Scottie Resources Intercepts 8.28 g/t Gold over 22.35 m at P-Zone at Scottie Gold Mine Project, BC

Rhea-AI Summary

Scottie Resources (OTCQB:SCTSF) reported 2025 drill assays from the P-Zone at the Scottie Gold Mine Project, including 8.28 g/t Au over 22.35 m (incl. 20.2 g/t over 7.55 m) in hole SR25-378 and multiple O-Zone hits.

The company recently released a PEA that models a low-capital DSO-first plan: at US$2,600/oz the after-tax NPV(5%) is C$215.8M with an IRR of 60.3% and initial capital of C$128.6M; a toll-mill scenario yields NPV(5%) C$380.1M and IRR 89.9%.

Positive

- High-grade intercept of 8.28 g/t Au over 22.35 m in SR25-378

- PEA valuation NPV(5%) C$215.8M and IRR 60.3% at US$2,600/oz

- Resource growth focus 2025 drilling aimed to convert inferred to indicated

Negative

- Initial capital of C$128.6M required by the PEA

- PEA sensitivity uses gold price assumption of US$2,600/oz

- True widths of reported drill intervals have not yet been established

News Market Reaction

On the day this news was published, SCTSF declined 1.62%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - November 4, 2025) - Scottie Resources Corp. (TSXV: SCOT) (OTCQB: SCTSF) (FSE: SR80) ("Scottie" or the "Company") is pleased to report new assays from its 2025 drilling of the P-Zone within the Scottie Gold Mine Project. The road-accessible Scottie Gold Mine Project, which includes the

"The first holes back from our 2025 Scottie Gold Mine drill program are very encouraging," stated Brad Rourke, CEO of the Company. The P-Zone intercept in hole SR25-378 highlights the strength of the system and the opportunity to add ounces to the existing resource. With our PEA now released, we are focused on continuing to demonstrate the growth potential of the deposit and the value that additional ounces bring to an already compelling economic project."

Highlights:

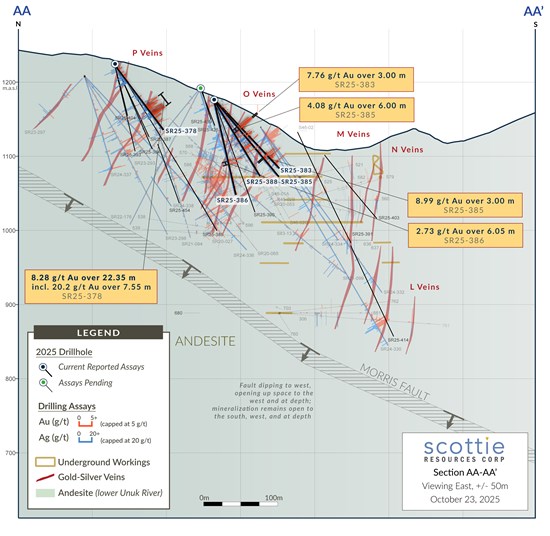

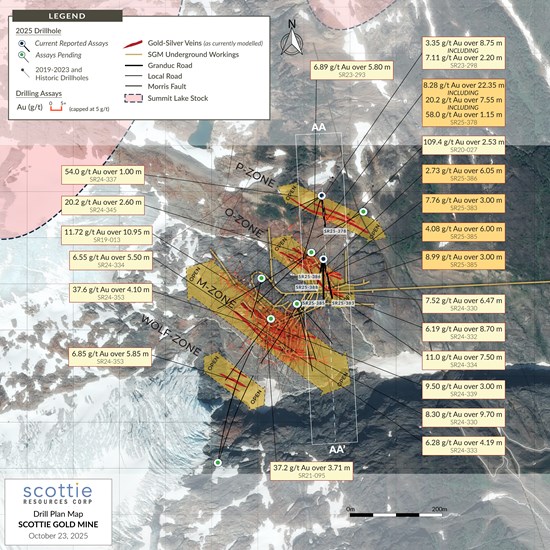

Scottie Gold Mine drillhole SR25-378 intersected 8.28 grams per tonne (g/t) gold over 22.35 metres (m), including 20.2 g/t gold over 7.55 m on the P-Zone (Table 1, Figures 1,2,4).

Scottie Gold Mine drillhole SR25-383 intersected 7.76 g/t gold over 3.0 m at the O-Zone (Table 1, Figures 1,2,4).

Scottie Gold Mine drillhole SR25-385 intersected 4.08 g/t gold over 6.00 m and 8.99 g/t Au over 3.00 at the O-Zone (Table 1, Figures 1,2).

Table 1: Highlight results from new drill assays (uncut) from the Scottie Gold Mine.

| Drill Hole | From (m) | To (m) | Width* (m) | Gold (g/t) | Silver (g/t) | Sub Zone | |

| SR25-378 | 8.10 | 9.35 | 1.25 | 1.41 | 0.00 | P-Zone | |

| 18.15 | 19.15 | 1.00 | 1.05 | 12.0 | P-Zone | ||

| 68.95 | 91.30 | 22.35 | 8.28 | 4.92 | P-Zone | ||

| including | 68.95 | 75.75 | 6.80 | 3.79 | 5.10 | P-Zone | |

| and including | 79.55 | 87.10 | 7.55 | 20.2 | 9.98 | P-Zone | |

| including | 79.55 | 80.70 | 1.15 | 58.0 | 27.0 | P-Zone | |

| 96.40 | 97.60 | 1.20 | 1.91 | 3.00 | P-Zone | ||

| SR25-383 | 48.00 | 51.00 | 3.00 | 7.76 | 3.00 | O-Zone | |

| 71.50 | 72.50 | 1.00 | 2.40 | 9.00 | O-Zone | ||

| 104.00 | 108.00 | 4.00 | 3.97 | 2.50 | O-Zone | ||

| 115.00 | 118.00 | 3.00 | 2.31 | 2.67 | O-Zone | ||

| SR25-385 | 44.90 | 50.90 | 6.00 | 4.08 | 5.67 | O-Zone | |

| 62.25 | 64.25 | 2.00 | 2.66 | 24.0 | O-Zone | ||

| 99.00 | 102.00 | 3.00 | 8.99 | 7.67 | O-Zone | ||

| SR25-386 | 83.40 | 89.45 | 6.05 | 2.73 | 0.00 | O-Zone | |

| including | 83.40 | 85.00 | 1.60 | 7.13 | 0.00 | O-Zone | |

| SR25-388 | 52.15 | 53.15 | 1.00 | 1.88 | 5.00 | O-Zone | |

| 59.00 | 60.00 | 1.00 | 7.30 | 34.0 | O-Zone | ||

| 75.00 | 78.00 | 3.00 | 2.79 | 5.00 | O-Zone | ||

| 83.00 | 84.00 | 1.00 | 5.24 | 13.0 | O-Zone | ||

| *True width of the intervals has not yet been established by drilling | |||||||

Figure 1: Overview plan view map of the Scottie Gold Mine, illustrating the locations of the reported drill results, cross-section (Figure 2), and the distribution of the modelled sulphide-rich zones.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11118/273060_f8196775841a3b20_002full.jpg

Figure 2: Cross-section displaying Scottie Gold Mine intercepts from drill holes SR25-378, -383, -385, -386.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11118/273060_f8196775841a3b20_003full.jpg

The 2025 drilling on Scottie Gold Mine targets was primarily focused on expanding the resource and increasing geological confidence in the known zones in order to convert from inferred to indicated classification. Additional follow up drilling was done on the Wolf Zone (discovered in 2024, see NR dated December 12, 2024), results to be released as the become available. The Scottie Gold Mine targets are open in multiple directions and are key to expanding the project's overall resource.

About the Scottie Gold Mine Project

Exploration of the Scottie Gold Mine Project over the past six years has produced exceptional drill results through the discovery of high-grade gold in four new zones (Blueberry Contact Zone, Domino, D-Zone, P-Zone) and the expansion of previously drill confirmed targets (Scottie Gold Mine, C-Zone, Bend Vein, Stockwork). There is a clear spatial relation between the outcropping and drill-confirmed high-grade gold targets and the contact with the Jurassic aged, Texas Creek Plutonic suite intrusion. Geological work in the area has established strong connections between the various deposits. The chemical, mineralogical, structural, and age relationships of the deposits and host rocks support a genetic model whereby all deposits are linked to the same mineralizing event.

The Blueberry Contact Zone is located just 2 kilometres northeast of the

The Company has recently completed a PEA which evaluates a low-capital DSO operation to deliver a gold-rich gravel product to Asian copper/precious metals smelters. At a gold price of US

Quality Assurance and Control

Results from samples taken during the 2025 field season were analyzed at SGS Minerals in Burnaby, BC. The sampling program was undertaken under the direction of Dr. Thomas Mumford. A secure chain of custody is maintained in transporting and storing of all samples. Gold was assayed using a fire assay with atomic absorption spectrometry and gravimetric finish when required (+9 g/t gold). Analysis by four acid digestion with multi-element ICP-AES analysis was conducted on all samples with silver and base metal over-limits being re-analyzed by emission spectrometry.

Dr. Thomas Mumford, P.Geo., non-independent and President of the Company, a qualified person under National Instrument 43-101, has reviewed and approved the technical information contained in this news release on behalf of the Company.

ABOUT SCOTTIE RESOURCES CORP.

Scottie Resources holds

Scottie's current resource estimate on the Scottie Gold Mine Project includes a total of 703,000 gold ounces at an average grade of 6.1 g/t (Inferred category), highlighting the potential for a significant near-surface, high-grade deposit. The Company's strategy is to continue expanding this resource and to define additional mineralization around past-producing mines through systematic drilling and surface exploration.

The Company has recently completed a PEA for the Scottie Gold Mine. The PEA outlines a robust Direct-Ship Ore (DSO) development scenario with strong economics and significant upside through a potential toll-milling option utilizing excess capacity at the nearby Premier mill. The base case DSO project delivers an after-tax NPV(

Additional Information

Brad Rourke

CEO

+1 250 877 9902

brad@scottieresources.com

Forward-Looking Statements

This news release may contain forward‐looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward‐looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward-looking statements. Forward‐looking statements are based on the beliefs, estimates and opinions of the Company's management on the date such statements were made. The Company expressly disclaims any intention or obligation to update or revise any forward‐looking statements whether as a result of new information, future events or otherwise.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy of accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273060