Snowline Gold Expands Measured and Indicated Gold Ounces By 96% In Updated Mineral Resource Estimate at Its Valley Gold Deposit, Yukon

Rhea-AI Summary

Positive

- 96% increase in Measured & Indicated gold resources to 7.94 million ounces

- 40% of total Measured and Indicated gold ounces now classified as Measured, indicating high confidence

- Resource demonstrates low sensitivity to cut-off grades, showing resilience to cost increases and gold price decreases

- Deposit remains open for expansion with potential for additional higher-grade zones

- High gold recovery rate of 92-93% expected from processing

Negative

- Lower grade in Inferred Resources at 0.62 g/t Au compared to Measured & Indicated Resources

- Significant capital requirements expected for mining costs ($5.00/tonne) and processing costs ($23.50/tonne)

News Market Reaction

On the day this news was published, SNWGF declined 3.76%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Updated Mineral Resource Estimate (MRE) for the Valley gold deposit, located on Snowline's

100% owned Rogue Project in the Yukon Territory, Canada, shows substantial growth and de-risking from the previous, initial MRE in 2024:Measured & Indicated Mineral Resources: 204 Mt at 1.21 g/t Au for 7.94 million ounces, a

96% increase in Measured and Indicated contained ounces*Inferred Mineral Resource: 45 Mt at 0.62 g/t Au for 0.89 million ounces

Resource remains open to expansion along multiple limits of current drill testing, with potential for additional higher grade gold zones outside the current resource, as indicated by late 2024 drilling

Quality of resource highlighted by consistent conversion to higher categories, including

40% of total Measured and Indicated gold ounces now classified as MeasuredInitial Preliminary Economic Assessment for Valley is well underway and expected to be finalized in the coming weeks

*Based on Indicated Mineral Resources of 4.052 Moz gold (76 Mt at 1.66 g/t Au), with no Measured Mineral Resources, in the previous MRE for Valley, supported by the technical report for Rogue entitled "Rogue Gold Project: NI 43-101 Technical Report and Mineral Resource Estimate," authored by Heather Burrell, P. Geo., Daniel J. Redmond, P. Geo., and Steven C. Haggarty, P. Eng., with an effective date of May 15, 2024.

VANCOUVER, BC / ACCESS Newswire / May 15, 2025 / SNOWLINE GOLD CORP. (TSX-V: SGD)(OTCQB:SNWGF) (the " Company " or " Snowline ") is pleased to report an updated Mineral Resource Estimate (MRE) prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) standards for the Valley gold deposit on its

"The updated mineral resource estimate for the Valley gold deposit is another positive milestone as we continue to uncover the full scale of this gold system," said Scott Berdahl, CEO & Director of Snowline. "With just 53 km of drilling so far, we have discovered and substantially derisked a large, continuous, non-refractory gold deposit exposed at surface, in an underexplored region with multiple large greenfield gold anomalies and recent prospecting discoveries. Importantly, a considerable majority of the known system at Valley has been upgraded into Measured and Indicated categories, which can be used to inform pre-feasibility and feasibility studies. We are excited to kick off our 2025 field season in the coming days, with the goals of rapidly advancing and expanding Valley alongside continued exploration and drill testing of regional targets.

"We are also pleased to report significant progress on the Preliminary Economic Assessment for Valley, which will be based on this updated MRE. We anticipate completion and release of this study in the coming weeks."

INITIAL MINERAL RESOURCE ESTIMATE OVERVIEW

The updated MRE for the Valley deposit is prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards incorporated by reference in NI 43-101. The MRE contains Measured Mineral Resources of 69.7 million tonnes (Mt) at 1.41 grams per tonne gold (g/t Au) for 3.15 million ounces (Moz) gold and Indicated Mineral Resources of 134.3 Mt at 1.11 g/t Au for an additional 4.79 Moz gold, in addition to Inferred Mineral Resources of 44.5 Mt at 0.62 g/t Au for 0.89 Moz gold ( Table 1 ) using a 0.3 g/t Au cut-off grade. The estimate is based on 52,736 metres (m) drill data from all 123 holes at Valley drilled to date. Work underway on a Preliminary Economic Assessment (PEA) will assess Snowline's view that Valley has strong potential to host a long-life, high-quality gold mine.

Snowline Gold Rogue Project, Yukon, Canada

Table 1: Valley Gold Deposit Mineral Resource Estimate

Mineral Resources (Above 0.30 g/t gold cut-off within 522 Mt total Material Shell)

Mineral Resource Category | Tonnage (Million Tonnes) | Gold Grade (Au g/t) | Contained Gold (Million Ounces) |

Measured Resources | 69.7 | 1.41 | 3.15 |

Indicated Resources | 134.3 | 1.11 | 4.79 |

Measured + Indicated Resources | 204.0 | 1.21 | 7.94 |

Inferred Resources | 44.5 | 0.62 | 0.89 |

Notes:

The effective date of the Mineral Resource Estimate is March 1, 2025, and the Mineral Resource Estimate is based upon all available exploration data available to the end of February 2025.

Values for tonnage and contained gold are rounded to the nearest thousand.

Estimated Mineral Resources were classified following CIM Definition Standards. The quantity and grade of the Inferred Mineral Resources listed here are uncertain in nature and have insufficient exploration data to classify them as Measured and/or Indicated Mineral Resources, and it is not certain that additional exploration will result in the upgrading of the Inferred Mineral Resources to a higher category.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by Metal Prices, Economic Factors, Environmental, Permitting, Legal, Title, or other relevant issues.

All stated Mineral Resources are contained with a pit shell of approximately 522 Mt of material. All blocks located below or outside of this pit shell have been excluded from the Mineral Resource Estimate regardless of gold grade or Mineral Resource category.

The Mineral Resource cut-off grade of 0.30 g/t gold and the Lerchs-Grossman limiting pit shell have been defined with the following assumptions:

An assumed conventional gold mill processing operation with a nominal process rate in the range of 25,000 t/day milled.

A gold price of US

$ 2,350 /ounce and CAN$/US$ exchange rate of 1.40.Average mining costs of CAN

$ 5.00 per tonne of material mined.Average processing costs of CAN

$ 23.50 per tonne processed.A process recovery of

92% to93% for gold.Average administrative costs of CAN

$ 59 million per annum or CAN$ 6.42 per tonne processed.A

1% royalty on recovered gold.Refining and selling costs of CAN

$ 10.00 per recovered ounce of gold.Overall pit slopes range from 41 to 48 degrees as per SRK geotechnical recommendations.

The pit shell selected as the Mineral Resources limit has a revenue factor of 1.00.

Snowline Gold Rogue Project, Yukon, Canada

Table 2: Valley Gold Deposit Mineral Resource Estimate

Sensitivity to Gold Cut-Off Grade

Gold Cut-off (Au g/t) | Mineral Resource Category | Tonnage (Million Tonnes) | Gold Grade (Au g/t) | Contained Gold (Million ounces) |

0.6 g/t | Measured Resources | 55.6 | 1.65 | 2.95 |

Indicated Resources | 89.1 | 1.45 | 4.14 | |

Total M+ I Resources | 144.7 | 1.52 | 7.09 | |

Inferred Resources | 16.3 | 0.97 | 0.51 | |

0.5 g/t | Measured Resources | 60.1 | 1.57 | 3.03 |

Indicated Resources | 103.0 | 1.32 | 4.39 | |

Total M+ I Resources | 163.1 | 1.41 | 7.42 | |

Inferred Resources | 22.3 | 0.89 | 0.61 | |

0.4 g/t | Measured Resources | 64.9 | 1.49 | 3.10 |

Indicated Resources | 118.2 | 1.21 | 4.61 | |

Total M+ I Resources | 183.0 | 1.31 | 7.70 | |

Inferred Resources | 31.5 | 0.74 | 0.74 | |

0.3 g/t | Measured Resources | 69.7 | 1.41 | 3.15 |

Indicated Resources | 134.3 | 1.11 | 4.79 | |

Total M+ I Resources | 204.0 | 1.21 | 7.94 | |

Inferred Resources | 44.5 | 0.62 | 0.89 | |

0.2 g/t | Measured Resources | 73.6 | 1.35 | 3.18 |

Indicated Resources | 150.9 | 1.01 | 4.95 | |

Total M+ I Resources | 224.5 | 1.12 | 8.10 | |

Inferred Resources | 60.1 | 0.53 | 1.01 |

Notes:

Bolded row represents the currently stated Mineral Resource Estimate.

Cut-off grades as low as 0.2 g/t Au are still considered to meet NI 43-101 guidelines for Reasonable Prospects for Eventual Economic Extraction.

Table 2 highlights the relatively low sensitivity to cut-off grades in the updated MRE for Valley, demonstrating a resilience to increases in costs assumptions and to decreases in the price of gold. Using the current cost estimations, for example, the break-even price of gold for the 0.6 g/t Au cut-off would be US

Further details regarding this updated MRE including the estimation methods and procedures will be detailed in an updated NI 43-101 Technical Report which will be filed on SEDAR+ (www.sedarplus.ca) following the completion of the forthcoming Valley PEA.

Figure 1 - Cross section 31 through Valley initial MRE block model. A large zone of continuous, >2 g/t Au mineralization is present from surface within a larger, continuous halo of mineralization.Resource blocks are 10 x 10 x 5 m. Only blocks above cutoff grade of 0.3 g/t Au located within the resource-constraining shell are included in the updated MRE for Valley - none of the mineralized blocks shown outside of this shell are counted towards the MRE. Mineralization remains open in multiple locations, particularly along the northeastern edge of the section. For the section display, drill holes project 25 m in front of and behind section.

Figure 2 - Long section through Valley initial MRE block model. As with the previous cross section, a large zone of continuous, >2 g/t Au mineralization is present from surface. Resource blocks are 10 x 10 x 5 m. Only blocks above cutoff grade of 0.3 g/t Au located within the resource-constraining shell are included in the updated MRE for Valley - none of the mineralized blocks shown outside of this shell are included. Mineralization remains open in multiple locations, particularly at depth in the southeastern and northern parts of the section. For the section display, drill holes project 25 m in front of and behind section.

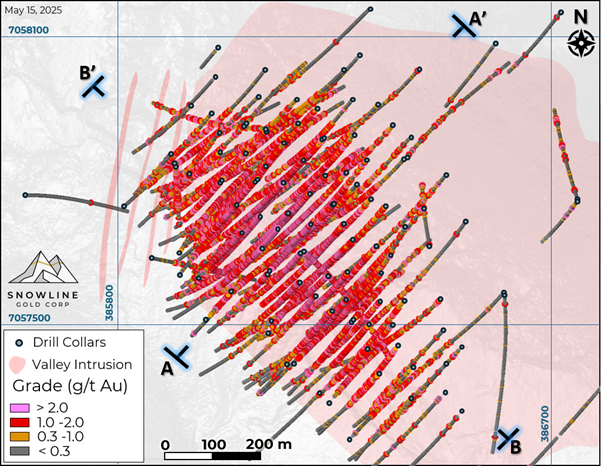

Figure 3 - Plan view of the Valley deposit , showing all drill results to date and section traces for Figures 1 & 2.

Figure 4 - Cross Section 31 through the Valley deposit showing the June 17, 2024 initial MRE (left) compared to the current updated MRE (right). The

ABOUT ROGUE

Snowline Gold's

Since its launch in 2021, Snowline has progressed the Rogue Project's Valley deposit from a greenfield prospecting discovery to a significant bulk tonnage gold resource, with a combined 7.94 Moz gold Measured and Indicated mineral resource at 1.21 g/t Au and an additional 0.89 Moz Inferred mineral resource at 0.62 g/t Au within a pit-shell constraint, as outlined in this release.

Exploration of the open Valley deposit is ongoing. Valley is a reduced intrusion-related gold system (RIRGS), geologically similar to multi-million-ounce RIRGS deposits currently in production, like Kinross's Fort Knox Mine in Alaska, but with substantially higher gold grades. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays within and along the margins of a one-kilometer-scale, mid-Cretaceous aged Mayo-series intrusion.

The Rogue Project area hosts multiple intrusions similar to Valley along with widespread gold anomalism in stream sediment, soil and rock samples. Elsewhere, RIRGS deposits are known to occur in clusters. For these reasons, Snowline considers the Rogue Project to have district-scale potential to host additional reduced intrusion-related gold systems.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration and development company with an eight-project portfolio covering roughly 360,000 ha (3,600 km 2 ). The Company is advancing its Valley deposit-a large, low-strip, near surface, >1 g/t Au bulk tonnage gold system located in the eastern Yukon-while continuing regional exploration of surrounding targets on the Rogue Project and the broader district in the highly prospective yet underexplored Selwyn Basin.

Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits across the central Yukon and Alaska. The Company's comprehensive first-mover position and extensive exploration database provide a distinct competitive advantage and a unique opportunity for investors to be part of multiple discoveries, the advancement of a significant gold deposit, and the creation of a new gold district.

QUALIFIED PERSON

The technical work of the updated MRE was completed by Dan Redmond, P.Geo., an independent qualified person as defined by NI 43-101. He has reviewed, verified and approved the technical information related to the MRE in this news release.

All other information in this news release has been prepared under the supervision of, verified and approved by Thomas K. Branson, M.Sc., P. Geo., VP Exploration of Snowline, as a qualified person for the purposes of NI 43-101.

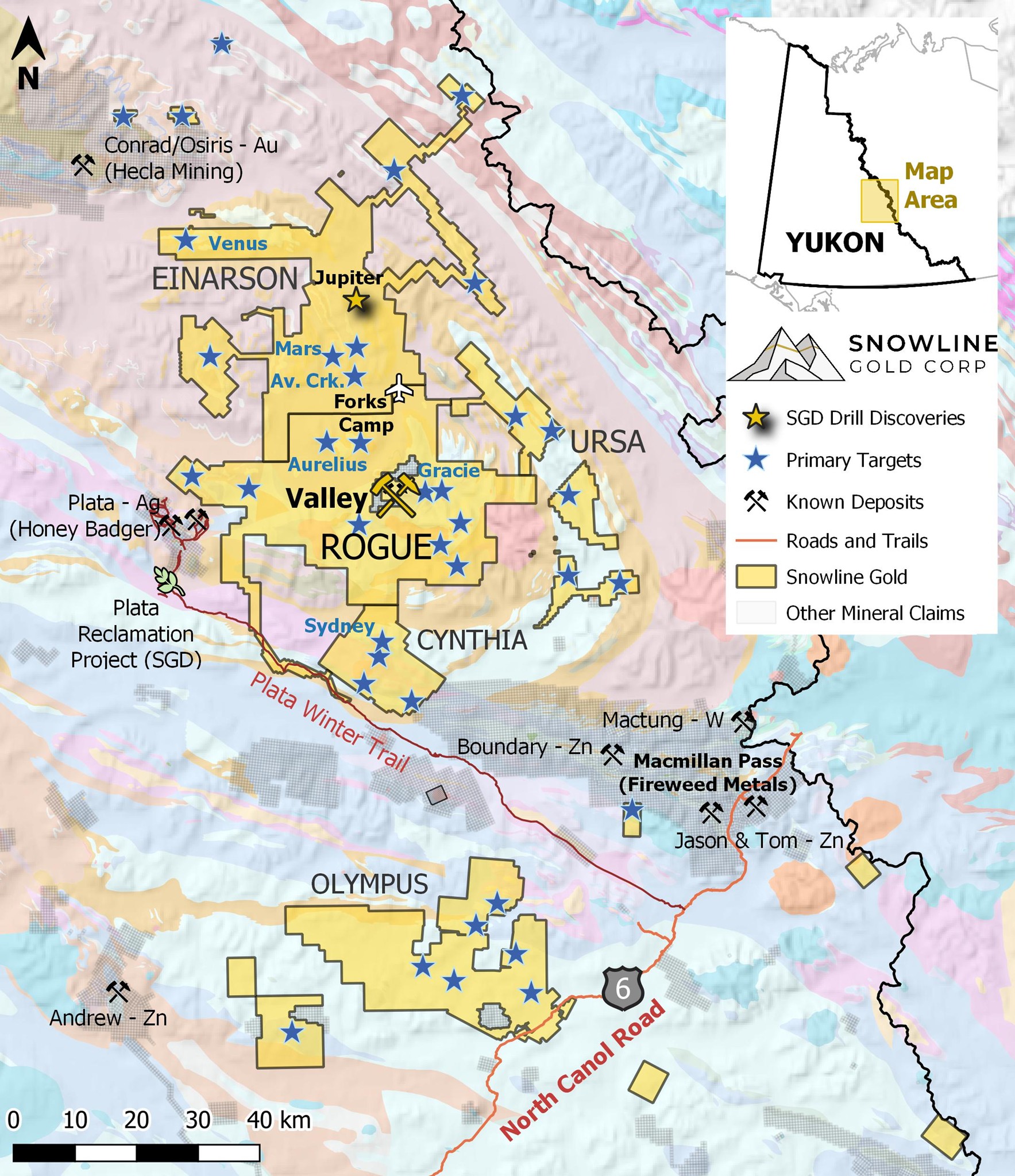

Figure 5 - Project location map for Snowline Gold's eastern Selwyn Basin projects: Rogue, Einarson, Ursa, Cynthia and Olympus. The Valley deposit is one of several prospective reduced intrusion-related gold system (RIRGS) targets on the broader 30 x 60 km Rogue Project, complemented by orogenic, Carlin-type, RIRGS and other sediment hosted gold targets on surrounding projects.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company's belief that Valley has excellent potential for continued growth, the anticipated timelines for the completion of a Preliminary Economic Assessment at Valley, various cost, price and production assumptions used to inform the Mineral Resource Estimate cut-off grade, the Company's belief that the region around Valley has the potential to become a prolific minerals district, the Company's view that Valley has encouraging potential to host a long-life, high-quality gold mine and the Company considering the Rogue Project to have district-scale potential to host additional reduced intrusion-related gold systems. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

View the original press release on ACCESS Newswire