Sirios Files Cheechoo Gold Project MRE Report on SEDAR: 1.3 Moz Indicated at 1.12 g/t Au, 1.7 Moz Inferred at 1.23 g/t Au

Rhea-AI Summary

Sirios Resources (OTCQB: SIREF) has filed a technical report on SEDAR for its Cheechoo Gold Project, revealing significant mineral resource estimates. The updated assessment shows 1.3 million ounces of Indicated Resources at 1.12 g/t Au and 1.7 million ounces of Inferred Resources at 1.23 g/t Au, including 446,000 ounces in underground resources at 3.09 g/t Au.

The 2025 MRE demonstrates substantial grade improvements over the 2022 estimate, with a 19% increase in open-pit indicated grade and a 38% increase in open-pit inferred grade. The project maintains a favorable strip ratio of 2.9:1 and suggests a Conceptual Exploration Target of 31-40 million tonnes grading between 1.27-1.45 g/t Au.

The assessment is based on 345 drill holes totaling 82,717 meters. The company plans a two-phase follow-up program including a PEA and additional drilling to expand resources.

Positive

- None.

Negative

- Resources are not yet classified as reserves, requiring additional economic validation

- Majority of resources remain in Inferred category with lower confidence level

News Market Reaction – SIREF

On the day this news was published, SIREF gained 0.99%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Montréal, Québec--(Newsfile Corp. - August 25, 2025) - Sirios Resources Inc. (TSXV: SOI) (OTCQB: SIREF) ("Sirios") is pleased to announce that it has filed on SEDAR the "Technical Report on the Cheechoo Project with an Updated Mineral Resource Estimate for the Cheechoo Gold Deposit, Eeyou Istchee James Bay, Quebec, Canada", with an effective date of July 1, 2025. The report, prepared in accordance with NI 43-101 standards, was completed for Sirios by PLR Resources Inc.

Dominique Doucet, President and CEO of Sirios Resources, stated:

"I congratulate our technical team and consultants for the excellent work showcased in this technical report, which highlights the compelling potential of the deposit. Cheechoo continues to deliver: gold ounces are up, grades are up, and the exploration targets remain numerous and highly promising. We are excited to advance the project further and are already preparing the next steps."

The full technical report is now available on SEDAR+ under Sirios' profile, as well as on the Company's website at sirios.com/en/cheechoo. The key results of the 2025 Mineral Resource Estimate were summarized in Sirios' press release dated July 10, 2025.

Highlights of the 2025 MRE include:

- 1.3 million ounces at 1.12 g/t Au (Indicated Resources);

- 1.7 million ounces at 1.23 g/t Au (Inferred Resources);

- including 446,000 ounces in underground resources at 3.09 g/t Au

- Significant gold grade increase over the 2022 MRE:

19% increase of the open-pit indicated grade (from 0.94 g/t Au to 1.12 g/t Au);38% increase of the open-pit inferred grade (from 0.73 g/t Au to 1.01 g/t Au);

- Low strip ratio of 2.9:1;

- Conceptual Exploration Target of 31 to 40 million tonnes of mineralization grading between 1.27 to 1.45 g/t Au.

The report recommends a two-phase follow-up work program on the property:

Phase 1:

- PEA on the Cheechoo Deposit

Phase 2:

- Drilling to expand the Mineral Resource Estimate

- Drilling to identify new exploration targets

- Metallurgical Testwork

Cheechoo Project Mineral Resource Estimate (MRE)

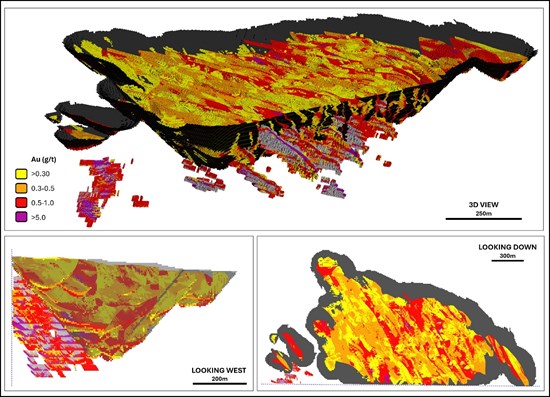

The updated Mineral Resource Estimate is based on 345 drill holes, totalling 82,717 meters, including 8,660 meters since 2022. This MRE introduces a new underground component and is based on a new geological model that has revealed previously underestimated, higher-grade zones within the deposit. An interactive 3D viewer of the new model is available at sirios.com/en/cheechoo.

Table 1: Indicated and Inferred Mineral Resources Estimate

| Pit constrained | 0.3 g/t Au Cut-off grade | Tonnes (t) | Au (g/t) | Au (koz) |

| Indicated | 34,993,000 | 1.12 | 1,262 | |

| Inferred | 38,222,000 | 1.01 | 1,242 | |

| Stope constrained | 1.5 g/t Au Cut-off grade | Tonnes (t) | Au (g/t) | Au (koz) |

| Inferred | 4,493,000 | 3.09 | 446 | |

| TOTAL | 0.3 & 1.5 g/t Au Cut-off grade | Tonnes (t) | Au (g/t) | Au (koz) |

| Total Indicated | 34,993,000 | 1.12 | 1,262 | |

| Total Inferred | 42,715,000 | 1.23 | 1,688 |

- The independent qualified person for the MRE, as defined by National Instrument ("NI") 43-101 guidelines, is Pierre Luc Richard, P.Geo., of PLR Resources Inc. with contributions from Stephen Coates, P.Eng., of Evomine for cut-off values, open pit optimization solids and underground optimization solids, and Christian Laroche, P.Eng., from Synectiq, for metallurgical parameters. The effective date of the MRE is July 01, 2025.

- These Mineral Resources are not mineral reserves as they have no demonstrated economic viability. No economic evaluation of these Mineral Resource has been produced. The quantity and grade of reported Inferred Resources in this MRE are uncertain in nature and there has been insufficient drilling to define these Inferred Resources as Indicated. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated category with continued drilling.

- The Qualified Persons are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issues that could materially affect the Mineral Resource Estimate.

- Calculations used metric units (metres (m), tonnes (t), and g/t). Metal contents in the above table are presented in troy ounces (metric tonne x grade / 31.103475). Values were rounded, and any discrepancies in total amounts are due to rounding errors.

- The Cheechoo Mineral Resource estimate follows the November 29, 2019, CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines.

- Resources are presented as undiluted and in situ for the open-pit scenario and include internal dilution for the underground scenario and are considered to have reasonable prospects for economic extraction. The constraining pit shell was developed using overall pit slopes of 50 degrees in bedrock and 25 degrees in overburden. The pit optimization to develop the mineral resource-constraining pit shells was done using the pseudoflow algorithm in Deswik software. The stope optimization to develop the underground mineral resource was done using Deswik.SO software.

- The MRE wireframe was prepared using Leapfrog Edge v.2024.1.3 and is based on 345 drill holes, totalling 82,717 meters drilled and 56,337 assays. The cut-off date for the drill hole database was May 13, 2025.

- Composites of 1.5 metres were created inside the mineralization domains. High-grade capping was done on the composited assay data. Based on individual statistical study for each zone, composites were capped at 25.0 g/t Au for the HG zones, 2.0 g/t Au for the corridors and 1.0 g/t for the tonalite intrusion. A three-pass capping strategy defined by capping values decreasing as interpolation search distances increase was used in the grade estimation for the HG zones.

- Pit constrained Mineral Resources for the base case are reported at a cut-off grade of 0.3 g/t Au; DSO-constrained Mineral Resources for the base case are reported at a cut-off grade of 1.5 g/t Au and include internal dilution (must-take). The cut-off grades will be re-evaluated in light of future prevailing market conditions and costs.

- Specific gravity values were estimated using data available in the drill hole database. Density values between 2.64 and 2.76 were applied to the host rocks.

- Grade model resource estimation was calculated from drill hole data using an Ordinary Kriging interpolation method in a sub-blocked model using blocks measuring 5 m x 5 m x 5 m in size and sub-blocks down to 0.625m x 0.625m x 0.625m. Both ordinary kriging (OK) and inverse square distance (ID2) interpolation methods were tested, resulting in no material difference in the Mineral Resource Estimates.

- The Indicated and Inferred Mineral Resource categories are constrained to areas where drill spacing is less than 50m and 100 metres respectively and show reasonable geological and grade continuity.

Figure 1: 2025 MRE Pit Shell and Block Model

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2313/263724_028e58eec41b6bb1_002full.jpg

Cautionary Statement Regarding Mineral Resources

The mineral resources disclosed in this press release conform to NI43-101 standards and guidelines and were prepared by independent qualified persons. The above-mentioned mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of the reported Inferred Mineral Resources are conceptual in nature and are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade and/or quality of continuity. An Inferred Mineral Resource has a lower level of confidence relative to a Measured or Indicated Mineral Resource and constitutes an insufficient level of confidence to allow conversion to a Mineral Reserve. It is reasonably expected, but not guaranteed, that the majority of Inferred Mineral Resources could be upgraded to Measured or Indicated Mineral Resources with additional drilling. The National Instrument 43-101 Technical Report, including the mineral resources for the Cheechoo Project contained in this news release, will be delivered and filed on SEDAR by Sirios Resources Inc. within 45 days of the date of this news release.

Qualified persons

The Mineral Resource Estimate and other scientific and technical information in this news release has been prepared and approved by independent qualified persons for purposes of NI 43-101: Pierre Luc Richard, P.Geo., of PLR Resources Inc. with contributions from Stephen Coates, P.Eng., of Evomine for cut-off values, open pit optimization solids and underground optimization solids, and Christian Laroche, P.Eng., from Synectiq, for metallurgical parameters.

About the Cheechoo Gold Project

The Cheechoo Gold Project is the flagship asset of Sirios Resources Inc., located in the Eeyou Istchee James Bay territory of Québec, less than 15 km from the Éléonore gold mine. The project is

About the Éléonore Gold Mine

The Éléonore Mine is an underground gold operation located in the Eeyou Istchee James Bay region of Québec, directly adjacent to Sirios' Cheechoo Property. Commercial production at Éléonore began in April 2015. In 2024, Dhilmar Ltd. acquired the mine from Newmont Corporation in a

About PLR Resources

PLR Resources specializes in mineral resource estimates and project evaluations and offers a wide variety of services, from grassroots exploration planning to feasibility studies and mining operation optimization, serving clients that include juniors, major operators as well as financial experts seeking reliable and realistic advice.

For more information, please contact:

Dominique Doucet, P.Eng., CEO

450-482-0603

info@sirios.com

www.sirios.com

Cautionary note regarding forward-looking statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation based on expectations. estimates and projections as at the date of this news release. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results. Performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, capital and operating costs varying significantly from estimates; the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; the other risks involved in the mineral exploration and development industry; and those risks set out in the Company's public documents filed on SEDAR at www.sedar.com. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

-30 -

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263724

FAQ

What are the new resource estimates for Sirios Resources' (SIREF) Cheechoo Gold Project in 2025?

How much did the gold grades improve in Sirios Resources' 2025 MRE compared to 2022?

What is the strip ratio for Sirios Resources' Cheechoo Gold Project?

What are the next steps for Sirios Resources' (SIREF) Cheechoo Project?

What is the exploration potential for Sirios Resources' Cheechoo Gold Project?