McEwen Inc. to Acquire Golden Lake Exploration Inc. — Further Consolidates Gold Bar Mine Complex in Nevada

Rhea-AI Summary

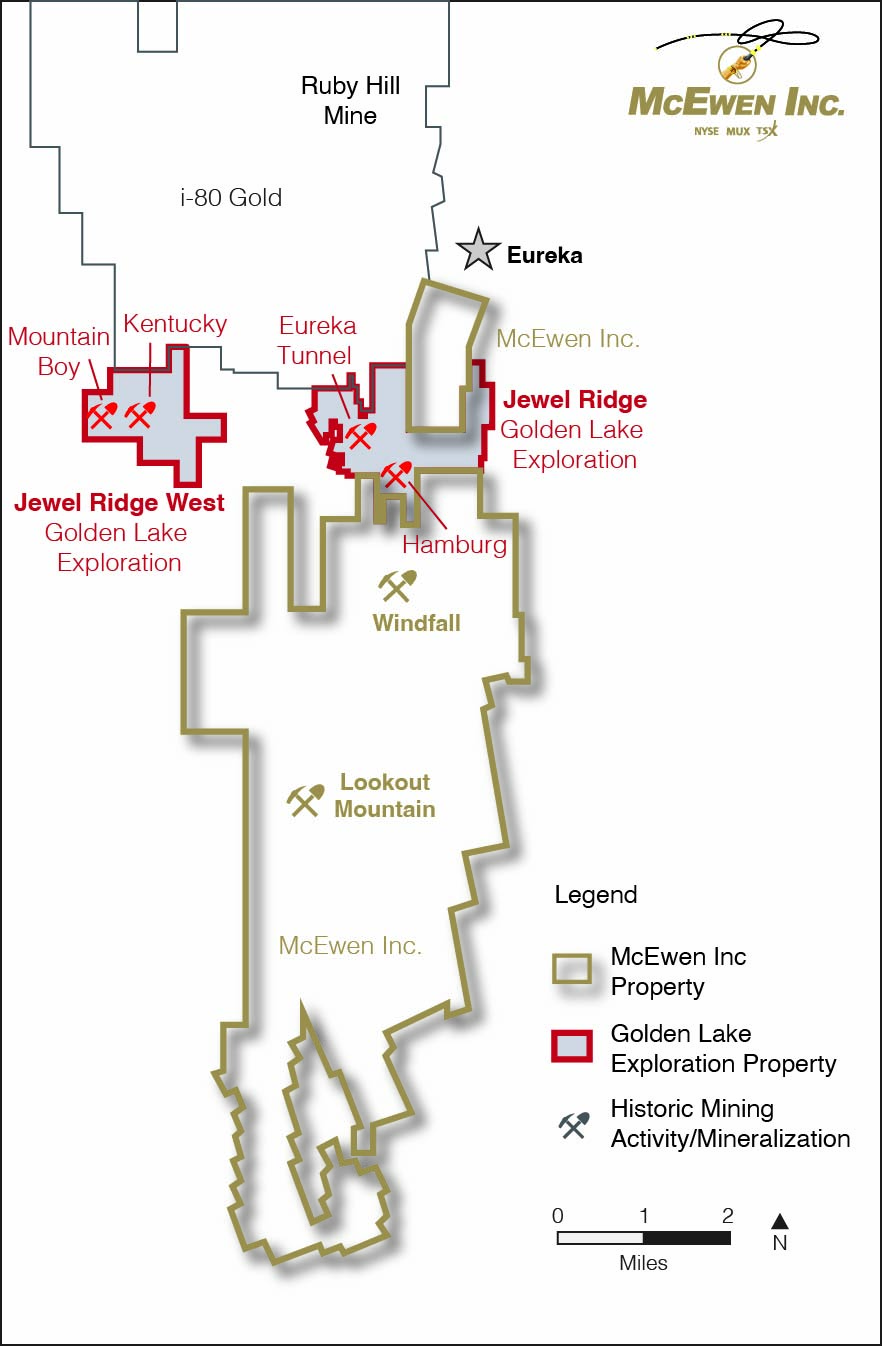

McEwen (NYSE/TSX: MUX) has signed a definitive agreement to acquire Golden Lake Exploration (CSE: GLM) by plan of arrangement, combining Jewel Ridge and Jewel Ridge West into McEwen's Gold Bar Mine Complex in Nevada.

The exchange ratio implies CDN $0.12 per Golden Lake share (≈60% premium vs 20‑day VWAP), leaving Golden Lake holders with ~0.5% of the combined company, subject to court, TSX and NYSE approvals and shareholder votes expected in March.

Positive

- Adds adjacent Jewel Ridge projects to Gold Bar Mine Complex, enhancing resource footprint

- Transaction offers ~60% premium to Golden Lake 20‑day VWAP

- McEwen to fund exploration and use existing Nevada infrastructure, potentially extending mine life

- Golden Lake shareholders gain access to McEwen’s diversified portfolio and US/Canada liquidity

Negative

- Golden Lake shareholders diluted to ~0.5% ownership of combined company

- Transaction subject to shareholder, court and TSX/NYSE approvals, creating closing execution risk

- Includes customary break fee provisions and potential for superior proposals delaying close

News Market Reaction – MUX

On the day this news was published, MUX gained 3.86%, reflecting a moderate positive market reaction. Argus tracked a trough of -9.0% from its starting point during tracking. Our momentum scanner triggered 13 alerts that day, indicating notable trading interest and price volatility. This price movement added approximately $60M to the company's valuation, bringing the market cap to $1.62B at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

MUX gained 3.86% while peers in momentum screens were mixed: ASM up ~4%, but LAC, PPTA and USAS down between ~4–5.4%, pointing to stock-specific factors beyond broad sector flows.

Previous Acquisition Reports

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Jan 13 | Post-acquisition drilling | Positive | -0.1% | Drill results update at recently acquired Tartan Mine Project with higher-grade hits. |

| Nov 03 | Strategic equity stake | Positive | -1.4% | Agreement to acquire ~31% interest in Paragon Geochemical using McEwen shares. |

| Mar 03 | Drilling on new asset | Positive | -2.8% | Drilling highlights at Windfall on the recently acquired Timberline Property in Nevada. |

| Aug 19 | Acquisition closing | Positive | -2.1% | Closing of Timberline Resources acquisition and plan to advance Eureka project. |

| Apr 16 | Acquisition announcement | Positive | -1.9% | Friendly acquisition agreement for Timberline Resources with share consideration terms. |

Past acquisition-related announcements for MUX often saw mildly negative next-day moves despite strategically positive narratives, suggesting a pattern of market caution around deals.

Over the past two years, McEwen has repeatedly used acquisitions to expand its project pipeline. Events on Apr 16, 2024, Aug 19, 2024, and Mar 3, 2025 centered on the Timberline/Windfall assets, while the Nov 3, 2025 Paragon stake added assay technology exposure. The Jan 13, 2026 Tartan update followed another acquisition. Today’s Golden Lake deal continues this strategy of consolidating Nevada and complementary assets.

Historical Comparison

In the past, MUX acquisition-tagged headlines produced an average move of 1.67%, often slightly negative on individual days. Today’s acquisition fits an ongoing build-out of Nevada and related assets.

The company’s acquisition path runs from Timberline (announcement and closing), to drilling at newly acquired projects like Windfall and Tartan, and into strategic stakes such as Paragon, showing a consistent build-and-develop approach.

Market Pulse Summary

This announcement adds Golden Lake’s Jewel Ridge assets, featuring historical intercepts such as 2.20 gpt over 28.96 m and 2.37 gpt over 67.57 m, directly into McEwen’s Gold Bar Mine Complex. The share-based consideration, set via a VWAP-derived exchange ratio, and a 60% premium highlight competitive terms. Context from prior deals at Timberline, Tartan and Paragon shows a continued strategy of expansion through targeted acquisitions.

Key Terms

plan of arrangement regulatory

volume-weighted average trading price financial

vwap financial

non-solicitation provisions regulatory

break fee financial

AI-generated analysis. Not financial advice.

TORONTO and VANCOUVER, British Columbia, Jan. 28, 2026 (GLOBE NEWSWIRE) -- McEwen Inc. (“McEwen”) (NYSE/TSX:MUX) and Golden Lake Exploration Inc. (“Golden Lake”) (CSE:GLM) are pleased to announce that they have entered into a Definitive Agreement (the "Agreement") on January 28, 2026 in respect of a proposed transaction (the "Proposed Transaction"), whereby McEwen would acquire all of the issued and outstanding shares of Golden Lake by way of plan of arrangement. If the Proposed Transaction is completed, Golden Lake would become a wholly-owned subsidiary of McEwen.

Golden Lake’s principal asset is its

The Proposed Transaction

Pursuant to the terms of the Proposed Transaction, each Golden Lake common share (a “Golden Lake Share”) would entitle its holder to receive 0.003876 McEwen common shares (each, a “McEwen Share”) as is equal to

Benefits of the Transaction for Golden Lake Shareholders:

- Ability to integrate Jewel Ridge and Jewel Ridge West into the Gold Bar Mine Complex, leveraging McEwen’s ability to fund exploration and utilize existing infrastructure;

- Access to McEwen’s Nevada technical team with a track record in gold exploration, open pit mining, heap leaching, permitting and mine development;

- Exposure to McEwen’s diversified portfolio of commodities, producing operations, development projects and royalties; and

- An attractive premium of approximately

60% to the 20-day VWAP of the Golden Lake Shares and the enhanced liquidity of McEwen Shares from dual listing on US and Canada stock exchanges.

Benefits of the Transaction for McEwen Shareholders:

- Adds an adjacent property to McEwen’s Gold Bar Mine Complex, with promising drill results.

- Continued execution on the Gold Bar Mine Complex plan to develop a long-life operation with increasing production.

Details of the Proposed Transaction

- The Proposed Transaction is expected to be completed by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia). Under the Plan of Arrangement, (i) all outstanding warrants of Golden Lake will be cashlessly exercised and cancelled in exchange for Golden Lake Shares having a value equal to their in-the-money amount, and (ii) all outstanding Golden Lake convertible notes will be converted into Golden Lake Shares based on principal and accrued interest in accordance with their terms. All issued and outstanding Golden Lake Shares (other than those held by McEwen or dissenting shareholders, but including the Golden Lake Shares issued to warrantholders and noteholders) will be exchanged for McEwen Shares on the basis of the Exchange Ratio. Outstanding stock options of Golden Lake will be exchanged for replacement options of McEwen on an equivalent economic basis, with adjusted exercise prices.

- To be effective, the Proposed Transaction will require the approval of 66 ⅔% of the votes cast by shareholders, warrantholders, and noteholders of Golden Lake at a special meeting of Golden Lake shareholders, warrantholders, and noteholders expected to take place in March (the "Golden Lake Meeting").

- The Agreement includes provisions such as conditions to closing the Proposed Transaction, and representations and warranties and covenants customary for arrangement agreements. The Agreement also includes: (i) customary deal protection and non-solicitation provisions in favor of McEwen, including a break fee of approximately C

$250,000 payable to McEwen in certain circumstances; and (ii) provisions allowing Golden Lake to consider and accept superior proposals, in compliance with its fiduciary duties. - Completion of the Proposed Transaction will be subject to customary closing conditions and receipt of necessary court and regulatory approvals, including approval of the TSX and the NYSE.

A copy of the Agreement will be filed on McEwen's and Golden Lake’s SEDAR+ profiles at www.sedarplus.ca. The Proposed Transaction was approved by the Board of Directors of both McEwen and Golden Lake. No fairness opinion was obtained in connection with the Proposed Transaction. Further details with respect to the Proposed Transaction are included in the Agreement and in an information circular to be mailed to Golden Lake shareholders in connection with the Golden Lake Meeting. Once available, a copy of the Agreement will be filed on each of McEwen's and Golden Lake’s SEDAR+ profiles at www.sedarplus.ca and a copy of the information circular will be filed on Golden Lake’s SEDAR+ profile at www.sedarplus.ca.

About McEwen

McEwen shares trade on both the NYSE and TSX under the ticker MUX.

McEwen provides its shareholders with exposure to a growing base of gold and silver production in addition to a very large copper development project, all in the Americas. The gold and silver mines are in prolific mineral-rich regions of the world, the Cortez Trend in Nevada, USA, the Timmins district of Ontario, Flin Flon in Manitoba and the Deseado Massif in Santa Cruz province, Argentina. McEwen is also reactivating its gold-silver El Gallo Mine in Mexico.

The Company has a

The Los Azules copper project is designed to be one of the world’s first regenerative copper mines and carbon neutral by 2038. Its Feasibility Study results were announced in the press release dated October 7, 2025.

McEwen also recently purchased

Chairman and Chief Owner Rob McEwen has invested over US

McEwen Contact Info and Social Media

| WEB SITE | SOCIAL MEDIA | |||

| www.mcewenmining.com | McEwen | Facebook: | facebook.com/mceweninc | |

| LinkedIn: | linkedin.com/company/mceweninc | |||

| CONTACT INFORMATION | X: | X.com/mceweninc | ||

| 150 King Street West | Instagram: | instagram.com/mceweninc | ||

| Suite 2800, PO Box 24 | ||||

| Toronto, ON, Canada | McEwen Copper | Facebook: | facebook.com/ mcewencopper | |

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | ||

| X: | X.com/mcewencopper | |||

| Relationship with Investors: | Instagram: | instagram.com/mcewencopper | ||

| (866)-441-0690 - Toll free | ||||

| (647)-258-0395 | Rob McEwen | Facebook: | facebook.com/mcewenrob | |

| Mihaela Iancu ext. 320 | LinkedIn: | https://www.linkedin.com/in/robert-mcewen-646ab24 | ||

| info@mcewenmining.com | X: | X.com/robmcewenmux | ||

About Golden Lake

Golden Lake Exploration is a junior public mining exploration company engaged in the business of mineral exploration and the acquisition of mineral property assets.

For Further Information, Please Contact:

Mike England

CEO & Director

Golden Lake Exploration Inc.

1-888-945-4770

Neither the NYSE, TSX or CSE have reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen and Golden Lake.

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

In this news release, forward-looking statements relate to, among other things, statements regarding: the Proposed Transaction; the Agreement; the receipt of necessary shareholder, court and regulatory approvals for the Proposed Transaction; the anticipated timeline for completing the Proposed Transaction; the terms and conditions pursuant to which the Proposed Transaction will be completed, if at all; the anticipated benefits of the Proposed Transaction including, but not limited to McEwen having an

In respect of the forward-looking statements concerning the Proposed Transaction, including the entering into the Agreement, and the anticipated timing for completion of the Proposed Transaction including, but not limited to the expectation of McEwen having a

Risks and uncertainties that may cause such differences include but are not limited to: the risk that the Proposed Transaction may not be completed on a timely basis, if at all; the conditions to the consummation of the Proposed Transaction may not be satisfied; the risk that the Proposed Transaction may involve unexpected costs, liabilities or delays; the possibility that legal proceedings may be instituted against the McEwen, Golden Lake and/or others relating to the Proposed Transaction and the outcome of such proceedings; the possible occurrence of an event, change or other circumstance that could result in termination of the Proposed Transaction; risks relating to the failure to obtain necessary shareholder and court approval; other risks inherent in the mining industry. Failure to obtain the requisite approvals, or the failure of the parties to otherwise satisfy the conditions to or complete the Proposed Transaction, may result in the Proposed Transaction not being completed on the proposed terms, or at all. In addition, if the Proposed Transaction is not completed, the announcement of the Proposed Transaction and the dedication of substantial resources of McEwen and Golden Lake to the completion of the Proposed Transaction could have a material adverse impact on each of McEwen's and Golden Lake’s share price, its current business relationships and on the current and future operations, financial condition, and prospects of each McEwen and Golden Lake.

McEwen and Golden Lake expressly disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

Qualified Person

Technical information pertaining to the Gold Bar Complex exploration contained in this press release has been prepared under the supervision of Robert Kastelic, MSc, CPG, Exploration Manager for McEwen Inc. in Nevada, and Luke Willis, P.Geo, Director of Resource Modelling for McEwen Inc., who are Qualified Persons (QPs) as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects. Technical information disclosed in this news release pertaining to the historic Jewel Ridge drilling was reviewed and approved by Don Hoy, P. Geo., who serves as a Qualified Person as defined under National Instrument 43-101 for Golden Lake Exploration Inc.

Historical References for Exploration Drilling at Jewel Ridge

- Golden Lake press release of March 23, 2022

- Golden Lake corporate website

Figure 1. McEwen and Golden Lake Property Locations, Eureka Nevada

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f5f16321-5767-432d-9143-d02a099f66fe