National Survey: Middle-Income Americans Grapple With Growing Financial Uncertainty; Inflation Once Again Is Top Concern

Food and Grocery Costs Expected to Rise According to

The latest Primerica Household Budget Index™ (HBI™), which measures the purchasing power of middle-income families, found that middle-income families’ perceptions of their personal finances align with overall economic conditions. Eighty-six percent (

“Middle-income Americans continue to face significant financial stress, and they are not anticipating relief in the near future,” said Glenn J. Williams, CEO of Primerica. “This makes having a clear financial game plan even more essential to helping families navigate whatever the future brings. Prioritization is key — understanding where to focus, what to adjust and how to stay on track amid economic uncertainty.”

The latest Primerica Household Budget Index™ (HBI™), which measures the purchasing power of middle-income families, found that middle-income families’ perceptions of their personal finances align with overall economic conditions. Eighty-six percent (

“Middle-income Americans are navigating a financial landscape that feels increasingly unpredictable, with rising costs stretching household budgets and disproportionately impacting middle-income families, accounting for over

Additional key findings from Primerica’s Q1 2025 U.S. Middle-Income Financial Security Monitor™ (FSM™)

-

Middle-income Americans are increasingly concerned about their financial future. Nearly half (

46% ) of respondents expect their financial situation to worsen in the coming year, up from27% in Q4 2024. Only18% believe their situation will improve in the next year, compared with26% of respondents in the previous survey. -

Families are cutting back on spending. Reaching the highest level in two years,

78% report limiting non-essential purchases, such as eating out and entertainment. In addition,64% say they are setting aside money for an emergency fund, up from59% in the previous survey. -

Changing jobs or even adding a second one is top of mind to close the gap between incomes and expenses. Fifty-two percent (

52% ) report either considering getting or already having a second job. More than half (55% ) are considering changing or are already actively switching jobs. -

Majority expect a 2024 tax refund. Fifty-three percent (

53% ) anticipate getting money back on their returns this year, with the top plans for those refunds including: saving (38% ), paying down debt (32% ) and/or paying outstanding bills (30% ).

Primerica Financial Security Monitor™ (FSM™) Topline Trends Data

Mar 2025 |

Dec

|

Sept

|

Jun 2024 |

Mar 2024 |

Dec 2023 |

Sept 2023 |

Jun 2023 |

Mar 2023 |

|

How would you rate the condition of your personal finances? |

|||||||||

Share reporting “Excellent” or “Good.” |

|

|

|

|

|

|

|

|

|

Analysis: Respondents’ assessments of their personal finances are down slightly from where they were a year ago. |

|||||||||

Overall, would you say your income is…? |

|||||||||

Share reporting “Falling behind the cost of living” |

|

|

|

|

|

|

|

|

|

Share reporting “Stayed about even with the cost of living” |

|

|

|

|

|

|

|

|

|

Analysis: Concern about meeting the increased cost of living remained steady with |

|||||||||

And in the next year, do you think the American economy will be…? |

|||||||||

Share reporting “Worse off than it is now” |

|

|

|

|

|

|

|

|

|

Share reporting “Uncertain” |

|

|

|

|

|

|

|

|

|

Analysis: The share of respondents expecting the economy to worsen over the next year has risen sharply since the previous poll. |

|||||||||

Do you have an emergency fund that would cover an expense of |

|||||||||

Reporting “Yes” responses |

|

|

|

|

|

|

|

|

|

Analysis: The percentage of Americans who have an emergency fund that would cover an expense of |

|||||||||

How would you rate the economic health of your community? |

|||||||||

Reporting “Not so good” and “Poor” responses |

|

|

|

|

|

|

|

|

|

Analysis: Respondents’ rating of the economic health of their communities has gotten worse over the past year. |

|||||||||

How would you rate your ability to save for the future? |

|||||||||

Reporting “Not so good” and “Poor” responses |

|

|

|

|

|

|

|

|

|

Analysis: A significant majority continue to feel it is difficult to save for the future. |

|||||||||

In the past three months, has your credit card debt…? |

|||||||||

Reporting “Increased” responses |

|

|

|

|

|

|

|

|

|

Analysis: Credit card debt has remained about the same over the past year. |

|||||||||

About Primerica’s Middle-Income Financial Security Monitor™ (FSM™)

Since September 2020, the Primerica Financial Security Monitor™ has surveyed middle-income households quarterly to gain a clear picture of their financial situation, and it coincides with the release of the monthly HBI™ four times annually. Polling was conducted online from March 3-6, 2025. Using Dynamic Online Sampling, Change Research polled 1,240 adults nationwide with incomes between

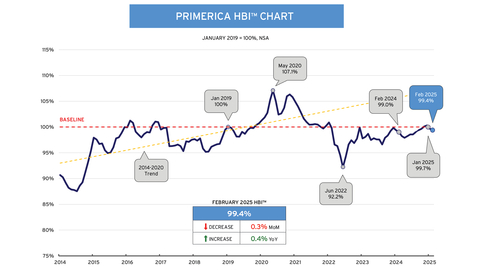

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed monthly on behalf of Primerica by its chief economic consultant Amy Crews Cutts, PhD, CBE®. The index measures the purchasing power of middle-income families with household incomes from

The HBI™ uses January 2019 as its baseline, with the value set to

Periodically, prior HBI™ values may be modified due to revisions in the CPI series and Consumer Expenditure Survey releases by the

About Primerica, Inc.

Primerica, Inc., headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20250409910736/en/

Media Contact:

Gana Ahn

678-431-9266

Email: Gana.Ahn@primerica.com

Investor Contact:

Nicole Russell

470-564-6663

Email: Nicole.Russell@primerica.com

Source: Primerica, Inc.