Onyx Gold Continues to Consolidate Key Ground at Munro-Croesus with Strategic Acquisitions

Rhea-AI Summary

Onyx Gold Corp. (OTCQX: ONXGF) has announced strategic acquisitions to expand its Munro-Croesus Project, located 75 km east of Timmins, Ontario. The company has signed agreements to acquire the 227-hectare Munro Property for $300,000 and a 50% interest in the Hewitt Property for $20,000 plus 75,000 common shares.

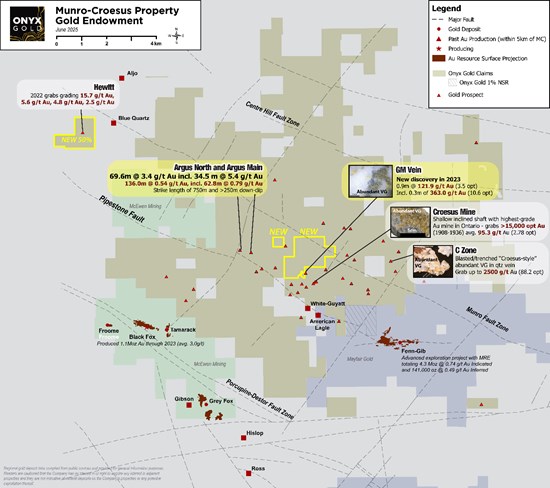

These acquisitions increase the project's total land holdings to 10,921 hectares (109 km²). The Munro Property notably extends along the 'Croesus Flow', which hosts the historic high-grade Croesus Mine and the company's recently discovered GM Vein. The Hewitt Property, situated on a northeast-trending fault splay, has shown promising gold samples up to 15.7 g/t Au.

Additionally, the company has engaged Chad Levesque Consulting for investor relations services at $5,000 monthly with 100,000 stock options.

Positive

- Strategic expansion of land package to 109 km² in the prolific Timmins Camp

- Acquisition of Munro Property extends coverage of prospective 'Croesus Flow' geological unit

- High-grade gold samples from Hewitt Property showing up to 15.7 g/t Au

- 100% ownership consolidation of key properties in a major gold-bearing region

Negative

- Additional cash expenditure of $300,000 for Munro Property acquisition

- Share dilution through issuance of 75,000 common shares for Hewitt Property

- New 1.0% net smelter returns royalty obligation on Hewitt Property

- Increased monthly expenses of $5,000 for investor relations services

News Market Reaction – ONXGF

On the day this news was published, ONXGF gained 3.82%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Total Project Land Holdings Expanded to 109 km2 to cover Key Geological Real Estate

Vancouver, British Columbia--(Newsfile Corp. - June 24, 2025) - Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF) is pleased to announce that it has signed mineral property purchase and sale agreements (the "Purchase Agreements") with two separate arm's length private vendors through its wholly-owned subsidiary to acquire a

These strategic acquisitions expand Onyx Gold's Munro-Croesus land package to 10,921 hectares (109 km²), further enhancing the Company's footprint and reinforcing its position as a leading gold explorer in the Timmins Camp.

"These acquisitions are another step forward in executing our strategy to consolidate prospective, but highly underexplored ground in one of Canada's most prolific gold camps," said Brock Colterjohn, President & CEO of Onyx Gold. "The addition of the Munro property, in particular, further enhances the strategic value of our Munro-Croesus Project by expanding our footprint along the prospective 'Croesus Flow' — a key geological unit that hosts the historic high-grade Croesus Mine and our recently discovered GM Vein, just 350 metres away. We're excited to advance these new properties and unlock additional high-impact drill targets for future exploration."

Terms of the Purchase Agreement for the Munro Property Claims

The Munro Property is a strategically located 227-hectare inholding within the Munro-Croesus Project (Figure 2). The Property covers the northwestern strike extension of the highly prospective mafic volcanic pillowed flow (the Croesus Flow), which hosts the past producing high-grade Croesus Gold Mine, the new GM vein target (see Company news release dated May 1, 2024), and numerous other prospects. The Munro Property also hosts the fully reclaimed past producing Munro Mine which produced chrysotile asbestos from 1950 to 1964.

The Company has the right to acquire

Terms of the Purchase Agreement for the Hewitt Property Claims

The Hewitt Property is situated on a northeast-trending secondary fault splay to the Painkiller Fault and contains gold-bearing mineralization with grab samples yielding 15.7 g/t Au, 5.6 g/t Au, 4.8 g/t Au, and 2.5 g/t Au2.

The Company has entered into a mineral property purchase and sale agreement (the "Hewitt Agreement") with the vendor for its

In addition, the Company will grant the vendor a

The Purchase Agreements are subject to the approval of the TSX Venture Exchange (the "Exchange").

Consultant Agreement

The Company has also entered into an investor relations agreement (the "IR Agreement") dated June 19th, 2025, with Chad Levesque Consulting ("CLC").

CLC has been retained for an initial term of six (6) months, with an anticipated start date of June 24th, 2025 (the "Initial Term"), to provide corporate and communications services to the Company, in consideration for an aggregate amount of

In addition, CLC will be granted 100,000 stock options (the "Options") with an exercise price determined based on the market price of the Company's shares at the time of issuance and expiring within 5 years of the date of issuance. The stock options shall vest over 12 months with no more than 1/4 of the options vesting in any 3-month period, in accordance with the terms of the Company's stock option plan. Following completion of the Initial Term either Onyx Gold or CLC may terminate the Agreement with 30 days' notice.

CLC and the Company are arm's length parties. CLC is principally owned by Chad Levesque. The entering into the IR Agreement and the grant of the stock options thereunder are subject to the approval of the Exchange.

Figure 1 - Munro-Croesus Gold Project with Newly Acquired Claims Highlighted in Yellow

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9800/256588_4871e31af437caaf_001full.jpg

Figure 2 - Newly Acquired Munro Property Claims Highlighted in Red, Partially Cover The Prospective 'Croesus Flow'

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9800/256588_4871e31af437caaf_002full.jpg

The Munro-Croesus Project

The Munro-Croesus Project is located along Highway 101 in the heart of the Abitibi greenstone belt, Canada's premier gold mining jurisdiction (Figure 1). This large,

The Project covers 109 km2 of highly prospective geology within the influence of major gold-bearing structural breaks. Bulk-tonnage gold deposits located in the immediate region include the Fenn-Gib gold project being developed by Mayfair Gold Corp. that contains an Indicated Resource of 4.31 Moz at 0.74 g/t Au and an Inferred Resource of 141 koz at 0.49 g/t Au, and the Tower Gold Project being developed by STLLR Gold Inc. that contains an open pit Indicated Resource of 4.46 Moz at 0.92 g/t Au and an Inferred Resource of 8.29 Moz at 1.09 g/t Au1.

About Onyx Gold

Onyx Gold is an exploration company focused on well-established Canadian mining jurisdictions, with assets in Timmins, Ontario, and Yukon Territory. Totaling more than 444 km2, the Company's extensive portfolio of quality gold projects in the greater Timmins gold camp includes the Munro-Croesus Gold property, renowned for its high-grade mineralization, plus two additional earlier-stage large exploration properties, Golden Mile and Timmins South. The Golden Mile 140 km2 property is located 9 km northeast of Newmont's multi-million-ounce Hoyle Pond deposit in Timmins. The Timmins South 187 km2 property is located to the south and southeast of Timmins and surrounds the Shaw dome structure.

Onyx Gold also controls four properties in the Selwyn Basin area of Yukon Territory, which is currently gaining significance due to recent discoveries in the area. Onyx Gold's experienced board and senior management team are committed to creating shareholder value through the discovery process, careful allocation of capital, and environmentally/socially responsible mineral exploration.

On Behalf of Onyx Gold Corp.

"Brock Colterjohn"

President & CEO

For further information, please visit the Onyx Gold Corp. website at www.onyxgold.com or contact:

Brock Colterjohn, President & CEO

or

Nicole Hoeller, NIKLI Communications - nicole@onyxgold.com

Phone: 1-604-283-3341

Email: information@onyxgold.com

Website: www.onyxgold.com

LinkedIn: https://www.linkedin.com/company/onyx-gold-corp

Twitter: https://twitter.com/OnyxGoldCorp

Ian Cunningham-Dunlop, P.Eng., Executive Vice President for Onyx Gold Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary and Forward-Looking Statements

This news release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events at the time of this news release. Generally, but not always, forward-looking statements and information can be identified by the use of forward-looking terminology such as "seek", "anticipate", "believe", "plan", "estimate", "forecast", "expect", "potential", "project", "target", "schedule", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof. This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things, statements regarding obtaining required regulatory approvals for the Purchase Agreements and the IR Agreement, the issuance of the Options under the IR Agreement, the Company's future exploration plans; and other statements that are not historical facts.

These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, delays in obtaining or failure to obtain required regulatory approvals for the Purchase Agreements and the IR Agreement, that the Company may not issue the Options, and other risks associated with executing the Company's objectives and strategies as well as those risk factors discussed in the Company's continuous disclosure documents filed under the Company's SEDAR+ profile at www.sedarplus.ca.

In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, the assumption that the Company will obtain the required regulatory approvals for the Purchase Agreements the IR Agreement, that the Company will issue the Options, and that the Company will have the necessary resources to carry out its exploration plans as anticipated, or at all.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial outlook that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/256588