EQUATOR Beverage Company Reports Record 2025 Revenue

Rhea-AI Summary

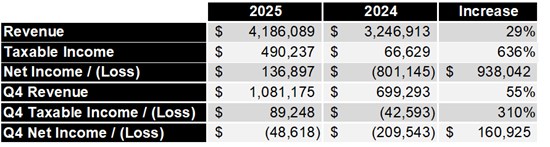

EQUATOR Beverage Company (OTCQB: MOJO) reported record 2025 results for the year ended December 31, 2025. Revenue reached $4,186,089, a 29% increase year-over-year. Taxable income rose to $490,237 (a 636% increase) and net income improved to $136,897, a $938,042 increase versus prior year. Q4 2025 revenue grew 55% (+$381,882) and Q4 taxable income turned positive at $89,248. The company repurchased 225,000 shares in 2025, totaling 1,084,467 shares repurchased to date (over 10% of authorized shares). EQUATOR said it will file its Form 10-K in early February 2026.

Positive

- Revenue +29% in 2025 to $4,186,089

- Q4 2025 revenue +55% (+$381,882)

- Taxable income to $490,237 (+636%)

- Net income improved by $938,042 to $136,897

- Repurchased 225,000 shares in 2025; total 1,084,467

Negative

- Q4 net result remained a net loss despite improvement

- Share repurchases may limit cash available for other uses

News Market Reaction – MOJO

On the day this news was published, MOJO declined 13.67%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

2025 Revenue

2025 Taxable Income

2025 Net Income

Jersey City, New Jersey--(Newsfile Corp. - January 6, 2026) - EQUATOR Beverage Company (OTCQB: MOJO), a leading producer and distributor of premium functional beverages, today announced financial results for the year ended December 31, 2025.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10490/279596_b927c3fb14239b3f_001full.jpg

CEO Commentary

Glenn Simpson, Chairman and Chief Executive Officer, stated:

EQUATOR delivered its highest revenue since inception. This performance reflects the work of a disciplined management team that each day works toward achieving the highest financial and operational performance to provide the highest company market capitalization for shareholders.

2025 Financial Highlights

- Revenue increased

29% which is the third consecutive year of double-digit revenue growth. - Taxable Income increased to

$490,237 , which as a percentage of revenue is in line with other major high performing beverage companies and above most of the industry. - Net Income increased to

$136,897 , which is a$938,042 improvement. - Q4 2025 Revenue increased by

$381,882 or55% compared to prior year. - Q4 Taxable Income increased to

$89,248 compared to a net loss of ($42,593) for the prior year. - Q4 Net Loss decreased by

$160,925 , a77% improvement from 2024.

Share Repurchase Program and Capital Structure Update

During 2025, EQUATOR repurchased 225,000 shares of its outstanding common stock, bringing total repurchases to date to 1,084,467 shares. This is over 10 percent of the authorized shares of EQUATOR.

We believe that the market has not rewarded EQUATOR for its excellent consistent quality of revenue and profits and therefore will continue to repurchase shares until EQUATOR achieves stock pricing parity with other well-run beverage companies. We further believe EQUATOR will approach parity with a market cap of seven to ten times revenue. This is a conservative multiple when you consider EQUATOR's consistent annual growth rate over the past three years.

EQUATOR will file its Form 10-K with the United States Securities and Exchange Commission in early February 2026.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10490/279596_b927c3fb14239b3f_004full.jpg

Forward-Looking Statements

This press release contains forward-looking statements within the definition of Section 27A of the Securities Act of 1933, as amended and such section 21E of the Securities Act of 1934, amended. These forward-looking statements should not be used to make an investment decision. The words 'estimate,' 'possible' and 'seeking' and similar expressions identify forward-looking statements, which speak only as to the date the statement was made. The company undertakes no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events, or otherwise. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted, or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. The risks and uncertainties to which forward-looking statements are subject include, but are not limited to, the effect of government regulation, competition and other material risk.

Information: www.equatorbeverage.com

Glenn Simpson

Chairman & CEO

EQUATOR Beverage Company

glennsimpson@equatorbeverage.com

917 574 1690

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/279596