Provenance Gold Closes Upsized Private Placement and Provides Drilling Update

Rhea-AI Summary

Provenance Gold (OTCQB: PVGDF) has successfully closed an upsized non-brokered private placement, raising $2,541,800 through the issuance of 12,709,000 units at $0.20 per unit. Each unit includes one common share and a half warrant exercisable at $0.25 until July 17, 2028.

The company has completed seven drill holes at its Eldorado project in Eastern Oregon, with the eighth underway. The drilling program targets expansion of the 2023 discovery zone and tests new areas, with all completed holes showing visual mineralization. Additionally, Provenance has granted 1,900,000 stock options to officers, directors, and consultants at $0.22 per share with a 36-month term.

Positive

- Successfully raised $2.54 million through an upsized private placement

- All completed drill holes showed visual mineralization

- Previous drilling results showed significant gold mineralization (2.01 g/t Au over 288.34m)

- Company has funds to continue summer drilling program

Negative

- Significant share dilution with 12.7 million new units issued

- Additional dilution potential from warrants and broker warrants

- Securities subject to resale restrictions until November 18, 2025

News Market Reaction

On the day this news was published, PVGDF declined 5.56%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - July 17, 2025) - Provenance Gold Corp. (CSE: PAU) (OTCQB: PVGDF) (the "Company" or "Provenance") is pleased to announce the closing of its non-brokered private placement (the "Offering") for gross proceeds of

Upon closing of the final tranche, the Company issued 12,709,000 units (each, a "Unit") at a price of

"We would like to thank our shareholders for their support and interest in our projects. Our Eldorado West and Eldorado East acquisitions are standing out to investors as a district-scale opportunity in Eastern Oregon. We continue to advance these projects diligently and are excited to have this financing behind us to enable our drill program to continue throughout the summer. We are excited to finally start receiving assays and continue to build on the gold mineralization and footprint at Eldorado. This project has unusually strong grade and scale. I believe it is just beginning to reveal its impressive dimensions as we continue to expand our exploration and drilling." - Rauno Perttu, CEO

In connection with closing the Offering, the Company paid

Drilling Update

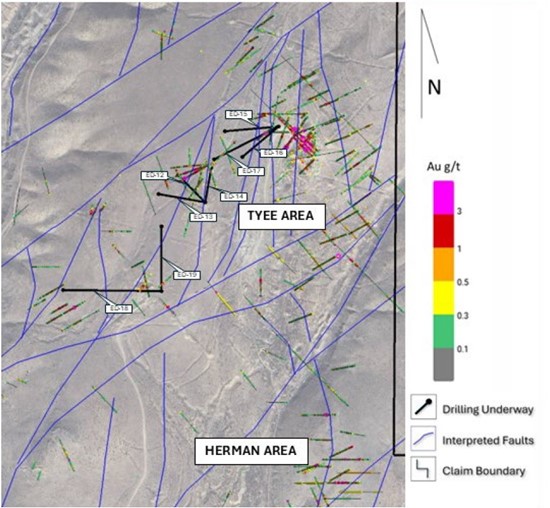

Seven drill holes (Figure 1) have been completed to date, with the eighth currently underway.

- Holes ED12-14 target expansion of the 2023 discovery zone from RC hole ED-04 and core holes EC-02 and EC-03.

- Holes ED-15-17 test the gap between this zone and the one intersected by core hole EC-01 (2.01 g.t Au over 288.34m: see December 9th, 2024 new release).

- Holes ED-18 and 19 and the next two are testing a significant step-out area to the southwest.

All completed holes exhibited visual mineralization. Results will be released when available.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5654/259114_provimg1.jpg

Stock Options

The Company also announces that it has granted 1,900,000 stock options to certain officers, directors and consultants of the Company. The options have an exercise price of

About Provenance Gold Corp.

Provenance Gold Corp. is a precious metals exploration company with a focus on gold and silver mineralization within North America. The Company currently holds interests in Nevada, and eastern Oregon, USA. For further information please visit the Company's website at https://provenancegold.com or contact Rob Clark, President at rclark@provenancegold.com.

On behalf of the Board,

Provenance Gold Corp.

Rauno Perttu, Chief Executive Officer

Safe Harbor Statement: Neither the Canadian Securities Exchange, nor its regulation services provider, accepts responsibility for the adequacy or accuracy of this press release. This news release may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When or if used in this news release, the words "anticipate", "believe", "estimate", "expect", "target, "plan", "forecast", "may", "schedule" and similar words or expressions identify forward-looking statements or information. Such statements represent the Company's current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259114