Lexin Delivers Strong Q1 2025 Results with Profit at a Three-Year High, Highlighting the Growing Strength of Its Multi-Business Ecosystem

Rhea-AI Summary

Positive

- Non-GAAP EBIT surged 104.7% YoY and 25.3% QoQ to RMB 580 million

- Dividend payout ratio increased from 25% to 30% effective H2 2025

- Asset quality improved with 5% QoQ decline in early-stage risk metrics and 9% QoQ drop in 90+ day delinquency rate

- Total user base grew 8.1% YoY to 232 million

- Funding costs decreased by 2.3% QoQ, marking seven consecutive quarters of decline

- Profit margin increased by 21% QoQ for fourth consecutive quarter

Negative

- Macroeconomic uncertainties and industry shifts pose ongoing challenges

- Significant R&D investment of RMB 156 million impacts expenses

News Market Reaction – LX

On the day this news was published, LX declined 10.84%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Shenzhen, China, May 22, 2025 (GLOBE NEWSWIRE) -- On May 22, LexinFintech Holdings Ltd. (“Lexin” or the “Company”) (NASDAQ: LX), a leading new-consumer digital technology service enabler in China, released its unaudited financial results for the first quarter of 2025. The revenue reached RMB 3.1 billion, while profit (Non-GAAP EBIT) surged to RMB 580 million, up

In terms of asset quality, in Q1, Lexin’s early-stage risk metrics for newly originated assets, FPD7 (First Payment Default 7), declined by

In terms of funding costs, it decreased by

Concerning the business scale, Lexin’s transaction volume in Q1 reached RMB 51.62 billion, with managed outstanding loan balance reaching RMB 107.33 billion. The total number of users grew to 232 million, up by

With this stunning business performance, following the previous announcement in last November to raise its cash dividend payout ratio, Lexin has disclosed in its quarterly report that it will further increase dividend payout ratio. Effective from the second half of 2025, the cash dividend payout ratio will increase from

“Amid external uncertainties, including macroeconomic challenges, our strong Q1 performance demonstrates the success of our strategic transformation over the past two years, centered on risk-driven, data-driven, and refined operations. We have now navigated this challenging transformation and embarked on a new phase of high-quality development,” Mr. Jay Wenjie Xiao, Chairman and Chief Executive Officer of Lexin, said.

“In the forthcoming quarters, despite challenges such as macroeconomic volatility and industry shifts, we are implicitly confident in achieving significant year-over-year net profit growth for the full year, supported by our enhanced capabilities, unique advantages in multi-business ecosystem, and substantially improved operational strength and resilience,” he added.

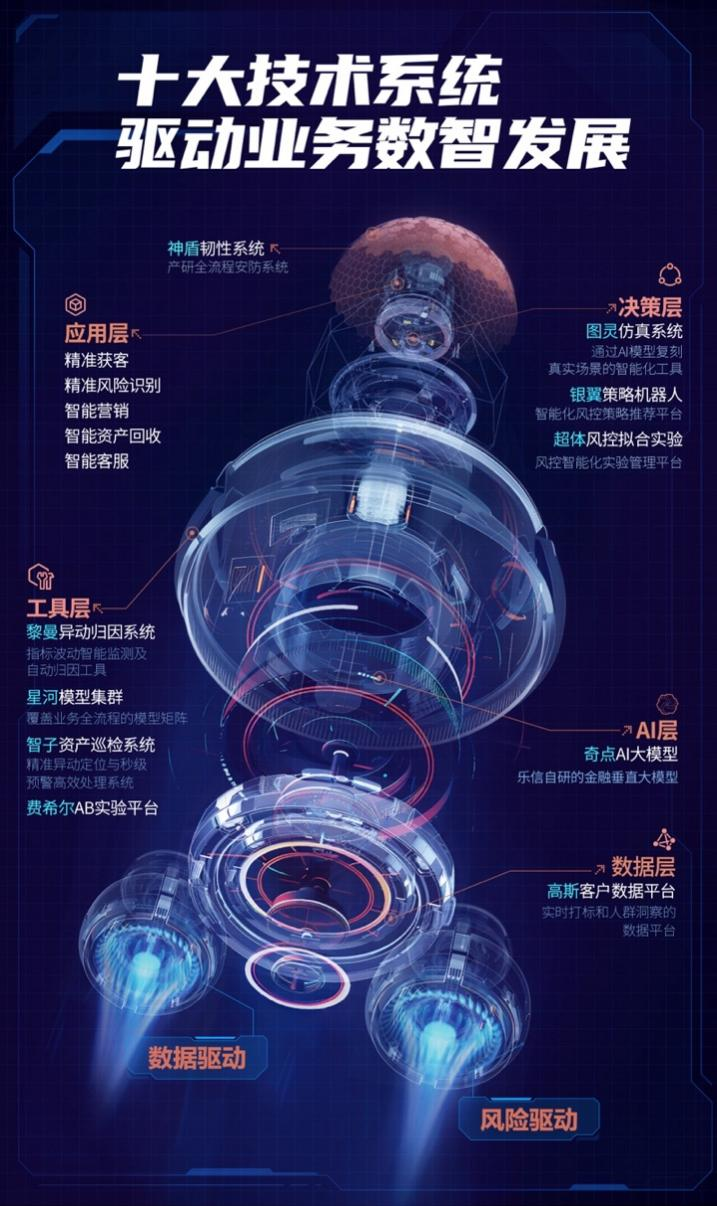

Dual-Drive Strategy Fuels Leap in Core Capabilities, Injecting Dynamic Momentum into Performance Growth

The financial report shows that Lexin invested RMB 156 million in R&D in Q1, which marks a

Lexin has completed a comprehensive upgrade of its risk control system, achieving high synergy between risk management and business operations. In Q1, the company increased investment in data algorithms, enhancing its ability to identify and differentiate customer segments at various stages, with a

Lexin has been actively engaged in exploring the integration of AI and digital finance, restructuring business processes to establish a full-chain quantitative operation analysis system. In Q1, the company introduced advanced large models such as DeepSeek R1 and QWen3, refining its locally deployed “Singularity” AI model through a “data distillation + domain fine-tuning” framework. Such cutting-edge technologies have already found their way into enhanced R&D efficiency, internal tools, and business empowerment. Furthermore, Lexin developed an AI Agent system equipped with financial adaptive capabilities using reinforcement learning algorithms and financial knowledge distillation, now being tested and applied in the assisted generation of pre-loan strategy to augment policy iteration efficiency. The deep integration of AI across business scenarios supports Lexin’s digital and intelligent development, further refining its capabilities in precision operation.

Synergistic Advantages of Ecosystem Businesses Become Evident, Driving Consumption Growth and Supporting SME Development

In Q1, Lexin’s installment retail business, personal consumption credit business, and inclusive finance business all achieved solid progress. Installment retail business recorded a transaction volume of RMB 1.126 billion, up by

Fenqile Mall, Lexin’s installment retail platform, targets high-quality and fast-growing young customers. Through the restructuring of the risk management system, supply chain upgrades, expanded user engagement, and improved consumption experiences, the Mall has registered significant Q1 transaction growth. Also in Q1, precision customer segmentation has been realized to match differentiated e-commerce products and financial services, thus increasing the installment approval rates. Lexin has also enhanced supply chain development. The “Zhenpin Hui” program has introduced first-tier authorized suppliers of premium brands in apparel, esports, and sports, all of which are categories popular among young consumers. Through the “Factory Direct” model, the Mall has further diversified product offerings, now covering 366 sub-industries and nearly 330,000 merchandise items, thus significantly enriching supply chain variety.

In Q1, in the sector of personal consumption credit business, “FlexiLoan” was launched, which is an on-demand credit product aligned with its “Easy Spending, Flexible Liquidity” philosophy, catering to young users’ needs for instant borrowing and longer repayment terms. FlexiLoan, alongside Lexin Gold Card, Lexin Liquidity, and Lexin Huaka, formed a diversified product matrix. By optimizing credit limits, interest rates, and tenures based on segmented customer demands, Lexin has enhanced its offer competitiveness, significantly boosting user retention and engagement.

Lexin’s Fenqile Inclusive Finance, which aims to empower micro and small businesses, actively advances notions of financial inclusiveness and expands into lower-tier cities in Q1. Its risk control approach based on “quantitative + interactive manual review” precisely tailors credit limits for qualified users, balancing risk mitigation with market competitiveness. Under the "Believe in Small Dreams" initiative, the Fenqile Inclusive Finance has deepened penetration in industrial clusters of small and self-employed businesses in lower-tier cities, connecting 150,000 micro and small businesses with approximately RMB 4.3 billion in funding. Over

In the overseas business sector, in Q1, Lexin upgraded its financial products in Mexico and Indonesia, refined its middle-office risk systems, and enhanced its customer acquisition channels. Overseas customer acquisition costs dropped by

Lexin consistently attaches great importance to the protection of consumer rights. In Q1, it deployed new tools such as AI-powered large models to optimize services of user touchpoints, such as App, enterprise WeChat, on-duty customer service, etc. Such tools can promptly address service bottlenecks to earn greater consumer trust. Moving forward, Lexin will continue strengthening its consumer protection capabilities by employing digital and systematic methods to deliver secure and seamless financial experiences for consumers.

Chuanda Xu LexinFintech Holdings Ltd chuandaxu (at) lexin.com