Middle-Income Consumers Remain Confident Amidst Price Pressures, Santander US Survey Finds

-

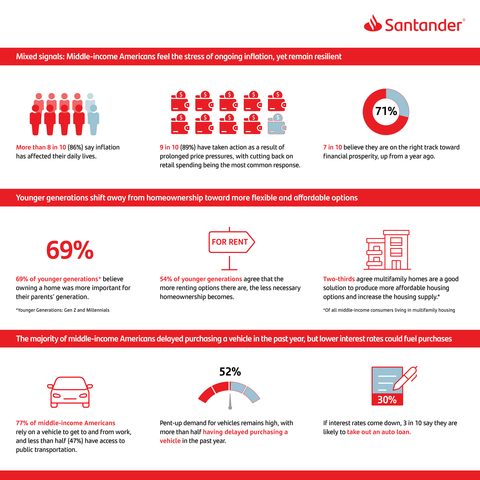

81% consider inflation a major concern, the highest level over the past year.

- Most middle-income households have remained current on their bills, though more are making spending cuts to manage higher prices.

- Gen Z and millennials have shifted their mindset around homeownership and find flexibility in renting, with 6 in 10 believing homeownership as a sign of financial prosperity is outdated.

-

Federal Reserve rate cuts could unlock pent-up vehicle demand, with

52% delaying a vehicle purchase over the last year.

(Graphic: Business Wire)

When it comes to their economic outlook and the possibility of a recession, consumers are sending mixed signals. While economic indicators suggest the economy is stable, a majority of middle-income Americans remain uncertain. More than six in 10 (

Amidst concerns about inflation and economic uncertainty, middle-income Americans are adapting to conditions. Most (

“Consumers continue to take actions to manage their finances and navigate economic stressors,” said Tim Wennes, CEO of Santander US. “Their ability to make necessary budget decisions to remain current on their bills and manage the overall economic uncertainty over the past few years has helped to boost their confidence. Looking ahead, I expect to see these behavioral changes lead to fundamental shifts in consumers’ financial priorities.”

The survey identified a change in mindset around homeownership, which is falling in importance as consumers seek out flexibility and affordability, especially among younger generations. Seven in 10 Gen Z and millennials say owning a home was more important for their parents’ generation. Meanwhile, vehicle access remains a top priority. The majority (

While many households continue to feel the effects of inflation, few consumers have taken advantage of the higher rates available on savings through a high-yield savings account or certificate of deposit (CD). Six in 10 households have not yet moved their savings to earn a higher rate of interest, and

“Many consumers hold misperceptions about opening high-yield savings accounts, including that they are too difficult to open or aren’t worth the effort,” said Wennes. “Many consumers could be putting their hard-earned savings to work for them by opening a high-yield savings account, which can now take only a matter of minutes. At Santander, we are working on introducing a new, national digital offering that will reduce the friction to create a fast onboarding experience and make it easier for customers to take advantage of higher rates.”

The study, which built upon previous research, assessed middle-income Americans’ current financial state and future aspirations, with a focus on how current economic conditions have impacted their households. It also explored their financial relationships with drivers of prosperity.

Homeownership vs. Renting

Middle-income Americans’ perspective on homeownership has shifted, with many now valuing renting as an option. This is especially true among younger generations. Six in 10 Gen Zers and millennials believe homeownership as a sign of financial prosperity is an outdated concept, and more than half (

While many renters cite benefits such as flexibility to pursue employment opportunities and access to more amenities,

Vehicle Access Critical for Consumers

Middle-income Americans continue to rely on vehicle access. The majority (

This research on financial prosperity, conducted by Morning Consult on behalf of Santander US, surveyed 2,202 Americans who are bank and/or financial services customers, ages 18-76. Survey participants are employed or looking for work, own/use at least one financial product and are the primary or shared decision-maker on household finances with household income in the “middle-income” range of

The full report and more information about the Santander US survey is available here.

About Santander US

Santander Holdings USA, Inc. (SHUSA) is a wholly-owned subsidiary of

Santander Bank, N.A. is a Member FDIC and a wholly owned subsidiary of Banco Santander, S.A. © 2024 Santander Bank, N.A. All rights reserved. Santander, Santander Bank, and the Flame Logo are trademarks of Banco Santander, S.A. or its subsidiaries in

View source version on businesswire.com: https://www.businesswire.com/news/home/20241008356038/en/

Media:

Andrew Simonelli

andrew.simonelli@santander.us

Caroline Connolly

caroline.connolly@santander.us

Source: Santander Holdings USA, Inc.