Solaris Announces Major Expansion of Warintza District, Reports New Anomalies with Sampling of Up to 8% Copper and Provides Project Update

Rhea-AI Summary

Solaris Resources (NYSE:SLSR) announced an expansion of its Warintza district with an option to acquire ~40,000 hectares of adjacent exploration concessions (Solaris 2) and reported early-stage sampling returning up to 8.38% Cu at Solaris 1.

The company disclosed a US$25 million minimum 4-year exploration commitment, upfront payment of US$0.25 million, milestone payments up to US$1.75 million, and an exclusive option price to be set by independent experts. The EIA technical approval is expected imminently and full permitting is targeted in H2 2026. A Feasibility Study is underway with Ausenco, Knight Piésold and AMC Consultants.

Positive

- 40,000 hectares expansion adjacent to Warintza

- Rock samples up to 8.38% Cu at Solaris 1

- Binding minimum US$25M exploration programme over 4 years

- Feasibility Study begun with Ausenco, Knight Piésold and AMC

Negative

- Environmental Impact Assessment not yet technically approved

- Exclusive option price to acquire claims remains undetermined

- Minimum US$25M commitment creates near-term cash obligation

News Market Reaction

On the day this news was published, SLSR gained 4.35%, reflecting a moderate positive market reaction. Argus tracked a peak move of +4.3% during that session. Our momentum scanner triggered 4 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $79M to the company's valuation, bringing the market cap to $1.91B at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

SLSR gained 6.6%, while peers showed mixed moves: ASM up 11.16%, PPTA up 5.3%, MUX and MTA modestly positive, and ITRG down 3.48%. With only 1 peer in the momentum scanner and no shared news, the move appears stock-specific.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Nov 06 | Pre-feasibility study | Positive | +4.6% | PFS with large reserves and strong project economics at Warintza. |

| Sep 11 | Community agreements | Positive | -1.1% | Indigenous partnership agreements and EIA submission for Warintza. |

Recent positive Warintza updates have produced mixed reactions, with one gain and one mild selloff on good news.

Over the past year, Solaris has advanced the Warintza project through key milestones. On Nov 6, 2025, a positive Pre‑Feasibility Study and maiden mineral reserve with a post‑tax NPV8% of US$4,617M saw the stock rise 4.57%. On Sep 11, 2025, community partnership agreements and EIA submission led to a -1.14% move. Today’s district‑scale concession expansion and exploration anomalies extend that growth narrative around Warintza.

Market Pulse Summary

This announcement highlights Solaris’ district-scale strategy at Warintza, adding about 40,000 hectares through Solaris 2 and reporting rock samples up to 8.38% Cu. Early anomalies at Tinki South and a planned minimum US$25M exploration programme expand the project’s optionality. The Feasibility Study and Environmental Impact Assessment process, targeting full permitting in the second half of 2026, remain key milestones to watch alongside ongoing community and regulatory engagement.

Key Terms

potassic alteration technical

copper porphyry systems technical

Environmental Impact Assessment regulatory

Feasibility Study technical

Pre-Feasibility Study technical

National Instrument 43-101 regulatory

Qualified Person regulatory

ppm technical

AI-generated analysis. Not financial advice.

HIGHLIGHTS OF THE PRESS RELEASE:

- Solaris strengthens its dominant position in the world-class Warintza district through an option to acquire new, highly prospective exploration concessions adjacent to the flagship project

- New areas interpreted to host significant copper mineralization, characterized by widespread potassic alteration typical of large copper porphyry systems

- Early-stage prospecting results from Solaris 1 identify compelling copper anomalies with rock samples returning up to

8.38% Cu, supporting immediate follow-up work and reinforcing district-scale discovery potential - Parallel track permitting strategy advancing strongly, with Environmental Impact Assessment (“EIA”) technical approval approaching

- Feasibility Study underway with leading international engineering and technical partners

QUITO, Ecuador, Jan. 28, 2026 (GLOBE NEWSWIRE) -- Solaris Resources Inc. (“Solaris” or the “Company”) (TSX: SLS; NYSE: SLSR) is pleased to announce a major advancement in its district-scale growth strategy. Ecuador’s state-owned mining company, Empresa Nacional Minera ENAMI EP (“ENAMI EP”), has granted Solaris an option to acquire up to a

This strategic award meaningfully expands Solaris’ footprint around Warintza by approximately 40,000 hectares, further consolidating its presence over one of the most compelling emerging copper districts globally. The newly optioned areas capture extensions of key geological trends continuous with Warintza, unlocking additional potential exploration upside and reinforcing the Company’s long-term vision of developing a future world-class copper mining hub.

Matthew Rowlinson, President and CEO of Solaris Resources, commented: “The award of these areas represents a significant step forward in strengthening our position across what is proving to be a highly prolific copper district. Early prospecting results from Solaris 1 are particularly encouraging, with multiple high-priority anomalies highlighting the broader geological potential beyond Warintza itself. With this expanded concession package, Solaris is well positioned to unlock a true district-scale opportunity built on shared infrastructure, responsible development and strong partnerships with the State and local communities.”

Gallo García, General Manager of ENAMI EP, commented: “We are very pleased that the second commercial agreement with Solaris has been finalized. By the end of 2024, the company had consolidated its position as a strategic partner of ENAMI EP, which has allowed us to strengthen a relationship based on cooperation and a shared vision for development. ENAMI EP is a strategic ally, committed to accompanying and supporting these processes. Together with Solaris, we are moving forward with mining projects that will represent a significant and sustainable contribution to the country’s development.”

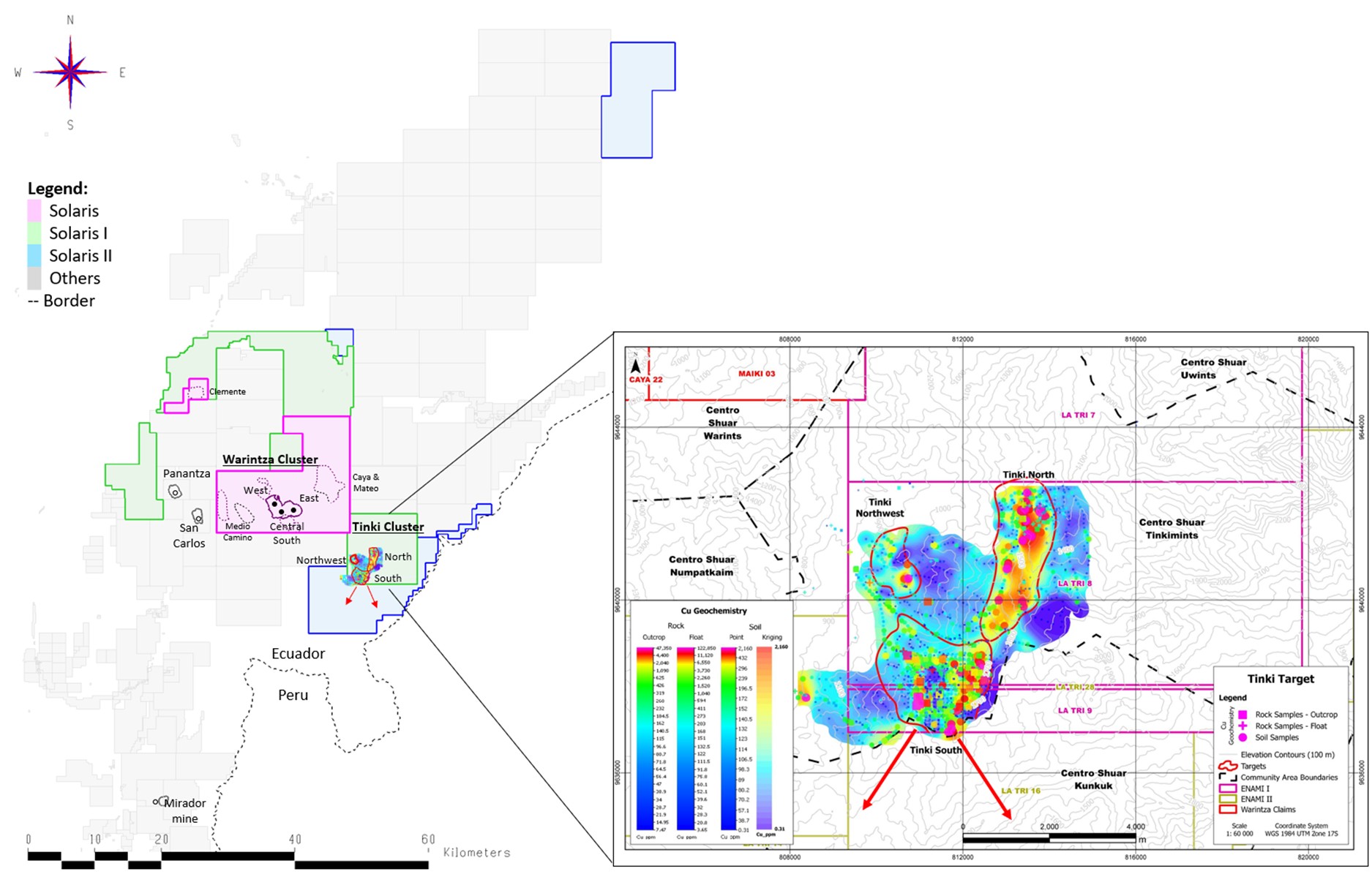

Image 1: Map of the Warintza Cluster

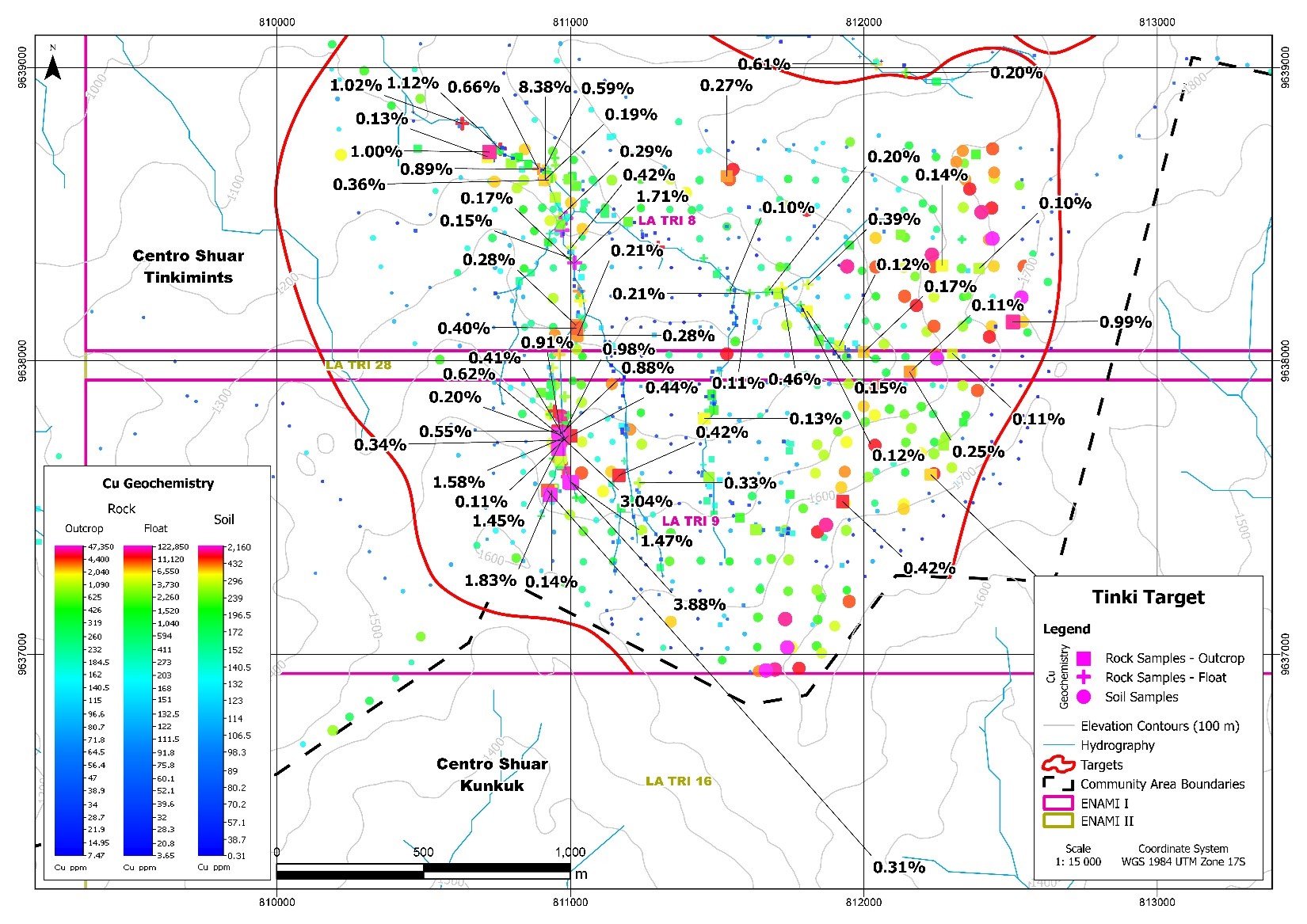

Image 2: Early-stage prospecting results from Solaris 1

Solaris 1 Prospecting Activities

Solaris continues to prioritize greenfield activities across the broader Warintza district, underpinned by the highly prospective geological potential of both its wholly owned and optioned properties. Within the Solaris 1 optioned areas (Image 2), three high-priority target areas have been identified: Tinki Northwest, Tinki North and Tinki South.

Over the past 16 months, the Company has completed 11 field prospecting expeditions, collecting more than 1,500 rock and soil samples, with efforts primarily focused on the Tinki South area.

Initial geochemical results have identified strong copper anomalies hosted within volcanic sequences affected by widespread potassic alteration, indicative of shallow, potentially high-grade copper mineralization that warrants detailed follow-up. At Tinki South, a systematic soil sampling programme was completed on a 100-metre grid, defining two significant copper anomalies:

- The western anomaly so far measures approximately 1,000 metres by 300 metres, with soil copper values ranging from 200 to 800 ppm and rock samples returning

0.11% to8.38% Cu.

- The eastern anomaly so far extends approximately 2,000 metres by 600 metres, with soil copper values ranging from 250 to 1,045 ppm and rock samples returning

0.10% to0.99% Cu.

Surface outcrops in both areas are partially leached, and higher and more consistent copper grades are anticipated at depth, further enhancing the exploration potential.

The Solaris 1 areas are located within the Shuar community of Tinkimints, which continues to provide constructive support for prospecting activities conducted under an established prospecting agreement. Solaris is working collaboratively with relevant ministerial authorities to advance permitting in an orderly and responsible manner, ensuring exploration programmes proceed in compliance with Ecuadorian regulations and international best practices.

Solaris 2 Concession Terms

The award of the Solaris 2 areas follows a process established by ENAMI EP pursuant to which credentialed bidders submit nonbinding proposals for proposed minimum investments on the new areas. The award is subject to entry into a definitive framework agreement for the new areas, with the terms expected to include: (i) an upfront payment to ENAMI EP of US

Together with the Company’s wholly owned Warintza property and the Solaris 1 and Solaris 2 optioned areas (shown in Image 1), Solaris is advancing a cohesive, district-scale development strategy. This consolidated land position enables planning beyond a single deposit toward a multi-asset growth trajectory, leveraging shared infrastructure, coordinated environmental and social management, and phased development across an integrated copper district. While Warintza remains the Company’s flagship and most advanced project, the surrounding areas provide meaningful optionality and long-term value creation potential.

2026 OUTLOOK AND KEY PROJECT MILESTONES

Permitting

Solaris continues to advance permitting activities at Warintza and remains confident in securing the approvals required to support construction and long-term development through a parallel-tracked, de-risked permitting strategy.

The Environmental Impact Assessment (“EIA”) is currently in the final stages of review, and the Company anticipates receipt of a second and final round of minor technical observations imminently. Following clarification of any final observations, Solaris expects the technical approval of the EIA to be issued.

Importantly, the EIA review timeline has not constrained broader project advancement. Solaris continues to progress multiple critical permits, technical studies and de-risking initiatives in parallel, maintaining momentum across all development workstreams. Through this approach, the Company expects Warintza to be fully permitted during the second half of 2026.

Feasibility Study

Solaris has commenced the Feasibility Study for Warintza, engaging globally recognized engineering and technical firms including Ausenco, Knight Piésold and AMC Consultants, who successfully delivered the Project’s Pre-Feasibility Study (“PFS”) published in November 2025. The Feasibility Study is focused on optimizing mine design and infrastructure, refining tailings management solutions, advancing capital and operating cost estimates, and establishing a clear pathway toward an informed construction decision.

Solaris looks forward to a transformative year ahead as it advances Warintza through permitting, feasibility and district-scale growth initiatives, reinforcing its position as a leading global copper development company.

Qualified Person

The scientific and technical content of this press release has been reviewed and approved by Jorge Fierro, M.Sc., DIC, PG, Vice President Exploration of Solaris who is a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects. Jorge Fierro is a Registered Professional Geologist through the SME (registered member #4279075).

On behalf of the Board of Solaris Resources Inc.

“Matthew Rowlinson”

President & CEO, Director

For Further Information

Patrick Chambers, VP Business Development & Investor Relations

Email: pchambers@solarisresources.com

About Solaris Resources Inc.

Solaris Resources is a copper-gold exploration and development company advancing a portfolio of high-quality assets across the Americas. Its flagship asset is the

Cautionary Notes and Forward-Looking Statements

This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the words “will” and “expected” and similar expressions are intended to identify forward-looking statements. These statements include statements regarding the results of the Technical Report, including future Project opportunities, future operating and capital costs, closure costs, timelines, permit timelines, and the ability to obtain the requisite permits; the outcome of the governmental review of the Technical EIA report; the outcome of the FPIC process; life of mine estimates for Warintza, including, but not limited to, copper production, grades, mining rates, strip ratios and the costs thereof; economics and associated returns of the Project; the technical viability of the Project; the ability to establish lines of communication at the Project, including but not limited to, the fibre optic line with leased internet and radio; the environmental impact of the Project, the ongoing ability to work cooperatively with stakeholders; the estimation of Mineral Reserves and Mineral Resources; the conversion of Mineral Resources to Mineral Reserves; and the filing and effective date of the Technical Report. Although Solaris believes that the expectations reflected in such forward-looking statements and/or information are reasonable, readers are cautioned that actual results may vary from the forward-looking statements. The Company has based these forward-looking statements and information on the Company’s current expectations and assumptions about future events including assumptions regarding the exploration and regional programmes. These statements also involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Solaris Management’s Discussion and Analysis, for the year ended December 31, 2024 available at www.sedarplus.ca. Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and Solaris does not undertake any obligation to publicly update or revise any of these forward-looking statements except as may be required by applicable securities laws.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1cecef79-fb29-494c-baa2-3b275c01640e

https://www.globenewswire.com/NewsRoom/AttachmentNg/a88c911c-30f9-4f17-9794-bf4dee2a92da