SecureTech Announces Major Milestones in Strategic Growth Plan

Rhea-AI Summary

SecureTech Innovations (OTC: SCTH) has announced significant progress in its 2025 strategic growth initiatives under new CEO J. Scott Sitra. Key achievements include: a 55% reduction in outstanding shares from 78M to 35M, with plans to reach 17M by Q3 2025; signing an MOU to acquire a technology company with $3M FY2024 revenue and $10M projected for FY2025; establishing two new subsidiaries (Terra Nova Technologies and Top Kontrol); and advancing plans for a Bitcoin treasury reserve. The company is preparing for a potential NASDAQ or NYSE uplisting later this year and is in discussions with investment banks for growth capital. Additionally, SecureTech plans to spin off Terra Nova Technologies as a separate OTCQB-listed entity.

Positive

- Share consolidation reduced outstanding shares by 55% (from 78M to 35M), enhancing per-share value

- Planned acquisition of a company with $3M revenue in FY2024 and projected $10M for FY2025

- Advanced discussions with investment banks for growth capital and potential NASDAQ/NYSE uplisting

- Strategic spin-off of Terra Nova Technologies planned to create additional shareholder value

Negative

- Current OTC listing status indicates lower trading liquidity

- Acquisition deal still pending completion of PCAOB audit

- Potential dilution risk from planned capital raising activities

- No specific timeline provided for NASDAQ/NYSE uplisting

Roseville, Minnesota, May 20, 2025 (GLOBE NEWSWIRE) -- SecureTech Innovations, Inc. (OTC: SCTH), an emerging leader in cybersecurity, Web3 solutions, and advanced security technologies, is pleased to share a comprehensive update on its strategic initiatives for 2025. Since joining the SecureTech team in January, President and CEO J. Scott Sitra has focused on advancing the key priorities outlined in SecureTech’s roadmap for innovation and growth. Each achieved strategic milestone increases underlying shareholder value, enhances operational efficiencies, and positions the company for long-term growth and success.

2025 Strategic Milestones and Corporate Developments Achieved:

- Share Structure Optimization: As part of its capital markets strategy, SecureTech completed a significant share consolidation that reduced its issued and outstanding shares by

55% , from 78 million to nearly 35 million. The company continues pursuing further reductions to reach its target share count of about 17 million by the end of Q3 2025. This initiative underscores SecureTech’s commitment to enhancing per-share value, strengthening market confidence, and advancing it towards a national market uplisting.

- Launched Mergers & Acquisitions Program: SecureTech recently signed a Memorandum of Understanding (MOU) to acquire a rapidly growing international technology enterprise with FY2024 revenue of nearly

$3 million and projections of$10 million for FY2025. A PCAOB auditing firm is conducting the required two-year SEC-mandated audit, with closing anticipated in June 2025. This acquisition aligns with SecureTech’s strategy to broaden its global presence as an innovative technology leader. SecureTech is also evaluating additional M&A opportunities targeting businesses with cutting-edge technologies and annual revenues between$5 million and$10 million , with the goal of quickly strengthening the company’s financial position and boosting long-term growth prospects.

- Capital Formation and National Exchange Uplisting Preparation: SecureTech is engaged in advanced discussions with multiple investment banks and institutional investors to secure growth capital aimed at expanding operations, strengthening its balance sheet, and supporting a planned application for uplisting to the NASDAQ or NYSE later this year. These efforts reflect the company’s commitment to improving liquidity, increasing institutional visibility, and building overall shareholder value.

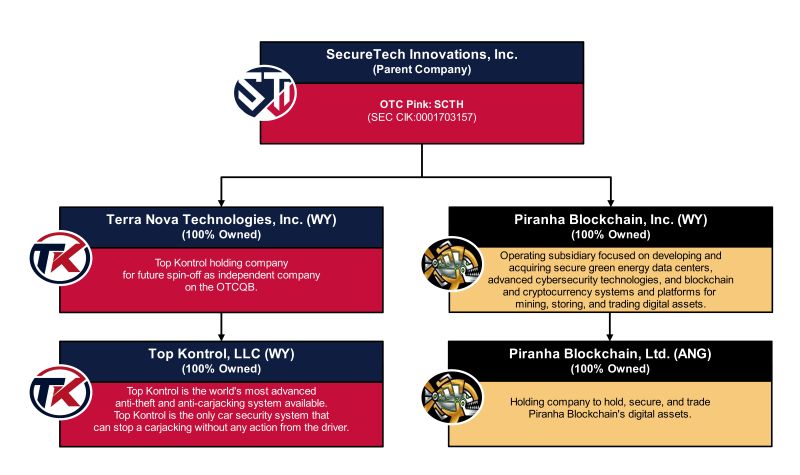

- Business Unit Expansion and Spin-Off Strategy: SecureTech has established two new wholly owned subsidiaries, Terra Nova Technologies, Inc. and Top Kontrol, LLC, both incorporated in Wyoming. The company is revitalizing its flagship anti-carjacking and automotive security product, Top Kontrol®, under Terra Nova Technologies. SecureTech plans to spin-off Terra Nova Technologies as a standalone entity on the OTCQB Market, allowing it to pursue independent growth while advancing SecureTech’s broader strategic objectives and delivering additional value to its shareholders.

- Blockchain Expansion and Digital Asset Strategy: Through its Piranha Blockchain subsidiaries and its strategic partnership with RockerFunder, LLC, SecureTech is advancing plans to establish a Bitcoin (BTC) treasury reserve as part of its broader digital asset acquisition and Web3 innovation strategy. This initiative reflects the company's focus on enhancing blockchain infrastructure, decentralized security, and digital wealth creation and management, while it continues to evaluate acquisition and investment opportunities in the blockchain and fintech sectors.

SecureTech will continue providing timely updates on these initiatives through official press releases and regulatory filings.

“We are executing our 2025 roadmap with precision and determination,” stated J. Scott Sitra, President and CEO of SecureTech. “Our proactive approach to corporate restructuring, capital acquisition, and strategic growth through mergers and acquisitions reflects our commitment to innovation, creating shareholder value, and maintaining full corporate transparency. We look forward to providing additional updates to our shareholders and the investment community as we continue to hit and exceed key milestones.”

About SecureTech Innovations

SecureTech Innovations, Inc. (OTC: SCTH) is an innovative technology company focused on developing and commercializing advanced security, safety, and digital infrastructure solutions. SecureTech is the developer of Top Kontrol®, the only patented anti-theft and anti-carjacking system that can safely stop a carjacking without any action from the driver. Through its Piranha Blockchain subsidiary, SecureTech is advancing cutting-edge cybersecurity and Web3 technologies, next generation blockchain architecture, and digital asset management systems.

For further information, visit our websites:

securetechinnovations.com, topkontrol.com, and piranhablockchain.com

This press release contains forward-looking statements that involve risks and uncertainties. Forward-looking statements refer to future events, expectations, plans, and prospects. SecureTech Innovations, Inc. (“SecureTech”) believes the expectations reflected in these forward-looking statements are reasonable as of the date they are made. However, actual results may differ materially from those expressed or implied by these forward-looking statements. SecureTech identifies forward-looking statements with words like 'believes,' 'estimates,' 'anticipates,' 'expects,' 'plans,' 'projects,' 'intends,' 'potential,' 'may,' 'could,' 'might,' 'will,' 'should,' 'approximately,' and similar expressions that convey uncertainty about future events or outcomes. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors, including market conditions and other circumstances. More detailed information about SecureTech and the risks that may affect these forward-looking statements can be found in SecureTech’s filings with the Securities and Exchange Commission (“SEC”), including the risks contained in the section of our Annual Report filed on Form 10-K entitled “Risk Factors.” These filings are available on the SEC’s website at www.sec.gov.

Forward-looking statements in this press release speak only as of the date they are made. SecureTech has no obligation to update any forward-looking statements to reflect new events or circumstances after the date of this press release, except as required by law.

Investor Relations

+1 (651) 317-8990

ir@securetechinnovations.com