Paragon Technologies Reports First Quarter 2025 Results

Rhea-AI Summary

Positive

- Revenue increased 10% YoY to $34.6 million

- Sale of Ohana unit generated $450,000 one-time gain

- SEDC continues to show sales growth

- Operational improvements at SI Systems with new sales and software professionals

- Contract signed for sale of another unit expected to close in Q2

Negative

- Net loss of $790,000 in Q1 2025, compared to $53,000 loss in Q1 2024

- $1.1 million in legal expenses from litigation, with additional $2+ million expected in Q2

- Investment portfolio declined by $165,000

- SI Systems backlog continues to decline

- SEDC margins remain tight with currency fluctuation impacts

- Potential charges coming from misclassification of former CEO as independent contractor

News Market Reaction 1 Alert

On the day this news was published, PGNT declined NaN%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Addresses Litigation Impact and Strategic Plan Progress

EASTON, PA / ACCESS Newswire / May 13, 2025 / Paragon Technologies, Inc. (OTC PINK:PGNT), a diversified holding company, today announced its financial results for the first quarter ended March 31, 2025.

For the first quarter of the year, Paragon's revenues increased by roughly

The board has initiated proceedings against the company's former legal counsel to recover the costs associated with the Gad litigation as it contends that the litigation was attributable to faulty legal advice provided by the company's former legal counsel.

Sam Weiser, Interim CEO at Paragon commented, "At SI Systems several operational improvements are underway that are designed to benefit shareholders in coming quarters. First, SI added two dedicated professionals in the first quarter who have restarted outbound sales calls to both our installed base and to targeted prospects. This effort is especially critical as our backlog continues to decline. In addition, SI has added two additional software professionals dedicated to a project designed to rewrite the company's operating software for its dispensing equipment; a project expected to be completed in the first half of 2026. This project is necessary as previous management terminated or drove away experienced SI professionals with the institutional knowledge related to the software's operation. As such, the current project is designed first to document the current code prior to the second phase where the operating system will be rewritten. Upon completion, the company's operating software for dispensing equipment will be properly documented to prevent this situation from recurring in the future. The costs associated with this project are being capitalized and will be expensed over the useful life of the updated software."

Mr. Weiser further noted, "SEDC sales continue to grow although margins remain tight, and currency fluctuations continue to impact the SEDC profit contribution. Additionally, the company closed on the sale of one Ohana unit which resulted in a one-time gain of

Mr. Weiser concluded, "We anticipate ongoing improvements at SI to have a positive impact on our results going forward. SEDC continues to increase sales which should contribute to an increase in profitability assuming a stable currency relationship between the Colombian peso and US dollar. Now that the Gad litigation is behind us, the true earnings power of the company will be evident in the second half of the year."

First Quarter 2025 Results

Revenue for the first quarter of 2025 increased to

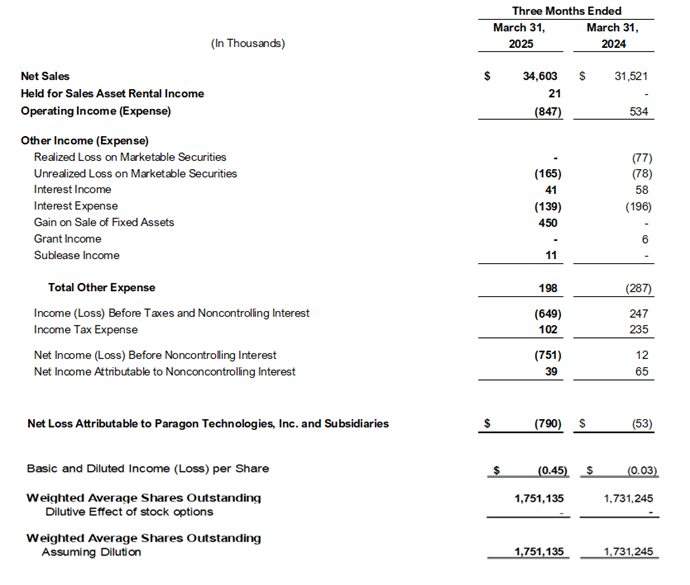

Paragon Technologies, Inc.'s Consolidated Statement of Operations for the three months ended March 31, 2025, are summarized below. For further detail on our results, shareholders should carefully review our quarterly report, which can be found at www.pgntgroup.com.

Consolidated Statements of Income and Comprehensive Income (Loss)

For the Quarter Ended March 31, 2025, 2024

About Paragon Technologies

Paragon Technologies, Inc. is a holding company owning subsidiaries that engage in diverse business activities, including material handling, distribution, real estate, and investments. For additional information please visit: www.pgntgroup.com.

Investor Relations Contact:

Alliance Advisors IR

ParagonIR@allianceadvisors.com

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements concern the Company's operations, financial condition and performance and are based largely on the Company's beliefs and expectations. These statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others, those related to: general economic conditions, including those in the markets in which the Company operates; the Company's ability to expand its revenue streams; technological changes in the Company's industry; the continued acceptance of the Company's distribution channel by vendors and customers; decreased demand for the Company's products and services and the Company's ability to retain or replace its significant customers; factors affecting the capital markets and share prices generally; economic and political risks of selling products in foreign countries, including risks of non-compliance with U.S. and foreign laws and regulations; cybersecurity risks and risks of damage and interruptions of information technology systems; and the Company's ability to complete acquisitions, strategic investments, divestitures, mergers or other transactions on acceptable terms or at all. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors, nor can management assess the impact of all such factors on the Company's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All statements in this press release other than statements that are purely historical are forward-looking statements. The Company does not intend and assumes no obligation, to update any forward-looking statements made in this press release. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this press release. For further information, contact the company at info@pgntgroup.com

SOURCE: Paragon Technologies, Inc.

View the original press release on ACCESS Newswire