Pacifica Silver Makes New High-Grade Discovery at Claudia with 3.53 g/t Au and 460 g/t Ag over 2.10 m from Justina Vein

Rhea-AI Summary

Pacifica Silver (OTCQB: PAGFF) reported assays from 11 additional holes of its Phase I, 8,000‑metre program at the 100% owned Claudia silver‑gold project, Durango, Mexico. Highlights include a new high‑grade Justina vein intercept of 2.10 m @ 3.53 g/t Au and 460 g/t Ag, including 0.80 m @ 9.01 g/t Au and 1,175 g/t Ag.

The program totaled 30 holes; Phase II is planned as a 12,000‑metre follow‑up to test lateral continuity and down‑dip extensions.

Positive

- New high‑grade Justina discovery: 2.10 m @ 3.53 g/t Au, 460 g/t Ag

- Ultra‑high subinterval: 0.80 m @ 9.01 g/t Au, 1,175 g/t Ag

- Phase I completed: 30 holes, 8,000 metres drilled

- Planned Phase II: 12,000‑metre follow‑up drill program

- Multiple veins extended down‑dip and along strike

- QA/QC using ALS labs with ISO/IEC 17025:2017 accreditation

Negative

- Insufficient metallurgical test work; recoveries were assumed

- Some large step‑out holes encountered no significant mineralization

- Poor core recovery in Guadalupana due to post‑mineral faulting

- Marketing and IR fees: C$250,000 plus US$50,000 funded from working capital

Vancouver, British Columbia--(Newsfile Corp. - February 9, 2026) - Pacifica Silver Corp. (CSE: PSIL) (OTCQB: PAGFF) ("Pacifica Silver" or the "Company") is pleased to announce assay results from 11 additional drill holes completed as part of its Phase I, 8,000-metre drill program at the

Drill Highlights

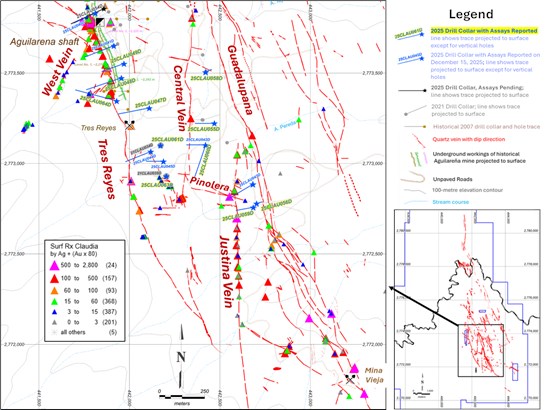

Hole 25CLAU059D intersected 2.10 m of 3.53 g/t Au and 460 g/t Ag (219.00 - 221.10 m), including 0.80 m of 9.01 g/t Au and 1,175 g/t Ag, marking a new discovery at the previously undrilled Justina vein, a north-south structure located approximately 1.5 km southeast of the Aguilareña shaft and mapped over 1,000 m (see Figure 1).

Hole 25CLAU064D intersected 6.00 m of 1.51 g/t Au and 68 g/t Ag (21.00-27.00 m), at the Aguilareña vein, including 1.65 m of 3.34 g/t Au and 211 g/t Ag.

Hole 25CLAU047D intersected 4.85 m of 1.09 g/t Au and 25 g/t Ag (107.50-112.35 m), at the Aguilareña vein, including 0.85 m of 3.64 g/t Au and 74 g/t Ag.

"The discovery of high-grade mineralization at the previously undrilled Justina vein marks a major success in our inaugural drill program at the Claudia Project," stated Todd Anthony, Chief Executive Officer of Pacifica Silver. "Hole 25CLAU059D, with 9.01 g/t Au and 1,175 g/t Ag over 0.80 m, demonstrated the Justina vein extends down dip for at least 160 m within a 500-m area that previously returned significant gold and silver assays from surface channel and rock chip samples in late 2025, thereby confirming the presence of a high-grade system at depth. Over the coming months, we plan to systematically follow up this discovery with step-out drilling to evaluate the lateral continuity of this promising structure. We also plan to explore additional high-priority targets in the southern zone, including areas near the highly prospective Mina Vieja area."

Discussion of Drill Results

Silver and gold assay results for the 11 holes are summarized in Table 1. Results are reported for holes corresponding to the project areas outlined below (Figure 1 - blue labels).

Central and Justina veins: Holes 055D, 059D, and 060D.

Aguilareña - Tres Reyes and West veins: Holes 047D, 048D, 049D, 061D, 063D, and 064D.

Guadalupana vein: Holes 056D and 058D.

The Company expects to announce assay results from the remaining nine holes from 2025 drilling in the northern portion of the Project in the weeks ahead (Figure 1 - black labels).

Figure 1 - Map Showing Locations of Drill Holes Reported in this Press Release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10814/283159_8390d1d7f4866a15_001full.jpg

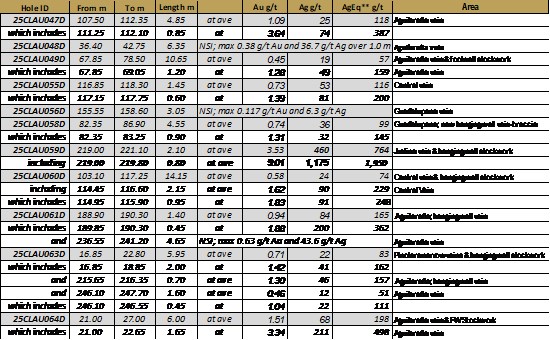

Table 1 - Significant Assay Results from Phase I Drill Program at Claudia Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10814/283159_8390d1d7f4866a15_002full.jpg

Composites calculated with Au minimum of 0.15 g/t (0.100 g/t Au if Ag > 30 g/t) and no more than 1.0 m internal below minimum.

*True widths are estimated to average

**Silver equivalent grade (AgEq) is calculated based on the following formula: AgEq (g/t) = Ag (g/t) + [Au (g/t) x (Au price / Ag price) x (Au recovery / Ag recovery)]. Metal prices for silver and gold are assumed to be US

Results for Central and Justina Vein Areas

Holes 25CLAU055D, 25CLAU059D and 25CLAU060D were drilled to (1) extend the Central vein; (2) test the high-priority Justina vein; and (3) investigate the subsurface location of the Pinolera trend, respectively.

1) At the Central vein, hole 25CLAU055D intersected 1.45 m of 0.73 g/t Au and 53 g/t Ag, including 0.60 m of 1.39 g/t Au and 81 g/t Ag from 116.85 m. This hole confirmed the Central vein extends at least 50 m down-dip from the intercept in historical hole 21CLAU031D, which returned 6.05 m at an average of 1.27 g/t Au and 90 g/t Ag from 62.1 m.

2) At the Justina vein, hole 25CLAU059D successfully intersected a high-grade interval of 9.01 g/t Au and 1,175 g/t Ag over 0.80 m from 219.0 m downhole (Table 1), within a broader 2.10 m zone of vein and stockwork averaging 3.53 g/t Au and 460 g/t Ag from 219.0 to 221.1 m. This discovery hole confirms that the vein extends down-dip at least 160 m from surface with strong silver and gold mineralization beneath areas of high-grade surface rock sampling (Figure 1). It also provides important information on the subsurface vein dip and orientation. The Justina vein and this intercept remain open to the south, where the vein crops out continuously for more than 1 km from the collar location of hole 25CLAU059D (Figure 1).

3) The Pinolera trend (Figure 1) is a N70W-striking, up-to-40-m-wide zone of subparallel veins - mostly only a few centimetres wide individually at surface - that crosses both the Central and Justina veins. Hole 25CLAU060D was drilled to investigate the subsurface location of these subparallel veins and intersected a broad zone of low-grade stockwork and spaced narrow veins in the hanging wall of the Central vein, returning 14.15 m averaging 0.58 g/t Au and 24 g/t Ag, including 2.15 m of 1.62 g/t Au and 90 g/t Ag from 114.45 m. Most importantly, this hole also intersected and extended the Central vein approximately 150 m south of previously reported hole 25CLAU042, with 3.15 m averaging 0.85 g/t Au and 43 g/t Ag from 92.4 m. Hole 25CLAU060D is not believed to have reached the core of the Pinolera trend, and therefore did not test the potentially more favourable zone where the Pinolera trend intersects or merges with the Central vein.

The Company plans to follow up the Justina vein discovery with step-out drilling to evaluate the lateral continuity and grade distribution of the vein as part of its ongoing Phase II, 12,000-m drill program. Additional drilling will target:

the Central vein at its projected intersection with the Pinolera trend; and

the 350 ms of untested strike length along the Central vein north of hole 25CLAU055D.

Aguilareña-Tres Reyes and West Vein Areas

Holes 25CLAUD047D, 25CLAU048D, 25CLAUD049D, 25CLAUD061D, 26CLAU063D and 25CLAUD064D were focused on delineating and expanding silver and gold mineralization along the Aguilareña-Tres Reyes vein where the bulk of historical exploration and artisanal mining was focused, including the area of a historical resource estimate by Compania Minera Bacis in the early 1990s.

- Hole 25CLAUD047D was drilled as a 380-m step out to the south, and about 50 m down dip, from the collar of hole 25CLAU041D, and 110 m south of and 50 m down dip from historical hole SCL07-08. It returned a significant interval of 4.85 m averaging 1.09 g/t Au and 25 g/t Ag, including 0.85 m of 3.63 g/t Au and 74 g/t Ag from 107.50 m (Table 1), confirming the Aguilareña vein is present in the gap between the Aguilareña and Tres Reyes workings.

Holes 25CLAU048D and 25CLAU049D, located near the southern end of the historical Aguilareña workings, successfully tested shallow portions of the Aguilareña vein within the 110-m undrilled gap south of previously reported hole 25CLAU041D (Figure 1).

Hole 25CLAU048D intersected the vein over 6.35 m (from 36.4 m to 42.75 m), with the best interval returning 1.0 m grading 0.38 g/t Au and 36.7 g/t Ag.

Hole 25CLAU049D intersected the vein and an adjacent footwall zone of narrow veins and stockwork, returning 10.65 m averaging 0.45 g/t Au and 19 g/t Ag from 67.85 m, including 1.20 m @ 1.28 g/t Au and 49 g/t Ag from 67.85 m (Table 1).

These holes confirm the continuity of the Aguilareña vein in the previously untested gap and provide important information on shallow vein structure and alteration. The vein remains open down-dip, particularly at deeper levels where higher-grade mineralization was previously reported in news on December 15, 2025. These results support further drilling to target higher-grade zones along the down-dip extension.

- Vertical holes 25CLAU061D and 25CLAU063D were drilled 190 and 340 m, respectively, southeast of the Tres Reyes historical workings and successfully demonstrated major down-dip extensions of the Aguilareña-Tres Reyes vein below historical holes 21CLAU034D and 21CLAU035D. Hole 25CLAU061D intersected a previously unrecognized hanging wall vein of 1.4 m width, containing 0.45 m of 1.88 g/t Au and 200 g/t Ag (Table 1) before intersecting the Aguilareña-Tres Reyes vein from 236.55 to 241.2 m (4.65 m drilled width). At this location, the vein included a maximum grade sample of 0.63 g/t Au and 43.6 g/t Ag.

- Hole 25CLAU063D intersected narrow veins and stockwork interpreted as the westernmost part of the Pinolera trend that included 2.0 m of 1.42 g/t Au and 41 g/t Ag from 16.85 m (Table 1), within a broader 5.95-m interval that averaged 0.71 g/t Au and 22 g/t Ag from 16.85 to 22.8 m. The Aguilareña-Tres Reyes vein was intersected at 246.1 to 247.7 m (1.6 m drilled thickness) and returned a maximum assay of 1.04 g/t Au and 22 g/t Ag from 246.1 to 246.55 m.

- Hole 25CLAUD064D was drilled to test the down dip extent of a zone of northeast-striking narrow veins that crop out discontinuously between the Aguilareña and West veins (Figure 1). After passing through approximately 2 to 3 m of void/old working within the Aguilareña vein, the hole returned 6.0 m averaging 1.51 g/t Au and 68 g/t Ag from 21.0 m, including 1.65 m at a grade of 3.34 g/t Au and 211 g/t Ag (Table 1). It does not appear that the hole reached the down dip projection of the West vein, which at surface is nearly vertical.

Guadalupana Vein Area

Hole 25CLAU056D was drilled as a 370 m step-out south of historical hole 21CLAU036D. It intersected one of the principal splays of the Guadalupana vein over approximately 3 m from 155.55 to 158.6 m. The vein was strongly brecciated by a post-mineral fault, resulting in poor core recovery. This interval returned maximum values of 0.12 g/t Au and 6.3 g/t Ag.

Hole 25CLAU058D targeted the down-dip extension of the Guadalupana vein, positioned approximately midway in the 800 m gap between the two southernmost historical holes (Figure 1). A previously unrecognized, finely banded quartz vein was intersected from 82.35 to 86.90 m (4.55 m) averaging 0.74 g/t Au and 36 g/t Ag, including a higher-grade subinterval of 0.90 m at 1.31 g/t Au and 32 g/t Ag (Table 1).

The main Guadalupana vein was then intersected over 1.55 m from 225.85 to 227.4 m but returned no significant mineralization. In the hanging wall, a 12.45 m zone of spaced narrow veins and stockwork (from 213.4 to 225.8 m) averaged 0.32 g/t Au and 6 g/t Ag.

Although no high-grade mineralization was encountered in holes 25CLAU056D or 25CLAU058D, these large step-out and reconnaissance holes successfully extended the known strike and down-dip continuity of the Guadalupana vein system. Vein textures and mineralogy indicate that the drilled intersections represent a relatively high level within the paleo-hydrothermal system, warranting additional follow-up drilling.

Quality Assurance/Quality Control

The 2025 drill samples were collected from HQ-diameter core and were logged and sampled at the Pacifica Silver gated and enclosed facility in Santiago Papasquiaro, Durango. Sample lengths varied from 0.25 to 6.5 m, with a median length of 0.85 m. Pacifica Silver geologists marked the core lengthwise to best divide the core into halves, perpendicular to veins, mineralized fractures and vein-breccia. Sample intervals were cut in half lengthwise and one-half of each sample was placed into pre-numbered plastic sample bags with numbered sample tickets and closed with ties. The closed sample bags were placed into numbered shipping sacks along with numbered bags of coarse preparation blanks and certified reference material (CRMs or "standards") inserted with each hole for quality control/quality assurance purposes.

Samples reported in this news release were transported by commercial package delivery to the ALS Minerals (ALS) laboratory in Hermosillo, Sonora, Mexico. At the ALS laboratory, the samples were crushed in their entirety to

Digital Marketing Service Agreements

The Company further reports that, on January 26, 2026, it entered into a six-month digital marketing agreement with Machai Capital Inc. ("Machai"), a Vancouver-based firm specializing in marketing and public awareness for the natural resources, technology, and special situation sectors. Under the agreement, Machai will implement a comprehensive digital marketing campaign commencing in February 2026, encompassing branding, content creation, search engine optimization, search engine marketing, lead generation, social media, email marketing and brand awareness initiatives. The total cost of the campaign is C

In addition, the Company has engaged GRA Enterprises LLC, operating as National Inflation Association ("NIA"), to provide investor relations services (the "Services") for an initial six-month term, with an option for Pacifica to extend the agreement for an additional six months. The total fee for the initial six-month period is US

Qualified Person

Patrick Loury, AIPG CPG, Exploration Technical Advisor for Pacifica Silver, is a Qualified Person for the purposes of National Instrument 43-101 and has reviewed and approved the technical content in this news release.

About Pacifica Silver Corp.

Pacifica Silver Corp. a Canadian resource company led by a proven management team with decades of mining and exploration experience in Mexico. The company is focused on its

Signed,

Todd Anthony

Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Todd Anthony

Phone:778-999-2627

Email: info@pacificasilver.com

Neither the CSE nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" within the meaning of Canadian securities legislation as may be amended from time to time, including, without limitation, statements regarding the perceived merit of the Project, expected timeline for permitting additional drill sites, potential quantity and/or grade of minerals and the potential size of the mineralized zones. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made, and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding the price of gold and silver; the accuracy of mineral resource estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of mineral resource estimates, including but not limited to changes to the cost assumptions, variations in quantity of mineralized material, grade or recovery rates, changes to geotechnical or hydrogeological considerations, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, including concession renewal, commodity price and exchange rate fluctuations, risks relating to COVID-19, the ongoing war in the Ukraine, delays in or failure to receive access agreements or amended permits, risks inherent in the estimation of mineral resources; and risks associated with executing the Company's objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, available on www.sedarplus.ca. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/283159