Red Pine Commences Focused Surface Drilling Program to Assess Potential for Near-Term, Open Pit Production

Rhea-AI Summary

Positive

- Strategy to generate early cash flow through open pit mining with minimal initial capital investment

- Existing infrastructure including 13,000m of underground development and proximity to roads and power

- Available excess mill capacity within trucking distance for toll milling arrangement

- Fully funded 25,000m exploration program with 65% already completed

- High gold price environment (US$2,200/oz) supporting operational viability

Negative

- Project still requires completion of technical studies and environmental approvals

- Need for Indigenous community engagement and permitting processes

- Preliminary Economic Assessment not expected until H1 2026

- Reliance on third-party toll milling arrangements

News Market Reaction – RDEXF

On the day this news was published, RDEXF gained 8.97%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

TORONTO, May 08, 2025 (GLOBE NEWSWIRE) -- Red Pine Exploration Inc. (TSXV: RPX, OTCQB: RDEXF) (“Red Pine” or the “Company”) is pleased to announce that it is evaluating the potential of developing an early-stage open pit operation at its Wawa Gold Project, Ontario.

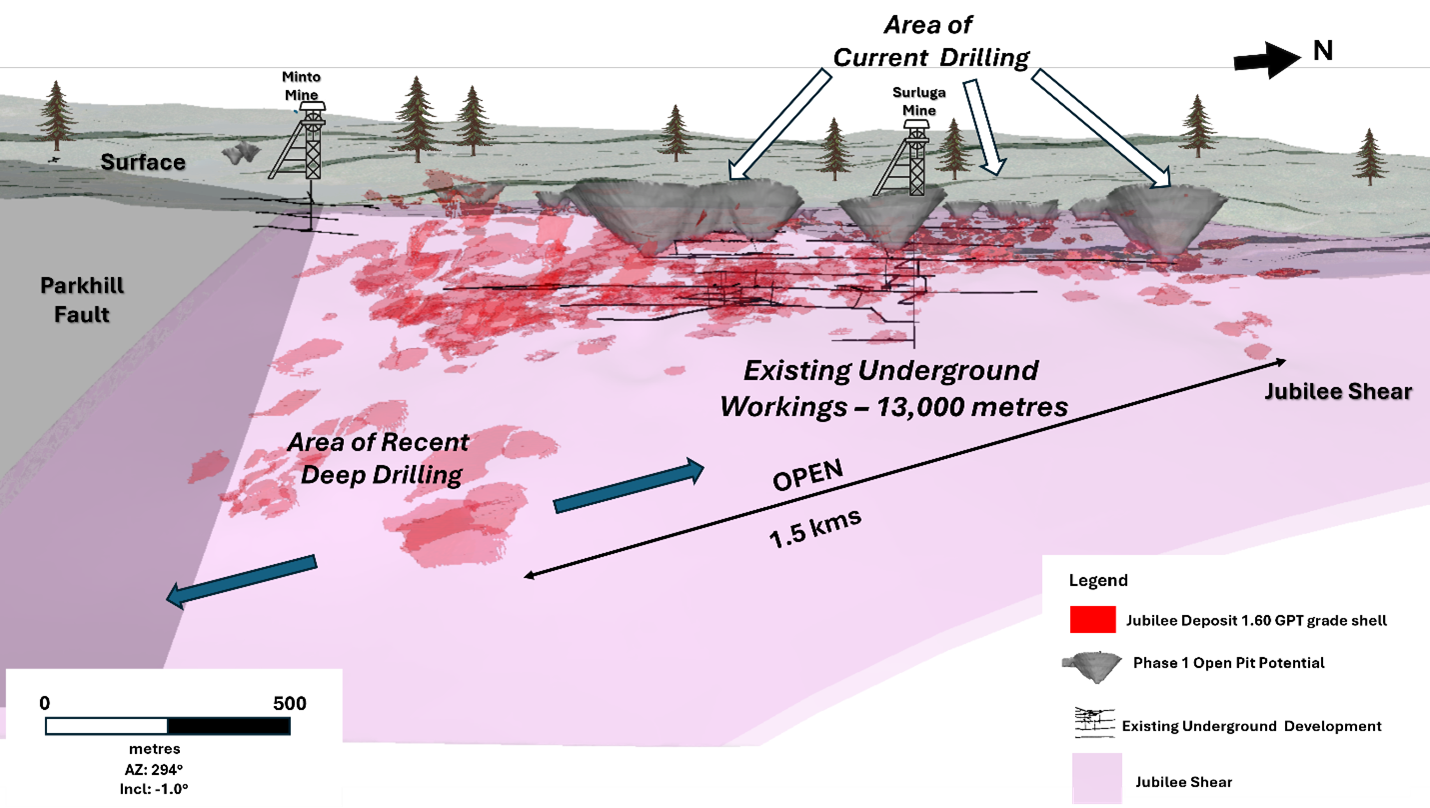

Management has initiated a review to assess the viability of near-term, open pit production in the current high-gold price environment, in parallel with its exploration program testing the Jubilee Shear at depth beyond the 2024 Mineral Resource Estimate (the “2024 MRE”). The Wawa Gold Project offers the opportunity to capitalize on the gold mineralization which extends to the surface, on a historic mining property and within a region having considerable infrastructure including excess mill capacity. The concepts under consideration include contract open pit mining with an off-site toll milling arrangement at one of the existing plants within the greater Michipicoten mining camp, allowing the Company to potentially benefit from early-stage cash flow to advance the long-term vision of developing a larger, open pit and underground operation.

Highlights

- Red Pine is refocusing a component of its drilling program to evaluate a potential open pit operation in two areas of the Jubilee Shear with approximately 8,500 m of drilling planned over a 3-month period (Figure 1). Scope for this shallow drilling is within the 2025 exploration budget.

- Drilling also continues to test the Jubilee Shear at depth beyond the 2024 MRE.

- Red Pine will initiate Indigenous community engagement, technical studies and environmental baseline work to allow for the future permitting and environmental approvals through the Ontario provincial processes.

- Internal assessments guiding the change in strategy were made based on a gold price of US

$2,200 /oz, which supports an open-pit operation and potentially allows for a faster ramp-up to production to enable the Company to self-fund the assessment of the project's larger open pit and underground potential. - The early open pits scenario would potentially generate free cash with a very small need for initial capital for future development of the larger mine.

- The region hosts excellent infrastructure and excess mill capacity; all within trucking distance.

- The Company intends to update the 2024 MRE with the completion of the 8,500 m surface drilling program as well as this review, with the objective to concurrently work towards a preliminary economic assessment (“PEA”), anticipated for completion in H1 2026.

Michael Michaud, President and CEO of Red Pine commented: “In this environment of record gold prices, our vision is to outline a path to near-term production for the shallower parts of the Jubilee Shear as we continue to delineate a larger open-pit and underground resource. This initiative represents an important opportunity to generate near-term cash flow while simultaneously advancing the long-term vision of developing a larger open pit and underground operation.

By integrating additional shallow drilling to outline a path to potential near-term production and progressing through the provincial permitting process alongside Indigenous engagement, we are positioning the Company for future growth. We believe this approach will unlock significant value for our shareholders while reinforcing Red Pine’s commitment to responsible and sustainable long-term resource development.

This phased approach could allow us to capitalize on the extensive on-site infrastructure, including 13,000 metres of underground development and close proximity to road, power and other mining operations necessary to support toll milling.”

Ongoing Drilling Program

Red Pine is currently drilling with 2 rigs and has completed approximately

Qualified Person

Jean-Francois Montreuil, P.Geo. and Vice President, Exploration of Red Pine and the Qualified Person, as defined by National Instrument 43-101, has reviewed and approved the technical information contained in this news release.

About Red Pine Exploration Inc.

Red Pine Exploration Inc. is a gold exploration company headquartered in Toronto, Ontario, Canada. The Company's shares trade on the TSX Venture Exchange under the symbol "RPX" and on the OTCQB Markets under the symbol “RDEXF”.

The Wawa Gold Project is in the Michipicoten Greenstone Belt of Ontario, a region that has seen major investment by several producers in the last five years. The Company’s land package hosts numerous historic gold mines and is over 7,000 hectares in size. Red Pine is building a strong position as a major mineral exploration and development player in the Michipicoten region.

For more information about the Company, visit www.redpineexp.com

Or contact:

Michael Michaud, President and Chief Executive Officer, at (416) 364-7024 or mmichaud@redpineexp.com

Or

Manish Grigo, Director of Corporate Development, at (416) 569-3292 or mgrigo@redpineexp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains statements which constitute “forward-looking information” within the meaning of applicable securities laws, including statements regarding the plans, intentions, beliefs and current expectations of the Company with respect to future business activities and operating performance.

Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions. Forward-looking information contained in this news release includes, but may not be limited to, statements regarding the potential of developing an early stage open-pit operation, updating the 2024 MRE and completing a PEA in Q1 2026.. Investors are cautioned that forward-looking information is not based on historical facts but instead reflects management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Such opinions, assumptions and estimates are inherently subject to a variety of risks and uncertainties that could cause actual events or results to differ materially from those projected and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information are: the Company's expectations in connection with the projects and exploration programs being met, the impact of general business and economic conditions, global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future conditions, fluctuating gold prices, currency exchange rates (such as the Canadian dollar versus the United States Dollar), variations in ore grade or recovery rates, changes in accounting policies, changes in the Company's mineral reserves and resources, changes in project parameters as plans continue to be refined, changes in project development, construction, production and commissioning time frames, the possibility of project cost overruns or unanticipated costs and expenses, higher prices for fuel, power, labour and other consumables contributing to higher costs and general risks of the mining industry, failure of plant, equipment or processes to operate as anticipated, unexpected changes in mine life, seasonality and weather, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, and limitations on insurance.

This information contained in this news release is qualified in its entirety by cautionary statements and risk factor disclosure contained in filings made by the Company, including the Company’s financial statements and related MD&A for the year ended July 31, 2024, and the interim financial reports and related MD&A for the period ended January 31, 2024, April 30, 2024, October 31, 2024, and January 31, 2025 filed with the securities’ regulatory authorities in certain provinces of Canada and available at www.sedar.com.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Figure 1 - 3D view showing conceptual pits and existing underground workings.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f0b30280-4fab-4399-b426-589c912c0425