Miata Doubles Mineralized Footprint at Jons Trend with a 500m Step Out in Hole 039 and Highlights 54 m at 1.04 g/t Au in Hole 043

Rhea-AI Summary

Miata Metals (OTCQB: MMETF) reported drill results from the Jons Trend at the Sela Creek gold project in Suriname on Dec 10, 2025. New assays confirm continuous gold mineralization across a 750 m by 250 m corridor to 200 m depth and a 500 m step-out in hole 25DDH-SEL-039 that the company says more than doubled the known mineralized footprint. Notable intercepts include 54.0 m at 1.04 g/t Au (25DDH-SEL-043), 53.6 m at 0.84 g/t Au (25DDH-SEL-038) and 4.9 m at 4.04 g/t Au (25DDH-SEL-039).

Miata completed 10,061 metres in 2025 and reports geophysical inversion suggesting main structures continue to 1.5 km depth; models are presented as exploration potential only.

Positive

- Known footprint increased by over 100% after 500m step-out

- Wide intercepts including 54.0m at 1.04 g/t Au

- All Jons Trend holes intersected gold mineralization

- 10,061 metres drilled in 2025, meeting annual target

- Geophysical inversion indicates structures to 1.5 km depth

Negative

- Implicit model based on limited data; not a guarantee of grades

- Depth continuity to 1.5 km inferred from magnetic inversion, not assays

- Jons Trend remains exploration-stage; no mineral resource reported

Key Figures

Market Reality Check

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Oct 15 | Drill results – Jons | Positive | -5.5% | Expanded near-surface Jons Trend system with multiple strong gold intercepts. |

| Sep 23 | Drill results – Jons | Positive | +55.7% | Strongest Sela Creek intercept to date and stacked lenses at Jons Trend. |

| Sep 16 | Drill results – Puma/Golden Hand | Positive | -3.3% | High-grade Puma and solid Golden Hand intercepts showing district potential. |

| Sep 04 | Drill results – Puma | Positive | +16.1% | Near-surface high-grade Puma intercepts along a long strike length. |

| Jul 16 | Initial drilling – Puma | Positive | +3.0% | Encouraging initial veining at Puma and very high-grade grab sample nearby. |

Drill result news has often been positive, but price reactions have been mixed, with both sharp gains and notable selloffs.

This announcement continues a stream of positive drill updates from Sela Creek in 2025. Prior releases on Sep 4, Sep 16, and Sep 23 highlighted strong gold intercepts at Puma and Jons Trend, with reactions ranging from about +55.68% to modest gains. The Oct 15 Jons Trend expansion news saw a -5.53% move, showing that even constructive exploration results have not always translated into sustained strength.

Market Pulse Summary

This announcement reports wide, continuous gold mineralization at Jons Trend, including intervals like 54 m at 1.04 g/t Au and a 500 m step-out that doubles the mineralized footprint to a 750 m x 250 m corridor. The 2025 drilling campaign totals 10,061 metres with results pending for 2,755 metres. Investors may watch future drill data, trend continuity at depth, and how additional zones contribute to an eventual resource picture.

Key Terms

g/t au technical

turbidite technical

shear zone technical

fire assay technical

atomic absorption (aa) technical

gravimetric finish technical

qualified person regulatory

national instrument 43-101 regulatory

AI-generated analysis. Not financial advice.

VANCOUVER, British Columbia, Dec. 10, 2025 (GLOBE NEWSWIRE) -- Miata Metals Corp. (CSE: MMET) (FSE: 8NQ) (OTCQB: MMETF) (“Miata” or the “Company”) is pleased to announce further drill results from the Jons Trend Zone at its Sela Creek Gold Project (“Sela Creek” or the “Project”) in Suriname.

Results from holes 25DDH-SEL-037 through 25-DDH-SEL039 and 25DDH-SEL-042 through 25DDH-SEL-046 confirm gold mineralization at Jons Trend across a 750 m by 250 m corridor to a depth of 200 m, remaining open along strike and at depth. Importantly, a 500 m step-out further validates this continuity, more than doubling the known mineralized footprint. Reprocessing of geophysical data indicates the main structures at Sela Creek, which potentially reflect the extent of the gold system, continue to a depth of 1.5 km.

Highlights

- 500 m step-out (hole 25DDH-SEL-039) confirms strike continuity and expands Jons Trend by over

100% , with 4.9 m of 4.04 g/t gold and 13.6 m at 0.80 g/t gold - Every hole at Jons trend has intersected gold mineralization, with most holes intersecting multiple, subparallel gold-bearing zones

- Continuous gold mineralization now apparent over 750 m x 250 m, open along strike and to depth, an increase in size of over 100 percent

- Drilling continues to return wide mineralized intervals, including:

- 54 m at 1.04 g/t gold and 3.4 m at 1.12 g/t gold (hole 25DDH-SEL-043)

- 53.6 m at 0.84 g/t gold (hole 25DDH-SEL-038)

- 18.9 m at 1.01 g/t gold and 5.4 m at 2.29 g/t gold (25DDH-SEL-044)

- 9 m at 0.79 g/t gold and 16.5 m at 0.83 g/t gold and 4.4 m at 3.13 g/t gold (25DDH-SEL-045)

- 34 m at 1.05 g/t gold and 12 m at 1.15 g/t gold hole (25DDH-SEL-046)

- 10,061 metres drilled in 2025, completing the annual target, with results from 2,755 metres pending

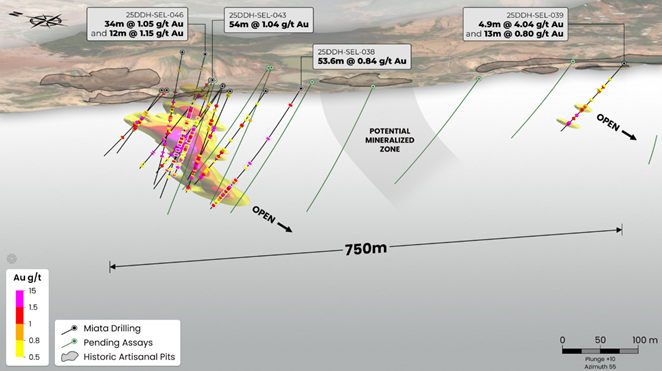

Figure 1. Oblique view of drilling in Jons Trend with an implicit grade model, showing that mineralization is open in all directions. Readers are cautioned that the model illustrates exploration potential based on limited data only and is not a guarantee that such gold grades are present.

“The drilling at Jons Trend continues to deliver significant mineralization across a large footprint that is entirely open, which supports the potential for a future open-pit resource at Sela Creek,” stated Dr. Jacob Verbaas, CEO of Miata Metals. “With all drill holes at Jons Trend across a 750 by 250 metre corridor returning mineralized intercepts, Jons Trend is rapidly emerging as the first major zone of mineralization on the project. We are just starting to grasp the extent of this target.

“Equally important, our ongoing work across the Sela Creek property allows us to define the project-scale controls on gold mineralization. We expect to accelerate our discovery-focused program in Q1 2026 with a fully funded two-rig program, which will allow us to work multiple prospects in parallel. Several prospects are drill-ready and primed for discovery. Our objective in 2026 is to demonstrate that Sela Creek is the next major gold district in Suriname.”

A Robust and Expanding Gold System

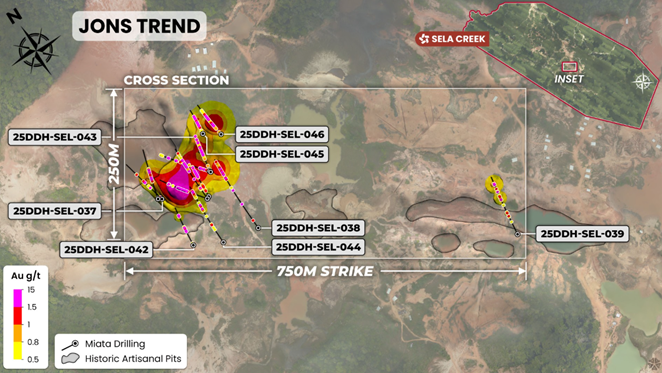

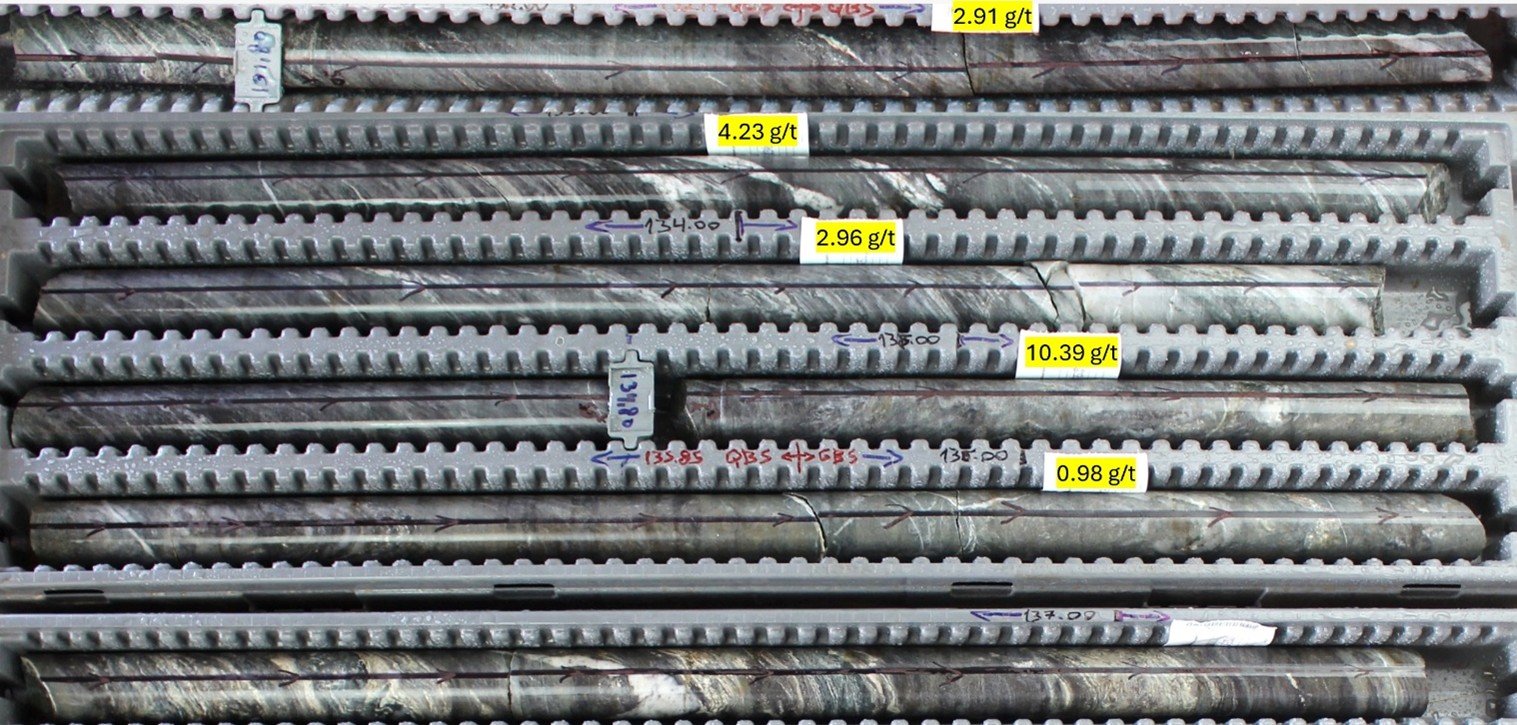

Drilling at Jons Trend continues to deliver wide, consistent intervals of gold mineralization hosted in strongly deformed quartz-pyrite-pyrrhotite veining within a thick turbidite sequence. Turbidite sequences tend to be homogeneous and laterally very continuous. This continuity is apparent in the grade distribution such as in hole 25DDH-SEL-046 (fig 3) as well as the strike length which is currently 750 m and open. Overall, Jons Trend is emerging as a large bulk-tonnage prospect that is potentially amenable to open-pit mining. Implicit grade shell modeling (fig 1 & 2) indicates repeated zones of south-easterly plunging mineralization.

Figure 2. Plan view of drilling at Jons Trend with implicit grade model projected to surface. Readers are cautioned that the model illustrates exploration potential exploration potential based on limited data only and is not a guarantee that such gold grades are present.

Continuity Confirmed by 500 m Step-Out

The results include hole 25DDH-SEL-039, a 500 m step-out that extends the mineralization of Jons Trend over 750 m (FIG 1). Hole 25DDH-SEL-039 yielded 4.9 m at 4.04 g/t gold (fig. 4) and 13.6 m at 0.8 g/t gold in separate intervals. Several holes were drilled in between the main discovery zone and 25DDH-SEL-039 to confirm the continuation of Jons Trend. Jons Trend so far has been drilled to an average depth of 134 m and remains open to depth and along strike.

Magnetic Data Implies Continuity to Depths of over 1 km

An inversion of the magnetic data indicates that the main structures on Sela Creek, including the steeply dipping Central Guyana Shear Zone continue to 1500m depth. The Central Guyana Shear Zone is a dominant project-scale gold control that runs the length of the Sela Creek concession. Given that the structural controls are indicative of the fluid system on Sela Creek the Company believes that gold mineralization may continue to these depths.

Figure 3. 25DDH-SEL-046 from 74 to 90 meters (within 17m of 1.59 g/t gold from 74 m), showing continuous grade distribution.

Figure 4. 25DDH-SEL-039, from 132 - 137 m, proving that the Jons Trend zone extends for 750 m along strike and remains open.

Table 1. Drill results. Intervals are reported as hole length, true width data is noted in Table 2.

| Hole ID | From | To | Interval | Grade (g/t Au) | Cut off | Hole length | Prospect |

| 25DDH-SEL-037 | 1.1 | 8.6 | 7.5 | 0.82 | 0.23 | 128.80 | Jons Pit |

| And | 38.6 | 49.8 | 11.2 | 0.54 | 0.03 | ||

| Including | 38.6 | 43.0 | 4.4 | 0.84 | 0.35 | ||

| And | 57.9 | 68.0 | 10.1 | 1.57 | 0.07 | ||

| Including | 61.0 | 63.0 | 2.0 | 5.53 | 3.65 | ||

| And | 90.0 | 93.0 | 3.0 | 0.77 | 0.38 | ||

| 25DDH-SEL-038 | 28.1 | 29.6 | 1.5 | 1.21 | 1.21 | 227.80 | Jons Trend |

| And | 87.0 | 89.0 | 2.0 | 1.43 | 0.09 | ||

| And | 134.0 | 135.0 | 1.0 | 2.46 | 2.46 | ||

| And | 143.0 | 144.0 | 1.0 | 0.63 | 0.63 | ||

| And | 167.9 | 221.5 | 53.6 | 0.84 | 0.03 | ||

| Including | 167.9 | 174.0 | 6.1 | 0.99 | 0.16 | ||

| Including | 182.0 | 221.5 | 39.5 | 0.94 | 0.10 | ||

| Including | 182.0 | 192.0 | 10.0 | 1.38 | 0.35 | ||

| Including | 195.0 | 200.0 | 5.0 | 1.71 | 0.36 | ||

| 25DDH-SEL-039 | 34.0 | 35.0 | 1.0 | 0.52 | 0.52 | 152.80 | Jons Trend |

| And | 48.0 | 54.0 | 6.0 | 0.60 | 0.35 | ||

| And | 57.0 | 62.0 | 5.0 | 0.86 | 0.53 | ||

| And | 79.0 | 80.8 | 1.8 | 0.62 | 0.61 | ||

| And | 92.4 | 106.0 | 13.6 | 0.80 | 0.25 | ||

| Including | 92.4 | 98.0 | 5.6 | 1.02 | 0.62 | ||

| And | 114.3 | 117.0 | 2.7 | 0.87 | 0.32 | ||

| And | 122.0 | 125.0 | 3.0 | 0.50 | 0.28 | ||

| And | 132.1 | 137.0 | 4.9 | 4.04 | 0.98 | ||

| Including | 133.0 | 135.9 | 2.8 | 5.62 | 2.96 | ||

| 25DDH-SEL-042 | 4.1 | 8.6 | 4.5 | 0.68 | 0.54 | 147.05 | Jons Trend |

| And | 58.0 | 63.4 | 5.4 | 0.83 | 0.01 | ||

| Including | 61.0 | 63.4 | 2.4 | 1.12 | 0.41 | ||

| And | 71.0 | 74.9 | 3.9 | 1.09 | 0.19 | ||

| And | 113.8 | 121.0 | 7.2 | 1.51 | 0.39 | ||

| Including | 116.0 | 119.0 | 3.0 | 2.32 | 1.37 |

| Hole | From | To | Interval (m) | Grade (g/t Au) | Cut off | Hole length | Prospect |

| 25DDH-SEL-043 | 10.1 | 12.3 | 2.2 | 0.59 | 0.59 | 152.80 | Jons Trend |

| and | 28.0 | 31.4 | 3.4 | 0.51 | 0.24 | ||

| and | 59.0 | 69.0 | 10.0 | 0.47 | 0.09 | ||

| and | 75.0 | 129.0 | 54.0 | 1.04 | 0.19 | ||

| including | 76.0 | 81.0 | 5.0 | 1.84 | 0.75 | ||

| including | 83.0 | 97.0 | 14.0 | 1.32 | 0.28 | ||

| including | 104.0 | 111.0 | 7.1 | 1.78 | 0.70 | ||

| including | 126.0 | 129.0 | 3.0 | 1.86 | 0.77 | ||

| and | 138.6 | 142.0 | 3.4 | 1.12 | 0.27 | ||

| and | 151.0 | 152.8 | 1.8 | 2.20 | 0.83 | ||

| 25DDH-SEL-044 | 45.0 | 47.0 | 2.0 | 0.48 | 0.21 | 179.80 | Jons Trend |

| and | 61.0 | 65.0 | 4.0 | 0.93 | 0.62 | ||

| and | 89.9 | 91.0 | 1.2 | 0.55 | 0.16 | ||

| and | 107.0 | 125.9 | 18.9 | 1.01 | 0.02 | ||

| including | 112.0 | 114.6 | 2.6 | 2.08 | 1.33 | ||

| including | 121.0 | 125.9 | 4.8 | 1.94 | 0.36 | ||

| and | 131.5 | 133.8 | 2.4 | 0.47 | 0.36 | ||

| and | 147.0 | 148.0 | 1.0 | 0.76 | 0.76 | ||

| and | 151.0 | 155.2 | 4.2 | 0.58 | 0.31 | ||

| and | 158.0 | 159.0 | 1.0 | 1.07 | 1.07 | ||

| and | 162.1 | 167.5 | 5.4 | 2.29 | 0.08 | ||

| including | 163.9 | 165.7 | 1.8 | 4.22 | 4.15 | ||

| 25DDH-SEL-045 | 25.1 | 28.1 | 3.0 | 0.41 | 0.21 | 188.80 | Jons Trend |

| and | 56.0 | 57.0 | 1.0 | 1.45 | 1.45 | ||

| and | 63.3 | 64.0 | 0.8 | 0.56 | 0.56 | ||

| and | 69.9 | 71.0 | 1.2 | 2.93 | 2.93 | ||

| and | 75.0 | 84.0 | 9.0 | 0.79 | 0.48 | ||

| including | 75.0 | 77.8 | 2.8 | 1.28 | 0.88 | ||

| and | 90.5 | 107.0 | 16.5 | 0.83 | 0.08 | ||

| including | 90.5 | 96.5 | 6.0 | 1.50 | 0.08 | ||

| including | 95.7 | 96.5 | 0.8 | 4.54 | 4.54 | ||

| including | 104.0 | 105.0 | 1.0 | 1.89 | 1.89 | ||

| and | 108.6 | 111.0 | 2.4 | 0.47 | 0.32 | ||

| and | 114.5 | 116.0 | 1.5 | 1.65 | 0.45 | ||

| and | 128.5 | 132.9 | 4.4 | 3.13 | 0.53 | ||

| including | 129.0 | 131.0 | 2.0 | 5.57 | 4.40 | ||

| and | 141.4 | 143.0 | 1.6 | 0.78 | 0.23 | ||

| and | 146.7 | 149.0 | 2.3 | 2.64 | 0.66 |

| Hole ID | From | To | Interval (m) | Grade (g/t Au) | Cut off | Hole length | Prospect |

| 25DDH-SEL-046 | 20.6 | 23.6 | 3.0 | 0.58 | 0.31 | 209.80 | Jons Trend |

| and | 50.5 | 61.0 | 10.5 | 0.45 | 0.16 | ||

| including | 50.5 | 55.0 | 4.5 | 0.60 | 0.18 | ||

| including | 58.0 | 61.0 | 3.0 | 0.44 | 0.34 | ||

| and | 66.0 | 68.0 | 2.0 | 0.48 | 0.44 | ||

| and | 73.0 | 107.0 | 34.0 | 1.05 | 0.13 | ||

| including | 74.0 | 91.0 | 17.0 | 1.59 | 0.90 | ||

| and | 120.0 | 132.0 | 12.0 | 1.15 | 0.13 | ||

| including | 130.1 | 131.0 | 0.9 | 4.37 | 4.37 | ||

| and | 137.0 | 138.4 | 1.3 | 2.36 | 2.36 | ||

| and | 144.0 | 145.0 | 1.0 | 3.79 | 3.79 | ||

| and | 154.0 | 156.0 | 2.0 | 0.94 | 0.54 | ||

| and | 166.0 | 167.0 | 1.0 | 0.62 | 0.62 | ||

| and | 177.2 | 178.0 | 0.8 | 0.62 | 0.62 | ||

Table 2. Collar information. True width of intervals in table 1 is calculated as true width % x interval. For example 34.0 m in hole 25DDH-SEL-046 has a true width of

| Hole ID | Easting* | Northing | Elevation (m) | Azimuth | Dip | Length (m) | Estimated True width | |

| 25DDH-SEL-037 | 754,675 | 418,259 | 107 | 348 | -48 | 128.8 | 77 | % |

| 25DDH-SEL-038 | 754,793 | 418,125 | 105 | 355 | -55 | 227.8 | 99 | % |

| 25DDH-SEL-039 | 755,178 | 417,872 | 109 | 5 | -44 | 152.8 | 87 | % |

| 25DDH-SEL-042 | 754,679 | 418,160 | 114 | 10 | -62 | 147.05 | 91 | % |

| 25DDH-SEL-043 | 754,774 | 418,254 | 106 | 5 | -65 | 152.8 | 100 | % |

| 25DDH-SEL-044 | 754,729 | 418,135 | 110 | 0 | -52 | 179.8 | 87 | % |

| 25DDH-SEL-045 | 754,801 | 418,319 | 134 | 0 | -78 | 188.8 | 71 | % |

| 25DDH-SEL-046 | 754,826 | 418,301 | 129 | 351 | -75 | 209.8 | 87 | % |

All drill results, including collar locations, are available on the Company website through this link. True widths are within

QAQC

Samples were analyzed at FILAB Suriname, a commercial certified laboratory under ISO 9001:2015. Samples are crushed and pulverized to

QP Statement

The scientific and technical information in this news release has been reviewed and approved by Dr. Jacob Verbaas, P.Geo., a director of the Company and Qualified Person as defined under the definitions of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Miata Metals Corp.

Miata Metals Corp. (CSE: MMET) is a Canadian mineral exploration company listed on the Canadian Securities Exchange, as well as the OTCQB (OTCQB: MMETF) and Frankfurt (FSE: 8NQ) Exchanges. The Company is focused on the acquisition, exploration, and development of mineral properties. The Company holds a

On Behalf of the Board

Dr. Jacob (Jaap) Verbaas, P.Geo | CEO and Director

info@miatametals.com

+1 778 488 9754

Forward-Looking Statements

Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “anticipates”, “anticipated”, “expected”, “intends”, “will” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are from those expressed or implied by such forward-looking statements or forward-looking information subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different, including receipt of all necessary regulatory approvals. Although management of the Company have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/bed28fd2-0959-42e4-be0d-bce4500b922a

https://www.globenewswire.com/NewsRoom/AttachmentNg/10f2bc7c-09bc-4470-8a0a-08e14fcf16e2

https://www.globenewswire.com/NewsRoom/AttachmentNg/87bb9673-061e-4cc9-91fe-2c0060d6154a

https://www.globenewswire.com/NewsRoom/AttachmentNg/71cd0bcf-5110-4860-930d-c1c5bbe8e5b5

https://www.globenewswire.com/NewsRoom/AttachmentNg/bb19f051-4b8c-499e-9482-40237156e359