Nova Confirms Higher-Grade Starter Pit Potential within the 4.05 Moz Pit-Constrained Korbel Gold Deposit

Rhea-AI Summary

Nova Minerals (NASDAQ: NVA) reports 2025 shallow RC drilling at the Korbel Main deposit has defined a near-surface higher-grade core inside the pit-constrained resource. Korbel Main is reported at 275 Mt @ 0.3 g/t Au for 2.70 Moz; Cathedral adds 150 Mt @ 0.3 g/t Au for 1.35 Moz, giving a combined Korbel pit-constrained resource of 4.05 Moz Au (S-K 1300 basis). A potential pilot starter pit (~250m x 80m x 20m) is identified and key intercepts include 9m @ 1.2 g/t Au and 26m @ 0.7 g/t Au. Previous test work showed ore sorting can upgrade 0.4 g/t material to >6 g/t. Results will feed the ongoing feasibility study and additional surface assay programs and metallurgical test work are underway.

Positive

- Defined near-surface core within Korbel Main's pit resource

- Pilot starter pit footprint ~250m x 80m x 20m identified

- Significant intercepts including 9m @ 1.2 g/t Au and 26m @ 0.7 g/t Au

- Combined Korbel resource of 4.05 Moz Au (pit-constrained, S-K 1300)

- Ore-sorting evidence previously upgraded 0.4 g/t to >6 g/t Au

Negative

- Shallow water table impacted drilling and sampling at Korbel

- Low bulk grades (0.3 g/t Au) require processing/scale to be economic

- Korbel grades lower than RPM, potentially limiting high-grade production

News Market Reaction – NVA

On the day this news was published, NVA gained 5.18%, reflecting a notable positive market reaction. Argus tracked a peak move of +12.6% during that session. Our momentum scanner triggered 37 alerts that day, indicating elevated trading interest and price volatility. This price movement added approximately $20M to the company's valuation, bringing the market cap to $413M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

NVA is up 1.31% while peers show mixed moves: FURY up 4.58%, OMEX up 1.92%, XPL down 0.82%, ATLX down 0.18%, LGO flat. This points to stock-specific factors around the Korbel drill update.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Jan 13 | RPM Valley drilling | Positive | +6.2% | High-grade RPM Valley intercepts supporting maiden M&I resource. |

| Jan 07 | RPM North drilling | Positive | +0.7% | Broad near-surface RPM North mineralization with new eastern extension. |

| Jan 05 | Antimony clarification | Positive | +8.1% | Clarified antimony plans and highlighted US$43.4M DoD project support. |

| Dec 22 | Offering closing | Negative | +6.0% | Closed $20M ADS offering to fund Estelle exploration and studies. |

| Dec 18 | Offering pricing | Negative | -17.7% | Priced $20M ADS offering at $6.83 per ADS, seen as dilutive. |

Recent drill and project updates have generally seen positive price reactions, and even one dilutive offering was absorbed positively, with only one clear divergence event.

Over the past months, Nova has delivered a series of Estelle project updates. RPM Valley and RPM North drilling on Jan 7 and Jan 13, 2026 reported long mineralized intervals and high-grade zones, supporting resource growth for the feasibility study. A US$43.4 million U.S. DoD award and clarification on antimony sourcing on Jan 5, 2026 also preceded strong gains. December 2025 offerings priced at $6.83 per ADS briefly weighed on shares, but the closing announcement on Dec 22 saw a positive reaction, indicating constructive sentiment toward project funding.

Market Pulse Summary

The stock moved +5.2% in the session following this news. A strong positive reaction aligns with Nova’s pattern of favorable responses to drilling and project updates, as seen after prior Estelle and RPM results. The confirmation of a higher-grade starter pit concept at Korbel within a 4.05 Moz pit-constrained resource could reinforce the project’s economics already advancing through the feasibility study. Investors would still need to weigh capital needs, past equity offerings, and execution risk as the company moves toward potential development.

Key Terms

reverse circulation drilling technical

pit-constrained resource technical

ore sorting technical

arsenopyrite medical

chalcopyrite medical

pyrite medical

Standard Reference Material (SRM) technical

SEC Regulation S-K 1300 regulatory

AI-generated analysis. Not financial advice.

Anchorage Alaska, Jan. 21, 2026 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” or the “Company”) (NASDAQ: NVA) (ASX: NVA) (FRA: QM3) ) is pleased to announce shallow reverse circulation drilling results within a proposed starter pit at the Korbel Main Deposit within the Company's flagship Estelle Gold and Critical Minerals Project (Estelle or the Project), located in the prolific Tintina Gold Belt in Alaska.

Highlights

-

- 2025 shallow RC drilling defines a near-surface higher-grade core at the bulk-tonnage Korbel Main Deposit, with grades up to 1.2 g/t Au.

- Results indicate a pilot starter pit approximately 250m long by 80m wide may be suitable within Korbel Main, with drilling identifying a higher-grade core within its bulk-tonnage pit-constrained resource of 275 Mt @ 0.3 g/t Au for 2.70 Moz Au (Table 3).

- Korbel Main forms part of the broader Korbel Gold Deposit, which includes the Cathedral Deposit, currently hosting a pit-constrained 1.35 Moz Au resource (150 Mt @ 0.3 g/t Au – Table 3).

- With gold prices currently around US

$4,600 /oz, the combined 4.05Moz Au (Table 3) Korbel bulk-tonnage pit-constrained resource is anticipated to materially contribute to Project economics under evaluation in the ongoing feasibility study (FS). - Highlights from the 2025 shallow, closely spaced, infill 14-hole reverse circulation (RC) drill program at Korbel include (Table 1 and Figure 4):

- KBRC_001

- 19m @ 0.6 g/t Au from surface including;

- 6m @ 1.0 g/t Au from 9m

- KBRC_006

- 25m @ 0.5 g/t Au from 1m including;

- 8m @ 0.8 g/t Au from 13m

- KBRC_010

- 9m @ 1.2 g/t Au from 1m

- 9m @ 1.2 g/t Au from 1m

- KBRC_011

- 26m @ 0.7 g/t Au from 1m

- 26m @ 0.7 g/t Au from 1m

- KBRC_013

- 22m @ 0.7 g/t Au from surface including;

- 9m @ 1.1 g/t Au from surface

- KBRC_001

- While RC drilling is significantly shallower than diamond core drilling, with average hole depth ~20m, the results highlight the potential for a pilot pit to further test ore sorting, building on previous work where 0.4 g/t Au material was successfully upgraded to over 6 g/t Au - more than a tenfold increase - potentially reducing processing costs and increasing mine production (ASX Announcement: 15 March 2021).

- The 2025 RC drill program focused on adding resource confidence to intercepts identified in previous diamond drilling campaigns, including:

- KBDH-002: 540m @ 0.3 g/t Au from 2m, incl. 158m @ 0.5 g/t Au (ASX Announcement: 22 June 2020)

- KBDH-004: 517m @ 0.3 g/t Au from 1m, incl. 106m @ 0.7 g/t Au (ASX Announcement: 14 July 2020)

- KBDH-012: 429m @ 0.6 g/t Au from (ASX Announcement: 19 August 2020)

- KBDH-002: 540m @ 0.3 g/t Au from 2m, incl. 158m @ 0.5 g/t Au (ASX Announcement: 22 June 2020)

- To view a commentary video from Nova’s CEO, Christopher Gerteisen, discussing the significance of these latest drill results, please click here.

- All drill results from Korbel have now been reported.

- Results from the extensive soil and rock chip surface samples taken from across the project area in 2025 will also be reported once received and processed.

Nova CEO, Mr Christopher Gerteisen, commented:

“We are pleased with the 2025 RC drilling results at Korbel Main, which have defined a near-surface, higher-grade core. The results highlight the potential for a pilot starter pit within Korbel Main’s 2.7 Moz bulk-tonnage pit-constrained resource and demonstrate strong potential to test ore sorting on a larger scale, building on previous work where material was upgraded more than tenfold, potentially lowering processing costs and increasing gold production.

“At current gold prices of around US

“We look forward to keeping the market informed as Korbel continues to progress towards production.

2025 Korbel Drilling Summary

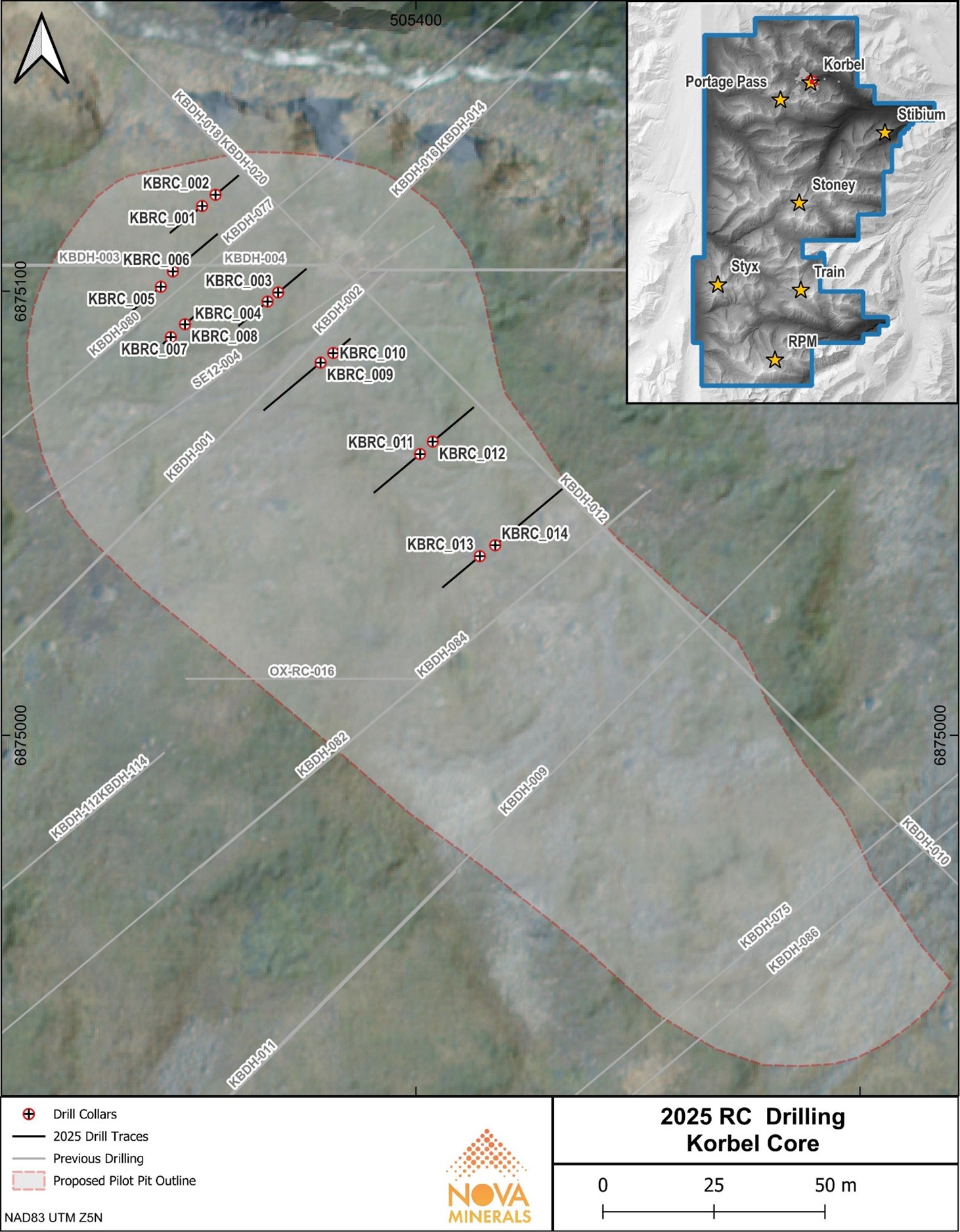

A total of 14 RC holes were drilled at the Korbel Main Deposit (Figure 3) to provide infill definition to the core of the existing 2.7 Moz (275 Mt @ 0.3 g/t Au) pit-constrained resource (Table 3) for a potential higher-grade starter pit. Despite challenges from a shallow water table, sufficient sampling was achieved to increase confidence in the near-surface higher-grade mineralization. This will support planning for a potential early-stage pilot pit (~250m long x 80m wide x 20m deep) to produce ore for further ore sorting analysis (Figure 3). With gold concentrated in arsenopyrite-bearing quartz veins, previous test work has shown that Korbel ore is highly amenable to ore sorting, with the potential to upgrade material from 0.4 g/t Au to over 6 g/t Au, which could reduce processing costs and increase mine production (ASX Announcement: 15 March 2021).

Although grades at Korbel are lower than at RPM, it remains a significant bulk-tonnage deposit, and with gold near US

Figure 1 below shows a typical RC drilling site at Korbel. At each site, -60 degree holes were drilled at 230 and 050 azimuths, crosscutting the dominant northwest structural trend of the steeply-dipping sheeted veins.

Figure 1. Korbel RC drill site

All 2025 RC holes targeted the granodiorite of the main Estelle pluton, which is crosscut by mineralized quartz veins. Nova believes these results highlight a zone of increased vein density, the main driver of gold mineralization

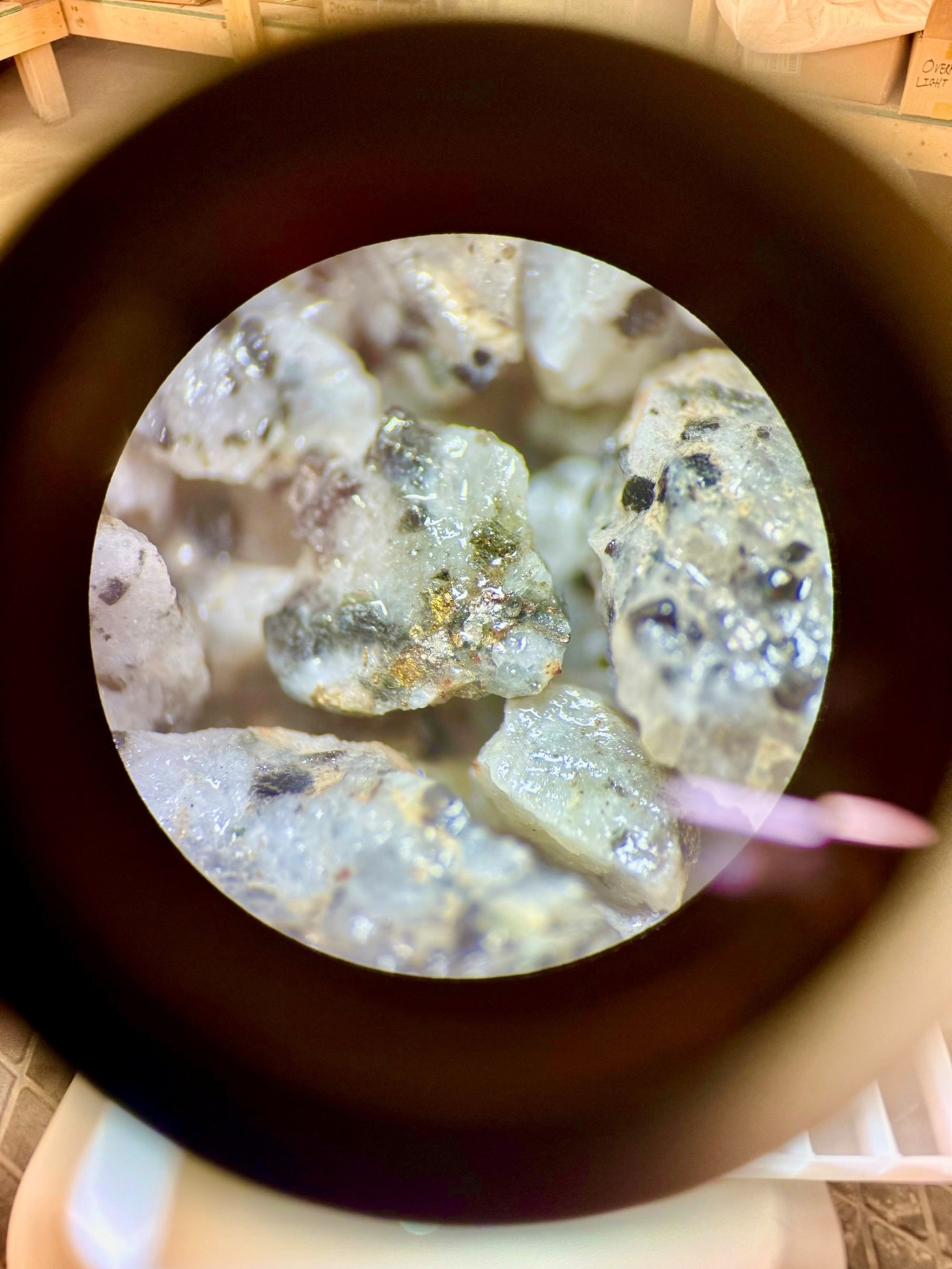

RC chips were preserved in chip trays for microscope analysis, and some notable chalcopyrite, pyrite, and arsenopyrite were observed (Figure 2).

Figure 2. Representative Korbel RC chip sample from the 2025 drilling showing chalcopyrite, pyrite, and arsenopyrite

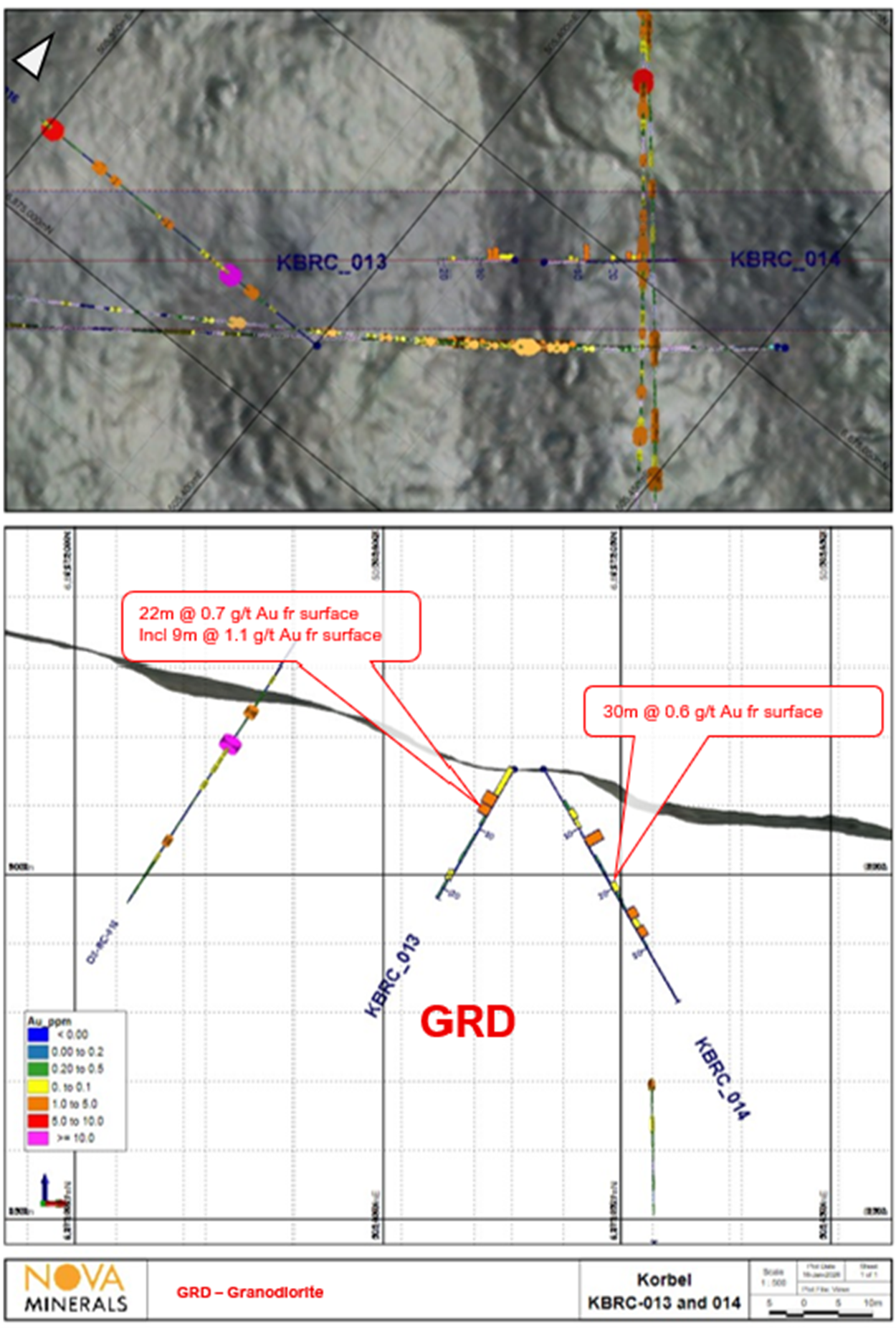

Figure 3 shows a plan view of the RC drill holes and potential higher-grade starter pit area. Figure 4 shows a cross section of two of the intercepts at KBDH-013 and KBDH-014.

Figure 3: Plan view of 2025 Korbel RC drilling showing the potential starter pilot pit area

Figure 4. KBRC-013 and -014 drill Intercepts (050 azi)

Table :1 Significant intercepts

| Hole_ID | From (m) | To (m) | Interval (m) | Au g/t |

| KBRC_001 | 0 | 19 | 19 | 0.6 |

| Including | 9 | 15 | 6 | 1.0 |

| KBRC_006 | 1 | 26 | 25 | 0.5 |

| Including | 13 | 21 | 8 | 0.8 |

| KBRC_009 | 4 | 33 | 29 | 0.4 |

| KBRC_010 | 1 | 10 | 9 | 1.2 |

| KBRC_011 | 1 | 27 | 26 | 0.7 |

| KBRC_013 | 0 | 22 | 22 | 0.7 |

| Including | 0 | 9 | 9 | 1.1 |

| KBRC_014 | 0 | 30 | 30 | 0.6 |

Table 2: Drill hole details

| Hole_ID | Easting | Northing | Elev (m) | EOH (m) | Azi | Dip | Zone | Assay Results | |

| KBRC_001 | 505351.9 | 6875119.2 | 920.0 | 18.5 | 230 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_002 | 505354.9 | 6875121.7 | 919.3 | 13.3 | 50 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_003 | 505369.0 | 6875099.7 | 919.7 | 16.2 | 50 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_004 | 505366.6 | 6875097.7 | 920.3 | 16.8 | 230 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_005 | 505342.6 | 6875101.0 | 923.3 | 18.0 | 230 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_006 | 505345.3 | 6875104.5 | 923.0 | 25.9 | 50 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_007 | 505344.8 | 6875089.7 | 924.7 | 4.3 | 230 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_008 | 505348.0 | 6875092.6 | 924.0 | 8.5 | 50 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_009 | 505378.6 | 6875083.9 | 919.2 | 33.1 | 230 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_010 | 505381.4 | 6875086.1 | 918.7 | 9.8 | 50 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_011 | 505401.0 | 6875063.3 | 915.7 | 26.8 | 230 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_012 | 505403.8 | 6875066.1 | 915.9 | 23.8 | 50 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_013 | 505414.4 | 6875040.3 | 915.3 | 21.6 | 230 | -60 | Korbel Core | ASX: 21/01/25 | |

| KBRC_014 | 505417.9 | 6875042.8 | 915.3 | 39.0 | 50 | -60 | Korbel Core | ASX: 21/01/25 | |

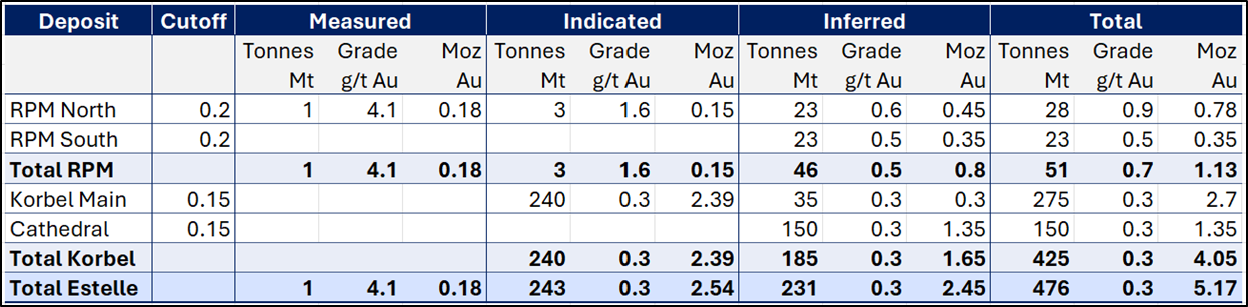

Table 3: S-K 1300 compliant pit-constrained mineral resource estimate

S-K 1300 compliant pit-constrained resource at a US

Note: The Mineral Resource Estimates (MRE) referenced in this press release differ from those disclosed in the ASX announcement. This press release reports the S-K 1300 pit-constrained resource, while the ASX announcement reports the JORC global resource.

Upcoming Milestones

- Drill results from Stibium

- Further results and potential new discoveries from the 2025 surface exploration mapping and sampling program

- Material FS test-work results as they become available

- Updated MRE

- Winter trail mobilization of heavy equipment

- Airborne geophysical surveys to commence in the spring of 2026

- Antimony phase 1 project updates

- Metallurgical test work ongoing

- Environmental test work ongoing

- West Susitna access road updates

Qualified Persons

Vannu Khounphakdee, Professional Geologist and member of Australian Institute of Geoscientists contracted by Nova Minerals to provide geologic consulting services. Mr. Khounphakdee holds a Master of Science in Mine Geology and Engineering. He is a qualified person with at least 5 years experience with this type of project. By reason of education, affiliation with a professional association, and past relevant work experience, Mr. Khounphakdee fulfills the requirements of Qualified Person (QP) for the purposes of SEC Regulation SK-1300 for data QA/QC checks relevant to this announcement.

Hans Hoffman is a State of Alaska Certified Professional Geologist contracted by Nova Minerals to provide geologic consulting services. Mr. Hoffman is a member of the American Institute of Professional Geologists and holds a Bachelor of Science degree in Geological Engineering with a double major in Geology and Geophysics. He is a qualified person with at least 5 years of experience with these types of projects. By reason of education, affiliation with a professional association, and past relevant work experience, Mr. Hoffman fulfills the requirements of Qualified Person (QP) for the purposes of SEC Regulation SK-1300 for the technical information presented in this announcement.

Christopher Gerteisen, Chief Executive Officer of Nova Minerals, is a Professional Geologist and member of Australian Institute of Geoscientists, and has supervised the preparation of this news release and has reviewed and approved the scientific and technical information contained herein. Mr. Gerteisen is a "qualified person" for the purposes of SEC Regulation S-K 1300.

Data Verification

Where possible each 1.52m to 3.05m RC interval was riffle split (dry) to obtain 3-5 kg samples at the drill site, these samples were crushed to achieve >

About Nova Minerals Limited

Nova Minerals Limited is advancing one of the world’s largest undeveloped gold deposits into production and securing a US domestic supply of the critical mineral antimony. The Company is focused on the exploration and development of the Estelle Gold and Critical Minerals Project, located in Alaska, a tier-one mining jurisdiction.

Estelle hosts two defined multi-million-ounce gold resources, and more than 20 prospects distributed along a 35-kilometre mineralized trend, in the prolific Tintina Gold Belt, a province which hosts a >220 million ounce (Moz) documented gold endowment and some of the world's largest gold mines and discoveries including, Kinross Gold Corporation's Fort Knox Gold Mine. In parallel, Nova is advancing its critical minerals strategy, fully-funded by a US

Further discussion and analysis of the Estelle Project is available through the interactive Vrify 3D animations, presentations, and videos, all available on the Company’s website. www.novaminerals.com.au

Forward Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” "will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Nova Minerals Limited’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the final prospectus related to the public offering filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Nova Minerals Limited undertakes no duty to update such information except as required under applicable law.

For Additional Information Please Contact

Investor Relations:

Dave Gentry, CEO

RedChip Companies, Inc.

Phone: 1-407-644-4256

Email: NVA@redchip.com

Nova Minerals:

Craig Bentley

Director of Finance & Compliance & Investor Relations

E: craig@novaminerals.com.au

M: +61 414 714 196

FAQ

What did Nova Minerals announce about Korbel drilling on January 21, 2026 (NVA)?

What is the reported pit-constrained resource for Korbel (NVA)?

What pilot pit size did Nova identify at Korbel Main (NVA)?

Which standout drill intercepts did Nova report at Korbel (NVA)?

How could ore sorting affect Korbel economics for Nova (NVA)?

What follow-up work did Nova list for the Estelle Project (NVA)?