Pershing Square Tontine Holdings, Ltd. Notes Disclosure

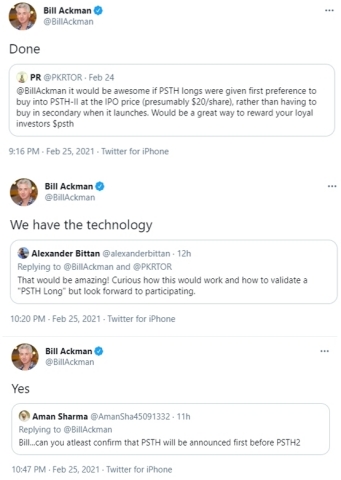

Pershing Square Tontine Holdings, Ltd. (NYSE:PSTH) (the “Company”) may provide information to the public via the Twitter account of its Chairman and CEO, Bill Ackman. Investors should follow this account for information about the Company. The following tweets were issued on that account during the evening of February 25, 2021.

(Photo: Business Wire)

About Pershing Square Tontine Holdings, Ltd.

Pershing Square Tontine Holdings, Ltd. (the “Company”), a Delaware corporation, is a newly organized blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with a private company. The Company is sponsored by Pershing Square TH Sponsor, LLC (the “Sponsor”), an affiliate of Pershing Square Capital Management, L.P. (“PSCM”), a registered investment advisor with more than

View source version on businesswire.com: https://www.businesswire.com/news/home/20210226005439/en/