Nasdaq Announces End-of-Month Open Short Interest Positions in Nasdaq Stocks as of Settlement Date November 28, 2025

Rhea-AI Summary

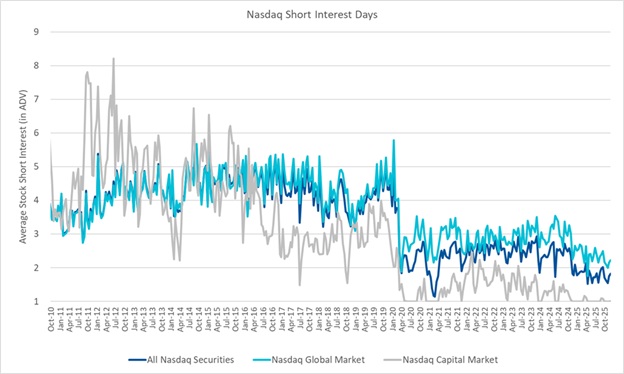

Nasdaq (NDAQ) reported end-of-month open short interest as of the November 28, 2025 settlement date. All Nasdaq securities had 18,191,305,171 shares sold short across 5,151 issues, up from 17,958,812,154 shares in 5,111 issues at the prior settlement date.

Short interest on the Nasdaq Global Market totaled 14,879,370,342 shares in 3,453 issues (previous: 14,632,128,542 in 3,414 issues), representing 2.22 days to cover (prior: 2.16). Nasdaq Capital Market short interest totaled 3,311,934,829 shares in 1,698 issues, with a 1.00 day average daily volume.

Positive

- None.

Negative

- None.

News Market Reaction

On the day this news was published, NDAQ gained 1.32%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Key peers in Financial Data & Exchanges also showed gains, with MSCI up 1.95%, CME up 1.89%, and ICE up 1.21%, indicating broadly positive sentiment across the group rather than a short-interest specific move in NDAQ.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | Listing transition | Positive | +1.0% | Walmart completed transfer of its listing to Nasdaq. |

| Dec 03 | Volume statistics | Positive | +2.2% | Release of detailed November 2025 trading volume data. |

| Dec 03 | Investor conference | Neutral | +2.2% | Planned presentation at Goldman Sachs financial services conference. |

| Dec 02 | Regulatory halt | Neutral | -0.9% | Nasdaq halted trading in MaxsMaking pending more information. |

| Dec 01 | Debt tender offers | Positive | -1.7% | Launch of cash tender offers for up to $95M of notes. |

Recent company updates, including volume statistics and listings activity, often coincided with modest positive moves, while balance sheet actions such as debt tenders have seen mixed or slightly negative reactions.

Over the last few weeks, Nasdaq reported several operational and capital markets updates. A December 9 listing milestone for Walmart on Nasdaq and the release of November 2025 volume statistics were followed by price gains of 1.02% and 2.19%. A conference appearance announcement on December 10, 2025 also aligned with a 2.19% move. By contrast, a trading halt in MaxsMaking and cash tender offers for up to $95,000,000 of debt saw modest negative reactions, underscoring varied responses to regulatory and balance sheet news.

Market Pulse Summary

This announcement provided an end-of-month snapshot of open short interest across 5,151 Nasdaq securities, totaling 18,191,305,171 shares and equating to 1.82 days of average daily volume. It is a market-structure update rather than company-specific news for Nasdaq, Inc. Investors tracking NDAQ may contextualize it alongside recent listing wins, monthly volume reports, and debt tender activity, while monitoring future disclosures, trading volumes, and regulatory filings for more direct impacts on the company’s fundamentals and trading dynamics.

Key Terms

short interest financial

short sale financial

AI-generated analysis. Not financial advice.

NEW YORK, Dec. 09, 2025 (GLOBE NEWSWIRE) -- At the end of the settlement date of November 28, 2025, short interest in 3,453 Nasdaq Global MarketSM securities totaled 14,879,370,342 shares compared with 14,632,128,542 shares in 3,414 Global Market issues reported for the prior settlement date of November 14, 2025. The November short interest represents 2.22 days compared with 2.16 days for the prior reporting period.

Short interest in 1,698 securities on The Nasdaq Capital MarketSM totaled 3,311,934,829 shares at the end of the settlement date of November 28, 2025, compared with 3,326,683,612 shares in 1,697 securities for the previous reporting period. This represents a 1.00 day average daily volume; the previous reporting period’s figure was 1.00.

In summary, short interest in all 5,151 Nasdaq® securities totaled 18,191,305,171 shares at the November 28, 2025 settlement date, compared with 5,111 issues and 17,958,812,154 shares at the end of the previous reporting period. This is 1.82 days average daily volume, compared with an average of 1.75 days for the prior reporting period.

The open short interest positions reported for each Nasdaq security reflect the total number of shares sold short by all broker/dealers regardless of their exchange affiliations. A short sale is generally understood to mean the sale of a security that the seller does not own or any sale that is consummated by the delivery of a security borrowed by or for the account of the seller.

For more information on Nasdaq Short interest positions, including publication dates, visit

http://www.nasdaq.com/quotes/short-interest.aspx

or http://www.nasdaqtrader.com/asp/short_interest.asp.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.

Media Contact:

Sam Raffalli

sam.raffalli@nasdaq.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6814a1d3-8670-44ae-9909-dfb83b569c5a

NDAQO