Pacific Bay Brazil Gold Property Update, Trading Resumption

Rhea-AI Summary

Pacific Bay Minerals (TSXV: PBM) announced the resumption of trading on April 21st, 2025, following a halt since January 7th, 2025. The company is finalizing a definitive option agreement with Appian Capital Advisory to acquire 100% of the Pereira-Velho gold prospect in Alagoas, Brazil.

The project spans 14,596 hectares in the gold-rich Borborema Province. Technical reports confirm gold presence in quartz veins and pyrite-rich zones, with over 6,300 meters of previous drilling. Metallurgical tests indicate strong gold recovery potential from oxidized ores.

The acquisition terms include payments to Appian of CDN$710,000 in cash and CDN$700,000 in either shares or cash, split across two tranches. Appian will retain a 1.5% NSR, which Pacific Bay can buy back for USD $3.5 million. The company has proposed a US$1,560,000 exploration budget including drilling, lab assaying, and metallurgical tests.

Positive

- Strategic acquisition of 14,596-hectare gold property in established mining region

- Previous drilling campaigns (6,300+ meters) confirmed continuous gold mineralization

- Strong gold recovery potential from oxidized ores confirmed by metallurgical tests

- Visible gold identified in multiple drill cores

- Excellent infrastructure with year-round exploration access

Negative

- Additional processing required for sulfide-rich ores, potentially increasing costs

- Significant capital expenditure required (US$1.56M exploration budget)

- Project acquisition and NSR buyback costs create substantial financial obligations

- Technical Report still subject to further review by Exchange

Vancouver, British Columbia--(Newsfile Corp. - April 16, 2025) - Reagan Glazier, President & CEO Pacific Bay Minerals Ltd. (TSXV: PBM) ("Pacific Bay" or, the "Company") reports that the shares of the Company will be reinstated for trading by the TSX Venture Exchange (the "Exchange") on commencement of trading, Monday April 21st, 2025. The shares of the Company were halted upon the Company disclosing in its January 7th, 2025 news release that is had signed a letter of intent to acquire a property in Brazil that was deemed to be a Fundamental Acquisition under Exchange policies and therefore a reviewable transaction. The resumption follows provision to the Exchange of certain information, such as a 43-101 compliant Technical Report on the Pereira-Velho gold prospect (the "Project") in Alagoas State, Brazil, which report remains subject to further comment and review by the Exchange, and a draft of the definitive option agreement with Appian Capital Advisory ("Appian") whereby Pacific Bay proposes to acquire

"Pacific Bay looks forward to completing this transaction as soon as possible and opening an exciting new chapter of gold exploration in Brazil," said Pacific Bay President & CEO Reagan Glazier. "The markets are volatile, but gold has remained strong and I believe this is a great time to be taking on such a promising property."

The Pereira-Velho Gold Prospect

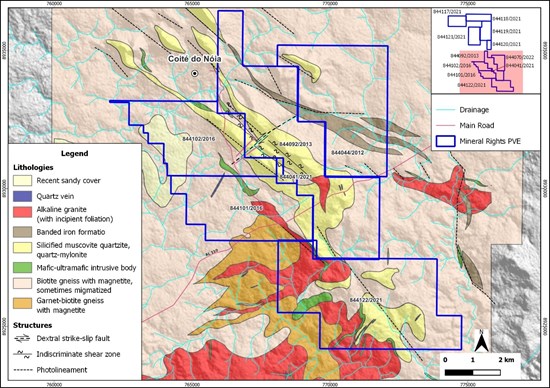

The following are key findings from the Technical Report on the Project, located in Coité do Nóia, Alagoas, Brazil.

Covering 14,596 hectares in the gold-rich Borborema Province, the project benefits from excellent road access and proximity to the commercial hub of Arapiraca, supporting year-round exploration in a tropical climate.

The Technical Report, prepared by RBM Serviços Técnicos Ltda., highlights significant gold discoveries driven by past exploration, including soil sampling, trenching, and two drilling campaigns totaling over 6,300 meters. These efforts confirmed gold in quartz veins and pyrite-rich zones, with continuous mineralization at depth-pointing to a promising orogenic gold system. Sample testing followed strict industry standards, verifying reliable gold grades and visible gold in drill cores.

Metallurgical tests suggest strong gold recovery potential from oxidized ores using methods like cyanidation or heap leaching, though sulfide-rich ores may require additional processing to unlock their value. The project's geology features ancient metamorphic rocks-gneisses, quartzites, and banded iron formations-ideal for hosting gold deposits.

The Technical Report recommends a US

With an eight-month exploration plan proposed, Pacific Bay is poised to unlock the full promise of Pereira Velho, delivering value to shareholders and stakeholders alike.

| Activity | Cost (US$) |

| Drilling | 850,000 |

| Lab assaying | 150,000 |

| Metallurgical tests | 25,000 |

| Resources statement report | 38,000 |

| Vehicles/rent/facilities/IT | 55,000 |

| G&A | 300,000 |

| Continency ( | 142,000 |

| Subtotal |

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_002full.jpg

Figure 2 Hills formed by quartzites, facing southeast

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_003full.jpg

Figure 3 Geological map with the main lithologies and structural features within the Pereira Velho Project area.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_004full.jpg

Figure 4 (a) Outcrop of fractured quartzite with the presence of (b) folded structure (flexural?); (c) quartzite with foliation trending to the NE and with boxwork and (d) outcrop of the quartzite with foliation trending to the SW

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_005full.jpg

Figure 5 (a, b) Drill core composed of biotite gneiss with propylitic alteration; (c) quartzo-feldspathic gneiss with argillic alteration.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_006full.jpg

Figure 6 (a) Free gold (VG-visible gold) identified in hole PVDH-045, at a depth of 49.50 meters; (b) Free gold (VG-visible gold) in hole PVDH-015, at a depth of 95.65 m

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_007full.jpg

Figure 7 Visible gold (VG) in drill core sample, PVDH-007

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_008full.jpg

Figure 8 Map with the compilation of soil geochemistry campaigns carried out by MVV and PVE. First-order anomalies for gold marked in magenta with values between 100 and 1090 ppb.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_009full.jpg

The Agreement

As previously announced, key terms of the Agreement are:

Payment to Appian of CND

- Upon signing the definitive agreement and obtaining necessary approvals:

- CDN

$280,000 in cash. - CDN

$250,000 in cash or common shares.

- CDN

- On the first anniversary of the definitive agreement:

- CDN

$430,000 in cash. - CDN

$450,000 in cash or common shares.

- CDN

Appian is to retain a

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Mr. David Bridge, P.Geo., a consultant of the Company, who is a "Qualified Person" as defined in NI 43-101

Pacific Bay Minerals Ltd.

Per/

Reagan Glazier, President and CEO

reagan@pacificbayminerals.com

(604) 682-2421

pacificbayminerals.com

This News Release contains forward-looking statements, which relate to future events. In some cases, you can identify forward-looking statements by terminology such as "will", "may", "should", "expects", "plans", or "anticipates" or the negative of these terms or other comparable terminology. All statements included herein, other than statements of historical fact, are forward looking statements, including but not limited to the Company's expectations regarding, the closing date of the Financing, the use of proceeds of the Financing and other matters. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking-statements. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith, and reflect the Company's current judgment regarding the direction of its business, actual results will may vary, sometimes materially, from any estimates, predictions, projections, assumptions, or other future performance suggestions herein. Except as required by applicable law, the Company does not intend to update any forward-looking statements to conform these statements to actual results.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/248745