Snowline Gold Announces Results of Preliminary Economic Assessment for Its Valley Gold Deposit, Rogue Project, Yukon

Rhea-AI Summary

Snowline Gold (OTCQB:SNWGF) has announced positive results from its Preliminary Economic Assessment (PEA) for the Valley gold deposit in Yukon, Canada. The study projects 6.8 million ounces of gold production over a 20-year mine life, with robust economics including a C$3.37 billion post-tax NPV at a 5% discount rate (at US$2,150/oz Au) and a 25% internal rate of return.

The project features significant production metrics with 544,000 ounces average annual gold production in the first five years at an attractive all-in sustaining cost of US$569/oz. The initial capital requirement of C$1.7 billion has a projected payback period of 2.7 years. The PEA envisions a conventional open-pit mining operation processing 25,000 tonnes per day, with the potential to become one of Canada's largest undeveloped gold deposits.

Positive

- Substantial gold production of 6.8 million ounces over 20-year mine life

- Impressive first 5-year production averaging 544,000 ounces annually

- Very low AISC of US$569/oz in first five years, well below industry average

- Strong NPV of C$3.37 billion with 25% IRR at US$2,150/oz gold price

- Quick capital payback period of 2.7 years

- Low strip ratio of 1.09:1 enhancing mining efficiency

- High average gold recovery rate of 92.2%

Negative

- High initial capital expenditure requirement of C$1.7 billion

- Significant sustaining capital needs of C$1.424 billion over mine life

- Project requires extensive infrastructure development including 130km of new road

- Reliance on diesel power generation adding to operational costs

- Water treatment likely required due to potential metal leaching concerns

News Market Reaction – SNWGF

On the day this news was published, SNWGF gained 9.20%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

One of the largest undeveloped gold deposits in Canada: PEA projected life of mine ("LOM") payable production of 6.8 million ounces of gold ("Au") over 20 years

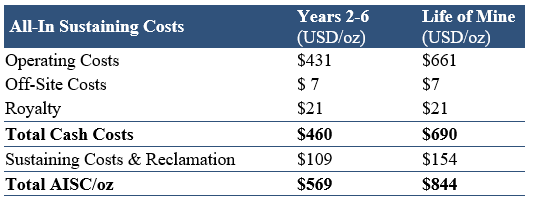

Significant production and high margins: 544koz annual average Au production at all in sustaining costs ("AISC")1 of US

$569 /oz2 Au for the first five full years of productionRobust economics: C

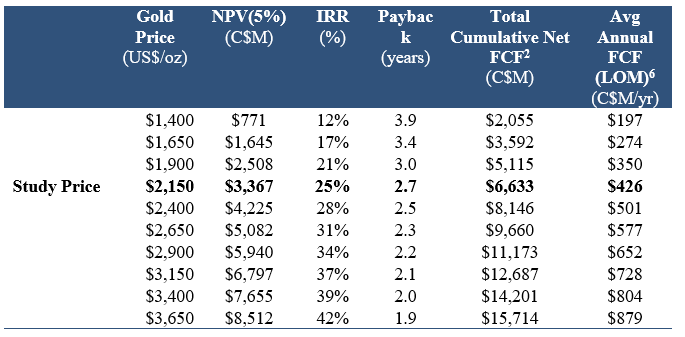

$3.37 billion post-tax net present value at a5% discount rate ("NPV5% ") at US$2,150 /oz Au, increasing to C$6.80 billion at US$3,150 /oz Au3,Compelling returns with significant leverage to gold:

25% post tax internal rate of return ("IRR") at US$2,150 /oz Au, increasing to37% at US$3,150 /oz AuRapid payback of initial capital expenditures: C

$1.7 billion initial capital paid back over 2.7 years at US$2,150 /oz Au, decreasing to 2.1 years at US$3,150 /oz AuGaining momentum: Fieldwork and engineering studies are underway on site to inform future technical studies, alongside extensive regional exploration and drilling aimed at complementary, district-scale discovery.

VANCOUVER, BC / ACCESS Newswire / June 23, 2025 / SNOWLINE GOLD CORP. (TSXV:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce results from its Preliminary Economic Assessment ("PEA" or the "Study") for its Valley gold deposit ("Valley") on its

The PEA envisions a conventional open pit mining and milling operation for Valley with a projected 20-year LOM producing 6.8 million ounces (Moz) of payable gold with a front-weighted production profile and attractive economic parameters.

"This PEA reinforces our conviction that Valley can become a world class mining operation developed at a high standard, with clear potential to bring significant economic benefits to the Yukon," said Scott Berdahl, CEO & Director of Snowline. "The rare combination of high margins and large scale makes for a robust asset with stability through a wide range of market conditions. The low strip ratio and strong gold grades enhance project economics by increasing mining efficiency while reducing the overall project footprint."

1 AISC are the sum of operating costs, off-site costs,

2 Based on an exchange rate of 1.40 CAD per 1.00 USD.

3 Sensitivities apply to the financial model only; pit selection, cut-off grade and processing schedules remain based on a US

"These results are a testament to the quality of the Valley deposit and to the hard work of Snowline's team. In less than four years, we've gone from soil sampling and Valley's first drill holes to a significant conceptual NPV. This serves as an important milestone as we continue to press forward on multiple fronts to efficiently and responsibly move Valley forward. Multiple field studies to support advanced technical studies are now underway on site, alongside environmental baseline work to inform future assessment and permitting. Combined with our ongoing regional exploration, we are excited by the path ahead and the opportunity to advance an important new contributor to the Canadian gold mining landscape."

PEA OVERVIEW

When available, readers are encouraged to read the PEA in the Company's technical report ("Technical Report") prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("43-101") in its entirety, including all qualifications, assumptions and exclusions that relate to the PEA and mineral resource model. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

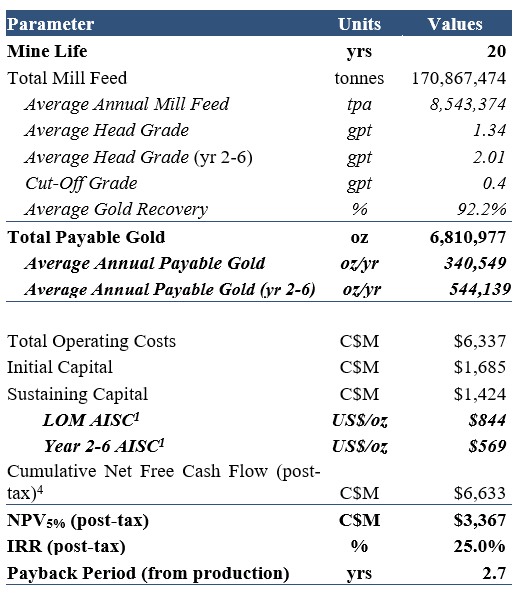

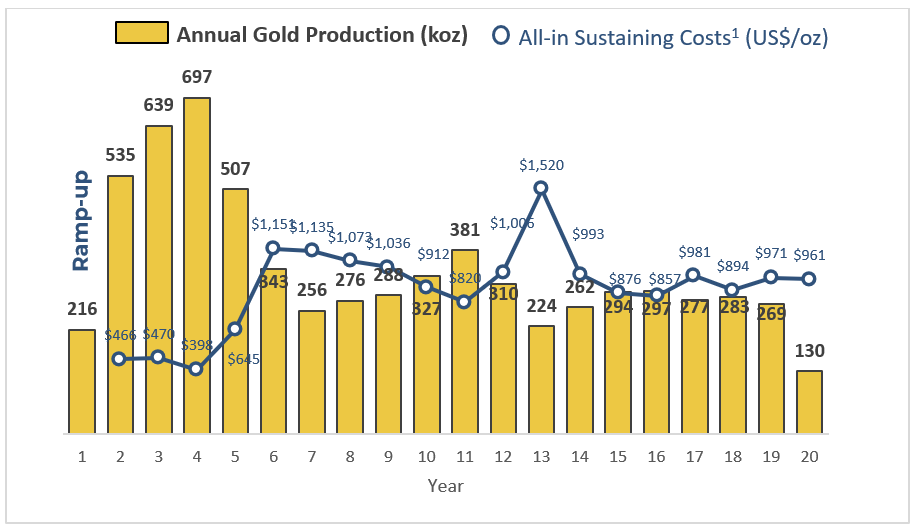

The PEA envisions a conventional open pit mining and milling operation with a nameplate processing capacity of 25,000 tonnes per day. Annual gold production averages 544,000 ounces per year during the first five full years, and 341,000 ounces per year over the 20-year LOM. Table 1 presents key operating and financial highlights from the PEA, using base study case assumptions of US

Table 1. Operating and Financial Summary

Figure 1. Annual Gold Production and AISC

MINERAL RESOURCE ESTIMATE

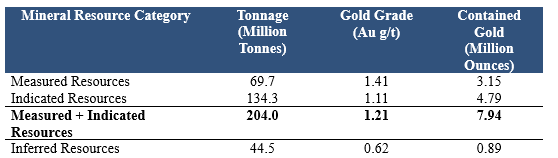

On May 15, 2025 the Company announced an updated mineral resource estimate (the "MRE") for Valley5.

The PEA is based on the MRE, which comprises 7.94 million ounces of gold averaging 1.21 g/t Au in the measured and indicated categories and an additional 0.89 million ounces gold averaging 0.62 g/t Au in the inferred category, based on roughly 53 km of drilling completed by the end of 2024. Note that the PEA production profile is based on a subset of the MRE (revenue factor 0.875 used for PEA vs. 1.0 used for MRE), and uses a higher cut-off grade (0.4 g/t Au PEA vs. 0.3 g/t Au MRE) on account of a lower gold price used in PEA pit design and processing (US

4 Cumulative Net Free Cash Flow ("FCF") is defined as gross revenue less

5 See news release dated May 15, 2025 available under the Company's profile at www.sedarplus.com and on the Company's website at www.snowlinegold.com.

Table 2: Valley Gold Deposit Mineral Resource Estimate

Mineral Resources (Above 0.30 g/t gold cut-off within 522 Mt total Material Shell)

Notes:

The effective date of the Mineral Resource Estimate is March 1, 2025, and the Mineral Resource Estimate is based upon all available exploration data available to the end of February 2025.

Values for tonnage and contained gold are rounded to the nearest thousand

Estimated Mineral Resources were classified following CIM Definition Standards. The quantity and grade of the Inferred Mineral Resources listed here are uncertain in nature and have insufficient exploration data to classify them as Measured and /or Indicated Mineral Resources, and it is not certain that additional exploration will result in the upgrading of the Inferred Mineral Resources to a higher category.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by Metal Prices, Economic Factors, Environmental, Permitting, Legal, Title, or other relevant issues.

All stated Mineral Resources are contained with a pit shell. All blocks located below or outside of this pit shell have been excluded from the Mineral Resource Estimate regardless of gold grade or Mineral Resource category.

The Mineral Resource cut-off grade of 0.30 g/t gold and the Lerchs-Grossman limiting pit shell have been defined with the following assumptions:

An assumed conventional gold mill processing operation with a nominal process rate in the range of 25,000 t/day milled.

A gold price of US

$ 2,350 /ounce and C$/US$ exchange rate of 1.40.Average mining costs of C

$5.00 per tonne of material mined.Average processing costs of C

$23.50 per tonne processed.A process recovery of

92% to93% for gold.Average administrative costs of C

$ 59 million per annum or CAN$ 6.42 per tonne processed.A

1% net smelter royalty on recovered gold.Refining and selling costs of C

$10.00 per recovered ounce of gold.Overall pit slopes range from 41 to 48 degrees as per SRK geotechnical recommendations.

The pit shell selected as the Mineral Resources limit has a revenue factor of 1.00.

MINING

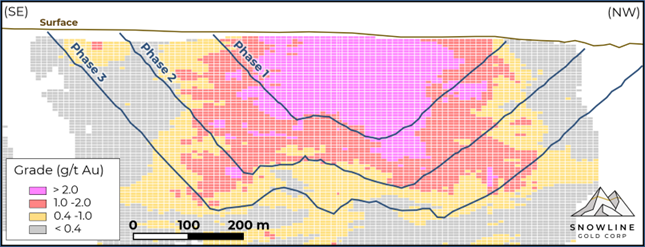

The mine plan is based on conventional open pit truck-and-shovel methods with a mill processing capacity of 9 Mtpa over a 20-year LOM. Pit optimization using a gold price of US

The mine schedule is phased to prioritize higher-grade feed in early years, supporting strong early cash flow (Figure 1). A mining bench height of 10 m was selected based on trade-offs between dilution control and equipment productivity. Haulage infrastructure includes dual-lane ramps and single-lane access for the last benches. Waste rock is primarily stored in the adjacent valley in the Waste Rock Storage Facility ("WSF") with some used for infrastructure construction.

Figure 2. Valley Mine Phases and Grade Distribution

Drill-and-blast operations are required for both waste and mill feed, while overburden is expected to be free-dig. The mine fleet consists of 24 m³ shovels, 139 t trucks, and associated support equipment sized to meet total material movement requirements.

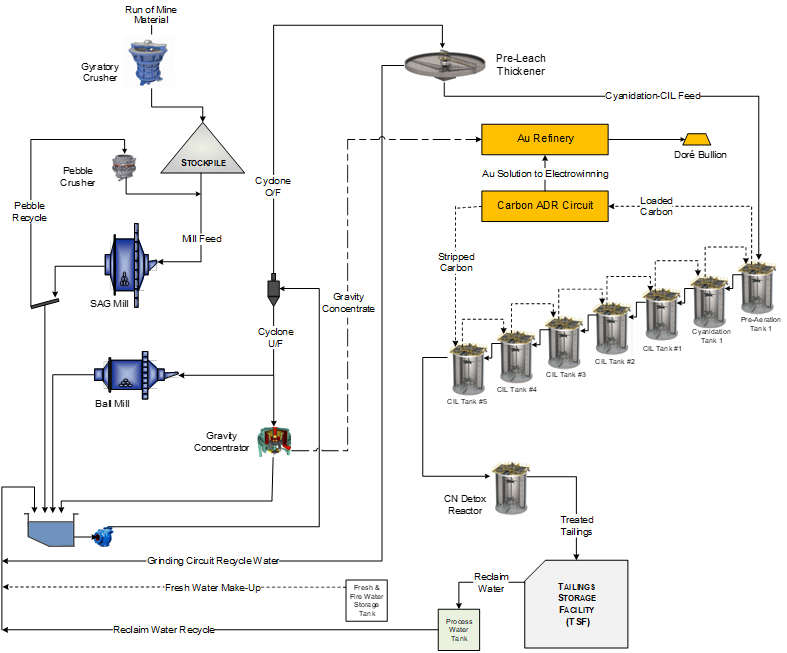

METALLURGY & PROCESSING

The PEA envisions a 25,000 tonne-per-day processing facility based on a standard metallurgical flowsheet, consisting of grinding, gravity separation and carbon-in-leach (CIL) followed by cyanide (CN) detox to produce gold doré (Figure 3). No heap leaching will be used in the project. Metallurgical testing indicates clean, non-refractory gold mineralization. Average gold recovery is estimated at

Figure 3. Processing Flowsheet

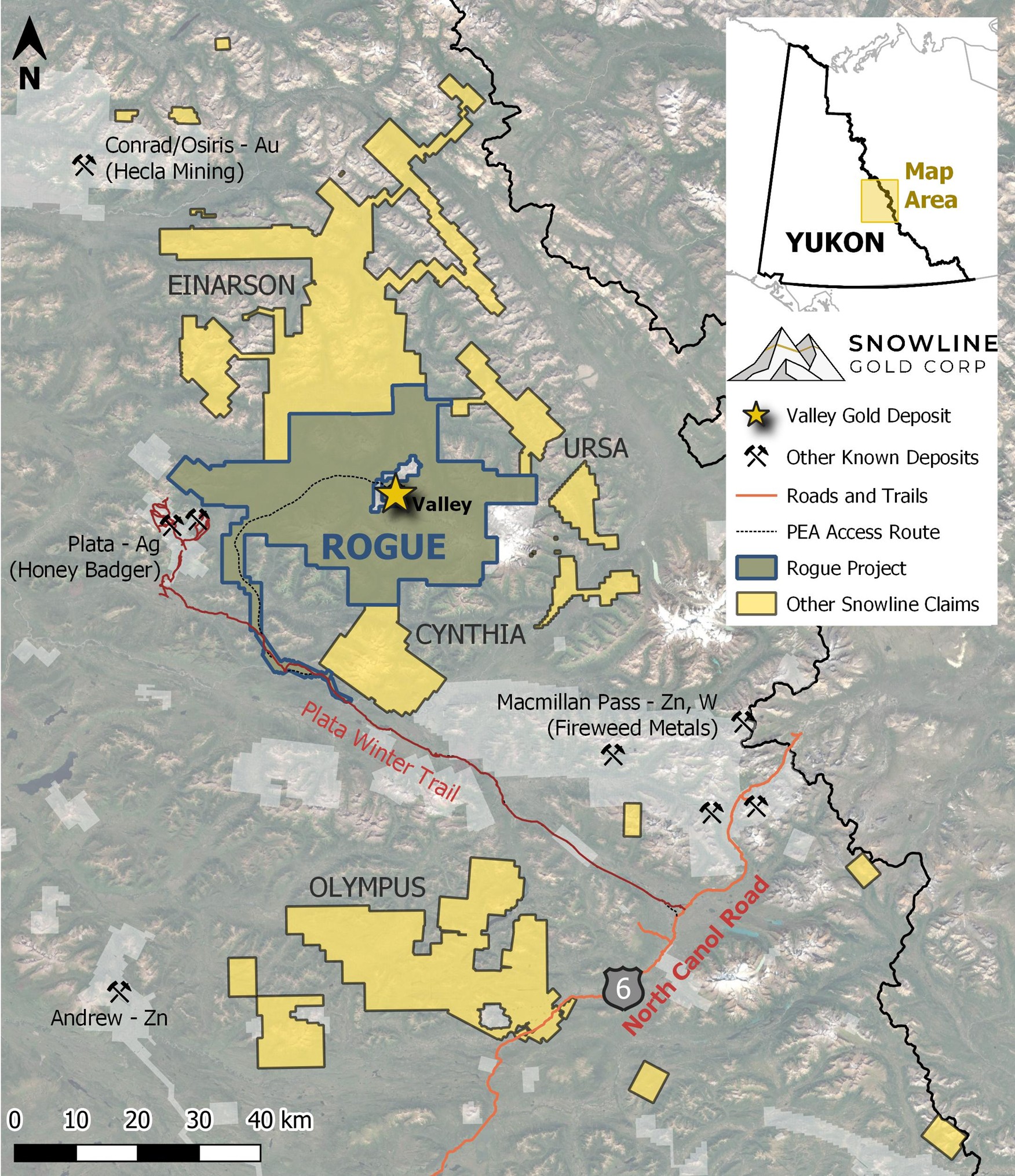

OFF-SITE INFRASTRUCTURE

Year-round road access to site is envisioned for the PEA, with the main development components comprising a bridge over the Pelly River, upgrades to the existing government-maintained North Canol Road, and 130 km of new road linking the North Canol Road to site. This new road primarily follows the route of the existing Plata Winter Trail (Figure 5).

ON-SITE INFRASTRUCTURE

The site layout comprises the process plant, fuel and power infrastructure, water and tailings storage facility, camp accommodations, an airfield, waste storage facilities, and administrative buildings. Infrastructure is grouped to minimize haul distances and optimize operations.

A short term 750-person camp is envisioned to support mining infrastructure and tailings storage facility ("TSF") construction, followed by a 250-person camp to support mining operations. Facilities include administrative offices, warehouses, maintenance shops, medical and environmental services, and an incinerator.

A dedicated 1,400 m long airfield is envisioned for crew rotation and select supply delivery. Costing includes support facilities for fuel storage and runway maintenance. Helicopter access would support emergency response and select logistics needs.

For the PEA, all power is assumed to be generated on-site using diesel generators. The installed capacity is 60 megawatts to meet a total demand of 36 megawatts. Five units of twelve megawatts each are planned, with potential integration of waste heat recovery systems.

TAILINGS MANAGEMENT

The location of the TSF was evaluated in accordance with geotechnical, water catchment, and environmental criteria. The embankments would be constructed using geosynthetic liners, with systems for seepage collection and staged construction. The design also considers water management strategies for both the operational and closure phases. Ongoing technical studies and field investigations will inform future refinement of location and design.

WATER MANAGEMENT

The water management system envisioned for the PEA separates contact water from non-contact water. Non-contact water is redirected away from site infrastructure using diversion channels. Contact water, primarily from the pit and WSF will be collected in a central pond and treated as required prior to discharge. Water from the TSF is recycled for processing with surplus water being treated as required prior to discharge. Given the uncertain potential for metal leaching ("ML") and acid rock drainage ("ARD") in the waste rock, the PEA conservatively assumes that water treatment will be necessary. This water management system is designed to support both ongoing operations and compliance following closure.

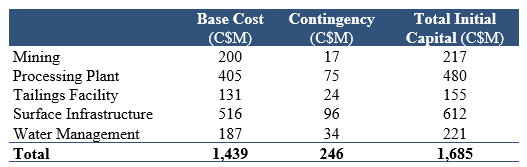

CAPITAL COSTS

The major components of pre-production capital are estimated at C

Table 3. Breakdown of Pre-Production Capital

Sustaining capital over the LOM is estimated to be C

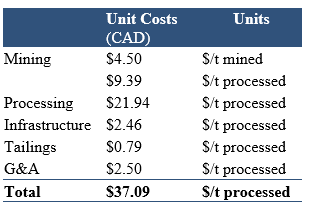

OPERATING COSTS

Operating costs are anticipated to average C

AISC, which include operating costs, off-site costs, a

Table 4. Summary of Operating Costs

Table 5. AISC/oz Breakdown

ECONOMIC ANALYSIS

The PEA provides an after-tax NPV

Table 6. Sensitivity Analysis

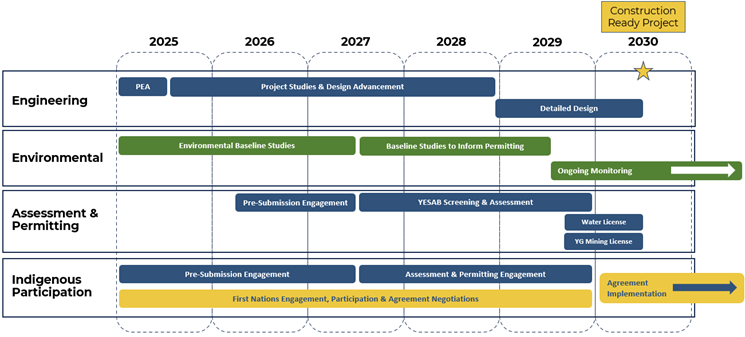

PROJECT TIMETABLE AND NEXT STEPS

Snowline intends to efficiently advance the Valley deposit through efforts in four key areas, as outlined in Figure 4 below.

Figure 4. Conceptual Project Advancement Timeline

6 Average Annual FCF is for LOM years 1-20 and is defined as Cumulative Net FCF, excluding pre-production capital costs and closure costs. Refer to the "Non-GAAP Financial Measures" section of this news release for more information.

Valley is located in the traditional territory of the First Nation of Na-Cho Nyäk Dun, with proposed site access also within the traditional territories of the Ross River Dena Council and Kaska Nation. The foundation of project advancement comes from ongoing engagement throughout all stages of project exploration, scoping, planning and baseline work. Through continued open communication and collaboration, the Company intends to design and advance Valley in a responsible, sustainable and ultimately beneficial manner.

The next technical study is expected to be a pre-feasibility study ("PFS") for the Rogue Project, focused on Valley. Fieldwork to support a PFS has recently commenced, and will include geotechnical drilling, groundwater characterization and monitoring, surface material characterization supported by lidar surveying and sonic drilling, and broader geochemical characterization of geological materials. Drilling is also underway at Valley that is planned to convert current inferred mineral resources to indicated mineral resources or higher, so that they may be considered in a PFS.

Preliminary environmental baseline monitoring began at Valley in October 2022. Over the coming months, the Company plans to expand the scope of these baseline studies, both spatially and by discipline to encompass a broader range of data types, to provide a holistic picture to inform future permitting.

OPPORTUNITIES AND EXPLORATION POTENTIAL

The PEA is an initial, conceptual evaluation of a mining scenario at Valley. While care has been taken to provide accurate estimates and realistic assumptions, the preliminary nature of the Study provides opportunities for further refinements of the operation that could potentially improve the project's technical and financial performance.

Resource Expansion & Satellite Deposits: The Valley gold deposit remains open in multiple directions, with open edges to the current resource, large volumes of the host intrusion still untested by drilling, and areas of gold mineralization encountered in drilling that are outside of the current resource and the PEA mine plan. Exploration drilling within the surrounding intrusion is currently underway. On a broader scale, the Rogue plutonic complex hosts multiple additional gold-bearing intrusions with the potential to host Valley-style mineralization. Surface exploration and drilling of multiple such targets are planned for the 2025 field season.

Throughput, Phasing & Cutoff Optimization: The PEA uses mine life and NPV as primary factors in determining mining rate and mill throughput, and assuming a constant milling capacity of 25,000 tonnes per day throughout the LOM. Scaling up LOM throughput would increase annual gold production, accelerating cash flows and thus potentially increasing NPV at the expense of mine life, while increasing initial capital expenditures.

Similarly, increasing mill throughput following Year 5 could conceptually increase annual production rates to more than 500,000 oz/year throughout the entirety of a shorter LOM, but the technical feasibility of this increase requires further study, and it would add capital costs that could potentially offset gains from accelerated cash-flow.

Outside of throughput considerations, using a higher cutoff grade would result in higher overall margins per ounce and-given the near-surface distribution of the highest grades in the deposit-reduced LOM stripping ratios, but doing so would result in a smaller production profile and a shorter LOM.

At present, such trade-offs have not been studied in detail. These factors will be analysed to inform future technical studies and planning.

Infrastructure Support: Capital expenditures in the PEA assume requisite upgrades to public infrastructure along the Yukon's North Canol Road-which provides access to a number of important resource projects-are borne entirely by the Rogue Project. Presently, the Canadian Government's Critical Minerals Infrastructure Fund has allocated initial capital to study potential road upgrades, bridge construction and power transmission along this infrastructure corridor. Given the public nature of the road and the presence of multiple resource companies in the region, the assumption that all expenditures would be borne by the Project is thought to be conservative.

Power Optimization: On-site diesel power generation is assumed for the PEA. For future technical studies and project planning, additional work will be conducted to review the relative impact of various alternative options.

Closure Costs: A conservative approach has been taken with respect to progressive reclamation, closure costs and post-closure reclamation work. Where uncertainties exist, financial allowances for worst-case scenarios have been made. Planned future work may provide further clarity which could eliminate any unneeded expenditures.

STUDY NOTES

Snowline retained SRK Consulting (Canada) Inc as lead consultants, along with additional independent contractors, to prepare the PEA in accordance with NI 43-101.

The PEA is based on the most recent (May 15, 2025) MRE for Valley, comprising 7.94 million ounces gold averaging 1.21 g/t Au in the measured and indicated categories and an additional 0.89 million ounces gold averaging 0.62 g/t Au in the inferred category, based on roughly 53 km of drilling completed by the end of 2024. Notably, approximately

The PEA is preliminary in nature and includes inferred mineral resources (approximately

CONFERNCE CALL DETAILS

The Company will host a conference call to discuss the results at 6:00 am PDT / 9:00 am EDT on Tuesday June 24, 2025. The details are below:

To participate in the conference call, please use the following dial-in numbers and request to join the Snowline Gold Corp call:

Webcast URL:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=IJ983Q4D

Participant Telephone Numbers:

Canada/USA Toll Free1-844-763-8274

International Toll +1-647-484-8814

ABOUT SNOWLINE GOLD CORP.

Figure 5. Rogue Project Regional Map

Snowline Gold Corp. is a Yukon Territory focused gold exploration and development company with an eight-project portfolio covering roughly 360,000 ha (3,600 km2). The Company is advancing its Valley deposit-a large, low-strip, near surface, >1 g/t Au bulk tonnage gold system located in the eastern Yukon-while continuing regional exploration of surrounding targets on the Rogue Project and the broader district in the highly prospective, yet underexplored Selwyn Basin.

Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits across the central Yukon and Alaska. The Company's comprehensive first-mover position and extensive exploration database provide a distinct competitive advantage and a unique opportunity for investors to be part of multiple discoveries, the advancement of a significant gold deposit, and the creation of a new gold district.

QUALIFIED PERSONS

The following authors of the PEA are qualified persons for the purposes of NI 43-101 and the PEA-related information in this news release has been prepared under the supervision of and approved by them:

Bob McCarthy, P.Eng., SRK Consulting (Canada) Inc

Ed Saunders, P.Eng., SRK Consulting (Canada) Inc

Ignacio Garcia, P.Eng., SRK Consulting (Canada) Inc

Mauricio Herrera, P.Eng., SRK Consulting (Canada) Inc

Christina James, P.Eng., SRK Consulting (Canada) Inc

Jeff Clarke, P.Geo., SRK Consulting (Canada) Inc

Heather Burrell, P. Geo., Archer, Cathro & Associates (1981) Limited

Steven C. Haggarty, P. Eng., Haggarty Technical Services Corp.

Daniel J. Redmond, P. Geo., D Redmond Consulting and Associates

Additional scientific and technical information in this news release not specific to the PEA has been prepared under the supervision of and approved by Thomas Branson, M.Sc., P. Geo., Vice President of Exploration for Snowline, as qualified person for the purposes of NI43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

USE OF NON-GAAP MEASURES

Certain financial measures referred to in this news release are not measures recognized under IFRS and are referred to as non-GAAP financial measures or ratios. These measures have no standardized meaning under IFRS and may not be comparable to similar measures presented by other companies. The definitions established and calculations performed by Snowline are based on management's reasonable judgement and are consistently applied. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

The non-GAAP financial measures used in this news release and common to the gold mining industry are all-in sustaining cost per ounce of gold sold, and free cash flow.

All-in sustaining cost per ounce of gold sold and free cash flow are non-GAAP financial measures or ratios and have no standardized meaning under IFRS Accounting Standards ("IFRS") and may not be comparable to similar measures used by other issuers. As Valley is not in production, the Company does not have historical non-GAAP financial measures nor historical comparable measures under IFRS, and therefore the foregoing prospective non-GAAP financial measures or ratios may not be reconciled to the nearest comparable measures under IFRS.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and forward-looking information (collectively, the "forward-looking statements") within the meaning of applicable Canadian securities legislation, concerning the business, operations and financial performance of the Company. Forward-looking statements in this news release include, but are not limited to, the Company's expectations and estimates with respect to: the economic and scoping-level parameters of the PEA and Valley; the anticipated timeline for completion of the Technical Report and potential PFS; mineral resource estimates; the cost and timing of any development of Valley; the proposed mine plan and mining methods; dilution and mining recoveries; processing method and rates; production rates; projected metallurgical recovery rates; infrastructure requirements; energy sources; capital, operating and sustaining cost estimates; the projected life of mine and other expected attributes of Valley; the NPV, IRR and payback period of capital; future metal prices; the timing of any engineering, environmental assessment or Indigenous consultation processes; the expansion of environmental baseline monitoring programs; changes to Valley configuration that may be requested as a result of stakeholder or government input; government regulations and permitting timelines; TSF; accessing to Valley and lodging; water management; estimates of reclamation obligations and closure costs; requirements for additional capital; environmental risks; future drill programs and general business and economic conditions.

Statements relating to "mineral resources" are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions that the mineral resources described can be profitably produced in the future. Generally, forward-looking statements can be identified using forward-looking terminology. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "target", "forecast", "schedule", "prospective", "envision", "continue", "intend", "assume", "anticipate", "believe", "estimate", "budget", "predict", "project" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to the inherent uncertainties regarding cost estimates; the use of non-GAAP measures in financial performance accounting; changes in commodity and metal prices; currency fluctuation; financing; unanticipated resource grades and recoveries; infrastructure; results of future exploration activities; cost overruns; availability of materials and equipment; timeliness of government approvals; political risk and related economic risk; unanticipated environmental impact on operations; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. Additionally, while the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View the original press release on ACCESS Newswire