Montage Gold Reports on Its Q2 and H1-2025 Activities

Rhea-AI Summary

Montage Gold (OTCQX:MAUTF) reported significant progress on its Koné gold project construction in Côte d'Ivoire for Q2 and H1-2025. The project remains on budget with $370 million (44%) of total capital committed and is well on track for first gold pour in Q2-2027.

Key highlights include over 3.0 million hours worked without injuries, 2,500+ employees on site, and CIL tank construction starting 2 months ahead of schedule. The company expanded its 2025 exploration program from 90,000 to 120,000 meters, with 83,280 meters already completed in H1-2025.

The company maintains robust liquidity of $735 million against remaining capital requirements of $676 million, supported by financing from Wheaton Stream, Zijin Loan Facility, and cash on hand.

Positive

- Project remains on budget and schedule for Q2-2027 gold pour with 44% ($370M) of capital already committed

- Outstanding safety record with over 3.0 million hours worked without Lost Time Injury

- CIL tank construction commenced 2 months ahead of schedule

- Strong liquidity position of $735M against $676M remaining capital requirements

- Exploration program expanded by 33% to 120,000 meters for 2025

- 90% local employment rate with over 2,500 employees and contractors on site

Negative

- Exploration meters drilled decreased by 8,494 meters in Q2 vs Q1-2025

- Cash flows used in investing activities increased by $31.6M quarter-over-quarter

- Total liquidity and available financing decreased by $98.1M from Q1 to Q2-2025

News Market Reaction

On the day this news was published, MAUTF gained 0.54%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Koné project construction on-budget and well on-schedule • Strong continued exploration focus • Robust liquidity sources

CONSTRUCTION ACTIVITIES

- Over 3.0 million hours worked without a Lost Time Injury, with more than 2,500 employees and contractors on-site

- Well on track for first gold pour in Q2-2027 and on budget with over

$370 million of capital committed as at today, representing approximately44% of the total capital expenditure, with prices in line with expectations - Rapid progress achieved on key process plant activities including the ball mill foundations, pre-leach and tailings thickeners, with notably the start of CIL tank erection occurring 2 months ahead of schedule which marks a key milestone

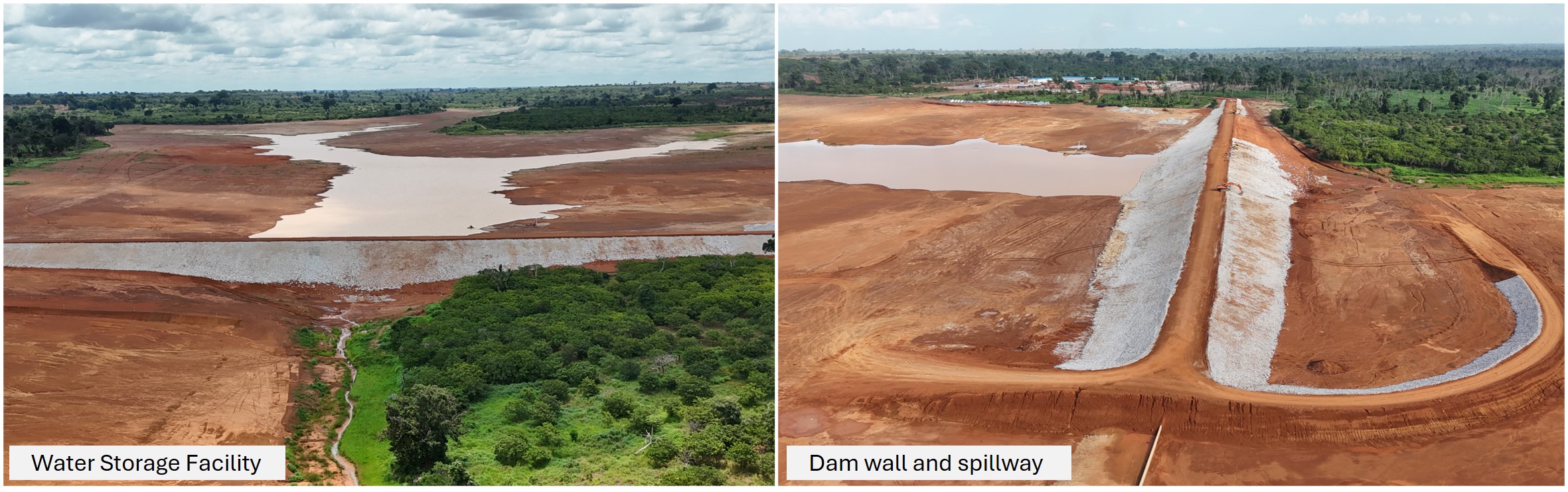

- Other key infrastructure is well advanced including the river abstraction facility, TSF, relocation site, and plant buildings, while the water storage facility was completed and is already holding water

EXPLORATION ACTIVITIES

- 2025 exploration programme increased from 90,000 to 120,000 meters, with 83,280 meters already drilled in H1-2025, focused on delineating higher-grade resources with the goal of supplementing production from the onset

- Step-out and in-fill drilling is underway at all 7 new higher-grade satellite deposits for which starter maiden resources were published in early 2025, whilst drilling progressed on the 6 targets which were advanced to pre-resource stage

- Maiden resources for new discoveries and updated resources for the recently made discoveries are expected to be published throughout the year

FINANCIAL POSITION

- Robust liquidity and available sources of financing totalling

$735 million compared to remaining capital disbursements of$676 million

VANCOUVER, Canada, Aug. 12, 2025 (GLOBE NEWSWIRE) -- Montage Gold Corp. (“Montage” or the “Company”) (TSX: MAU, OTCQX: MAUTF) is pleased to report on its construction and exploration activities for Q2-2025, with highlights provided in Table 1 below.

| Table 1: Business and financial highlights | ||||||||||||

| THREE MONTHS ENDED | SIX MONTHS ENDED | |||||||||||

| All amounts in $ million unless otherwise specified | June 30, 2025 | March 31, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | Δ Q2-2025 vs. Q1-2025 | ||||||

| CONSTRUCTION ACTIVITIES | ||||||||||||

| Cumulative hours worked, million hrs | 2.7 | 1.0 | - | 2.7 | - | +1.7 | ||||||

| Lost-Time Injuries Frequency Rate, % | 0.0 | 0.0 | - | 0.0 | - | 0.0 | ||||||

| Total cumulative capital committed, inclusive of amount disbursed | 339.2 | 217.5 | - | 339.2 | - | +121.7 | ||||||

| - Cumulative capital disbursed | 158.8 | 84.6 | - | 158.8 | - | +74.2 | ||||||

| - Cumulative capital committed and to be disbursed | 180.4 | 132.9 | - | 180.4 | - | +47.5 | ||||||

| EXPLORATION ACTIVITIES | ||||||||||||

| Meters drilled, meters | 37,393 | 45,887 | 20,543 | 83,280 | 20,543 | (8,494 | ) | |||||

| Exploration expenditure | 6.4 | 6.9 | 3.9 | 13.3 | 5.8 | (0.5 | ) | |||||

| CASH FLOW AND LIQUIDITY POSITION1 | ||||||||||||

| Cash flows used in investing activities | (88.3 | ) | (56.7 | ) | (0.3 | ) | (145.0 | ) | (0.3 | ) | (31.6 | ) |

| Cash flows generated from financing activities | 150.5 | 0.4 | 0.3 | 151.0 | 26.4 | +150.1 | ||||||

| Cash and cash equivalents, end of period | 99.9 | 42.7 | 24.3 | 99.9 | 24.3 | +57.2 | ||||||

| Total Liquidity and Available Financing | 734.8 | 832.9 | 24.3 | 734.8 | 24.3 | (98.1 | ) | |||||

| 1As referenced in the Company’s Financial Statements and Management’s Discussion and Analysis for the three and six months ended June 30, 2025, available on SEDAR+ and on the Company’s website. | ||||||||||||

The Company’s interim consolidated Financial Statements and associated Management’s Discussion and Analysis for the three and six months ended June 30, 2025 and 2024, have been filed under the Company’s profile on SEDAR+ (www.sedarplus.ca) and are available for download on the Company’s website.

Rapid construction progress is being made at the Company’s flagship Koné project in Côte d’Ivoire which remains well on-schedule to pour gold in Q2-2027 and on-budget. A total of 1,765,720 construction hours were worked in Q2-2025, totalling over 3.0 million since the commencement of the project until today, safely without a Lost Time Injury (“LTI”). Significant progress is being made on the key processing infrastructure including the ball mill, CIL area, and pre-leach and tailings thickeners. The water storage facility (“WSF”) has been completed and the tailings storage facility (“TSF”) commenced. The construction of the 225KV electrical substation, preparation for grid connection, storage buildings, administrative and plant offices, relocation site, permanent camp and airstrip preparation are advancing well. A total of

Figure 1: CIL tank installation

In parallel, the Company continues to be focused on unlocking value through its exploration programme. Since the start of the year, a total of 83,280 meters has been drilled, already exceeding the 81,815 meters completed during the full year of 2024. Due to the ongoing successful results and drilling efficiency, the 2025 exploration programme has been increased from 90,000 meters to 120,000 meters, with a corresponding budget increase of US

Martino De Ciccio, Chief Executive Officer of Montage, commented: “We are very pleased with the rapid progress being made to unlock value at our Koné project in Côte d’Ivoire, which is one of the largest gold projects currently under construction globally.

“On the construction front, we remain on budget and well on schedule for first gold pour in Q2-2027. With over 2,500 employees and contractors on-site, we are pleased to have already achieved over 3.0 million hours worked without a lost-time injury. Moreover, we have commenced building the CIL tanks more than two months ahead of schedule, due to the rapid ramp-up of construction activities and efficient execution of the earthworks and foundations.

“On the exploration front, the continued delineation of resources, as recently published, provides significant confidence in achieving our previously announced short-term objective of discovering at least 1 million ounces of Measured and Indicated Resources at a

“Our continued success builds on the momentum generated thus far to advance our strategy of creating a premier African gold producer and delivering value for all our stakeholders.”

KONÉ PROJECT UPDATE

Construction continues to progress on-budget and well on-schedule for first gold pour in Q2-2027, with key highlights summarized below:

- On-site workforce now exceeds 2,500 employees and contractors, with over

90% local employment, demonstrating the Company’s commitment to local content and community engagement. - Montage’s construction team has ramped-up construction activities, with key self-perform tasks undertaken including earthworks, concrete and civils works, building and camp construction, and electricals. These activities are supported by the vocational training programmes which were launched in Q3-2024, in partnership with the government-accredited Lycée Technique de Mankono. On-site training encompasses steel fixing, building, electrical, masonry, carpentry, plumbing, firefighting, working at heights, environmental management, and heavy equipment operation.

- Strong continued safety record with over 3.0 million hours without a LTI since construction commenced until today.

- Process plant construction continues to rapidly advance:

- CIL tank construction has commenced, occurring 2 months ahead of schedule which marks a key milestone.

- Mill foundation and first lift is complete, with the second lift underway.

- Pre-leach and tails thickener concrete pours are complete.

- Reagent, cyanide and lime storage areas are progressing well with concrete foundations complete, and construction of steel-framed buildings has commenced 7 weeks ahead of schedule.

- Construction of the plant site office, control room and main admin buildings have progressed rapidly, with the site construction and admin teams already operating from the new plant site office.

- Gold room pad structural fill placement has been completed.

Figure 2: Process plant key infrastructure

- Engineering, design, and procurement progress continues to advance alongside the site works, with infrastructure engineering expected to be

90% complete in the coming weeks. - Fabrication of long-lead items such as the crushers, mill, thickeners, HPGR and structural steel are all progressing on schedule with pricing in line with or below budget.

- Water supply remains on track with the installation of decant tower units complete at the river abstraction site. Concrete pours and rock fill are complete. The transfer, booster station, and decant concrete are complete. Field fabricated tanks have been completed and hydrostatically tested. Mechanical and piping installation is well advanced. Electrical switchrooms are in place and field wiring has commenced. Welding of the high-density polyethylene (“HDPE”) pipes continues to progress on schedule.

Figure 3: River abstraction site and pumping infrastructure

- Water Storage Facility is complete and is already holding water.

Figure 4: Water storage facility

- Grid connection: The 22.5km power line to the main 225KV grid connection point has now been cleared, paving the way for the installation of the tower bases. On site, underground conduits for high voltage electrical cables are well advanced connecting key processing and administrative buildings.

Figure 5: Electrical substation and high-voltage grid connection preparation

- Gbongogo haul road clearing has been completed between the Koné processing plant and the Marahoué river crossing. Culverts have been emplaced, with erosion protection ongoing across the length of the haul road. The remaining haul road north of the Marahoué river is scheduled to commence in Q4-2025.

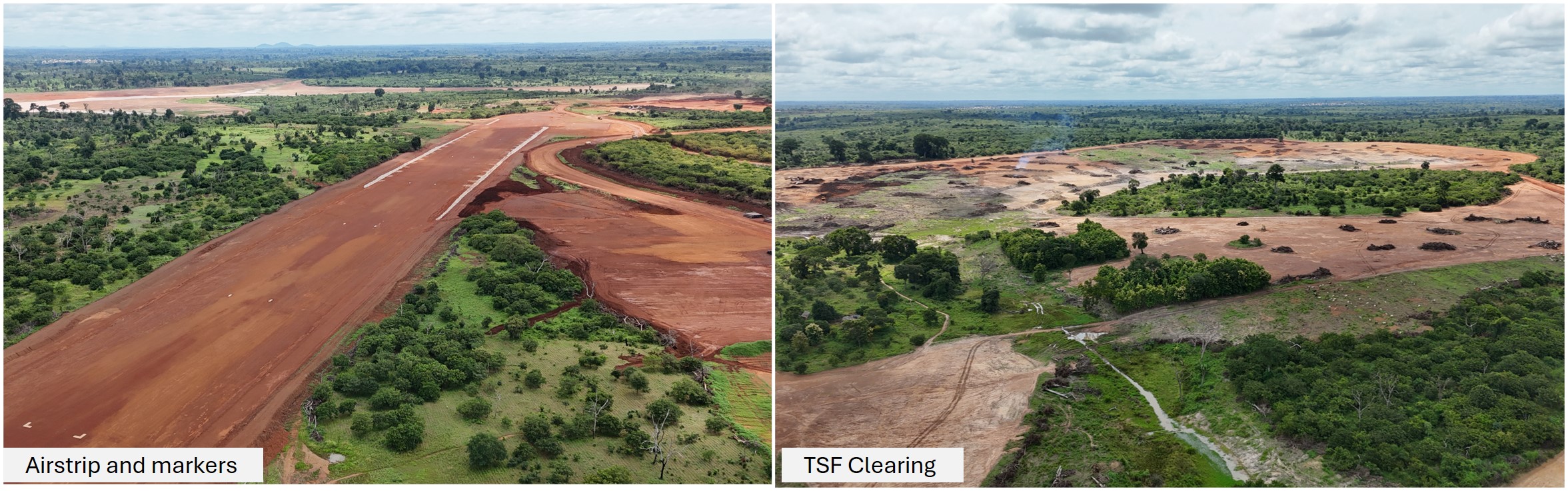

- Tailings Storage Facility (“TSF”) key equipment, including TSF liners and rip rap, are ongoing with deliveries tracking ahead of schedule. The rapid earthworks progress across the entire project has enabled TSF earthworks to commence 3 months ahead of schedule.

- Airstrip earthworks is complete. Construction of the airstrip hanger pad and installation of concrete runway markers is ongoing. The airstrip was approved by the Autorité Nationale de l'Aviation Civile in Q1-2025.

Figure 6: Airstrip and TSF clearing

- The permanent camp construction is advancing well as 240 rooms have been completed. Water treatment facility is now operational, with final works underway at facility and recreational buildings.

Figure 7: Permanent camp

- The Livelihood Restoration Plan (“LRP”) continued with the implementation of the four pilot programmes aiming to restore and enhance the livelihoods of Persons Affected by the Project (“PAPs”). These pilot programmes include the design and implementation of farming and gardening projects, as well as the training of PAPs to utilise the programmes to increase crop-generated revenues. The pilot projects currently involve 162 PAPs following agreements with affected communities. The results of the pilot programmes will be used to develop a complete LRP programme in the coming months. Additionally, the literacy programme continues to be rolled out to the surrounding communities, benefiting over 500 individuals.

- Resettlement village construction is now

85% complete, with strong progress on construction of the village school and on places of worship. A total of 42 buildings have already been seen roofs installed 2 months ahead of schedule, with interior plastering and painting ongoing.

Figure 8: Resettlement village construction and pilot farming project

Timeline to first gold pour

The Company remains on track for first gold pour in Q2-2027, based on a 27-month construction period for the process plant, with key upcoming milestones presented in Table 2 below. As noted above, major construction works for the water storage dam, power supply, site infrastructure, and earth and concrete works are well underway.

| Table 2: Koné project timeline to first gold pour | ||||||||||

| Work Stream | Q1-2025 | Q2-2025 | Q3-2025 | Q4-2025 | Q1-2026 | Q2-2026 | Q3-2026 | Q4-2026 | Q1-2027 | Q2-2027 |

| Tailings Dam & Water Dams | ||||||||||

| Tailings Dam | * | * | * | |||||||

| Water Storage & Dam | * | * | ||||||||

| Construction | ||||||||||

| Power Supply | * | * | * | * | * | |||||

| Site Infrastructure | * | * | * | * | * | * | * | |||

| Earth works & Concrete Works | * | * | * | * | * | * | ||||

| Structural, Mechanical, Piping | * | * | * | * | * | * | ||||

| Electrical | * | * | * | * | ||||||

| Process Plant Commissioning | * | * | ||||||||

| First Gold | * | |||||||||

In order to have greater mining flexibility and agility to bring into production new discoveries made, along with potential cost savings, owner mining with vendor equipment financing is being evaluated alongside contract mining, with a full tender process undertaken on both options. A decision is expected to be announced in the coming months.

CASH FLOW, LIQUIDITY SOURCES AND CAPITAL REQUIREMENTS

Cash flows generated from financing activities increased by

As at June 30, 2025, the Company had a consolidated cash balance of

As at June 30, 2025, the Company had total liquidity and available financing of

Given the carve-out embedded into the Wheaton and Zijin Financing Package documentation to allow for a

A total of

EXPLORATION ACTIVITIES

The Company is focused on advancing the Koné project construction whilst simultaneously unlocking value through achieving its short-term exploration target, as published on October 7, 2024, of discovering more than 1Moz of Measured and Indicated Resources, at a grade

The Company completed 37,393 meters of drilling amounting to an exploration expenditure of

The H1-2025 exploration programme focussed on three parallel tracks: infill and extension drilling of previously delineated starter deposits, advancing pre-resource targets toward maiden resource definition, and testing new targets. In total, 23 targets have been drill tested since the start of the year, with mineralization confirmed at all targets. Targets along the Gbongogo-Koroutou Trend, including Gbongogo South and Koban North deposits, were prioritized given their proximity to the haulage road already built.

Based on the efforts conducted in 2024, the Company announced an updated Mineral Resource Estimate on April 8, 2025, which included maiden resources for 7 new deposits, while another 6 targets were advanced to the pre-resource definition stage. On July 21, 2025, the Company published an update to the Mineral Resource Estimate of both the Gbongogo South and Koban North deposits which increased in size while exhibiting a high rate of conversion from Inferred to Indicated Resources. In-fill and step-out drilling at the ANV deposit is also expected to yield an updated, larger Indicated Resource estimate, in late Q3-2025, whilst resource updates are expected for year-end for other targets such as Yere North, Lokolo Main, Sena and Diouma North, where drilling has been done in H1-2025.

Additionally, pre-production drilling of approximately 56,000 meters has been launched earlier this year and is expected to be completed in Q3-2025. The programme is comprised of approximately

In addition to the exploration activities on the Koné project, on April 7, 2025, the Company announced a strategic partnership with African Gold Limited (“African Gold”; ASX:A1G). The investment in African Gold was subsequently closed in Q2-2025, in two tranches, with Montage obtaining a

TSX LISTING

The Company graduated to the TSX at market open on April 29, 2025, and continues to trade under the stock symbol “MAU”. The graduation represents a significant milestone in the Company’s journey towards becoming a premier African gold producer as it is expected to enhance visibility, broaden the investor base, increase liquidity, and provide potential index inclusion.

ABOUT MONTAGE GOLD

Montage Gold Corp. (TSX: MAU) is a Canadian-listed company focused on becoming a premier African gold producer, with its flagship Koné project, located in Côte d’Ivoire, at the forefront. Based on the Updated Feasibility Study published in 2024 (the “UFS”), the Koné project has an estimated 16-year mine life and sizeable annual production of +300koz of gold over the first 8 years and is expected to enter production in Q2-2027.

QUALIFIED PERSONS STATEMENT

The scientific and technical contents of this press release have been verified and approved by Mr. Peder Olsen, a Qualified Person pursuant to NI 43-101. Mr. Olsen, President and Chief Development Officer of Montage, is a registered Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM).

CONTACT INFORMATION

| For Investor Relations Inquiries: Jake Cain Strategy & Investor Relations Manager jcain@montagegold.com +44-7788-687-567 | For Media Inquiries: John Vincic Oakstrom Advisors john@oakstrom.com +1-647-402-6375 | For Regulatory Inquiries: Kathy Love Corporate Secretary klove@montagegold.com +1-604-512-2959 |

FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward-looking Statements in this press release include statements related to the Company’s objectives of achieving first gold pour in the second quarter of 2027; the Company’s mineral reserve and resource estimates; results of the drill programmes including targeted additions to the estimated mineral resources at the Koné Project, and the timing thereof; expected recoveries and grades of the Koné Project; timing in respect of the commencement of construction, the length of construction and of the mining operations at the Koné Project, including estimated construction costs; timing and amount of necessary financing related to the mining operations at the Koné Gold Project; the timing and amount of future production from the Koné project; anticipated mining and processing methods of the Koné project; anticipated mine life of the Koné project.

Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that any Forward-looking Statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements, including that the returns from the Koné project will be lower than estimated, that targeted additions to the mineral resources will not be achieved or that the cost of construction of the Koné project will be higher than estimated. Important factors that could cause actual results to differ materially from include uncertainties inherent in the preparation of mineral reserve and resource estimates and definitive feasibility studies, and in delineating new mineral reserve and resource estimates, including but not limited to, assumptions underlying the production estimates not being realized, incorrect cost assumptions, decreases in the price of gold, unexpected variations in quantity of mineralized material, grade or recovery rates being lower than expected, unexpected adverse changes to geotechnical or hydrogeological considerations, or expectations in that regard not being met, unexpected failures of plant, equipment or processes (including construction equipment), delays in or increased costs for the delivery of construction equipment and services, unexpected changes to availability of power or the power rates, failure to maintain permits and licenses, higher than expected interest or tax rates, adverse changes in project parameters, unanticipated delays and costs of consulting and accommodating rights of local communities, environmental risks inherent in the Côte d’Ivoire, title risks, including failure to renew concessions, unanticipated commodity price and exchange rate fluctuations, delays in or failure to receive access agreements or amended permits, and other risk factors set forth in the Company’s Annual Information Form available at www.sedarplus.ca, under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

__________________________

1 Source: For further information on the discovery target please refer to the Company’s news release dated October 7, 2024, and for information regarding the Koné deposit please refer to the Updated Feasibility Study available on Montage’s website and on SEDAR+. See “Technical Disclosure”.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b768554d-6122-480d-8fea-423084d941f7

https://www.globenewswire.com/NewsRoom/AttachmentNg/c6c4392b-6575-4474-8f55-67ca9958f224

https://www.globenewswire.com/NewsRoom/AttachmentNg/0b4da570-e842-4662-a3f0-44ce9b2fd760

https://www.globenewswire.com/NewsRoom/AttachmentNg/75d89e86-2509-4590-bf65-2240ee3fc11c

https://www.globenewswire.com/NewsRoom/AttachmentNg/38162997-ff8f-4e8e-b6c3-b53ad5b52c2d

https://www.globenewswire.com/NewsRoom/AttachmentNg/a204f0ee-0102-42b9-8bb9-210fdb1539d5

https://www.globenewswire.com/NewsRoom/AttachmentNg/d049768b-d761-47be-a0a8-5938e486daa5

https://www.globenewswire.com/NewsRoom/AttachmentNg/a782a98b-bbd8-4be3-af4d-5ec9f82da5aa