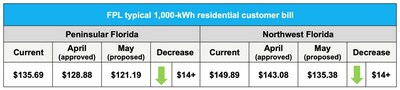

FPL seeks back-to-back rate decreases for customers in April and May

- Typical 1,000-kWh residential bill would be more than

$14 - Typical 1,000-kWh residential bill in

Northwest Florida in May would be the lowest in nearly five years.

If the Florida Public Service Commission (PSC) approves FPL's request, a typical 1,000-kWh residential customer bill would be more than

Approved April rate decrease: Rates are going down in April because a temporary surcharge to recover restoration costs from past hurricanes ends March 31. That means a typical 1,000-kWh residential customer bill will fall nearly

Proposed May rate decrease: FPL asked the PSC to reduce the fuel charge on customer bills to reflect lower projected prices for natural gas, which is used in FPL's power plants to generate electricity. If the PSC approves, a typical 1,000-kWh residential customer bill would fall about

A word from FPL President and CEO Armando Pimentel: "We are committed to providing reliable energy and keeping customer bills as low as possible. While we are pleased with the possibility of back-to-back rate reductions, we also encourage customers to take advantage of tools and tips from our energy experts to help customers reduce their energy usage and make their bills even lower."

Rates + usage = monthly bill: A customer's monthly bill is determined by rates approved by the Florida Public Service Commission and by the amount of electricity the customer uses. Bills tend to increase in warmer months as customers use more air conditioning. FPL offers tools and tips to reduce energy consumption at FPL.com/WaysToSave.

Florida Power & Light Company

As America's largest electric utility, Florida Power & Light Company serves more customers and sells more power than any other utility, providing clean, affordable, reliable electricity to approximately 5.9 million accounts, or more than 12 million people. FPL operates one of the most fuel efficient and cleanest power generation fleets in the

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fpl-seeks-back-to-back-rate-decreases-for-customers-in-april-and-may-302088042.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fpl-seeks-back-to-back-rate-decreases-for-customers-in-april-and-may-302088042.html

SOURCE Florida Power & Light Company