Chairman, Miles Thompson added "The newly acquired Atlantica Exploration Licence has historic drill intercepts with copper mineralisation similar to that at Planalto, directly along strike to the Silica Cap PEA pit. Further exploration within the enlarged Planalto licence area has the opportunity for additional near-term discovery."

Readers are strongly encouraged to read the Company's Technical Report prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") in respect of the PEA which will be filed on the Company's website and under the Company's profile on SEDAR+ within 45 days of this news release. The Technical Report will contain important qualifications, assumptions and exclusions that relate to the PEA. The PEA has an effective date of October 15, 2025.

PEA Summary

It is anticipated that Planalto will be developed as a conventional open pit mine, with processing via a conventional crushing and grinding circuit followed by froth flotation. The process plant with nameplate capacity of 8 Mtpa(3), will produce a single saleable chalcopyrite concentrate to be transported internationally to third-party smelters. Revenue will be from copper with gold credits.

The Company retained SRK Consulting (UK) Ltd and SRK Consultores do Brasil Ltda., as Lara's independent engineering consultants to prepare the PEA in accordance with NI 43-101.

Planalto MRE

The PEA is based upon the Planalto Mineral Resource Estimate dated July 3, 2024 ("MRE") which was reported above a cut-off grade of

- Indicated Mineral Resources of 47.7 Mt(3) at an average grade of

0.53% Cu(3) and 0.06 g/t(3) Au(3), or0.56% CuEq(3), containing 253 kt Cu (0.56 billion lb Cu); - Inferred Mineral Resources of 154 Mt at an average grade of

0.36% Cu and 0.04g/t Au, or0.38% CuEq, containing 549 kt Cu (1.2 billion lb Cu).

All mineralised material processed in the PEA is from Mineral Resources that are currently classified as Indicated and Inferred. The PEA is preliminary in nature and includes Inferred Mineral Resources which make up approximately

Mining

Planalto is characterized by consistent geological and mineralisation continuity down dip and along a 1.5 km strike length. The shallow dipping and near surface mineralisation makes it highly amenable to open pit extraction with a low waste to mineralisation strip ratio. Mineralised copper oxidised material is observed at Planalto, however neither the MRE nor the PEA includes this material.

The PEA incorporates conventional open pit mining using a truck and shovel operation where drilling, blasting, loading, and hauling are to be undertaken by mining contractors.

Over the estimated 18 year mine life, mineralised RoM (material exceeding an insitu grade of

The smaller bench size and mining equipment for RoM mining have been designed to improve mining selectivity and reduce dilution (

Over Years 1-8 inclusive, the maximum material movement is on average projected to be 20 Mtpa increasing to 35 Mtpa in later years. Over the LoM a total of 410 Mt is planned to be extracted, including 130 Mt of RoM mineralised material; 13 Mt of additional low-grade material to be processed at the end of mining; and 266 Mt waste rock that will be placed in a designated facility. Table 2 sets out the projected LoM mining schedule.

Table 2: Mining Production Schedule

| Year | RoM * (Mt) | Cu (%) | Au (g/t) | Waste (Mt) | Strip (t/t) | Total Moved (Mt) |

| 0 | 0.8 | 0.50 | 0.07 | 16.2 | 21.2 | 17.0 |

| 1 | 7.9 | 0.45 | 0.05 | 14.1 | 1.8 | 22.0 |

| 2 | 8.9 | 0.46 | 0.05 | 13.1 | 1.5 | 22.0 |

| 3 | 8.8 | 0.46 | 0.05 | 6.2 | 0.7 | 15.0 |

| 4 | 8.7 | 0.49 | 0.05 | 6.3 | 0.7 | 15.0 |

| 5 | 8.8 | 0.50 | 0.05 | 13.2 | 1.5 | 22.0 |

| 6 | 8.7 | 0.46 | 0.05 | 13.3 | 1.5 | 22.0 |

| 7 | 8.9 | 0.38 | 0.04 | 12.1 | 1.4 | 21.0 |

| 8 | 9.4 | 0.36 | 0.03 | 11.6 | 1.2 | 21.0 |

| 9 | 9.7 | 0.36 | 0.03 | 16.8 | 1.7 | 26.5 |

| 10 | 9.0 | 0.40 | 0.05 | 26.0 | 2.9 | 35.0 |

| 11 | 8.3 | 0.43 | 0.05 | 26.7 | 3.2 | 35.0 |

| 12 | 8.9 | 0.42 | 0.04 | 26.1 | 2.9 | 35.0 |

| 13 | 8.5 | 0.43 | 0.05 | 23.5 | 2.8 | 32.0 |

| 14 | 8.8 | 0.42 | 0.05 | 13.2 | 1.5 | 22.0 |

| 15 | 8.5 | 0.41 | 0.05 | 12.5 | 1.5 | 21.0 |

| 16 | 7.6 | 0.46 | 0.06 | 12.9 | 1.7 | 20.5 |

| 17 | 3.5 | 0.42 | 0.05 | 2.5 | 0.7 | 6.0 |

| Total | 144 | 0.43 | 0.05 | 266 | 1.9 | 410 |

* RoM includes 13 Mt of low-grade material stockpiled and processed at end of LoM | ||||||

Metallurgy Recoveries

Metallurgical recoveries used in the PEA are based on results generated from 2 phases of laboratory flotation testwork performed by Lara at Blue Coast Laboratories in Canada. The results of the Blue Coast metallurgical testwork were used in a steady-state process simulation software (USIM PAC), to develop a plant flowsheet and mass balance, with forecast concentrate quantity and quality based on treating 8 Mtpa. Results indicated that Planalto chalcopyrite mineralisation has the metallurgical characteristics to potentially produce a clean quality saleable copper-gold concentrate.

Processing and Tailings

The PEA assumes the plant will process RoM during the following stages, 0.6 Mt during commissioning, 7.5 Mt in Year 1 and 8 Mt in Year 2 through Year 18.

A traditional copper flotation process flow sheet has been adopted, incorporating a conventional semi-autogenous grinding mill followed by 2 ball mills at a target grind size of

Equipment selection was undertaken in conjunction with major equipment manufacturers and has been costed based on quotes received from Brazilian and international manufacturers.

Based on average feed grades, the plant would be expected to achieve average metallurgical recoveries of

Table 3 presents the estimated LoM plant feed and concentrate production schedule, for the 18-year LoM.

Table 3: Processing and Concentrate Production Schedule

| Year | Plant Feed (Mt) | Cu (%) | Au (g/t) | Cu concentrate (kt) | Cu (kt) | Au (koz) |

| 1 | 7.5 | 0.49 | 0.06 | 120.4 | 33.7 | 6.9 |

| 2 | 8.0 | 0.49 | 0.05 | 127.7 | 35.8 | 7.2 |

| 3 | 8.0 | 0.49 | 0.06 | 127.0 | 35.6 | 7.4 |

| 4 | 8.0 | 0.52 | 0.05 | 134.8 | 37.7 | 7.2 |

| 5 | 8.0 | 0.53 | 0.06 | 137.3 | 38.4 | 7.5 |

| 6 | 8.0 | 0.48 | 0.05 | 125.1 | 35.0 | 7.1 |

| 7 | 8.0 | 0.40 | 0.04 | 103.4 | 28.9 | 5.4 |

| 8 | 8.0 | 0.39 | 0.03 | 100.8 | 28.2 | 4.2 |

| 9 | 8.0 | 0.40 | 0.04 | 103.9 | 29.1 | 4.8 |

| 10 | 8.0 | 0.43 | 0.05 | 112.3 | 31.5 | 6.1 |

| 11 | 8.0 | 0.44 | 0.05 | 113.2 | 31.7 | 6.2 |

| 12 | 8.0 | 0.45 | 0.05 | 116.4 | 32.6 | 6.2 |

| 13 | 8.0 | 0.45 | 0.05 | 115.7 | 32.4 | 6.3 |

| 14 | 8.0 | 0.44 | 0.05 | 114.7 | 32.1 | 6.3 |

| 15 | 8.0 | 0.43 | 0.06 | 111.3 | 31.2 | 7.3 |

| 16 | 8.0 | 0.44 | 0.06 | 115.4 | 32.3 | 7.9 |

| 17 | 8.0 | 0.28 | 0.03 | 73.9 | 20.7 | 4.3 |

| 18 | 8.2 | 0.18 | 0.02 | 46.9 | 13.1 | 2.8 |

| Total | 144 | 0.43 | 0.05 | 2,000 | 560 | 111 |

The PEA envisages a tailings storage facility ("TSF") located to the south-east of the mine site which is entirely within Lara's licence area. The TSF comprises two cells which would be utilised for conventional slurry tailings with storage for the first 13 years of tailings production. During Year 13 of operations, a new deep cone thickener would be installed close to the TSF. Tailings deposition would switch to paste (65

Infrastructure

The PEA envisages a number of infrastructure requirements for the Project which have been designed and costed at a scoping level, including power supply, processing plant, tailings storage facility, waste rock dump, water management channels including a river diversion, process water supply pond, water treatment plant, a 4 km site access road and bridge, haul roads, RoM pad and low grade stockpile and miscellaneous site utilities.

Power in Brazil's national grid is

This PEA assumes concentrate will be trucked by road approximately 680 km to the port of Vila do Conde (Barcarena, Pará State) where it will be loaded onto ocean going vessels for shipping.

Water Management

The tropical climate and the topographic situation of the Project area mean that surface water management will be key to de-risking mining operations and safeguarding the natural environment. The PEA envisages numerous diversion channels to manage surface water runoff and water levels in the nearby creeks particularly during intense storm events. It also gives consideration to treating all water that has been in contact with sulphide-bearing rock. A water treatment plant has been designed and costed at a scoping level. A provisional water balance for the site, including the requirement for water in the processing plant has been estimated.

Environment, Permitting and Social Considerations

Lara's approvals roadmap includes an application for the Preliminary License (LP) in Q3 2026, an application for the Installation License (LI) in Q4 2028, and the Operating Licence (LO) for the start of operations for 2030.

Building on environmental information collected from the Project area in 2021, CLAM Engenharia has commenced an environmental impact assessment ("EIA") which is due to be completed in Q2 2026. Field studies will include air quality, springs survey, water quality, flora and fauna, socio-economic and speleology (caves). The need for studies on archaeology, historical and cultural heritage will be determined following consultation with regulatory authorities.

As the EIA improves the understanding of the environmental and social context of the Project, strong links between Project development and ESG workstreams will be needed to embed sustainability into technical decision making. Early and effective integration of these workstreams will likely improve permitting timeframes and outcomes.

Ongoing key issues include acquisition of surface rights, minimizing the Project footprint to avoid impacts on existing land use and protected areas, characterizing and minimising geochemical risks from mine waste, appropriate design of mine waste facilities, minimising impacts on surface water and groundwater users and Project affected people. Climate change considerations will also need to be considered in future stages of Project development, particularly minimising carbon emissions from the future operation and demonstrating resilience to future climate scenarios in operational and closure designs.

A provisional estimated closure cost of US

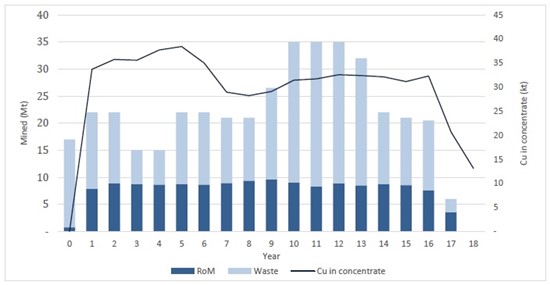

Life of Mine Production Plan

The estimated LoM production under the PEA is summarized in Figure 1 and Table 4.

Figure 1: Mining and Cu in Concentrate Profile

Note: Year 0 is the pre-stripping year, with some RoM mined and stockpiled

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2373/271209_figure1.jpg

Table 4: LoM Production Summary

| Units | Value | |

| Production Rates | ||

| Peak mining rate (ore+waste) | Mt/yr | 35.0 |

| Peak processing | Mt/yr | 8.0 |

| Mine Production | ||

| Total mined | Mt | 410 |

| Waste | Mt | 266 |

| RoM | Mt | 130 |

| Low grade material | Mt | 13.4 |

| Strip ratio | t/t (waste/RoM) | 1.9 |

| Payable metal | ||

| Copper | kt | 540 |

| Gold | koz | 99.7 |

Capital Costs

The estimated initial capital for construction and ramp-up, together with expected sustaining capital and closure costs, is presented in Table 5. The costs have been estimated to an accuracy of -

Table 5: Capital Costs

| Initial (US$ million) | Sustaining (US$ million) | Total (US$ million) | |

| Mining Pre-Strip | 28.5 | -- | 28.5 |

| Processing Plant | 238.5 | 85.9 | 324.4 |

| Tailing Management Facility | 13.1 | 62.1 | 75.2 |

| Water Management | 15.0 | -- | 15.0 |

| On-Site Infrastructure | 28.3 | -- | 28.3 |

| Power Supply | 20.6 | -- | 20.6 |

| Construction Support | 29.5 | -- | 29.5 |

| EPCM | 47.3 | -- | 47.3 |

| Owners Costs | 33.7 | -- | 33.7 |

| Mine Closure | -- | 18.3 | 18.3 |

| Contingency | 90.9 | 3.7 | 94.6 |

| Total | 546 | 170 | 716 |

Operating Costs

The estimated Planalto operating costs represent the onsite costs to produce copper concentrate; additional costs associated with the concentrate transport are captured in the net smelter return calculation. Projected site operating costs are presented in Table 6. The average life-of-mine operating cost of material moved is US

Table 6: Operating Costs

| Description | Unit | Cost |

| Mining | US$/t ex-pit | 3.04 |

| Mining | US$/t processed | 8.34 |

| Processing | US$/t processed | 7.66 |

| Tailings | US$/t processed | 0.13 |

| G&A | US$/t processed | 1.62 |

| Total | US$/t processed | 17.75 |

SUDAM Taxation Benefit

Companies located in the Amazon region may benefit from certain tax incentives. SUDAM is an administratively and financially independent federal government agency that oversees development in the Amazon region. The region includes the state of Pará in which the Project is located. Under the concession program, companies can receive either partial or complete tax exemption on income taxes for Brazilian companies.

The tax exemption applies only to income from facilities operating in the designated region and consists of a reduction of

The PEA assumes that the Planalto Project would be eligible for SUDAM tax exemption, but this can only be confirmed once an application has been submitted and approved.

Metal Price Assumptions and Payability

Metal prices used for the PEA reflect a long term, real basis. These are included in Table 7 alongside 3 year historic prices, long-term consensus forecast ("CMF") prices and current spot prices. CMF prices have been sourced from SCP resource Finance, a UK based financial institution with extensive experience in the copper-gold mining sector that analyses data from Bloomberg and FactSet, where the 2029 median price has been selected. The PEA has been prepared on a

Table 7: Metal Price Assumptions

| Commodity | PEA Prices | 3yr Historic Price to 15 Oct 2025 | Consensus Long Term | Spot Price 15 Oct 2025 |

| Copper | US | US | US | US |

| Gold | US | US | US | US |

The payabilities applied to the economic model were benchmarked from publicly available data from various other mines selling copper-gold concentrates through a third-party refiner, inclusive of treatment charges. The economic analysis assumes all handling and logistics costs associated with shipping of concentrates to an Asian smelter. The smelter payment terms applied in the PEA are detailed in Table 8.

Table 8: Smelter Terms

| Metal | Payability (%) | Treatment Charge | Refining Charge |

| Cu | 96.6 | US | US |

| Au | 90.0 | - | US |

Economic Analysis

The cash flow model was based on the assumed production schedule, associated metal grades, metallurgical recoveries and capital and operating costs outlined in this news release. Table 9 shows the projected Planalto PEA highlights.

Table 9: PEA Financial Highlights

| Key Unit Costs | ||

| Total site costs* | US$/lb Cu payable | 2.14 |

| Government royalties | US$/lb Cu payable | 0.08 |

| Total adjusted operating costs* | US$/lb Cu payable | 2.54 |

| All in sustaining costs* | US$/lb Cu payable | 2.70 |

| Capital Costs | ||

| Initial | US$ million | 546 |

| Sustaining | US$ million | 148 |

| Closure cost | US$ million | 22 |

| Total capital cost | US$ million | 716 |

| Financial Evaluation | ||

| Average annual net revenue* | US$ million | 259 |

| Average annual free cashflow* | US$ million | 91 |

| After-tax NPV @ | US$ million | 378 |

| After-tax IRR | % | |

| Initial capital/NPV ratio* | 1:1 | 1.44 |

| Payback** | Years | 3.5 |

*This is a non-IFRS measure. See "Non-IFRS Financial Performance Measures" below; **Payback from start of production

Sensitivity Analysis

The sensitivity analysis of the Planalto Project's NPV to the discount rate is presented in Table 10 and 11.

Table 10: Sensitivity Analysis to Discount Rate

| Discount Rate | Unit | NPV Sensitivity to Discount Rate |

| US$ million | 495 | |

| US$ million | 378 | |

| US$ million | 284 |

Table 11: Sensitivity Analysis to Metal Price

| Copper Price | Gold Price | NPV to Metal price (US$M) | IRR After Tax Sensitivity to Metal price |

| US$/t | US$/oz | ||

| 9,2501 | 2,434 | 328 | |

| 9,500 2 | 2,500 | 378 | |

| 10,500 3 | 2,750 | 582 | |

| 11,000 4 | 4,000 | 724 |

1: 3 year historic average, 2: PEA prices, 3: Consensus long term; 4: Spot Prices on 15 October 2025 - see Table

The PEA is based on the Company's MRE which is dated July 3, 2024. The effective date of the PEA is October 15, 2025.

Project Opportunities

- Tailings - There is opportunity to significantly reduce required footprint areas for TSF development by utilising paste thickened/central thickened discharge technologies. This would significantly reduce the volumes of excess contact water to be managed on the TSF and simplify closure of the facilities given that tailings material can be incorporated in the engineered cover system to form a water shedding surface.

- Metallurgy - There is potential for further improvements to metallurgical recoveries and optimization of processing reagent consumption during more detailed future study phases, which could involve more exhaustive and larger scale pilot plant test work. Test work is continuing.

- MRE Growth Potential - The Company believes that there is further potential to add to the 2024 MRE at Planalto, since the mineralization is open in some places within the MRE constraining pit and at depth the pit is limited in places by the depth of existing drilling. Furthermore there is strike extension potential in the Silica Cap deposit south-eastwards into the new Atlantica licence, where historical drilling intercepted copper mineralization. A number of copper in soil geochemical anomalies within the Planalto Exploration Licence have had limited follow up exploration including very limited drilling.

- Oxide Exploration - Excluded from the PEA is processing of oxide mineralised material, where the exploration target has been defined through a combination of drilling, surface trenches and soil geochemistry. Initial metallurgical testing suggests marginal economic recoveries, and more test work is planned. If incorporated into future studies, additional plant components would be required that are not considered in the PEA.

- Power - There is potential to connect directly to the nearby 230 kV transmission line, reducing the capital cost and line losses while simplifying access and permitting for the short 3Km connection distance. In addition, significant savings in power tariff costs may be achieved when connecting directly at the 230 kV transmission level as a "Grid User", circa USD 0.04/kWh compared with the estimated PEA cost of USD 0.06/kWh for a 138 kV utility connected user. Power constitutes

39% of the plant operational cost of 7.66 US$/t processed. - Concentrate Treatment and Refining Charges - The PEA smelter charges to treat copper concentrates reflect long term benchmark rates, Lara considers that current market rates are low (negative) and may remain lower than rates used in the PEA.

- Metal Price - The Project economics are particularly sensitive to metal price. The current spot price and consensus long term price for copper and gold are higher than the metal prices used in the PEA. Higher metal prices have the potential to significantly positively impact the economic return of the Project.

Project Risks

- The PEA incorporates Inferred Mineral Resources which are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. While the Company intends to conduct further drilling with the objective of converting Inferred Mineral Resources to Indicated Mineral Resources there can be no assurance this will be successful.

- The technical and cost estimates are at the scoping stage; therefore further technical, economic and permitting related work is required to be completed in order to achieve a prefeasibility level of study ("PFS"). Only when a positive PFS is issued will it be possible to convert Indicated and Measured Mineral Resources to Mineral Reserves.

- The PEA assumes that Planalto would be eligible for SUDAM tax benefits, but Lara has not yet made application to determine eligibility.

Planalto Mineral Resource Statement

The Planalto Mineral Resource statement dated July 3, 2024 is presented in Table 11. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. For further information please refer to the Technical Report on a Mineral Resources Estimate for the Planalto Project, Canaã dos Carajás, Pará, Brazil, September 2024 with effective date of July 3, 2024 available on SEDAR+ (www.sedarplus.ca) and the Company's website www.laraexploration.com.

Table 11: Planalto Mineral Resource Statement, July 03, 2024

| Resource Category | Domain | Tonnage (Mt) | Cu Grade (%) | CuEq Grade (%) | Au Grade (g/t) | Cu (kt) | Cu (Mlb) | Au (koz) |

| Indicated | Main Mineralization | 47.7 | 0.53 | 0.56 | 0.06 | 253 | 557 | 92 |

| Host Rock Mineralization | - | - | - | - | - | - | - | |

| Total Indicated | 47.7 | 0.53 | 0.56 | 0.06 | 253 | 557 | 92 | |

| Inferred | Main Mineralization | 77.7 | 0.51 | 0.54 | 0.06 | 396 | 874 | 149.9 |

| Host Rock Mineralization | 76.3 | 0.2 | 0.22 | 0.03 | 153 | 336 | 73.6 | |

| Total Inferred | 154.0 | 0.36 | 0.38 | 0.04 | 549 | 1210 | 223.5 | |

Notes related to the Mineral Resource Estimate:

- The MRE has been reported in accordance with the CIM Definition Standards on Mineral Resources and Reserves and National Instrument 43-101.

- The QP responsible for the MRE is Martin Pittuck CEng, FGS, MIMMM(QMR).

- The MRE contains fresh rock domains only, the oxide mineralization is not reported.

- The MRE is reported above a cut-off grade of

0.16% CuEq which reflects the technical and economic parameters assumed in the GE21 report and which also reflects the technical and economic parameters used in the PEA (Tables 6, 7 and 8 above). - CuEq = Cu grade plus Au grade multiplied by a factor based on [gold price 2200 $/oz x

68% recovery x90% payability] / [copper price 10,000 $/t x88% recovery x83.7% payability] - Tonnage is based on dry density.

- The MRE is within Lara's tenement areas.

- The MRE numbers have been rounded to reflect the estimate precision; this may cause summation errors which are not considered to be material.

- The PEA QPs and other authors are not aware of any legal, permitting, political, environmental, or other risks that could materially affect the development of the Mineral Resource.

- SRK confirms that the different metal prices and technical economic parameters in the PEA, when compared to the GE21 MRE report, are such that there is no material difference in calculated CuEq factor and reporting cut off grade.

Technical Information and Qualified Persons

The following persons are the Qualified Persons under NI 43-101 that are responsible for the PEA and have reviewed and approved the scientific and technical information contained in this news release:

- Martin Pittuck, MIMMM(QMR) CEng FGS, Corporate Consultant (Resource Geology)

- Leonardo de Freitas Leite, MSc, FAusIMM (CP), Principal Consultant (Mining Engineering)

- Liam MacNamara PhD, ACSM, MIMMM, Principal Consultant (Mineral Processing)

- Jamie Spiers, CEng MIMMM, Principal Consultant (Tailings Engineering)

- David Carruth, CEng MICE IntPE, Principal Consultant (Water Engineering)

- Colin Chapman, CEng MIMMM, Principal Consultant (Infrastructure)

- Thiago Toussaint MSc, MBA, MAusIMM CP(Env)

All of the foregoing persons are independent Qualified Persons, as defined under NI 43-101.

Details of the PEA will be provided in a technical report prepared in accordance with NI 43-101 with an effective date of October 15, 2025, which will be filed on the Company's website and under the Company's profile on SEDAR+ within 45 days of this news release.

About Lara Exploration

Lara is an exploration company, advancing its

For further information on Lara Exploration Ltd. please consult our website www.laraexploration.com, or contact Chris MacIntyre, VP Corporate Development, at +1 416 703 0010.

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Non-IFRS Financial Performance Measures

"All-in Sustaining Costs", "Total Site Costs", "Total Adjusted Operating Costs", "Average Annual Net Revenue", "Average Annual Free Cashflow" and "Initial Capital/NPV ratio" are not performance measures reported in accordance with International Financial Reporting Standards ("IFRS"). These performance measures are included because these statistics are key performance measures that management uses to monitor performance. Management uses these statistics to assess the overall effectiveness and efficiency of the contemplated mining operations. These performance measures do not have a standardized meaning under IFRS and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. As the Project is not in production, the prospective non-IFRS financial measures presented may not be compared or reconciled to the equivalent historical non-IFRS measure.

Cautionary Note Regarding Forward Looking Information

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "opportunity", "intend" or "believe", variants of these words and other similar words, phrases, or statements that certain events or conditions "could", "may", "should", "will" or "would" occur. This news release contains forward-looking information regarding future or estimated financial and operational performance under the PEA including: estimated initial capital, sustaining capital, operating, sustaining and other costs, closure costs, net present value, internal rate of return and payback; metals price assumptions; estimated gold and copper production; estimated processing rates, throughput, ore grades and recovery rates; estimated LoM; the potential for future MRE growth from drilling; the development of Planalto as a conventional open pit mine; the potential to process the oxide mineralized material and the economics thereof; whether or not current or future discoveries of copper-gold mineralization at Planalto will have sufficient economic merit to consider development; potential repeatability and improvements to the economic assumptions and/or to metallurgical recoveries used in the PEA and MRE in future studies; the potential to convert some or all of the MRE to mineral reserves through economic studies and the timing and results of any such studies; opportunities to use a lower cut-off grade in the future; the carbon intensity of any future operation; the results of subsequent stages of permitting, including but not limited to the timing, granting and conditions of the LP, LI and LO referred to herein; the outcomes of future economic studies and the Company's plans in respect thereof; the potential for tax exemptions under SUDAM; project opportunities including the reduction of required footprint areas for TSF development, oxide exploration and the processing of oxide mineralized material, further improvements to metallurgical recoveries and optimization of processing reagent consumption, and MRE growth potential and the potential to convert existing inferred resources to the indicated category. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, unexpected results from exploration programs, changes in the state of equity and debt markets, fluctuations in commodity prices and exchange rates, delays in obtaining required regulatory or governmental approvals or permits, environmental risks, limitations on insurance coverage; and other risks and uncertainties involved in the mineral exploration and development industry. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including, but not limited to, the assumption that the assay results confirm that the interpreted mineralization contains significant values of copper and gold; that the mineralization remains open at depth; that activities will not be adversely disrupted or impeded by regulatory, political, community, economic, environmental and/or healthy and safety risks; the Company's ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including gold; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; that the Planalto Project will not be materially affected by potential supply chain disruptions; general business and economic conditions will not change in a materially adverse manner; and other assumptions and factors generally associated with the mining industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.

1 The PEA is preliminary in nature, and it includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and, as such, there is no certainty that the PEA results will be realized.

2 kt; thousand metric tonnes; koz: thousand ounces; lb: pounds; Mt: million metric tonnes; km: kilometres

3 Mtpa: million metric tonnes per annum; Mt: million metric tonnes; Cu: copper; g/t: grams per metric tonne; Au: gold; CuEq : copper equivalent where Cu grade is added to Au grade multiplied by a factor based on [gold price 2200 $/oz x

4 dmt: dry metric tonne

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271209