Noble Plains Uranium Completes Agreement to Acquire Drill Data on Shirley Central Project in Wyoming

Rhea-AI Summary

Noble Plains Uranium (OTCQB: NBLXF) completed a data acquisition from Pathfinder Mines (Ur-Energy subsidiary) for 1,211 historical drill holes on the Shirley Central Project in Shirley Basin, Wyoming.

The dataset includes lithologic logs, geophysics and interpretations; Noble Plains paid US$125,000 and issued C$650,000 in shares, plus contingent payments tied to future NI 43-101 resource pounds.

Positive

- Acquired 1,211 historical drill holes dataset

- Data avoids an estimated US$6M and years of drilling

Negative

- Contingent payments tied to future resource report could dilute shares

- Contingent share issuance requires TSXV approval and has ownership cap

News Market Reaction

On the day this news was published, NBLXF gained 7.73%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - February 3, 2026) - Noble Plains Uranium Corp. (TSXV: NOBL) (OTCQB: NBLXF) (FSE: INE0) ("Noble Plains" or the "Company"), a U.S. focused uranium exploration and development company, is pleased to announce it has completed the data acquisition agreement with Pathfinder Mines Corporation ("Pathfinder"), a wholly owned subsidiary of Ur-Energy Inc. (TSX: URE) (NYSE: URG), to acquire the historical database for 1,211 drill holes located on Noble Plains' Shirley Central Project ("Shirley Central" or the "Project") in Wyoming's past-producing Shirley Basin that was previously announced on December 18, 2025.

This high-quality dataset includes lithologic logs, geophysical results and historical interpretations from multiple operators who drilled the basin while it was in active production. Noble Plains estimates this dataset would cost in excess of US

"With this transaction now closed, we have immediately put this extensive historical dataset to work," said Drew Zimmerman, CEO of Noble Plains. "This is how we have moved quickly to create value, acquiring historically drilled uranium assets in top U.S. jurisdictions and rapidly advancing them toward defined pounds in the ground. Welcoming Ur-Energy as a new shareholder further validates the quality of Shirley Central and its strategic location beside a new ISR facility under construction."

The newly acquired drillhole data will immediately be used to refine geological modelling across the property to guide the Company's 22-hole drill program already permitted. By validating the historical results, Noble Plains will work towards establishing a resource estimate prepared in accordance with National Instrument 43-101 standards at Shirley Central.

"We are pleased to see this data now formally in the hands of the Noble Plains team as they advance Shirley Central," commented John Cash, Chairman of Ur-Energy. "The broader historical dataset contributed to the definition of uranium resources currently being advanced toward production at our Shirley Basin Project. We believe this subset of data will assist Noble Plains in efficiently interpreting the geology and identifying uranium-bearing roll fronts as they progress toward drilling and resource definition."

Strategic Location for Future ISR Development

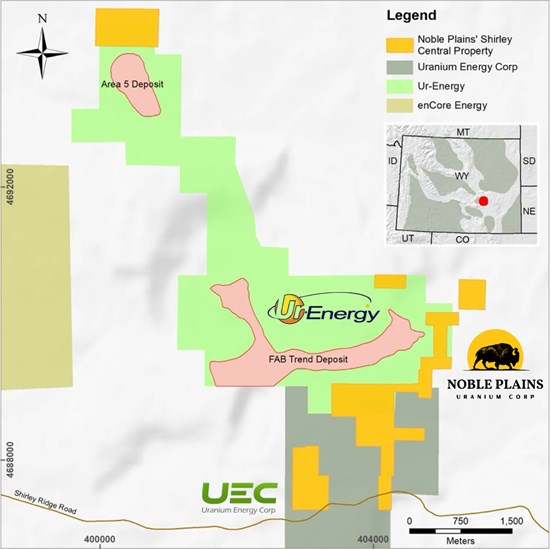

Shirley Central consists of 30 unpatented mineral claims covering 665 acres adjacent to the boundary of Ur-Energy's Shirley Basin ISR Project, which currently hosts a NI 43-101 compliant Measured & Indicated resource of 8.816 million lb U₃O₈ at

The Project is also bordered by Uranium Energy Corp. (UEC), placing Noble Plains directly between two of the most active U.S. uranium developers.

Figure 1: Shirley Central Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3717/282466_69844795741b1b63_001full.jpg

Terms of the Transaction

Under the data acquisition agreement, Noble Plains will pay US

About Noble Plains Uranium

Noble Plains Uranium Corp. is a U.S.-focused uranium exploration and development company advancing a portfolio of high-potential projects amenable to In Situ Recovery (ISR) - the most capital-efficient and environmentally responsible method of uranium extraction. Our strategy targets historically drilled and underexplored assets in proven jurisdictions, with the objective of rapidly delineating NI 43-101-compliant resources and building a scalable inventory of domestic uranium.

- Technical Report Summary, Amended Report for S-K 1300, "Shirley Basin ISR Uranium Project, Carbon County Wyoming, USA" dated March 11, 2024 and prepared by Western Water Consultants, Inc.

- Ur-Energy Announces Q3 2025 Results; Construction Advances at Shirley Basin and Exploration Underway in the Great Divide Basin: Press Release dated November 3, 2025

More information is available at: www.nobleplains.com

On Behalf of the Board of Directors,

"Drew Zimmerman", CEO & President

For further information, please contact: Drew Zimmerman: (778) 686-0973

Website: www.nobleplains.com

Bradley Parkes, P.Geo., VP Exploration of Noble Plains Uranium Corp., is the Qualified Person as defined in National Instrument 43-101, who has read and approved the technical content of this news release.

This news release includes certain forward-looking statements as well as management's objectives, strategies, beliefs and intentions. Forward looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements include, but are not limited to, statements regarding the planned drill program, the timing of drilling and results, the potential to outline a uranium resource prepared in accordance with National Instrument 43-101 standards, the potential to confirm or expand mineralisation, and the expected advancement of the Company's exploration strategy. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including but not limited to: the Company's ability to complete the drill program as planned, the interpretation of historic data, the accuracy of geological modelling, the results of drilling and downhole probing, operational risks and weather delays, regulatory approvals, availability of equipment and personnel, the speculative nature of mineral exploration and development, and fluctuating commodity prices, as described in more detail in our recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements and we caution against placing undue reliance thereon. We assume no obligation to revise or update these forward-looking statements except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282466