Osisko Development Provides Infill Drilling Update on Its 13,000-Meter Lowhee Program at Cariboo Gold Project; Intercepts Include 596.40 g/t Gold Over 2.0 Meters from 6.1 Meters Downhole, Including 2,293.56 g/t Gold Over 0.5 Meters from 6.6 Meters Downhole

Rhea-AI Summary

Osisko Development (NYSE: ODV) reported results from its 13,000-meter Lowhee infill drilling program at Cariboo, with 11,025 m of full results (~80% of program) and ~12.1 km (~88%) of total meters completed. Highlight intercepts include 596.40 g/t Au over 2.0 m (incl. 2,293.56 g/t over 0.5 m).

Remaining assays and QA/QC are pending; drilling was suspended after an incident on Jan 23, 2026, with the program now expected to finish in early Q2 2026.

Positive

- Infill drilling: 11,025 m of reported results (~80% of program)

- Aggregate meters completed: ~12.1 km (~88% of planned)

- High-grade intercept: 596.40 g/t Au over 2.0 m (incl. 2,293.56 g/t/0.5 m)

- Multiple multi-meter zones >5 g/t supporting resource refinement

Negative

- Drilling suspended after Jan 23, 2026 incident causing schedule delay

- Remaining assays and QA/QC pending for unreported holes

News Market Reaction

On the day this news was published, ODV gained 1.78%, reflecting a mild positive market reaction. This price movement added approximately $20M to the company's valuation, bringing the market cap to $1.14B at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

ODV was up 1.78% with mixed but mostly positive gold peers: IAUX +2.97%, GAU +2.28%, DC +1.49%, CMCL +0.53%, while GROY declined 2.61%. Scanner data flagged this as stock‑specific rather than a broad sector momentum move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Feb 09 | Project management deal | Positive | +8.0% | Signed project and construction management services agreement for Cariboo development. |

| Feb 03 | Bought‑deal completed | Neutral | +4.1% | Closed US$143.8M bought‑deal share offering to fund Cariboo work and working capital. |

| Feb 02 | Executive appointment | Positive | +0.9% | Appointed VP Permitting and Compliance to strengthen regulatory capabilities in Canada. |

| Jan 27 | Asset sale | Positive | -1.0% | Completed sale of San Antonio Gold Project for Axo shares and contingent payments. |

| Jan 26 | Bought‑deal announced | Neutral | +0.0% | Announced US$125M bought‑deal equity financing to fund Cariboo drilling and exploration. |

Recent Cariboo‑focused announcements, including project management and equity financings, were generally followed by positive price reactions, with only the San Antonio asset sale seeing a modest negative move.

Over the past weeks, Osisko Development has concentrated news flow around its Cariboo Gold Project. A project and construction management agreement on Feb 9, 2026 and a VP permitting hire on Feb 2, 2026 both coincided with gains. Two bought‑deal offerings in late January and early February boosted funding for Cariboo infill drilling and exploration, also aligning with positive or stable price action. The San Antonio project sale slightly weighed on shares but further focused the portfolio on Cariboo, tying directly into today’s infill drilling update.

Regulatory & Risk Context

An effective F‑3/A shelf registers 104,751,318 common shares for resale from an August 2025 private placement. Osisko would not receive proceeds from shareholder resales but could receive up to US$126.8 million if related warrants are fully exercised, earmarked for the Cariboo Gold Project.

Market Pulse Summary

This announcement highlights detailed infill drilling progress at the Lowhee Zone, including standout grades such as 596.40 g/t Au over 2.0 m and substantial completion of the 13,000 m program. It follows recent Cariboo‑focused financings and project management steps, reinforcing the asset’s centrality. Investors may track remaining assay results, how new intercepts feed into updated resource and reserve models, and the interaction with existing registration statements for potential future equity activity.

Key Terms

infill drilling technical

photon assay technical

diamond drill technical

qa/qc technical

AI-generated analysis. Not financial advice.

HIGHLIGHTS

- 11,025 m of infill drilling completed (5,043 m new results) on 10-m drill spacing in 116 drill holes from August 2025 representing ~

80% of the total planned ~13 km infill program - Highlight intercepts include: 596.40 g/t Au over 2.0 m from 6.1 m downhole (including 2,293.56 g/t Au over 0.5 m from 6.6 m downhole), 21.67 g/t Au over 3.5 m from 96.5 m downhole (including 135.44 g/t Au over 0.5 m from 99.5 m downhole), and 21.97 g/t Au over 2.5 m from 48.7 m downhole

- Results to date continue to contribute to a more detailed understanding of spatial controls and local variability of the Lowhee Zone

- An aggregate total of ~12.1 km (~

88% ) of total planned drill meters have been completed to date, with full assays and QA/QC pending for the remaining, unreported holes - Infill program anticipated to conclude in early Q2 2026

MONTREAL, Feb. 11, 2026 (GLOBE NEWSWIRE) -- Osisko Development Corp. (NYSE: ODV, TSXV: ODV) ("Osisko Development" or the "Company") is pleased to announce new infill drilling results from its ongoing 13,000-meter program on 10 meter drill spacing that commenced in August 2025 in the Lowhee Zone of the Company's permitted,

Chris Lodder, President, stated, "This tighter drill spacing gives us a better understanding of vein corridor spatial geometries and local variability specific to this part of the Lowhee deposit, while reinforcing the importance of continued drilling in underexplored zones. As this work concludes, the resulting information is expected to help refine infill drill requirements and production designs and sequencing in the Lowhee Deposit of the Cariboo Gold Project."

In total, an aggregate of approximately 12.1 kilometres ("km"), representing ~

DRILL ASSAY HIGHLIGHTS

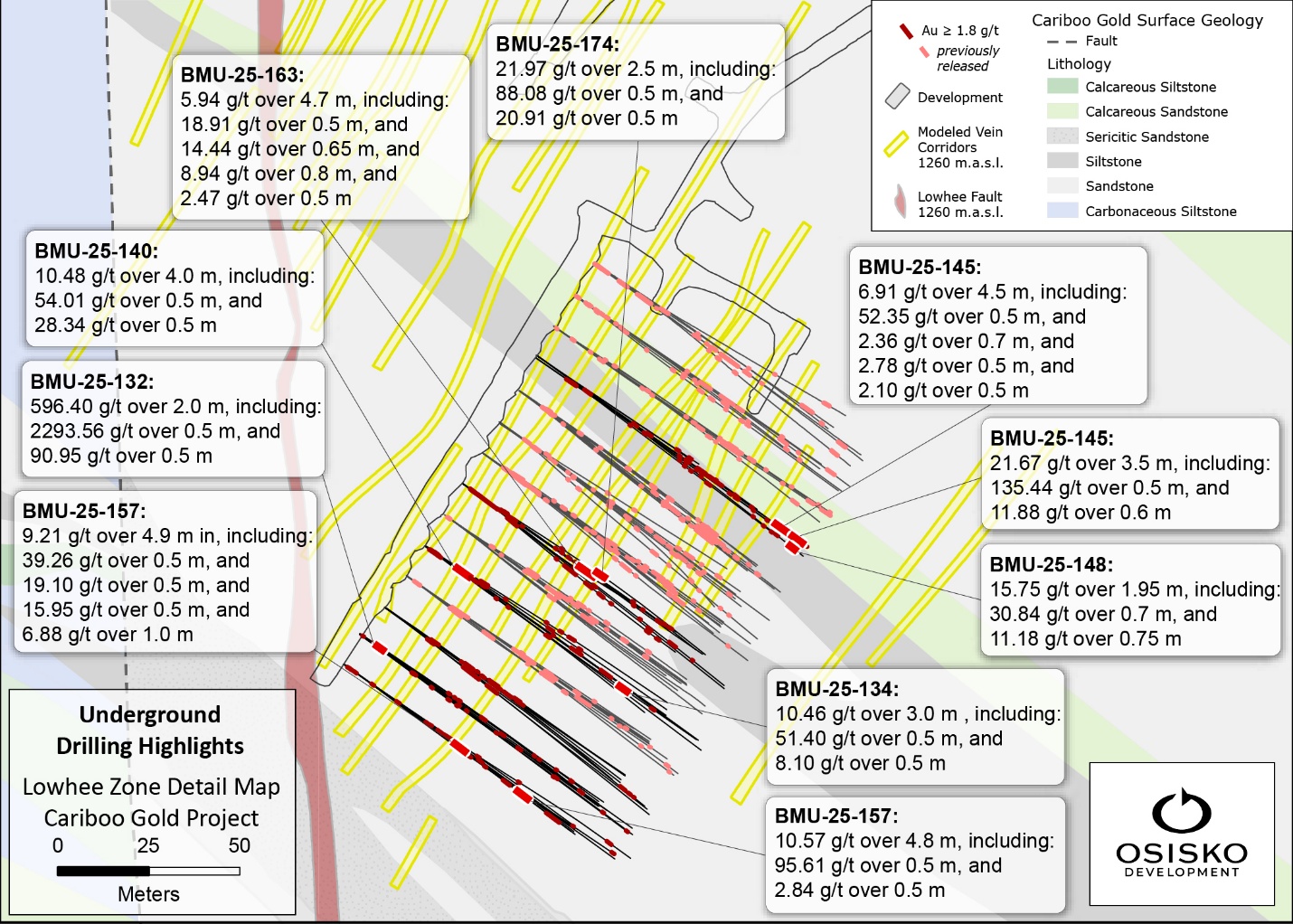

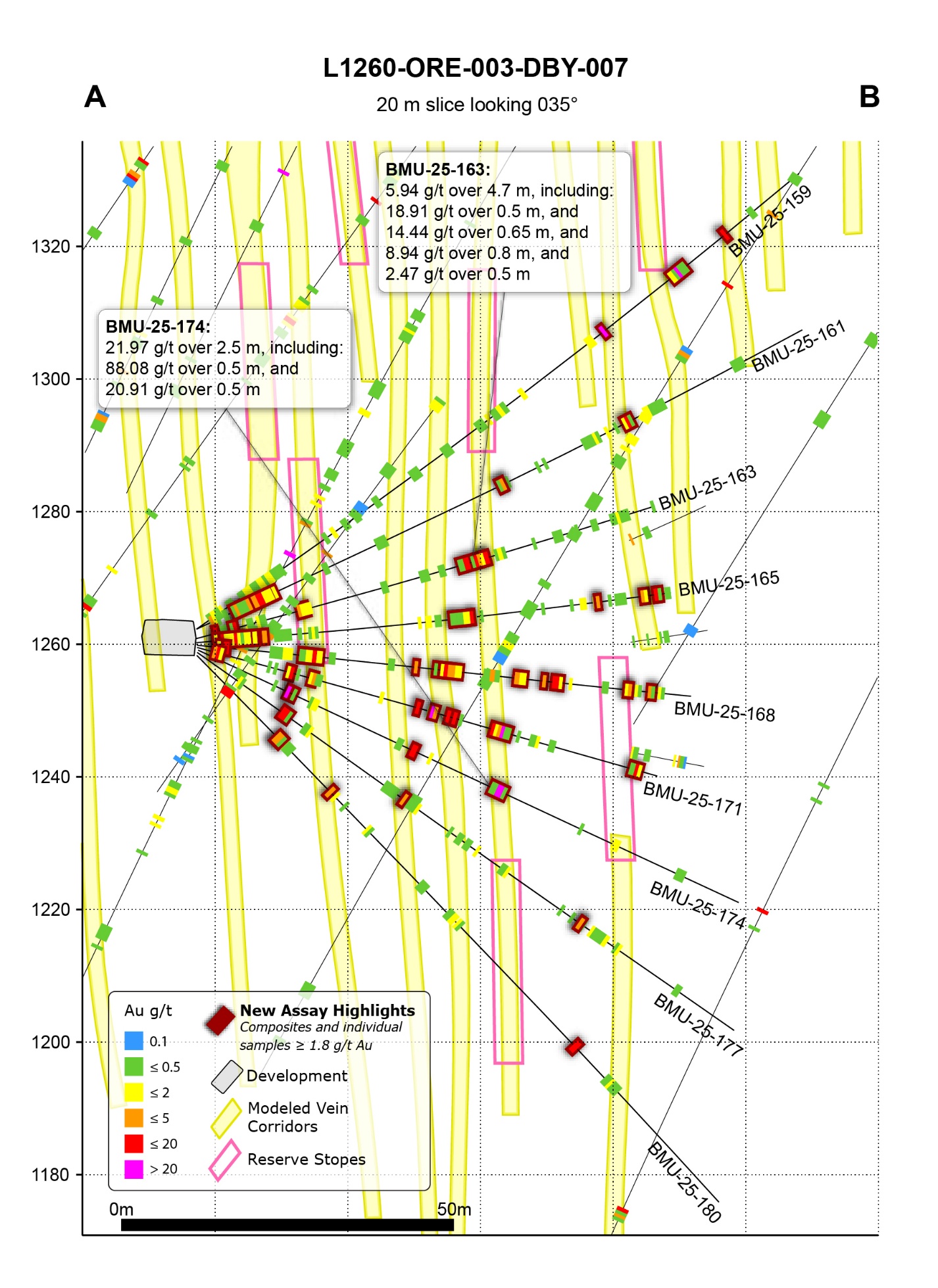

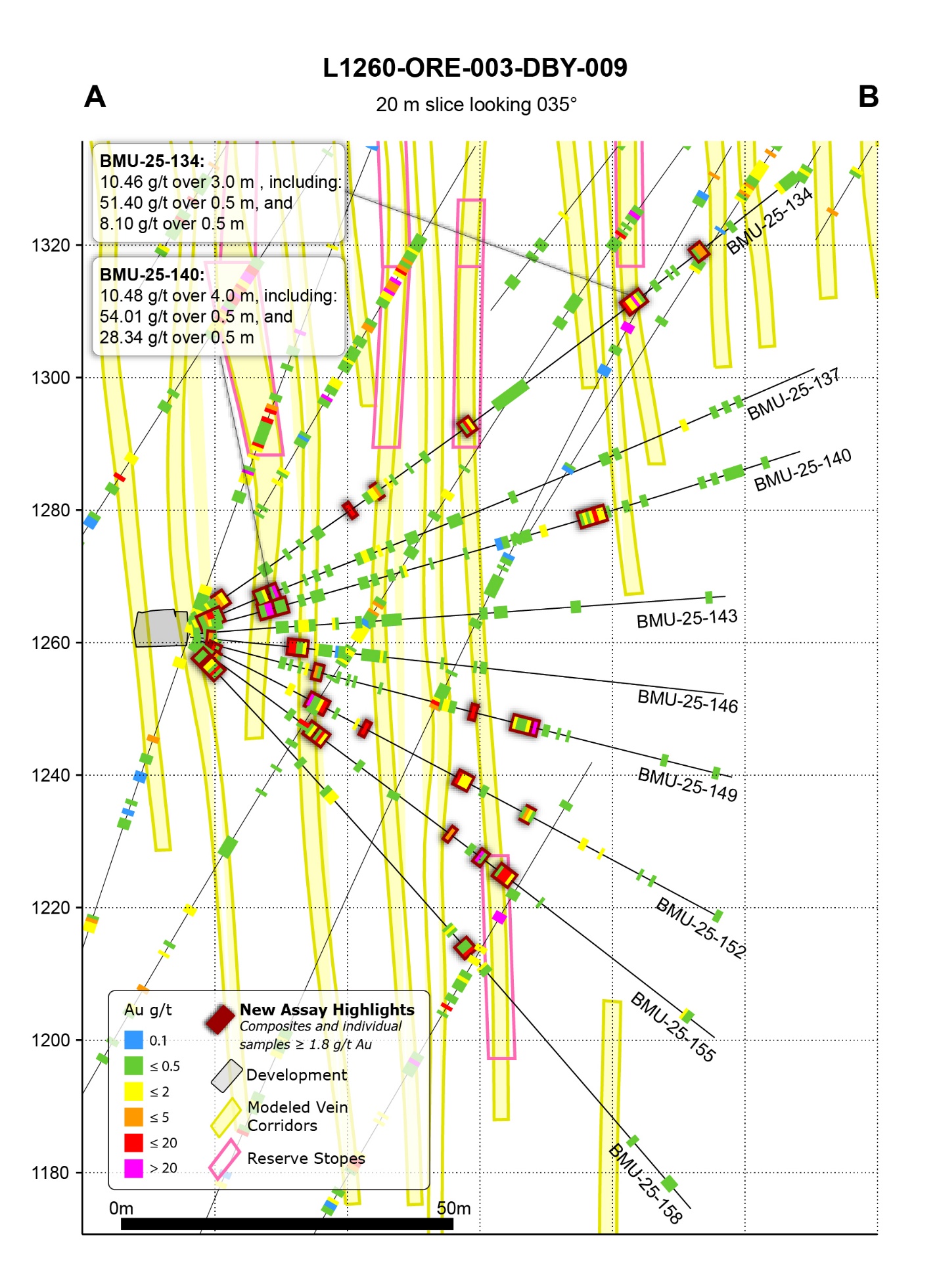

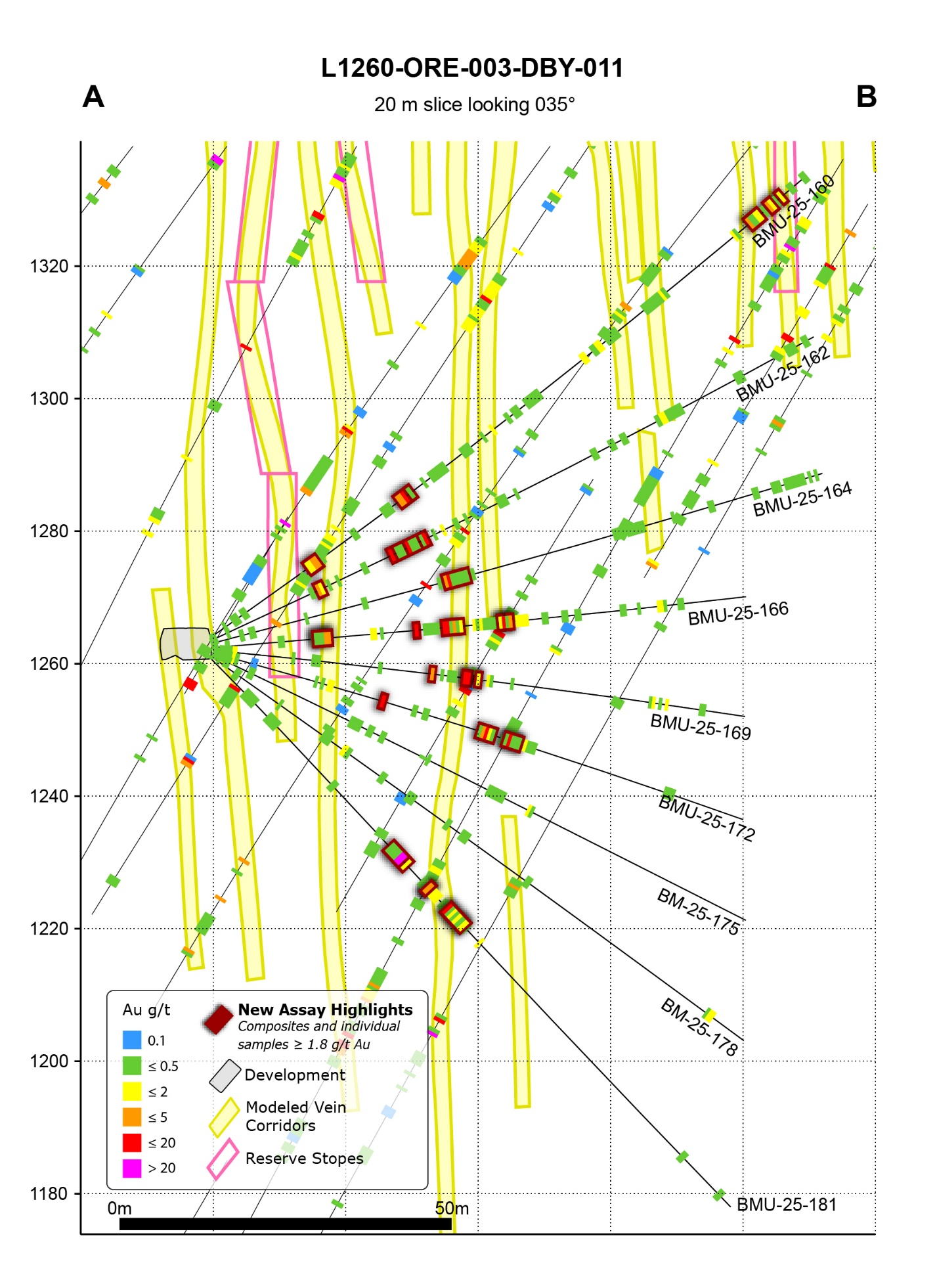

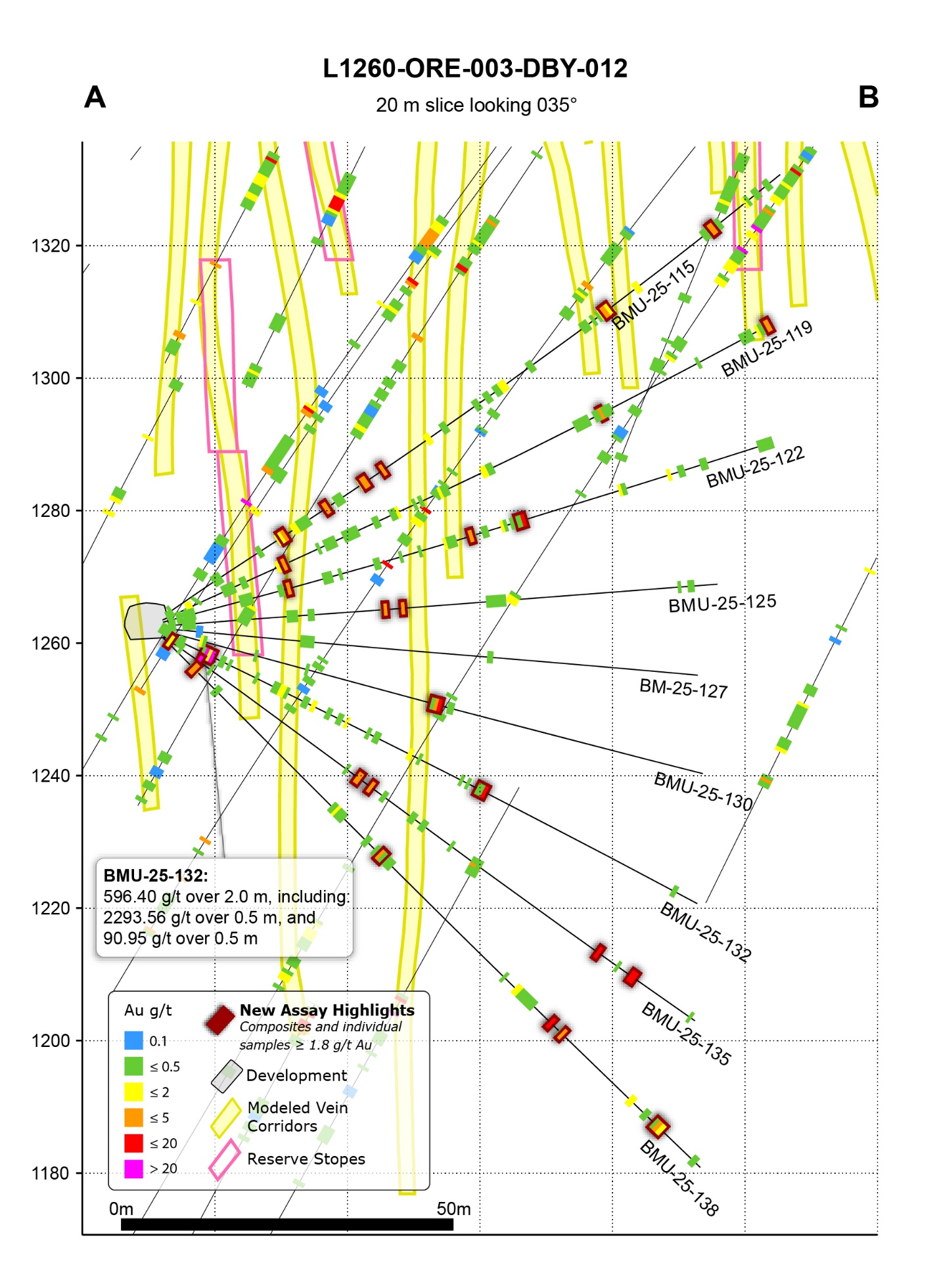

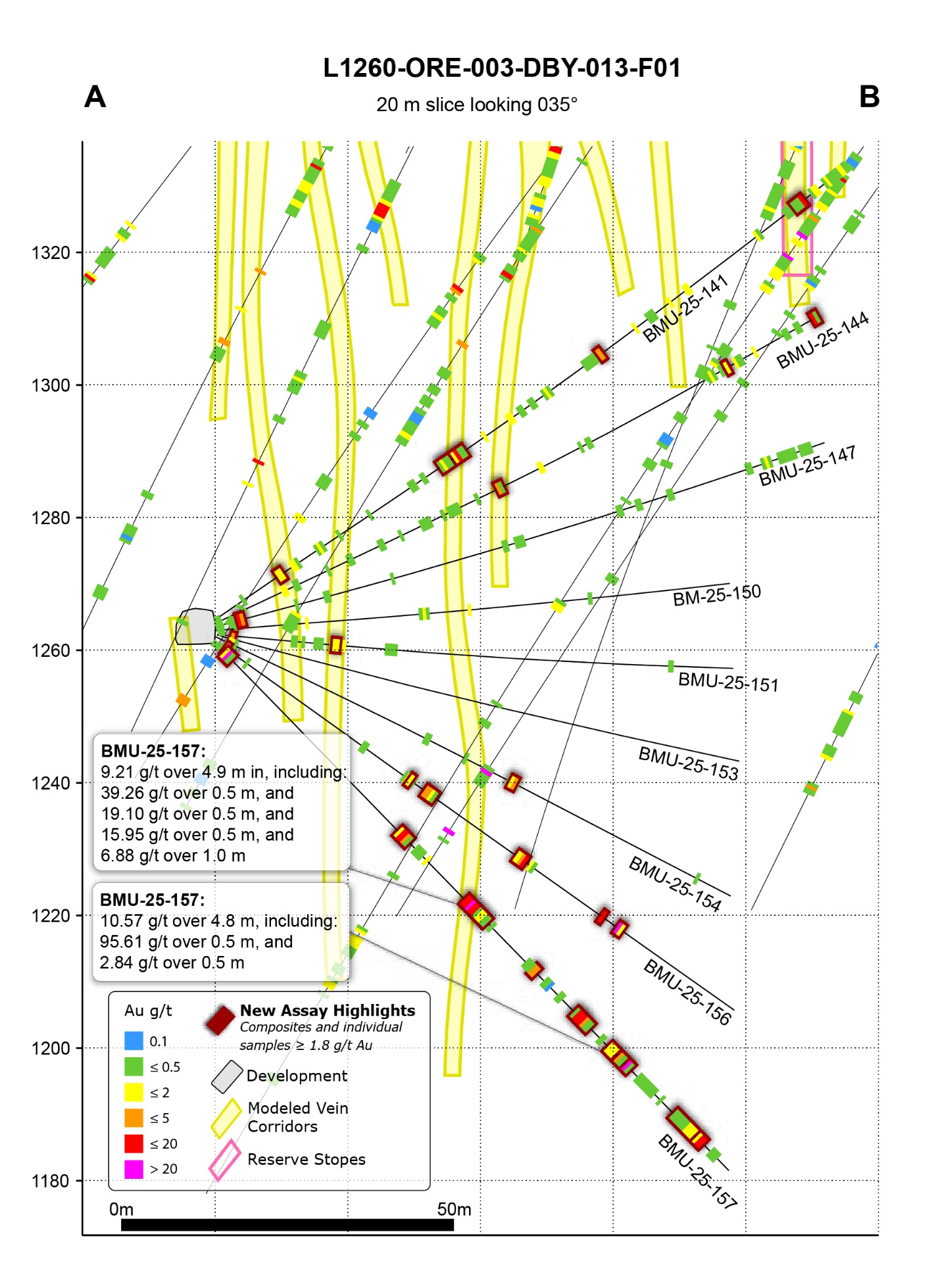

This news release includes assays from fifty-four (54) underground infill HQ diamond drill ("DD") holes (63.5-millimeter diameter) totaling 5,043 m with depths ranging from 51 to 117 m completed between mid-October 2025 and December 2025 (see Table 1). Assays for six (6) complete drill fans were received by January 11, 2026 (Figure 2). Select photon assay highlights include:

- 596.40 ("g/t") gold ("Au") over 2.0 m in BMU-25-132 from 6.1 m downhole, including:

- 2,293.56 g/t over 0.5 m from 6.6 m downhole, and

- 90.95 g/t over 0.5 m from 7.6 m downhole

- 2,293.56 g/t over 0.5 m from 6.6 m downhole, and

- 21.67 g/t over 3.5 m in BMU-25-145 from 96.5 m downhole, including:

- 135.44 g/t over 0.5 m from 99.5 m downhole, and

- 11.88 g/t over 0.6 m from 97.0 m downhole

- 21.97 g/t over 2.5 m in BMU-25-174 from 48.7 m downhole, including:

- 88.08 g/t over 0.5 m from 49.7 m downhole, and

- 20.91 g/t over 0.5 m from 50.2 m downhole

- 9.21 g/t over 4.9 m in BMU-25-157 from 53.9 m downhole, including:

- 39.26 g/t over 0.5 m from 54.9 m downhole, and

- 19.10 g/t over 0.5 m from 55.9 m downhole, and

- 15.95 g/t over 0.5 m from 55.4 m downhole, and

- 6.88 g/t over 1.0 m from 53.9 m downhole

- 10.57 g/t over 4.8 m in BMU-25-157 from 84.9 m downhole, including:

- 95.61 g/t over 0.5 m from 88.7 m downhole, and

- 2.84 g/t over 0.5 m from 80.0 m downhole

- 10.48 g/t over 4.0 m in BMU-25-140 from 11.0 m downhole, including:

- 54.01 g/t over 0.5 m from 12.4 m downhole, and

- 28.34 g/t over 0.5 m from 11.9 m downhole

- 6.91 g/t over 4.5 m in BMU-25-145 from 90.0 m downhole, including:

- 52.35 g/t over 0.5 m from 92.5 m downhole, and

- 2.36 g/t over 0.7 m from 90.5 m downhole, and

- 2.78 g/t over 0.5 m from 90.0 m downhole, and

- 2.10 g/t over 0.5 m from 92.0 m downhole

- 5.94 g/t over 4.7 m in BMU-25-163 from 41.1 m downhole, including:

- 18.91 g/t over 0.5 m from 43.65 m downhole, and

- 14.44 g/t over 0.65 m from 45.15 m downhole, and

- 8.94 g/t over 0.8 m from 42.0 m downhole, and

- 2.47 g/t over 0.5 m from 44.15 m downhole

- 15.75 g/t over 1.95 m in BMU-25-148 from 108.1 m, including:

- 30.84 g/t over 0.7 m from 108.1 m downhole, and

- 11.18 g/t over 0.75 m from 109.3 m downhole

- 10.46 g/t over 3.0 m in BMU-25-134 from 81.4 m, including:

- 51.40 g/t over 0.5 m from 82.9 m downhole, and

- 8.10 g/t over 0.5 m from 81.4 m downhole

Complete assay highlights, including true width estimates, are presented in Table 1 and drill hole locations and orientations are listed in Table 2. Intervals not recovered by drilling were assigned zero grade. Top cuts have not been applied to high grade assays.

DISCUSSION OF RESULTS

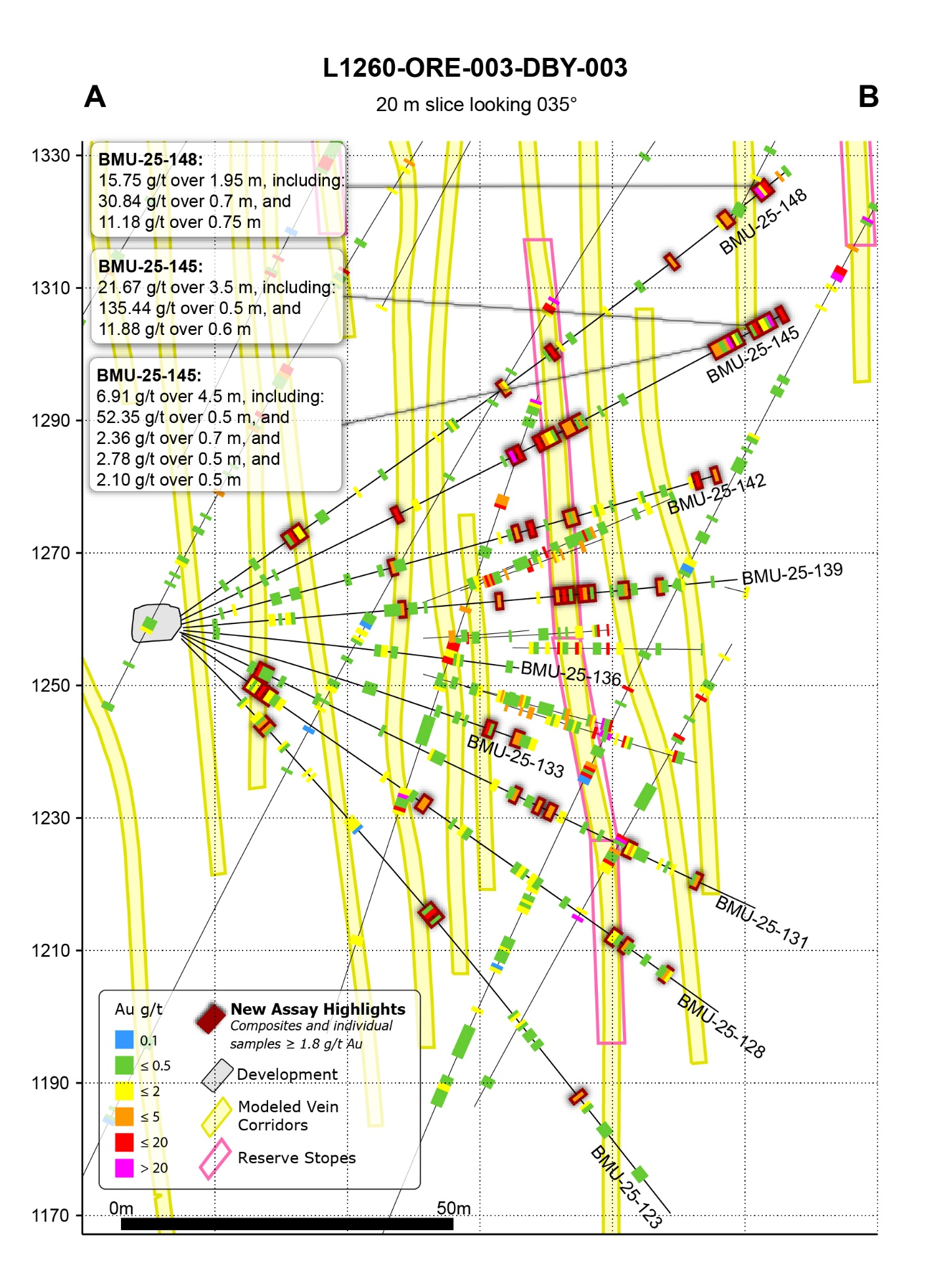

- Based on the results observed to date, the above cut-off assay composites show a general spatial correlation with the modelled reserve stopes. Individual intercepts are not expected to align precisely with the modelled areas, and a degree of variability within the vein corridors is both anticipated and acceptable as tighter spaced infill drilling informs a refinement of the local reserve model. This work is one of the key objectives of the ongoing program.

- Occurrences of above cut-off assays are also being observed in areas not previously included in the reserve model, suggesting potential for upside mineralization. These intervals will be incorporated in the planned remodelling and mineral resource calculation process to determine their implications on the updated local block model and any potential adjustments to planned reserve stopes. In certain areas, this may support the addition of new planned reserve stopes, subject to the final estimation process outcome.

- A spatial offset of certain intercepts when compared to the modelled vein corridors and mineral reserve stope shapes is evident in the cross sections. This reflects, in part, the lower spatial accuracy of the surface-based drill hole data compared to underground drilling, which carries higher survey precision, as well as the more oblique angles of intercepts that the surface-based drill holes have with the vein planes. These factors will be accounted for in the vein corridor remodelling process to be undertaken upon conclusion of this program and will serve as an important operational template for future infill drilling used in production stope design.

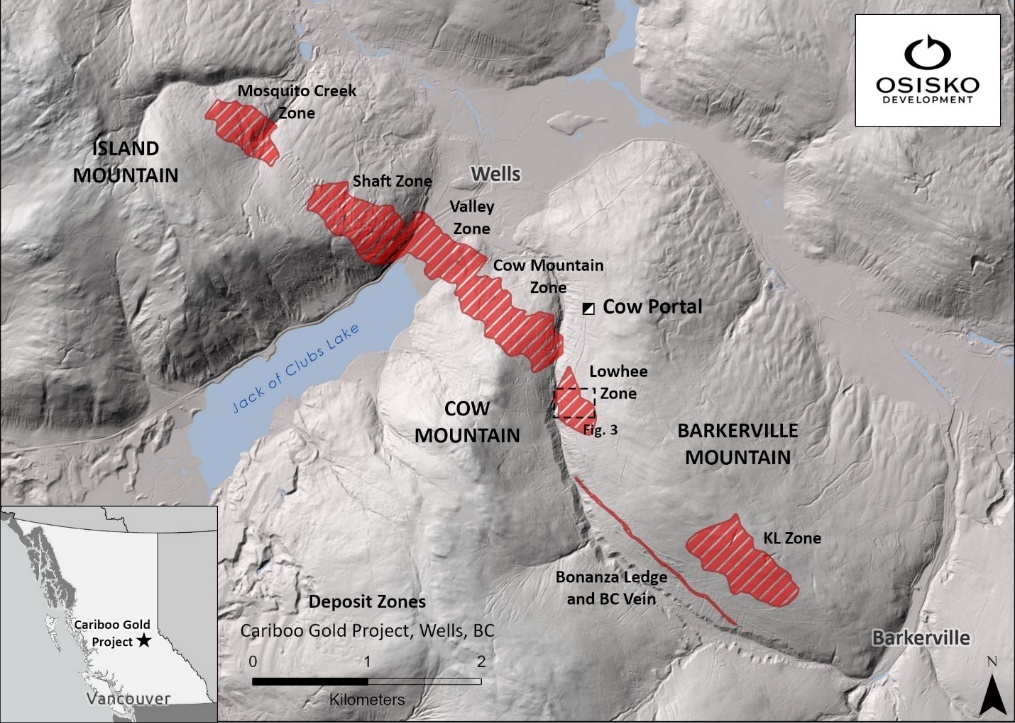

Figure 1: Cariboo Gold Project deposit map with Location of Lowhee Zone and Cow Portal underground access.

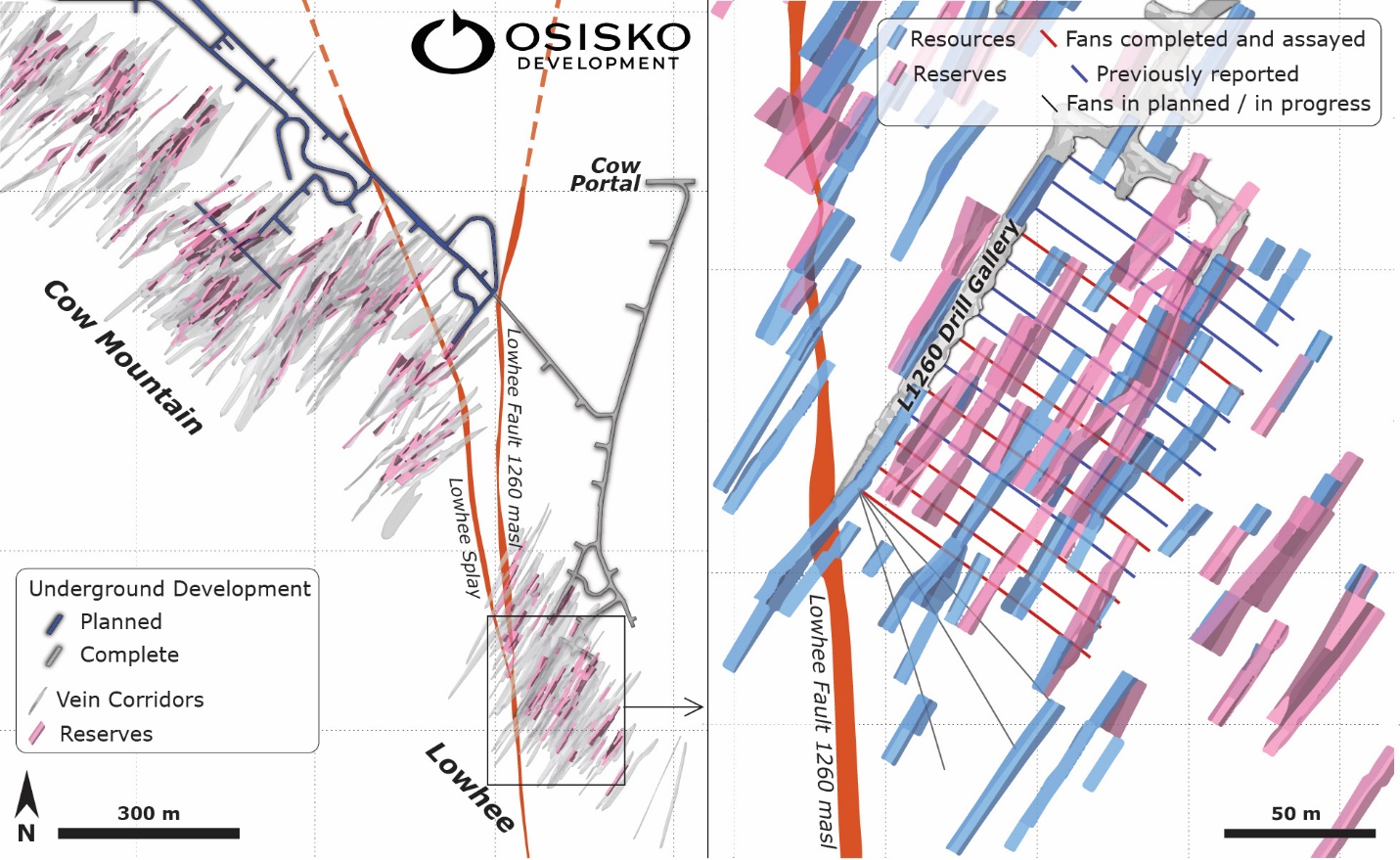

Figure 2: Location and overview of the ongoing 13,000-meter infill drilling campaign.

Figure 3: Lowhee Zone infill select underground drilling highlights (plan view).

Figure 4: Lowhee Zone infill select underground drill assay highlights (this release) with previously released surface and underground diamond drilling results in cross section by fan.

Table 1: Length weighted assay composites and individual samples>=1.8 g/t for Lowhee Zone underground DD.

| Drillhole ID | From (m) | To (m) | Length (m) | Au (g/t) | Est. True Width (m) | |

| BMU-25-115 | 20.65 | 21.65 | 1 | 1.91 | 0.79 | |

| Including | 21.15 | 21.65 | 0.5 | 2.35 | ||

| 28.65 | 29.3 | 0.65 | 2.93 | 0.53 | ||

| 35.5 | 36.4 | 0.9 | 2.09 | 0.74 | ||

| 39 | 39.5 | 0.5 | 2.93 | 0.43 | ||

| 80.05 | 81.3 | 1.25 | 2.10 | 0.99 | ||

| Including | 80.05 | 80.8 | 0.75 | 2.21 | ||

| and | 80.8 | 81.3 | 0.5 | 1.95 | ||

| 100.5 | 101.3 | 0.8 | 2.27 | 0.66 | ||

| BMU-25-119 | 19.95 | 20.45 | 0.5 | 2.38 | 0.47 | |

| 73 | 73.5 | 0.5 | 2.91 | 0.38 | ||

| 101.3 | 102 | 0.7 | 3.79 | 0.67 | ||

| BMU-25-122 | 19.4 | 19.9 | 0.5 | 3.35 | 0.50 | |

| 48 | 48.55 | 0.55 | 2.49 | 0.53 | ||

| 55.5 | 56.8 | 1.3 | 2.64 | 1.02 | ||

| Including | 56.3 | 56.8 | 0.5 | 6.42 | ||

| BMU-25-123 | 17.5 | 18 | 0.5 | 2.27 | 0.41 | |

| 18.5 | 19 | 0.5 | 2.95 | 0.38 | ||

| 55 | 57.5 | 2.5 | 1.86 | 2.05 | ||

| Including | 55.7 | 56.4 | 0.7 | 6.14 | ||

| 91.3 | 91.8 | 0.5 | 2.20 | 0.35 | ||

| BMU-25-125 | 33.5 | 34 | 0.5 | 2.44 | 0.50 | |

| 36.15 | 36.65 | 0.5 | 2.11 | 0.49 | ||

| BMU-25-127 | No Significant Assays | |||||

| BMU-25-128 | 12.45 | 16.6 | 4.15 | 1.84 | 3.59 | |

| Including | 14.5 | 15 | 0.5 | 10.73 | ||

| 44 | 45 | 1 | 3.59 | 0.94 | ||

| 79 | 80 | 1 | 1.97 | 0.91 | ||

| 81.5 | 82 | 0.5 | 2.60 | 0.45 | ||

| 89 | 89.5 | 0.5 | 2.72 | 0.45 | ||

| BMU-25-130 | 41.6 | 43.2 | 1.6 | 4.75 | 1.45 | |

| Including | 42.2 | 42.7 | 0.5 | 3.09 | ||

| and | 42.7 | 43.2 | 0.5 | 11.98 | ||

| BMU-25-131 | 12.75 | 14.6 | 1.85 | 2.20 | 1.60 | |

| Including | 12.75 | 13.25 | 0.5 | 7.34 | ||

| 55.75 | 56.25 | 0.5 | 2.54 | 0.38 | ||

| 59.6 | 60.1 | 0.5 | 3.86 | 0.43 | ||

| 61.4 | 62.2 | 0.8 | 4.35 | 0.75 | ||

| 74.5 | 75.5 | 1 | 2.08 | 0.94 | ||

| Including | 74.5 | 75 | 0.5 | 1.90 | ||

| and | 75 | 75.5 | 0.5 | 2.26 | ||

| 86 | 86.5 | 0.5 | 2.07 | 0.45 | ||

| BMU-25-132 | 6.1 | 8.1 | 2 | 596.40 | 1.81 | |

| Including | 6.6 | 7.1 | 0.5 | 2293.56 | ||

| and | 7.6 | 8.1 | 0.5 | 90.95 | ||

| 52.45 | 54 | 1.55 | 2.47 | 1.50 | ||

| 53.5 | 54 | 0.5 | 7.04 | 0.49 | ||

| BMU-25-133 | 48.55 | 49.55 | 1 | 2.84 | 1.00 | |

| Including | 48.55 | 49.05 | 0.5 | 5.58 | ||

| 53 | 54 | 1 | 2.80 | 0.94 | ||

| BMU-25-134 | 5.3 | 6.75 | 1.45 | 2.19 | 1.19 | |

| Including | 5.3 | 6 | 0.7 | 3.81 | ||

| 29.5 | 30.05 | 0.55 | 9.64 | 0.45 | ||

| 34.5 | 35 | 0.5 | 3.50 | 0.45 | ||

| 50.8 | 52.3 | 1.5 | 4.78 | 1.36 | ||

| Including | 51.3 | 51.8 | 0.5 | 12.83 | ||

| 81.4 | 84.4 | 3 | 10.46 | 2.49 | ||

| Including | 81.4 | 81.9 | 0.5 | 8.10 | ||

| and | 82.9 | 83.4 | 0.5 | 51.40 | ||

| 94.5 | 96.1 | 1.6 | 2.28 | 1.35 | ||

| Including | 95 | 95.6 | 0.6 | 3.03 | ||

| and | 95.6 | 96.1 | 0.5 | 3.50 | ||

| BMU-25-135 | 1 | 1.5 | 0.5 | 1.83 | 0.37 | |

| 6.25 | 6.75 | 0.5 | 44.15 | 0.41 | ||

| 36 | 36.75 | 0.75 | 4.40 | 0.61 | ||

| 38.45 | 38.95 | 0.5 | 4.34 | 0.44 | ||

| 80.9 | 81.4 | 0.5 | 11.61 | 0.45 | ||

| 87 | 88 | 1 | 9.08 | 0.82 | ||

| BMU-25-136 | No Significant Assays | |||||

| BMU-25-137 | 1.65 | 5 | 3.35 | 2.08 | 2.97 | |

| Including | 2.5 | 3 | 0.5 | 2.45 | ||

| and | 3 | 4 | 1 | 5.32 | ||

| 11 | 14.15 | 3.15 | 5.02 | 2.58 | ||

| Including | 13.65 | 14.15 | 0.5 | 29.90 | ||

| BMU-25-138 | 6.4 | 7.1 | 0.7 | 2.52 | 0.49 | |

| 46.2 | 47.2 | 1 | 2.09 | 0.71 | ||

| Including | 46.2 | 46.7 | 0.5 | 3.89 | ||

| 82.4 | 82.9 | 0.5 | 10.49 | 0.25 | ||

| 84.8 | 85.3 | 0.5 | 2.45 | 0.47 | ||

| 104.2 | 106.1 | 1.9 | 1.80 | 1.51 | ||

| Including | 104.7 | 105.4 | 0.7 | 4.24 | ||

| BMU-25-139 | 33 | 33.5 | 0.5 | 2.63 | 0.48 | |

| 47.65 | 48.15 | 0.5 | 3.02 | 0.47 | ||

| 56.5 | 59 | 2.5 | 3.27 | 2.46 | ||

| Including | 56.5 | 57 | 0.5 | 3.32 | ||

| and | 57.5 | 58 | 0.5 | 12.78 | ||

| 60.1 | 62.2 | 2.1 | 2.99 | 2.07 | ||

| Including | 60.1 | 60.6 | 0.5 | 8.54 | ||

| and | 60.6 | 61.2 | 0.6 | 3.17 | ||

| 66.35 | 67.35 | 1 | 2.16 | 1.00 | ||

| Including | 66.85 | 67.35 | 0.5 | 4.14 | ||

| 72 | 72.5 | 0.5 | 2.53 | 0.43 | ||

| BMU-25-140 | 11 | 15 | 4 | 10.48 | 3.28 | |

| Including | 11.9 | 12.4 | 0.5 | 28.34 | ||

| and | 12.4 | 12.9 | 0.5 | 54.01 | ||

| 61.3 | 65 | 3.7 | 1.85 | 3.20 | ||

| Including | 63.3 | 64 | 0.7 | 6.49 | ||

| BMU-25-141 | 11 | 12 | 1 | 1.94 | 0.91 | |

| 40.5 | 45.1 | 4.6 | 2.50 | 3.77 | ||

| Including | 43.5 | 44.1 | 0.6 | 16.47 | ||

| 69.8 | 70.5 | 0.7 | 2.22 | 0.59 | ||

| 106.7 | 108.7 | 2 | 1.82 | 1.88 | ||

| Including | 108.2 | 108.7 | 0.5 | 6.40 | ||

| BMU-25-142 | 32.8 | 33.3 | 0.5 | 2.99 | 0.47 | |

| 52.2 | 52.7 | 0.5 | 3.89 | 0.43 | ||

| 54.5 | 55 | 0.5 | 6.93 | 0.48 | ||

| 60.25 | 61.75 | 1.5 | 2.98 | 1.45 | ||

| Including | 60.25 | 60.75 | 0.5 | 3.62 | ||

| and | 61.25 | 61.75 | 0.5 | 4.93 | ||

| 80.6 | 81.1 | 0.5 | 18.53 | 0.49 | ||

| 83.5 | 84 | 0.5 | 3.41 | 0.49 | ||

| BMU-25-143 | No Significant Assays | |||||

| BMU-25-144 | 47 | 48 | 1 | 2.60 | 0.64 | |

| Including | 47 | 47.5 | 0.5 | 4.71 | ||

| 86 | 86.5 | 0.5 | 1.95 | 0.38 | ||

| 101 | 102 | 1 | 6.41 | 0.89 | ||

| Including | 101 | 101.5 | 0.5 | 12.59 | ||

| BMU-25-145 | 36 | 36.5 | 0.5 | 6.09 | 0.48 | |

| 55.5 | 57.1 | 1.6 | 13.58 | 1.45 | ||

| Including | 55.5 | 56.1 | 0.6 | 22.90 | ||

| and | 56.6 | 57.1 | 0.5 | 15.97 | ||

| 60 | 63.05 | 3.05 | 2.22 | 2.87 | ||

| Including | 60 | 60.5 | 0.5 | 8.15 | ||

| and | 61 | 61.6 | 0.6 | 2.50 | ||

| 64.55 | 67.5 | 2.95 | 1.97 | 2.74 | ||

| Including | 64.55 | 65.05 | 0.5 | 3.85 | ||

| and | 65.05 | 66 | 0.95 | 2.24 | ||

| and | 67 | 67.5 | 0.5 | 3.34 | ||

| 90 | 94.5 | 4.5 | 6.91 | 3.97 | ||

| Including | 90 | 90.5 | 0.5 | 2.78 | ||

| and | 90.5 | 91.2 | 0.7 | 2.36 | ||

| and | 92 | 92.5 | 0.5 | 2.10 | ||

| and | 92.5 | 93 | 0.5 | 52.35 | ||

| 96.5 | 100 | 3.5 | 21.67 | 3.23 | ||

| Including | 97 | 97.6 | 0.6 | 11.88 | ||

| and | 99.5 | 100 | 0.5 | 135.44 | ||

| 101.5 | 102 | 0.5 | 5.63 | 0.43 | ||

| BMU-25-146 | 2.75 | 3.4 | 0.65 | 2.77 | 0.56 | |

| 15 | 17.6 | 2.6 | 4.05 | 2.44 | ||

| Including | 15 | 15.5 | 0.5 | 11.90 | ||

| and | 15.5 | 16.1 | 0.6 | 6.73 | ||

| BMU-25-147 | 3.5 | 4.5 | 1 | 3.79 | 0.98 | |

| Including | 3.5 | 4 | 0.5 | 5.01 | ||

| and | 4 | 4.5 | 0.5 | 2.57 | ||

| BMU-25-148 | 19.8 | 22.5 | 2.7 | 3.92 | 2.54 | |

| Including | 20.5 | 21 | 0.5 | 16.72 | ||

| and | 21.5 | 22.5 | 1 | 1.94 | ||

| 59.5 | 60 | 0.5 | 2.55 | 0.41 | ||

| 68.7 | 69.2 | 0.5 | 7.79 | 0.44 | ||

| 91.35 | 91.85 | 0.5 | 2.14 | 0.41 | ||

| 101.5 | 102.5 | 1 | 2.30 | 0.79 | ||

| Including | 101.5 | 102 | 0.5 | 2.33 | ||

| and | 102 | 102.5 | 0.5 | 2.26 | ||

| 108.1 | 110.05 | 1.95 | 15.75 | 1.69 | ||

| Including | 108.1 | 108.8 | 0.7 | 30.84 | ||

| and | 109.3 | 110.05 | 0.75 | 11.18 | ||

| 112.1 | 112.6 | 0.5 | 3.41 | 0.41 | ||

| BMU-25-149 | 19 | 20 | 1 | 2.30 | 0.82 | |

| Including | 19 | 19.5 | 0.5 | 4.35 | ||

| 43.5 | 44 | 0.5 | 11.90 | 0.44 | ||

| 50 | 53.55 | 3.55 | 3.43 | 3.50 | ||

| Including | 53.05 | 53.55 | 0.5 | 21.45 | ||

| BMU-25-150 | No Significant Assays | |||||

| BMU-25-151 | 17.5 | 18.5 | 1 | 2.00 | 0.88 | |

| BMU-25-152 | 2.6 | 4.1 | 1.5 | 5.77 | 1.45 | |

| Including | 3.1 | 3.6 | 0.5 | 16.74 | ||

| 19.7 | 22.45 | 2.75 | 7.31 | 2.58 | ||

| Including | 19.7 | 20.2 | 0.5 | 22.08 | ||

| and | 21.3 | 21.85 | 0.55 | 1.97 | ||

| and | 21.85 | 22.45 | 0.6 | 12.89 | ||

| 29 | 29.5 | 0.5 | 5.78 | 0.46 | ||

| 45 | 47 | 2 | 2.22 | 1.73 | ||

| Including | 45 | 45.5 | 0.5 | 5.46 | ||

| 56.5 | 57.5 | 1 | 2.25 | 0.82 | ||

| Including | 56.5 | 57 | 0.5 | 3.97 | ||

| BMU-25-153 | 2.1 | 2.6 | 0.5 | 2.20 | 0.38 | |

| BMU-25-154 | 49.5 | 50.5 | 1 | 1.90 | 0.91 | |

| Including | 50 | 50.5 | 0.5 | 2.65 | ||

| BMU-25-155 | 4 | 4.5 | 0.5 | 3.26 | 0.41 | |

| 21.9 | 24.9 | 3 | 2.36 | 2.43 | ||

| Including | 23.9 | 24.4 | 0.5 | 11.93 | ||

| 48.4 | 48.9 | 0.5 | 4.25 | 0.43 | ||

| 54 | 55 | 1 | 18.42 | 0.82 | ||

| Including | 54 | 54.5 | 0.5 | 36.46 | ||

| 57.7 | 60.2 | 2.5 | 8.60 | 1.92 | ||

| Including | 58.2 | 59.2 | 1 | 17.20 | ||

| and | 59.2 | 59.7 | 0.5 | 7.56 | ||

| BMU-25-156 | 1.7 | 2.2 | 0.5 | 2.15 | 0.46 | |

| 35.8 | 36.3 | 0.5 | 1.926 | 0.32 | ||

| 38.7 | 40.7 | 2 | 2.10 | 1.73 | ||

| Including | 38.7 | 39.2 | 0.5 | 3.22 | ||

| and | 39.2 | 39.7 | 0.5 | 4.09 | ||

| 55.65 | 57.4 | 1.75 | 2.92 | 1.43 | ||

| Including | 56.4 | 56.9 | 0.5 | 2.99 | ||

| and | 56.9 | 57.4 | 0.5 | 6.46 | ||

| 71.35 | 71.85 | 0.5 | 6.50 | 0.43 | ||

| 74.3 | 75.3 | 1 | 19.53 | 0.71 | ||

| Including | 74.3 | 74.8 | 0.5 | 38.30 | ||

| BMU-25-157 | 1.85 | 3.5 | 1.65 | 6.96 | 1.17 | |

| Including | 2.35 | 2.85 | 0.5 | 21.49 | ||

| 39.5 | 41.9 | 2.4 | 6.95 | 1.70 | ||

| Including | 40 | 40.9 | 0.9 | 15.22 | ||

| and | 40.9 | 41.4 | 0.5 | 4.92 | ||

| 53.9 | 58.8 | 4.9 | 9.21 | 4.01 | ||

| Including | 53.9 | 54.9 | 1 | 6.88 | ||

| and | 54.9 | 55.4 | 0.5 | 39.26 | ||

| and | 55.4 | 55.9 | 0.5 | 15.95 | ||

| and | 55.9 | 56.4 | 0.5 | 19.10 | ||

| and | 68.5 | 69.4 | 0.9 | 2.57 | ||

| 77.55 | 81 | 3.45 | 5.83 | 2.33 | ||

| Including | 78.05 | 79.05 | 1 | 14.58 | ||

| and | 79.05 | 79.55 | 0.5 | 5.63 | ||

| and | 79.55 | 80.05 | 0.5 | 4.45 | ||

| 84.9 | 89.7 | 4.8 | 10.57 | 3.39 | ||

| Including | 87 | 87.5 | 0.5 | 2.84 | ||

| and | 88.7 | 89.2 | 0.5 | 95.61 | ||

| 99 | 105.4 | 6.4 | 3.14 | 4.53 | ||

| Including | 102.8 | 103.45 | 0.65 | 1.97 | ||

| and | 104.45 | 105.4 | 0.95 | 17.59 | ||

| BMU-25-158 | 2 | 6.3 | 4.3 | 2.00 | 2.88 | |

| Including | 5.3 | 5.8 | 0.5 | 15.10 | ||

| 61 | 62.9 | 1.9 | 2.08 | 1.34 | ||

| Including | 62.4 | 62.9 | 0.5 | 7.47 | ||

| BMU-25-159 | 75.8 | 76.35 | 0.55 | 22.39 | 0.50 | |

| 89 | 92 | 3 | 5.14 | 2.46 | ||

| Including | 90.25 | 90.75 | 0.5 | 29.46 | ||

| 99.25 | 99.75 | 0.5 | 5.01 | 0.35 | ||

| BMU-25-160 | 18 | 20 | 2 | 1.95 | 1.73 | |

| 19 | 20 | 1 | 3.35 | |||

| 35 | 37.6 | 2.6 | 2.62 | 2.25 | ||

| Including | 35 | 36 | 1 | 2.19 | ||

| and | 36 | 36.5 | 0.5 | 9.05 | ||

| 102.55 | 104.9 | 2.35 | 1.94 | 1.73 | ||

| Including | 102.55 | 103.05 | 0.5 | 4.78 | ||

| and | 104 | 104.9 | 0.9 | 1.98 | ||

| 106.4 | 107.4 | 1 | 1.94 | 0.71 | ||

| Including | 106.4 | 106.9 | 0.5 | 2.35 | ||

| 108.7 | 109.2 | 0.5 | 1.96 | 0.38 | ||

| BMU-25-161 | 2.35 | 3.35 | 1 | 2.11 | ||

| Including | 2.35 | 2.85 | 0.5 | 3.03 | ||

| 6 | 13.3 | 7.3 | 1.91 | 6.86 | ||

| Including | 6.5 | 7 | 0.5 | 3.71 | ||

| and | 8.5 | 9 | 0.5 | 4.37 | ||

| and | 9.4 | 10.15 | 0.75 | 2.69 | ||

| and | 10.15 | 11.15 | 1 | 5.57 | ||

| 50.4 | 51.4 | 1 | 2.36 | 0.98 | ||

| Including | 50.9 | 51.4 | 0.5 | 4.29 | ||

| 71.5 | 73 | 1.5 | 2.50 | 1.41 | ||

| Including | 72 | 72.5 | 0.5 | 6.32 | ||

| BMU-25-162 | 17.75 | 18.75 | 1 | 2.02 | 0.91 | |

| Including | 17.75 | 18.25 | 0.5 | 2.83 | ||

| 30 | 36.15 | 6.15 | 2.02 | 5.04 | ||

| Including | 30 | 30.5 | 0.5 | 6.44 | ||

| and | 32.8 | 33.3 | 0.5 | 5.23 | ||

| and | 35.65 | 36.15 | 0.5 | 11.63 | ||

| BMU-25-163 | 2.9 | 3.4 | 0.5 | 6.64 | 0.49 | |

| 5.4 | 6.4 | 1 | 9.61 | 0.82 | ||

| Including | 5.9 | 6.4 | 0.5 | 18.94 | ||

| 15.9 | 17.5 | 1.6 | 2.21 | 1.47 | ||

| Including | 15.9 | 16.4 | 0.5 | 4.32 | ||

| 41.1 | 45.8 | 4.7 | 5.94 | 4.58 | ||

| Including | 42 | 42.8 | 0.8 | 8.94 | ||

| and | 43.65 | 44.15 | 0.5 | 18.91 | ||

| and | 44.15 | 44.65 | 0.5 | 2.47 | ||

| and | 45.15 | 45.8 | 0.65 | 14.44 | ||

| BMU-25-164 | 36.55 | 40.3 | 3.75 | 1.99 | 3.62 | |

| Including | 36.55 | 37.05 | 0.5 | 4.43 | ||

| and | 37.05 | 37.55 | 0.5 | 9.15 | ||

| BMU-25-165 | 2.75 | 10.7 | 7.95 | 2.06 | 7.92 | |

| Including | 3.75 | 4.25 | 0.5 | 6.08 | ||

| and | 5.75 | 6.25 | 0.5 | 11.01 | ||

| and | 7.25 | 7.75 | 0.5 | 1.89 | ||

| and | 8.55 | 9.2 | 0.65 | 1.92 | ||

| and | 10 | 10.7 | 0.7 | 4.60 | ||

| 38.5 | 42 | 3.5 | 2.01 | 3.29 | ||

| Including | 41.5 | 42 | 0.5 | 11.24 | ||

| 60.7 | 61.2 | 0.5 | 2.64 | 0.47 | ||

| 67.5 | 68.5 | 1 | 2.02 | 1.00 | ||

| Including | 67.5 | 68 | 0.5 | 2.80 | ||

| 69.5 | 70.6 | 1.1 | 6.62 | 1.10 | ||

| Including | 69.5 | 70.1 | 0.6 | 11.91 | ||

| BMU-25-166 | 15.5 | 18 | 2.5 | 2.08 | 2.38 | |

| Including | 17 | 18 | 1 | 4.93 | ||

| 30.75 | 31.25 | 0.5 | 5.86 | 0.43 | ||

| 35 | 38 | 3 | 2.80 | 2.75 | ||

| Including | 35 | 36 | 1 | 5.86 | ||

| and | 36.5 | 37 | 0.5 | 3.58 | ||

| 43.5 | 45.5 | 2 | 2.67 | 1.41 | ||

| Including | 43.5 | 44 | 0.5 | 1.91 | ||

| and | 44 | 44.5 | 0.5 | 6.23 | ||

| and | 45 | 45.5 | 0.5 | 2.40 | ||

| BMU-25-168 | 3 | 4.8 | 1.8 | 7.76 | 1.79 | |

| Including | 3 | 3.5 | 0.5 | 1.97 | ||

| and | 4 | 4.8 | 0.8 | 16.21 | ||

| 15.5 | 19 | 3.5 | 2.40 | 3.49 | ||

| Including | 17.5 | 18.15 | 0.65 | 10.70 | ||

| 33 | 33.5 | 0.5 | 4.69 | 0.49 | ||

| 36 | 40.2 | 4.2 | 2.42 | 4.14 | ||

| Including | 37.5 | 38.1 | 0.6 | 6.79 | ||

| and | 38.1 | 38.6 | 0.5 | 4.99 | ||

| and | 38.6 | 39.2 | 0.6 | 3.03 | ||

| and | 44.5 | 45.2 | 0.7 | 3.05 | ||

| 48.25 | 50 | 1.75 | 1.87 | 1.52 | ||

| Including | 48.25 | 49 | 0.75 | 3.56 | ||

| 52.5 | 53 | 0.5 | 2.03 | 0.50 | ||

| 54 | 55.5 | 1.5 | 9.68 | 1.45 | ||

| Including | 54 | 54.5 | 0.5 | 8.59 | ||

| and | 54.5 | 55 | 0.5 | 19.69 | ||

| 65 | 66 | 1 | 2.37 | 0.97 | ||

| Including | 65.5 | 66 | 0.5 | 3.19 | ||

| 68.5 | 69.5 | 1 | 2.51 | 0.98 | ||

| Including | 68.5 | 69 | 0.5 | 4.62 | ||

| BMU-25-169 | 33.1 | 33.6 | 0.5 | 2.18 | 0.48 | |

| 38.1 | 39.1 | 1 | 6.56 | 0.77 | ||

| 38.1 | 38.6 | 0.5 | 6.18 | |||

| 38.6 | 39.1 | 0.5 | 6.94 | |||

| 40.1 | 40.6 | 0.5 | 1.91 | 0.50 | ||

| BMU-25-171 | 2.5 | 4 | 1.5 | 5.27 | 1.30 | |

| Including | 2.5 | 3 | 0.5 | 3.44 | ||

| and | 3 | 3.5 | 0.5 | 10.60 | ||

| 14 | 15 | 1 | 4.66 | 0.98 | ||

| Including | 14.5 | 15 | 0.5 | 8.28 | ||

| 17.5 | 18.5 | 1 | 2.05 | 0.98 | ||

| Including | 18 | 18.5 | 0.5 | 3.59 | ||

| 34.25 | 34.75 | 0.5 | 6.55 | 0.43 | ||

| 36.5 | 37.5 | 1 | 11.58 | 0.97 | ||

| Including | 36.5 | 37 | 0.5 | 20.44 | ||

| and | 37 | 37.5 | 0.5 | 2.71 | ||

| 39 | 40.5 | 1.5 | 4.21 | 1.48 | ||

| Including | 39 | 39.5 | 0.5 | 6.84 | ||

| and | 40 | 40.5 | 0.5 | 5.72 | ||

| 46 | 49 | 3 | 9.07 | 2.82 | ||

| Including | 46 | 46.5 | 0.5 | 9.71 | ||

| and | 47 | 47.5 | 0.5 | 2.70 | ||

| and | 47.5 | 48 | 0.5 | 40.36 | ||

| 67.7 | 69.5 | 1.8 | 5.11 | 1.69 | ||

| Including | 68.5 | 69 | 0.5 | 16.17 | ||

| and | 69 | 69.5 | 0.5 | 1.89 | ||

| BMU-25-172 | 26.5 | 27 | 0.5 | 5.80 | 0.32 | |

| 41.85 | 44.35 | 2.5 | 2.10 | 2.35 | ||

| Including | 42.35 | 42.85 | 0.5 | 2.39 | ||

| and | 42.85 | 43.35 | 0.5 | 6.43 | ||

| 46 | 48.5 | 2.5 | 2.27 | 2.35 | ||

| Including | 46.5 | 47 | 0.5 | 10.23 | ||

| BMU-25-174 | 14.7 | 16.2 | 1.5 | 12.03 | 1.15 | |

| Including | 14.7 | 15.2 | 0.5 | 35.79 | ||

| 35.5 | 36.3 | 0.8 | 17.77 | 0.73 | ||

| 48.7 | 51.2 | 2.5 | 21.97 | 2.35 | ||

| Including | 49.7 | 50.2 | 0.5 | 88.08 | ||

| and | 50.2 | 50.7 | 0.5 | 20.91 | ||

| BMU-25-175 | No Significant Assays | |||||

| BMU-25-177 | 15.5 | 17.1 | 1.6 | 6.06 | 1.03 | |

| Including | 15.5 | 16.1 | 0.6 | 11.67 | ||

| and | 16.1 | 16.6 | 0.5 | 5.26 | ||

| 38 | 38.5 | 0.5 | 3.12 | 0.48 | ||

| 70.5 | 71.05 | 0.55 | 2.44 | 0.48 | ||

| BMU-25-178 | No Significant Assays | |||||

| BMU-25-180 | 17 | 18.5 | 1.5 | 2.06 | 1.30 | |

| Including | 17 | 18 | 1 | 3.02 | ||

| 28.5 | 29.1 | 0.6 | 3.73 | 0.42 | ||

| 81.65 | 82.5 | 0.85 | 18.07 | 0.60 | ||

| BMU-25-181 | 39 | 43 | 4 | 5.43 | 2.83 | |

| Including | 41 | 42 | 1 | 20.67 | ||

| and | 47.3 | 48 | 0.7 | 2.54 | ||

| 51.7 | 55.7 | 4 | 1.85 | 3.15 | ||

| Including | 51.7 | 52.2 | 0.5 | 7.41 | ||

| and | 52.7 | 53.2 | 0.5 | 1.84 | ||

| and | 53.7 | 54.3 | 0.6 | 1.90 | ||

| and | 55 | 55.7 | 0.7 | 1.86 | ||

Table 2: Underground DD collar locations, drillhole orientations, and max depths. Negative dips point down.

| Hole ID | Mine Location | Easting (UTM z12N) | Northing (UTM z 12N) | Elevation (m) | Dip | Azimuth | Depth (m) |

| BMU-25-115 | L1260-ORE-DBY-003-DBY-012 | 596445.8 | 5882735.4 | 1264.4 | 35.0 | 125.3 | 114.0 |

| BMU-25-119 | L1260-ORE-DBY-003-DBY-012 | 596445.3 | 5882735.8 | 1263.5 | 25.0 | 124.8 | 102.0 |

| BMU-25-122 | L1260-ORE-DBY-003-DBY-012 | 596445.4 | 5882735.7 | 1263.1 | 15.0 | 125.1 | 96.0 |

| BMU-25-123 | L1260-ORE-DBY-003-DBY-003 | 596493.8 | 5882811.7 | 1257.1 | -45.2 | 124.8 | 114.0 |

| BMU-25-125 | L1260-ORE-DBY-003-DBY-012 | 596445.3 | 5882735.8 | 1262.6 | 4.9 | 125.1 | 84.0 |

| BMU-25-127 | L1260-ORE-DBY-003-DBY-012 | 596445.5 | 5882735.8 | 1262.2 | -5.0 | 125.0 | 81.0 |

| BMU-25-128 | L1260-ORE-DBY-003-DBY-003 | 596493.8 | 5882811.7 | 1257.5 | -35.0 | 125.1 | 99.0 |

| BMU-25-130 | L1260-ORE-DBY-003-DBY-012 | 596445.7 | 5882735.7 | 1261.8 | -14.9 | 125.2 | 84.0 |

| BMU-25-131 | L1260-ORE-DBY-003-DBY-003 | 596493.9 | 5882811.8 | 1257.8 | -25.1 | 125.3 | 96.0 |

| BMU-25-132 | L1260-ORE-DBY-003-DBY-012 | 596445.7 | 5882735.7 | 1261.3 | -25.0 | 125.0 | 90.0 |

| BMU-25-133 | L1260-ORE-DBY-003-DBY-003 | 596494.0 | 5882812.5 | 1258.1 | -15.0 | 124.7 | 56.5 |

| BMU-25-134 | L1260-ORE-DBY-003-DBY-009 | 596463.3 | 5882760.1 | 1263.0 | 34.8 | 125.3 | 114.0 |

| BMU-25-135 | L1260-ORE-DBY-003-DBY-012 | 596445.5 | 5882735.8 | 1261.0 | -35.0 | 124.6 | 99.0 |

| BMU-25-136 | L1260-ORE-DBY-003-DBY-003 | 596494.5 | 5882812.1 | 1258.3 | -5.0 | 124.7 | 51.0 |

| BMU-25-137 | L1260-ORE-DBY-003-DBY-009 | 596463.6 | 5882759.9 | 1262.2 | 25.0 | 125.0 | 102.0 |

| BMU-25-138 | L1260-ORE-DBY-003-DBY-012 | 596445.5 | 5882736.0 | 1260.9 | -44.9 | 124.5 | 114.0 |

| BMU-25-139 | L1260-ORE-DBY-003-DBY-003 | 596494.4 | 5882812.2 | 1258.7 | 5.0 | 125.4 | 84.0 |

| BMU-25-140 | L1260-ORE-DBY-003-DBY-009 | 596463.6 | 5882760.0 | 1261.7 | 15.0 | 125.3 | 96.0 |

| BMU-25-141 | L1260-ORE-DBY-003-DBY-013 | 596441.0 | 5882727.7 | 1262.6 | 35.0 | 125.0 | 117.0 |

| BMU-25-142 | L1260-ORE-DBY-003-DBY-003 | 596494.3 | 5882812.3 | 1259.3 | 15.0 | 125.0 | 84.0 |

| BMU-25-143 | L1260-ORE-DBY-003-DBY-009 | 596463.6 | 5882760.0 | 1261.2 | 5.0 | 125.0 | 81.0 |

| BMU-25-144 | L1260-ORE-DBY-003-DBY-013 | 596441.0 | 5882727.7 | 1262.6 | 25.0 | 125.0 | 102.0 |

| BMU-25-145 | L1260-ORE-DBY-003-DBY-003 | 596494.2 | 5882812.4 | 1259.9 | 25.4 | 125.5 | 102.0 |

| BMU-25-146 | L1260-ORE-DBY-003-DBY-009 | 596463.6 | 5882760.0 | 1260.8 | -5.0 | 125.0 | 81.0 |

| BMU-25-147 | L1260-ORE-DBY-003-DBY-013 | 596441.0 | 5882727.7 | 1262.6 | 15.0 | 125.0 | 96.0 |

| BMU-25-148 | L1260-ORE-DBY-003-DBY-003 | 596494.0 | 5882812.5 | 1260.4 | 35.0 | 125.4 | 114.0 |

| BMU-25-149 | L1260-ORE-DBY-003-DBY-009 | 596464.0 | 5882759.8 | 1260.5 | -15.0 | 125.0 | 84.0 |

| BMU-25-150 | L1260-ORE-DBY-003-DBY-013 | 596441.0 | 5882727.7 | 1262.6 | 4.9 | 125.0 | 78.0 |

| BMU-25-151 | L1260-ORE-DBY-003-DBY-013 | 596441.0 | 5882727.7 | 1262.6 | -5.2 | 125.1 | 78.0 |

| BMU-25-152 | L1260-ORE-DBY-003-DBY-009 | 596463.9 | 5882759.8 | 1260.2 | -25.0 | 125.0 | 90.0 |

| BMU-25-153 | L1260-ORE-DBY-003-DBY-013 | 596441.0 | 5882727.7 | 1262.6 | -14.9 | 125.1 | 81.0 |

| BMU-25-154 | L1260-ORE-DBY-003-DBY-013 | 596441.0 | 5882727.7 | 1262.6 | -25.0 | 125.0 | 87.0 |

| BMU-25-155 | L1260-ORE-DBY-003-DBY-009 | 596463.6 | 5882759.8 | 1260.0 | -35.0 | 122.8 | 99.0 |

| BMU-25-156 | L1260-ORE-DBY-003-DBY-013 | 596441.0 | 5882727.7 | 1262.6 | -35.1 | 125.0 | 96.0 |

| BMU-25-157 | L1260-ORE-DBY-003-DBY-013 | 596441.0 | 5882727.7 | 1262.6 | -45.2 | 125.2 | 111.0 |

| BMU-25-158 | L1260-ORE-DBY-003-DBY-009 | 596463.4 | 5882759.9 | 1259.7 | -45.1 | 124.9 | 114.0 |

| BMU-25-159 | L1260-ORE-DBY-003-DBY-007 | 596473.9 | 5882777.7 | 1259.8 | 35.1 | 125.3 | 114.0 |

| BMU-25-160 | L1260-ORE-DBY-003-DBY-011 | 596452.2 | 5882743.2 | 1263.9 | 35.1 | 124.9 | 114.0 |

| BMU-25-161 | L1260-ORE-DBY-003-DBY-007 | 596473.9 | 5882777.7 | 1259.8 | 25.1 | 124.8 | 102.0 |

| BMU-25-162 | L1260-ORE-DBY-003-DBY-011 | 596452.2 | 5882743.1 | 1263.5 | 25.0 | 124.7 | 102.0 |

| BMU-25-163 | L1260-ORE-DBY-003-DBY-007 | 596473.9 | 5882777.7 | 1259.8 | 14.9 | 125.1 | 72.0 |

| BMU-25-164 | L1260-ORE-DBY-003-DBY-011 | 596452.2 | 5882743.2 | 1263.0 | 14.9 | 124.8 | 96.0 |

| BMU-25-165 | L1260-ORE-DBY-003-DBY-007 | 596473.9 | 5882777.7 | 1259.8 | 5.1 | 125.0 | 72.0 |

| BMU-25-166 | L1260-ORE-DBY-003-DBY-011 | 596452.4 | 5882743.1 | 1262.4 | 5.0 | 125.0 | 81.0 |

| BMU-25-168 | L1260-ORE-DBY-003-DBY-007 | 596473.9 | 5882777.7 | 1259.8 | -5.0 | 124.9 | 75.0 |

| BMU-25-169 | L1260-ORE-DBY-003-DBY-011 | 596452.5 | 5882743.0 | 1262.0 | -5.1 | 124.8 | 81.0 |

| BMU-25-171 | L1260-ORE-DBY-003-DBY-007 | 596473.9 | 5882777.7 | 1259.8 | -15.0 | 125.2 | 72.0 |

| BMU-25-172 | L1260-ORE-DBY-003-DBY-011 | 596452.5 | 5882743.0 | 1261.6 | -15.4 | 0.0 | 84.0 |

| BMU-25-174 | L1260-ORE-DBY-003-DBY-007 | 596473.9 | 5882777.7 | 1259.8 | -24.9 | 125.3 | 90.0 |

| BMU-25-175 | L1260-ORE-DBY-003-DBY-011 | 596452.5 | 5882743.1 | 1261.3 | -25.3 | 125.2 | 90.0 |

| BMU-25-177 | L1260-ORE-DBY-003-DBY-007 | 596473.9 | 5882777.7 | 1259.8 | -34.9 | 125.1 | 99.0 |

| BMU-25-178 | L1260-ORE-DBY-003-DBY-011 | 596452.4 | 5882743.1 | 1261.0 | -35.1 | 124.8 | 99.0 |

| BMU-25-180 | L1260-ORE-DBY-003-DBY-007 | 596473.9 | 5882777.7 | 1259.8 | -45.1 | 125.0 | 114.0 |

| BMU-25-181 | L1260-ORE-DBY-003-DBY-011 | 596452.4 | 5882743.2 | 1260.7 | -45.1 | 125.0 | 114.0 |

ABOUT LOWHEE ZONE

Geological mapping and geochemical sampling were carried out on Barkerville Mountain from 2017-2018, with the Lowhee Zone identified as a high-priority drill target. From 2019 to 2022, a total of 167 surface drill holes were completed, totaling 54,494.5 m.

Lowhee zone access is through Cow portal on the northwestern flank of Barkerville Mountain (Figure 1 and Figure 2) Cow portal construction was completed in Q4 2024 and development of the underground ramp into the Lowhee zone commenced in Q1 2025. Approximately 350 m of development has been advanced within the Lowhee zone deposit at the 1,290 and 1,260-elevation levels since completion of the main access ramp. The probable mineral reserves estimate for the Lowhee Zone includes 104,491 ounces of contained Au (923,162 tonnes grading 3.52 g/t Au) and represents approximately

ABOUT CARIBOO GOLD PROJECT

The Cariboo Gold Project is a permitted,

The Cariboo Gold Project hosts probable mineral reserves of 2.071 million ounces of contained Au (17,815 kt grading 3.62 g/t Au); measured mineral resources of 8,000 ounces of contained Au (47 kt grading 5.06 g/t Au); indicated mineral resources of 1.604 million ounces of contained Au (17,332 kt grading 2.88 g/t Au); and inferred mineral resources of 1.864 million ounces of contained Au (18,774 kt grading 3.09 g/t Au). Mineral resources are reported exclusive of mineral reserves.

Technical Reports

Scientific and technical information relating to the Cariboo Gold Project and the 2025 feasibility study on the Cariboo Gold Project is supported by the technical report, titled "NI 43-101 Technical Report, Feasibility Study for the Cariboo Gold Project, District of Wells, British Columbia, Canada" and dated June 11, 2025 (with an effective date of April 25, 2025) (the "Cariboo Technical Report").

For readers to fully understand the information in the Cariboo Technical Report, reference should be made to the full text of the Cariboo Technical Report in its entirety, including all assumptions, parameters, qualifications, limitations and methods therein. The Cariboo Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context. The Cariboo Technical Report was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and is available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile and on the Company's website at www.osiskodev.com.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed, verified and approved by Scott Smith, P. Geo., Vice President, Exploration of Osisko Development, a "qualified person" within the meaning of NI 43-101. Verification includes core photo and three-dimensional review of logged drillhole data and assays consistent with the Company's standard operating procedures.

Quality Assurance (QA) – Quality Control (QC)

Whole core sampling was used for all HQ core completed in the logging facilities following daily QAQC checks for logging and sampling errors. Quality control (QC) samples are inserted at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance. Samples are bagged, labeled, sealed with numbered security tags

Samples are taken by expeditor from the logging facilities direct to MSALABS’s analytical facility in Prince George, B.C., Canada, for preparation and analysis. The MSALABS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is dried, crushed, and split into sealed containers. Analysis for gold is by gamma ray analysis using the Chrysos PhotonAssay (PA1408X). Samples are bombarded with gamma rays and the resulting signal is sent to the detectors.

Alternatively Drill core samples are submitted to ALS Geochemistry’s analytical facility in North Vancouver, British Columbia for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed, and 250 grams is pulverized. Analysis for gold is by 50 gram fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.01 ppm and upper limit of 100 ppm. Samples with gold assays greater than 100 ppm are re-analyzed using a 1,000-gram screen metallic fire assay. A selected number of samples are also analyzed using a 48 multi-elemental geochemical package by a 4-acid digestion, followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectroscopy (ICP-MS).

ABOUT OSISKO DEVELOPMENT CORP.

Osisko Development Corp. is a continental North American gold development company focused on past producing mining camps with district scale potential. The Company's objective is to become an intermediate gold producer through the development of its flagship, fully permitted,

For further information, visit our website at www.osiskodev.com or contact:

| Sean Roosen | Philip Rabenok |

| Chairman and CEO | Vice President, Investor Relations |

| Email:sroosen@osiskodev.com | Email:prabenok@osiskodev.com |

| Tel: +1 (514) 940-0685 | Tel: +1 (437) 423-3644 |

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this news release may be deemed "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (together, "forward-looking statements"). These forward-looking statements, by their nature, require Osisko Development to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Forward-looking statements are not guarantees of performance. Words such as "may", "will", "would", "could", "expect", "believe", "plan", "anticipate", "intend", "estimate", "continue", "objective", "strategy", variants of these words or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including the assumptions, qualifications, limitations or statements relating to the prospectivity of exploration in the Lowhee Zone and targets outside of currently defined mineral reserves and/or mineral resources; the consistency of results with modelled reserve stopes (if at all); the results (if any) of further exploration work to define and expand mineral resources; the results, timing, utility and significance of the ongoing 13,000-meter infill drill program (including the temporary suspension of drilling activities following the incident reported on January 23, 2026 and the anticipated conclusion of the program in early Q2 2026) and its impacts on the local block model and/or future production stope designs and sequencing (if any); the ability and utility of exploration work (including drilling) to inform resource modeling, mine planning, production stope design procedures and parameters, refinement of infill drill requirements, and the appropriate drill spacing for future infill drilling (if at all); the ability and timing (if at all) to complete future additional systemic grid infill drill programs; the interpretation and accuracy of spatial geometries, geological structure and local variability modeling and assumptions in regard to potential reserve or resource revisions (if at all); the Company's strategy and objectives relating to the Cariboo Gold Project as well as its other projects; the assumptions, qualifications and limitations relating to the Cariboo Gold Project being permitted; assumptions, qualifications and parameters underlying the Cariboo Technical Report (including, but not limited to, the mineral resources, mineral reserves, production profile, mine design and project economics); the results of the Cariboo Technical Report as an indicator of quality and robustness of the Cariboo Gold Project, as well as other considerations that are believed to be appropriate in the circumstances; the ability of the Company to achieve the estimates outlined in the Cariboo Technical Report in the timing contemplated (if at all); the ability, progress and timing in respect of the 13,000-meter infill drill program; the contemplated work plan and activities at the Cariboo Gold Project and the timing, scope and results thereof and associated costs thereto; the potential impact of tariffs and other trade restrictions (if any); mineral resource category conversion; the future development and operations at the Cariboo Gold Project; management's perceptions of historical trends, current conditions and expected future developments; the utility and significance of historic data, including the significance of the district hosting past producing mines; future mining activities; the ability of exploration work (including drilling and sampling) to accurately predict mineralization; the ability of the Company to expand mineral resources beyond current mineral resource estimates; the ability of the Company to complete its exploration and development objectives for its projects in the timing contemplated and within expected costs (if at all); the ongoing advancement of the deposits on the Company's properties; sustainability and environmental impacts of operations at the Company's properties; gold prices; the costs required to advance the Company's properties; the ability to adapt to changes in gold prices, estimates of costs, estimates of planned exploration and development expenditures; the profitability (if at all) of the Company's operations; regulatory framework remaining defined and understood as well as other considerations that are believed to be appropriate in the circumstances, and any other information herein that is not a historical fact may be "forward looking information". Osisko Development considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko Development, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko Development and its business. Such risks and uncertainties include, among others, risks relating to third-party approvals, including the issuance of permits by governments, capital market conditions and the Company's ability to access capital on terms acceptable to the Company for the contemplated exploration and development at the Company's properties; the ability to continue current operations and exploration; regulatory framework and presence of laws and regulations that may impose restrictions on mining; errors in management's geological modelling; the timing and ability of the Company to obtain and maintain required approvals and permits; the results of exploration activities; risks relating to exploration, development and mining activities; the global economic climate; fluctuations in metal and commodity prices; fluctuations in the currency markets; dilution; environmental risks; and community, non-governmental and governmental actions and the impact of stakeholder actions. Osisko Development is confident a robust consultation process was followed in relation to its received BC Mines Act and Environmental Management Act permits for the Cariboo Gold Project and continues to actively consult and engage with Indigenous nations and stakeholders. While any party may seek to have the decision related to the BC Mines Act and/or Environmental Management Act permits reviewed by the courts, the Company does not expect that such a review would, were it to occur, impact its ability to proceed with the construction and operation of the Cariboo Gold Project in accordance with the approved BC Mines Act and Environmental Management Act permits. Readers are urged to consult the disclosure provided under the heading "Risk Factors" in the Company's annual information form for the year ended December 31, 2024 as well as the financial statements and MD&A for the year ended December 31, 2024 and quarter ended September 30, 2025, which have been filed on SEDAR+ (www.sedarplus.ca) under Osisko Development's issuer profile and on the SEC's EDGAR website (www.sec.gov), for further information regarding the risks and other factors facing the Company, its business and operations. Although the Company believes the expectations conveyed by the forward-looking statements are reasonable based on information available as of the date hereof, no assurances can be given as to future results, levels of activity and achievements. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. Forward-looking statements are not guarantees of performance and there can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a2f67ed7-b07e-4ceb-b270-55ca39146d22

https://www.globenewswire.com/NewsRoom/AttachmentNg/2fd71957-c12e-44fc-ae28-06c11015f305

https://www.globenewswire.com/NewsRoom/AttachmentNg/5c3323c4-0d11-41cc-b6e8-94cb77309f5d

https://www.globenewswire.com/NewsRoom/AttachmentNg/5c381732-cdeb-4ac6-9452-f52e8a6a4921

https://www.globenewswire.com/NewsRoom/AttachmentNg/bfc35c71-46ea-4b13-8db0-a13d990cc771

https://www.globenewswire.com/NewsRoom/AttachmentNg/f7fc6c0f-40f7-477b-8f3e-fcef7e8c7916

https://www.globenewswire.com/NewsRoom/AttachmentNg/01436672-95da-4fa0-8d99-d7883df9930d

https://www.globenewswire.com/NewsRoom/AttachmentNg/4e2aad2e-a0c7-4ec2-9709-c3dc854c72ac

https://www.globenewswire.com/NewsRoom/AttachmentNg/7599a997-e127-401d-83cb-abde2269ed0a