ROK Resources Announces Full Repayment of its Credit Facility & Working Capital Surplus

Rhea-AI Summary

Positive

- Successful unwinding of crude oil swap hedges generating $6.29 million in proceeds

- Achievement of $4.0 million working capital surplus

- Complete repayment of existing line of credit

- Significant debt reduction of over $85 million since 2022

- 38% increase in base production from 2,900 to 4,000 boepd

Negative

- None.

NOT FOR DISTRIBUTION TO THE U.S. NEWSWIRE OR FOR DISSEMINATION IN THE UNITED STATES

REGINA, SK / ACCESS Newswire / May 7, 2025 / ROK Resources Inc. ("ROK" or the "Company") (TSXV:ROK)(OTCQB:ROKRF) is pleased to announce, consistent with the Company's ongoing corporate strategy to expeditiously reduce debt, the Company has unwound its crude oil swap hedges generating proceeds of

The proceeds of the settlement of the crude oil swap hedges have been used to fully repay the Company's existing line of credit. Since 2022, the Company has retired more than

The Company will continue to manage free cash flow to further enhance its already stable balance sheet, facilitate strategic area growth when appropriate, and consider alternative ways to maximize shareholder value.

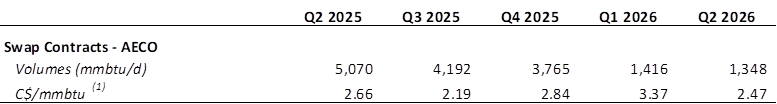

Hedging Update

The Company's remaining natural gas swaps are as follows:

Notes:

Prices reported are the average price for the period

Based on a WTI forecast price of US

$60 per barrel

About ROK

ROK is primarily engaged in petroleum and natural gas exploration and development activities in Alberta and Saskatchewan. It has offices located in both Regina, Saskatchewan, Canada and Calgary, Alberta, Canada. ROK's common shares are traded on the TSX Venture Exchange under the trading symbol "ROK".

For further information, please contact:

Bryden Wright, President and Chief Executive Officer

Jared Lukomski, Senior Vice President, Land & Business Development

Phone: (306) 522-0011

Email: investor@rokresources.ca

Website: www.rokresources.ca

Conversion Measures

Production volumes and reserves are commonly expressed on a barrel of oil equivalent ("boe") basis whereby natural gas volumes are converted at the ratio of 6 thousand cubic feet ("Mcf") to 1 barrel of oil ("bbl"). Although the intention is to sum oil and natural gas measurement units into one basis for improved analysis of results and comparisons with other industry participants, boe's may be misleading, particularly if used in isolation. A boe conversion ratio of 6 Mcf to 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. In recent years, the value ratio based on the price of crude oil as compared to natural gas has been significantly higher than the energy equivalency of 6:1 and utilizing a conversion of natural gas volumes on a 6:1 basis may be misleading as an indication of value.

Abbreviations

bbls/d bopd | barrels per day barrels per day | |

boepd | barrels oil equivalent per day | |

IP | Initial Production | |

NGLs | Natural Gas Liquids | |

Mboe Mg/l | Thousands of barrels of oil equivalent Milligrams per Litre | |

MMboe mmbtu | Millions of barrels of oil equivalent Million British thermal units | |

PDP | Proved Developed Producing | |

TP | Total Proved Reserves | |

TPP | Total Proved and Probable Reserves | |

WTI C$ US$ | West Texas Intermediate, the reference price paid in U.S. dollars at Cushing, Oklahoma for the crude oil standard grade Canadian dollars U.S. dollars |

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation that are not historical facts. Forward-looking statements involve risks, uncertainties, and other factors that could cause actual results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements with respect to the Company's objectives, goals, or future plans and the expected results thereof. Forward-looking statements are necessarily based on several estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include but are not limited to general business, economic and social uncertainties; litigation, legislative, environmental, and other judicial, regulatory, political and competitive developments; delay or failure to receive board, shareholder or regulatory approvals; those additional risks set out in ROK's public documents filed on SEDAR+ at www.sedarplus.ca; and other matters discussed in this news release. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Except where required by law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether because of new information, future events, or otherwise.

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility of the adequacy or accuracy of this release.

SOURCE: ROK Resources Inc.

View the original press release on ACCESS Newswire