Hourly Earnings Growth for U.S. Small Business Workers Increases and Job Growth Slows Amid Tight Job Market

Small businesses continued to add jobs in April but at a slower pace. Meanwhile, hourly earnings ticked up to

“Our jobs index remains over 100, indicating continued year-over-year employment growth, yet the pace of growth has slowed,” said John Gibson, Paychex president and CEO. “Demand for qualified workers continues to outweigh supply, which may be forcing employers to consider offering higher wages to attract and retain talent.”

“Hourly earnings growth increased to

Jobs Index and Wage Data Highlights:

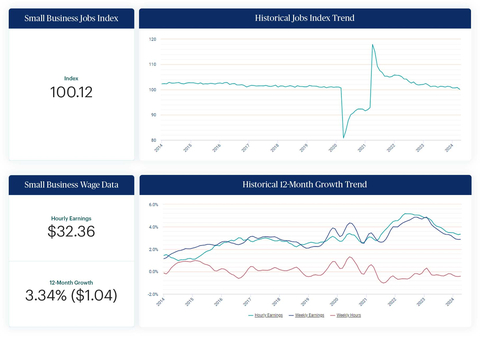

- At 100.12, the national jobs index continues to represent positive job gains but is down 1.06 percentage points from last year (101.18).

-

Hourly earnings growth increased to

3.34% in April, marking the end of a steady deceleration that began mid-2022. However, as weekly hours worked growth (-0.41% ) remains negative year-over-year, weekly earnings growth is below three percent again in April (2.88% ). -

The West (

3.75% ) leads regional hourly earnings growth for the 11th consecutive month.Washington (4.91% ) andSeattle (5.11% ) tops states and metros, respectively, for hourly earnings growth amongU.S. small business workers. - The rate of small business job growth decelerated across all industries in April, though Education and Health Services (101.60) remains one of the strongest sectors for job growth.

-

For the sixth consecutive month, Construction led growth among sectors in hourly earnings (

3.85% ), weekly earnings (3.80% ), and weekly hours worked (0.28% ).

The complete Small Business Employment Watch results for April 2024, including interactive charts detailing the data at a national, regional, state, metro, and industry sector level are available at www.paychex.com/watch. Learn more and sign up to receive monthly Employment Watch alerts.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each month by Paychex, Inc. Focused exclusively on businesses with less than 50 workers, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful industry benchmark delivers real-time insights into the small business trends driving the

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company delivering a full suite of technology and advisory services in human resources, employee benefit solutions, insurance, and payroll. The company serves approximately 740,000 customers in the

View source version on businesswire.com: https://www.businesswire.com/news/home/20240430349010/en/

Tracy Volkmann

Paychex, Inc.

Manager, Public Relations

(585) 387-6705

tvolkman@paychex.com

@Paychex

Colleen Bennis

Matter Communications

Account Director

(585) 666-9510

cbennis@matternow.com

Source: Paychex, Inc.