NHI Responds to ISS Recommendation

Rhea-AI Summary

Positive

- Superior total shareholder return (TSR) compared to peer group over 1-year period

- Successfully completed over $400 million in dispositions of underperforming assets at premium valuations

- Added 5 new independent directors in past 5 years showing governance improvements

- Premium market valuation acknowledged by ISS

- Received $43.7 million in net proceeds from sale of seven properties in 2022 lease amendment

Negative

- ISS raised concerns regarding NHC lease negotiations

- Governance improvements still needed according to ISS recommendation

- Potential disruption in company momentum if board composition changes

News Market Reaction

On the day this news was published, NHI declined 1.96%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Urges Shareholders to Vote FOR NHI's Director Nominees on the WHITE Proxy Card

Strongly Disagrees with ISS' Recommendation; Believes that it Would Put at Risk Company's Superior Shareholder Returns

MURFREESBORO, TN / ACCESS Newswire / May 13, 2025 / National Health Investors, Inc. (NYSE:NHI) ("NHI" or "the Company") issued the following statement regarding a May 12, 2025 report by proxy advisory firm Institutional Shareholder Services ("ISS"):

We strongly disagree with ISS' recommendation which we believe would disrupt the momentum that NHI, under the guidance of our Board, has created to capitalize on the significant growth opportunity in the senior housing industry and that has resulted in outperformance by NHI compared to our relevant peer group. Robert G. Adams and James R. Jobe possess the critical experience and skills that NHI needs right now and that are key to continuing to deliver superior shareholder returns.

Importantly, neither of the Land & Buildings (L&B) nominees have any operational experience in the senior housing industry with one L&B nominee working full-time for the past 13 years managing a family farm and the other L&B nominee managing a very small privately-held self storage company with only two facilities and who has never served on a public company board. We strongly believe that these are not the qualifications or experience that will drive the Company's ability to continue to achieve meaningful growth and to continue delivering strong total shareholder return. Instead, we believe it is critical that NHI's shareholders keep the current directors in place and not risk their investment.

Despite their recommendation, ISS helpfully cites factors that we believe support the Board's nominees, including our superior TSR and operational performance. Notably, the ISS report commends NHI on its outperformance of its relevant peer group and confirms that their recommendation is focused solely on seeking further governance improvements in addition to the numerous steps the Board has already taken, including adding 5 new independent directors in the past 5 years, proposing to declassify the Board and having all Board committees composed solely of independent directors.

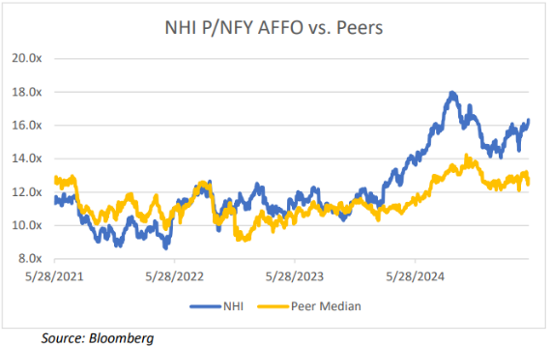

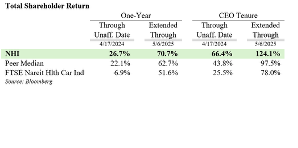

The report emphasizes that our TSR has outperformed the relevant peer group and index over the 1-year period and since our current CEO joined the Company (see tables below). We acted early and decisively at the onset of the pandemic to aggressively optimize our portfolio, resulting in over

However, we strongly disagree with ISS' concerns regarding the NHC lease negotiations. Consistent with best practices in corporate governance, the Board has formed a Special Committee composed solely of independent and disinterested directors to eliminate any perceived conflicts of interest during this upcoming negotiation. The Special Committee has the full authority of the Board to determine the best path forward for our Company and our shareholders with a mandate to create maximum NHI shareholders value. NHI has hired a nationally recognized independent consultant, Blueprint, to assist in the lease negotiations and we are completely aligned with our shareholders on this key issue. We believe the ISS analysis of the current NHC lease fails to take into account certain key facts and provisions, including that NHI received

Importantly, we commend ISS for highlighting our openness to modernizing our corporate governance and the significant changes that have materialized over the last several years. ISS notes that:

"The company's board…[has] committees comprised entirely of independent directors"

"…it modified its bylaws to remove a provision that required shareholders calling a special meeting to bear the costs of mailing the meeting materials."

"The board also appointed a new nominating/governance committee chair, retired two long-tenured directors, and made a commitment well before this annual meeting to submit a declassification proposal."

The NHI Board greatly values the feedback from all shareholders and is committed to continuing to evolve our governance to maximize shareholder returns. The NHC lease is very important to the Company, and we believe that management and NHI's Special Committee along with guidance from Blueprint will drive an outcome that is in the best of interests of shareholders. We also believe the biggest opportunity is outside of the one-time NHC lease renewal and that our nominees are best suited to guide the Company in what we view as the very early stages of long-term and outsized growth. We urge shareholders to protect their investment by voting "FOR" the NHI Board nominees.

VOTE THE WHITE PROXY CARD TODAY FOR ALL NHI'S RECOMMENDED NOMINEES

The May 21, 2025 Annual Meeting is fast approaching, and it's important to vote as soon as possible. The Board urges all shareholders to vote "FOR" NHI's director nominees, Candice W. Todd, Robert W. Chapin, Jr., James R. Jobe, and Robert G. Adams, on the WHITE proxy card to protect NHI's future and your investment.

For more information on how to protect the value of your investment at NHI, visit www.nhireit.com. Shareholders who have any questions or need assistance voting may contact the Company's proxy solicitor, Sodali & Co. LLC, toll-free at (800) 662-5200.

About National Health Investors

Incorporated in 1991, National Health Investors, Inc. (NYSE: NHI) is a real estate investment trust specializing in sale, leasebacks, joint-ventures, senior housing operating partnerships, and mortgage and mezzanine financing of need-driven and discretionary senior housing and medical investments. NHI's portfolio consists of independent living, assisted living and memory care communities, entrance-fee retirement communities, skilled nursing facilities, and specialty hospitals. For more information, visit www.nhireit.com.

Forward-Looking Statements

This communication includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements regarding the Company's, tenants', operators', borrowers' or managers' expected future financial position, results of operations, cash flows, funds from operations, dividend and dividend plans, financing opportunities and plans, capital market transactions, business strategy, budgets, projected costs, operating metrics, capital expenditures, competitive positions, acquisitions, investment opportunities, dispositions, acquisition integration, growth opportunities, expected lease income, continued qualification as a REIT, plans and objectives of management for future operations, continued performance improvements, ability to service and refinance our debt obligations, ability to finance growth opportunities, and similar statements including, without limitation, those containing words such as "may", "will", "should", "believes", "anticipates", "expects", "intends", "estimates", "plans", "projects", "likely" and other similar expressions are forward-looking statements.

Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements. Such risks and uncertainties include, among other things; the operating success of our tenants, managers and borrowers for collection of our lease and interest income; the risk that our tenants, managers and borrowers may become subject to bankruptcy or insolvency proceedings; risks related to the concentration of a significant percentage of our portfolio to a small number of tenants; risks associated with pandemics, epidemics or outbreaks on our operators' business and results of operations; risks related to governmental regulations and payors, principally Medicare and Medicaid, and the effect that changes to laws, regulations and reimbursement rates would have on our tenants' and borrowers' business; the risk that the cash flows of our tenants, managers and borrowers may be adversely affected by increased liability claims and liability insurance costs; the risk that we may not be fully indemnified by our tenants, managers and borrowers against future litigation; the success of property development and construction activities, which may fail to achieve the operating results we expect; the risk that the illiquidity of real estate investments could impede our ability to respond to adverse changes in the performance of our properties; risks associated with our investments in unconsolidated entities, including our lack of sole decision-making authority and our reliance on the financial condition of other interests; risks related to our joint venture investment with Life Care Services for Timber Ridge; inflation and increased interest rates; adverse developments affecting the financial services industry, including events or concerns involving liquidity, defaults, or non-performance by financial institutions; operational risks with respect to our SHOP structured communities, risks related to our ability to maintain the privacy and security of Company information; risks related to environmental laws and the costs associated with liabilities related to hazardous substances; the risk of damage from catastrophic weather and other natural or man-made disasters and the physical effects of climate change; the success of our future acquisitions and investments; our ability to reinvest cash in real estate investments in a timely manner and on acceptable terms; competition for acquisitions may result in increased prices for properties; our ability to retain our management team and other personnel and attract suitable replacements should any such personnel leave; the risk that our assets may be subject to impairment charges; our ability to raise capital through equity sales is dependent, in part, on the market price of our common stock, and our failure to meet market expectations with respect to our business, or other factors we do not control, could negatively impact such market price and availability of equity capital; the potential need to refinance existing debt or incur additional debt in the future, which may not be available on terms acceptable to us; our ability to meet covenants related to our indebtedness which impose certain operational limitations and a breach of those covenants could materially adversely affect our financial condition and results of operations; downgrades in our credit ratings could have a material adverse effect on our cost and availability of capital; we rely on external sources of capital to fund future capital needs, and if we encounter difficulty in obtaining such capital, we may not be able to make future investments necessary to grow our business or meet maturing commitments; our dependence on revenues derived mainly from fixed rate investments in real estate assets, while a portion of our debt bears interest at variable rates; our ability to pay dividends in the future; legislative, regulatory, or administrative changes; and our dependence on the ability to continue to qualify for taxation as a real estate investment trust and other risks which are described under the heading "Risk Factors" in Item 1A in our Form 10-K for the year ended December 31, 2024. Many of these factors are beyond the control of the Company and its management. The Company assumes no obligation to update any of the foregoing or any other forward looking statements, except as required by law, and these statements speak only as of the date on which they are made. Investors are urged to carefully review and consider the various disclosures made by NHI in its periodic reports filed with the Securities and Exchange Commission (the "SEC"), including the risk factors and other information in the above referenced Form 10-K. Copies of these filings are available at no cost on the SEC's web site at https://www.sec.gov or on NHI's web site at https://www.nhireit.com.

Important Additional Information Regarding Proxy Solicitation

NHI has filed a definitive proxy statement and WHITE proxy card (the "Proxy Statement") with the SEC in connection with the solicitation of proxies for the Company's Annual Meeting. The Company, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the Annual Meeting. Information regarding the names of the Company's directors and executive officers and their respective interests in the Company by security holdings or otherwise is set forth in the Proxy Statement. To the extent holdings of such participants in the Company's securities have changed since the amounts described in the Proxy Statement, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information can also be found in the Company's Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 25, 2025. Details concerning the nominees of the Company's Board of Directors for election at the Annual Meeting are included in the Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY'S DEFINITIVE PROXY STATEMENT AND ANY AMENDMENTS AND SUPPLEMENTS THERETO BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. These documents, including the definitive Proxy Statement (and any amendments or supplements thereto) and other documents filed by the Company with the SEC, are available for no charge at the SEC's website at www.sec.gov and at the Company's investor relations website at https://investors.nhireit.com.

Contact: Dana Hambly, Vice President, Finance and Investor Relations

Phone: (615) 890-9100

SOURCE: National Health Investors

View the original press release on ACCESS Newswire