Mako Mining Reports Second Quarter 2025 Financial Results, Including Record Adjusted EBITDA of US$21.3 million, a Record Increase In Cash of US$18.2 million and EPS of US$0.11/share from 11,476 oz Gold Sold at US$3,323/oz

Rhea-AI Summary

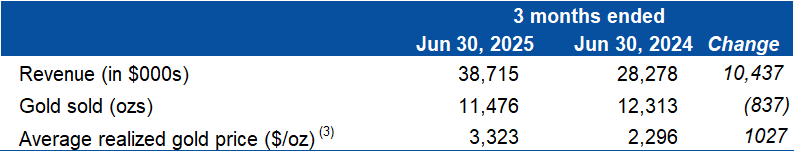

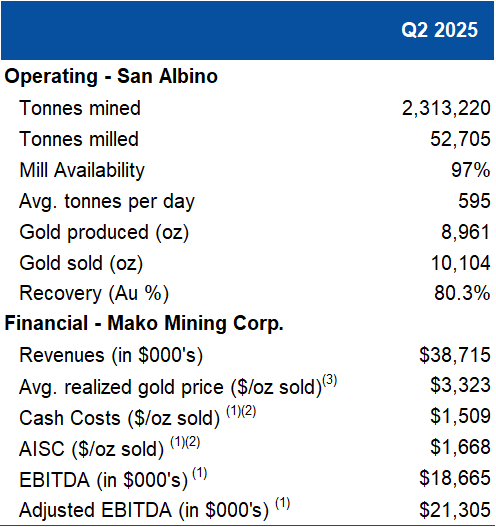

Mako Mining (OTCQX:MAKOF) reported exceptional Q2 2025 financial results, achieving record performance metrics. The company generated $38.7 million in revenue from gold sales, a significant increase from $28.3 million in Q2 2024. Key highlights include record Adjusted EBITDA of $21.3 million, an $18.2 million increase in cash, and earnings per share of $0.11.

The company sold 11,476 ounces of gold at an average price of $3,323 per ounce, with Cash Costs of $1,509 and AISC of $1,668 per ounce sold. Mako demonstrated strong operational efficiency with a Twelve Trailing Months ROE of 33.9% and ROA of 23.5%. The company expects similar production rates for San Albino in H2 2025, with Q4 projected to be a record quarter as mining resumes at Moss Mine.

Positive

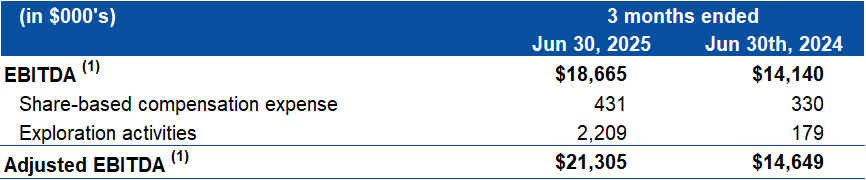

- Record Adjusted EBITDA of $21.3 million in Q2 2025

- Revenue increased to $38.7 million, up from $28.3 million in Q2 2024

- Strong profitability with $8.8 million Net Income and $0.11 EPS

- Impressive TTM Return on Equity of 33.9% and Return on Assets of 23.5%

- Record $18.2 million increase in cash position

- Q4 2025 expected to be a record quarter for the company

Negative

- Mining at Moss Mine was delayed due to equipment delays from contractor

- Second half of 2025 performance heavily weighted towards Q4, indicating potential volatility

- Acquired Elevation Gold Mining Corporation's debt with expected recoveries significantly below face value

News Market Reaction

On the day this news was published, MAKOF gained 2.56%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / August 22, 2025 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three and six months ended June 30, 2025 ("Q2 2025"). All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

The Company's financial results for Q2 2025 reflect record gold sales from its San Albino and Moss Mine of

Q2 2025 Mako Mining Highlights

Financial

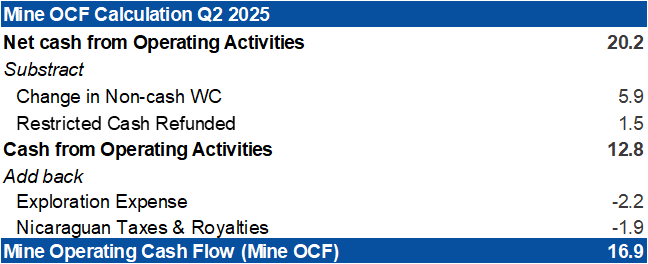

$38.7 million in Revenue$16.9 million in Mine Operating Cash Flow ("MineOCF") (1) (4)$21.3 million in Adjusted EBITDA (1)$18.2 million increase in cash$8.8 million Net Income$1,509 Cash Costs ($/oz sold) (1) (2)$1,668 All-In Sustaining Costs ("AISC") ($/oz sold) (1) (2)Twelve Trailing Months ("TTM") Return on Equity ("ROE") (1) of

33.9% and Return on Assets ("ROA") of23.5% (1)Delivered final installment of 13,500 oz of silver in Q2 2025 to the Sailfish Silver Loan

Growth

$2.2 million in exploration and evaluation expenses ($0.4 million San Albino and Las Conchitas,$0.5 million exploration in El Jicaro Concession in Nicaragua and, approximately,$1.1 million at Eagle Mountain, Guyana)

Subsequent to June 30th, 2025

The Company made interest payments of

$0.3 million on the Revised Wexford Loan.On July 2, 2025, the Company acquired for

$1.8 million the secured indebtedness of Elevation Gold Mining Corporation from Maverix Metals Inc. under Elevation's ongoing CCAA proceedings As principal secured creditor, Mako is now entitled to distributions under the CCAA process, though expected recoveries will be significantly below the debt's face value.

Akiba Leisman, Chief Executive Officer, states that "Q2 was another strong quarter for Mako, with record Adjusted EBITDA of US

Table 1 - Revenue Mako Mining Corp.

Table 2 - Operating San Albino and Financial Data Mako Mining Corp.

Table 3 - EBITDA Reconciliation

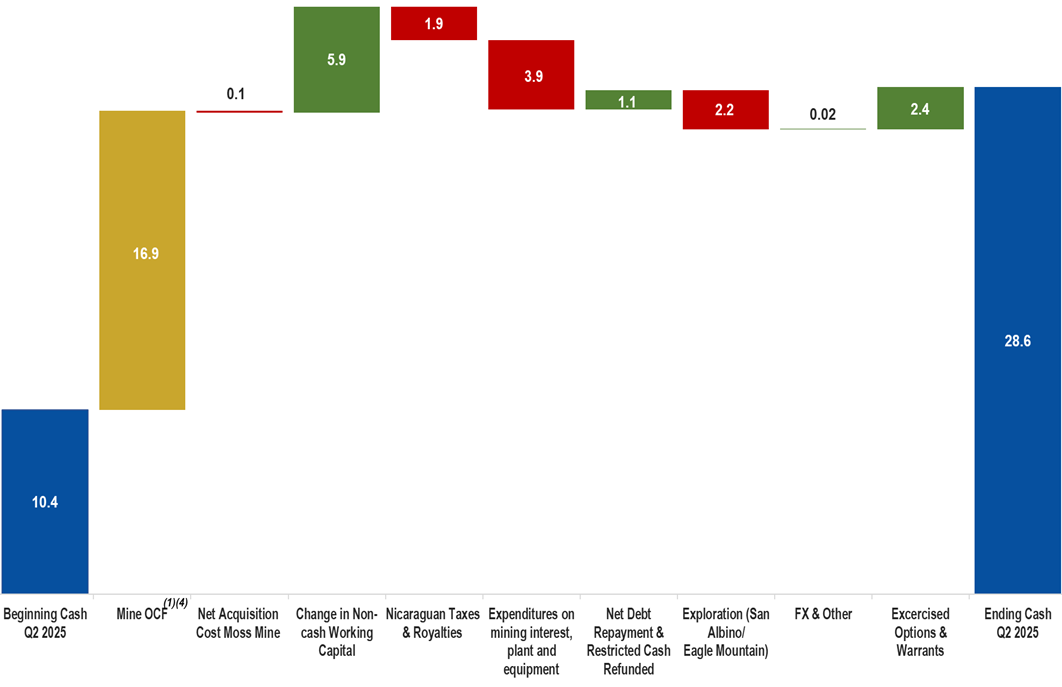

Chart 1

Q2 2025 - Mine OCF Calculation and Cash Reconciliation (in $ million)

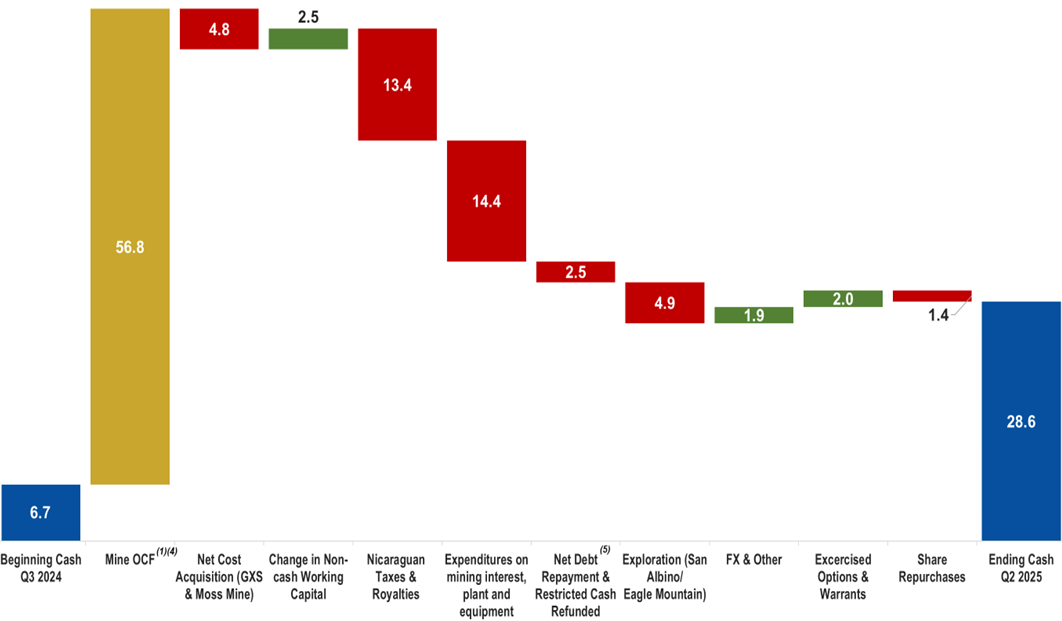

Chart 2

Twelve Trailing Months (TTM) - Mine OCF Calculation and Cash Reconciliation (in $ million)

End Notes

Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Realized price before deductions from Sailfish gold streaming agreement.

Refer to "Chart 1 & 2 - Mine OCF Calculation and Cash Reconciliation (in $ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF.

Includes Repayment Silver Loan, Wexford Loan, Wexford Bridge Loan related to Goldsource Acquisition, other lease payments and a release of US

$1.5 million from Trisura Guarantee insurance Company held as collateral for various environmental bonds held at the Moss Mine

For complete details, please refer to condensed interim consolidated financial statements and the associated management discussion and analysis for the three and six months ended June 30, 2025, available on SEDAR+ (www.sedarplus.ca) or on the Company's website (www.makominingcorp.com).

Non-GAAP Measures

The Company has included certain non-GAAP financial measures and non-GAAP ratios in this press release such as EBITDA, Adjusted EBITDA, Mine Operating Cash Flow cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, these are commonly used performance measures and ratios, but do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

"EBITDA" represents earnings before interest (including non-cash accretion of financial obligation and lease obligations), income taxes and depreciation, depletion and amortization.

"Adjusted EBITDA" represents EBITDA, adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of G&A, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of gold production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"Mine OCF" represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expense

"ROE" is calculated by dividing the twelve trailing months Net Income by the average shareholder's equity. The average shareholder's equity is calculated by adding the total equity at the end of the period to the total equity at the beginning of the period and dividing by two.

"ROA" is calculated by dividing the twelve trailing months Net Income by the average total assets. The average total assets is calculated by adding the total assets at the end of the period to the total assets at the beginning of the period and dividing by two.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally and offers district-scale exploration potential. In addition, Mako also owns the Moss Mine in Arizona, an open pit gold mine in northwestern Arizona. Mako also holds a

For further information on Mako Mining Corp., contact Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and the Company's profile on the SEDAR+ website at www.sedarplus.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, management's expectation that the Moss mine will be a substantial cash flowing mine when full scale mining operations begin in September 2025 and the expectation that 2025 will show the results from the work performed by the Company in 2024. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24, 2022 measures having impacts on business operations not currently expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR+ at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with information regarding the Company's Q2 2025 and full year 2024 financial results and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on ACCESS Newswire