Scorpio Gold Reports Maiden Mineral Resource Estimate and Historical Mineral Resource Estimate

Rhea-AI Summary

Scorpio Gold (OTCQB: SRCRF) has announced its Maiden Mineral Resource Estimate (MRE) for its 100%-owned Manhattan District in Nevada, along with a Historical MRE for satellite deposits. The Maiden MRE revealed 740,000 oz of contained gold in the inferred category, with 18,343 tonnes grading 1.26 g/t gold at the Goldwedge & Manhattan Pit areas.

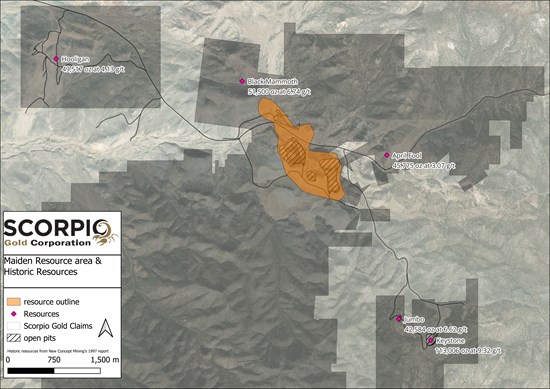

The Historical MRE, covering the Black Mammoth, April Fool, Hooligan, Keystone, and Jumbo areas, indicates 1,652,325 tonnes grading 5.89 g/t gold for 303,949 oz of contained gold. The Maiden MRE incorporates over 92,000 metres of historical drilling from more than 1,300 drillholes, establishing a robust foundation for future expansion.

Positive

- Maiden MRE confirms significant gold resource of 740,000 oz in inferred category

- High-grade mineralization with 1.26 g/t gold average grade, notably higher than typical Nevada open-pit deposits

- Extensive historical data incorporated: 92,000+ meters of drilling from 1,300+ drillholes

- Additional Historical MRE indicates 303,949 oz of contained gold in satellite deposits

Negative

- Resource entirely in Inferred category, requiring additional work to upgrade classification

- Historical MRE requires significant validation work before being considered current

- 2025 drilling results not yet incorporated into resource estimate

News Market Reaction

On the day this news was published, SRCRF gained 1.74%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - September 11, 2025) - Scorpio Gold Corporation (TSXV: SGN) (OTCQB: SRCRF) (FSE: RY9) ("Scorpio Gold", or the "Company") is pleased to announce the Maiden mineral resource estimate (the "Maiden MRE") at the

The Maiden MRE covers the Goldwedge & Manhattan Pit areas of the Project and comprises 18,343 tonnes grading 1.26 g/t gold for a total of 740,000 oz contained gold in the inferred category. The effective date of the Maiden MRE is June 4, 2025.

The Historical MRE covers the Black Mammoth, April Fool, Hooligan, Keystone, and Jumbo areas of the Project and comprises 1,652,325 tonnes grading 5.89 g/t gold for a total of 303,949 oz contained gold.

"The Maiden MRE represents the starting point for the newly consolidated

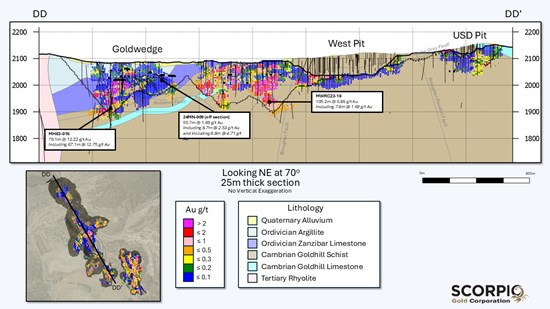

"The Maiden MRE is a rewarding and necessary step towards unlocking the Manhattan District's true potential. Taking the time to review, compile, and validate the historic data included in the resource quantifies the history of the area and has proved to be the most cost effective measure to this interim resource. One of many examples from this process is uncovering the very high-grade interval in drill hole MH83-016, of 12.22 g/t over 70.1 metres, which sits in the Goldwedge target of the resource. Pairing converted historic resources with the Phase 1 2025 and upcoming Phase 2 drilling positions the Maiden MRE as a starting point for Manhattan's unrealized potential," commented Harrison Pokrandt, VP Exploration of Scorpio Gold.

Figure 1. Location Map Showing the Area of the Maiden MRE and the Historical MRE

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/265978_31461d58d4577b12_001full.jpg

Maiden MRE

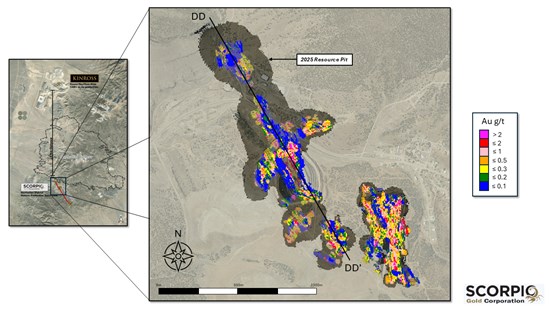

The Maiden MRE represents the first modern resource prepared for the consolidated Manhattan District and covers the Goldwedge and Manhattan Pit areas. Importantly, the estimate incorporates over 92,000 metres of historical drilling in more than 1,300 drillholes, providing a robust foundation while also highlighting the significant upside potential of the district. The resource is entirely in the Inferred category and reflects only the validation and conversion of legacy data - it does not yet include any of Scorpio Gold's 2025 drilling, which is already underway and expected to provide additional growth.

The results confirm the high-grade character of the mineralization, with an average grade of 1.26 g/t Au at a 0.3 g/t cut-off. This grade is notably higher than many Nevada open-pit deposits and underscores Manhattan's potential to become a standout open-pit gold project in the state. The resource also captures both the continuity of mineralization within the Goldwedge area and the potential for larger tonnage envelopes surrounding historical high-grade structures.

With this initial resource in place, Scorpio Gold is positioned to pursue its goal of defining a multi-million-ounce district. The Maiden MRE provides a clear starting point for ongoing exploration and expansion, setting the stage for upcoming drilling to further delineate and grow the resource base.

Table 1. Pit-constrained Inferred inventories at a variety of gold cut-off grade sensitivities.

| Cut-off grade | Tonnes ≥ cut-off | Average gold grade ≥ cut-off | Gold Contained |

| Au (g/t) | kt | Au (g/t) | koz |

| 0.1 | 28,378 | 0.88 | 802 |

| 0.2 | 23,006 | 1.05 | 777 |

| 0.3 (Selected) | 18,342 | 1.26 | 740 |

| 0.4 | 14,496 | 1.49 | 696 |

| 0.5 | 11,762 | 1.74 | 657 |

| 0.6 | 9,754 | 1.98 | 622 |

| 0.7 | 8,232 | 2.23 | 590 |

| 0.8 | 7,124 | 2.46 | 563 |

| 0.9 | 6,280 | 2.68 | 540 |

| 1 | 5,561 | 2.90 | 518 |

Notes:

Inferred resource estimates are based on economically constrained open pits generated using the Hochbaum Pseudoflow algorithm in Datamine's Studio NPVS and the following optimization parameters (all dollar values are in US dollars):

Inferred Resource classification only.

$2,500 /ounce gold price.- Mill recovery of

90% for gold. - 50 degree pit slope angle for in-situ rock, 30 degree pit slope angle for overburden.

- Mining costs of

$3.00 per tonne for both ore and waste. - Milling costs of

$15.00 per tonne processed. - G&A cost of

$3.50 per tonne processed. 2% royalty costs.- A 0.3 g/t gold only cutoff was applied for Inferred resource reporting.

Ore loss and dilution not applied.

- Mineral Resources are not Mineral Reserves (as that term is defined in the CIM Definition Standards) and do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The quantity and grade of reported Inferred resources in this estimate are conceptual in nature and there has been insufficient exploration to define these Inferred resources as an Indicated or Measured mineral resource.

- The mineral resources in this estimate were calculated with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions.

The NI 43-101 mineral resource estimate was based on a total of 92,635 m of drilling completed in 1,341 drillholes. Estimates of mineral resources were completed using a three-dimensional block model with a regular block size of 5x5x5 m, with estimation domains constructed based on modeled mineralization controls and geostatistical analysis of the drill sample data. The effects of potentially anomalous high-grade sample data are controlled using traditional top-cutting as well as limiting the distance of influence during block grade interpolation. Inferred resources were classified based on a drill data spacing of 50 m or less (25 m to the closest drillhole), considering blocks which were estimated using two or more drillholes only; Measured or Indicated resources were not classified. Model validation for the final reported Inverse Distance Cubed (ID3) estimate includes statistical validation using Ordinary Kriging (OK) and Nearest Neighbor (NN) estimates, Swath plot comparisons between composite data and the three estimation methods, visual validation on cross sections and plan levels, and grade-tonnage envelopes from Sequential Gaussian Simulation. The estimated Inferred mineral resources are contained within an economically constrained open pit generated using the Hochbaum Pseudoflow algorithm in Datamine's Studio NPVS1.

An NI 43-101 technical report detailing the mineral resource estimate for the Manhattan Project will be completed and filed on SEDAR+ (www.sedarplus.ca) and Scorpio's website (www.scorpiogold.com) within 45 days.

Figure 2. Inferred Resource Block Model and Resource Pit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/265978_31461d58d4577b12_002full.jpg

Figure 3. Long-Section DD-DD' showing Inferred Block Model and Geology for the Manhattan Goldwedge Area

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/265978_31461d58d4577b12_003full.jpg

Historical MRE

The Historical MRE was completed at the Keystone, Black Mammoth, Hooligan, April Fool, and Jumbo areas of the Project in 1997 by New Concept Mining, Inc. utilizing an open pit scenario.

Table 1. Historical MRE - Imperial Units, as stated in source report.

| Area | Proven-Probable | Possible | ||||

| Tons | Grade Oz/Ton | Oz | Tons | Grade Oz/Ton | Oz | |

| Keystone | 132,226 | 0.112 | 14,867 | 283,685 | 0.352 | 99,707 |

| Black Mammoth | 12,000 | 0.125 | 1,500 | 250,000 | 0.2 | 50,000 |

| Hooligan | 220,265 | 0.063 | 13,794 | 190,947 | 0.187 | 35,722 |

| April Fool | 361,602 | 0.044 | 15,775 | 150,000 | 0.2 | 30,000 |

| Jumbo | 16,304 | 0.099 | 1,606 | 204,348 | 0.201 | 40,978 |

| TOTALS: | 742,397 | 0.064 | 47,542 | 1,078,980 | 0.238 | 256,407 |

Notes:

- Source: A. Berry and P. Willard, 1997. "Exploration and Pre-Production Mine Development, Manhattan District Project, Nye County", a report prepared by New Concept Mining, Inc.

- The Historical MRE was based on the following assumptions: (a) Proven, Probable and Possible categorizations are historical and in accordance with the U.S. Bureau of Mines in 1943 and as recommended by the Society of Economic Geologists in 1956; (b) open pit mining method; (c) polygonal estimation method, (d) for Proven category a search radius approximating to 15 feet up and down dip and 25 feet along strike; for Probable category a search radius approximating to 75-90 feet up and down dip and 90-150 feet along strike; and for Possible category a search radius approximating to 50 feet up and down dip from Probable material and 90-150 feet along strike, (e) mineral resource tonnage and grades were reported as undiluted, (f) fire assay gold grades used in estimation we uncut; and (g) contained Au ounces are in-situ and did not include recovery losses. Strike and dip orientations were determined by variography at the time. Mineral resource tonnage and contained metal were not rounded to reflect the accuracy of the Historical MRE.

- The reader is cautioned that the Historical MRE is considered historical in nature and as such is based on prior data and reports prepared by previous property owners. A Qualified Person has not done sufficient work to classify the Historical MRE as a current resource and the Company is not treating the Historical MRE as a current resource. Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimate on the t can be classified as a current resource. There can be no assurance that any of the Historical MRE, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. Even if classified as a current resource, there is no certainty as to whether further exploration will result in any mineral resources being upgraded to another category.

Table 2. Historical MRE - Metric Units

| Area | Proven-Probable | Possible | ||||

| Tonnes | Grade Grams/Tonne | Grams | Tonnes | Grade Grams/Tonnes | Grams | |

| Keystone | 119,953 | 3.48 | 462,416 | 377,303 | 12.05 | 3,101,237 |

| Black Mammoth | 10,886 | 3.89 | 46,655 | 237,682 | 6.86 | 1,555,175 |

| Hooligan | 199,821 | 1.96 | 429,042 | 373,045 | 6.41 | 1,111,079 |

| April Fool | 328,040 | 1.37 | 490,658 | 464,118 | 6.86 | 933,105 |

| Jumbo | 14,791 | 3.08 | 49,952 | 200,172 | 6.88 | 1,274,559 |

| TOTALS: | 673,491 | 2.00 | 1,478,723 | 1,652,320 | 7.946 | 7,975,155 |

Notes:

- Conversion of tons (U.S. short tons) to tonnes (metric tonnes) by multiplying tons by 0.9071847.

- Conversion of ounces to grams by multiplying ounces by 31.1035

- Source: A. Berry and P. Willard, 1997. "Exploration and Pre-Production Mine Development, Manhattan District Project, Nye County", a report prepared by New Concept Mining, Inc.

- The Historical MRE was based on the following assumptions: (a) Proven, Probable and Possible categorizations are historical and in accordance with the U.S. Bureau of Mines in 1943 and as recommended by the Society of Economic Geologists in 1956; (b) open pit mining method; (c) polygonal estimation method, (d) for Proven category a search radius approximating to 15 feet up and down dip and 25 feet along strike; for Probable category a search radius approximating to 75-90 feet up and down dip and 90-150 feet along strike; and for Possible category a search radius approximating to 50 feet up and down dip from Probable material and 90-150 feet along strike, (e) mineral resource tonnage and grades were reported as undiluted, (f) fire assay gold grades used in estimation we uncut; and (g) contained Au ounces are in-situ and did not include recovery losses. Strike and dip orientations were determined by variography at the time. Mineral resource tonnage and contained metal were not rounded to reflect the accuracy of the Historical MRE.

- The reader is cautioned that the Historical MRE is considered historical in nature and as such is based on prior data and reports prepared by previous property owners. A Qualified Person has not done sufficient work to classify the Historical MRE as a current resource and the Company is not treating the Historical MRE as a current resource. Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimate on the t can be classified as a current resource. There can be no assurance that any of the Historical MRE, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. Even if classified as a current resource, there is no certainty as to whether further exploration will result in any mineral resources being upgraded to another category.

The following is a brief description of the data used for the Historical MRE and the geology of each area:

Table 3. Description Of Data Used In Historical MRE.

| Area | Geological Description | Data used in Historical MRE |

| Keystone and Jumbo | Hosted in fine grained clastic sediments, breccias and a felsic stock complex with extensive brecciation. Mineralization is classic low sulphidation epithermal type, with extensive drusy quartz and carbonate textures in veins and breccia fill with pyrite and its oxidation products and associated clays. Mineralization appears to be focussed along a north-west trending fault system. Keystone and Jumbo's fault systems strike towards each other over 600 m. | Historical MRE for Keystone and Jumbo are based on exploration and mine development drilling by Nevada Goldfields Inc. Significant historical open pit and underground mining exists at the Keystone deposit. Keystone and Jumbo have a combined 41 drillholes totalling 4,880 m. |

| Black Mammoth | Gold mineralization is hosted in near vertical zones of calcite dominant veining and blossom into the receptive Zanzibar limestone, and argillite beds that comprise the Black Mammoth hill. This zone represents the north-west extension of the Gold Wedge area. Had historical production up to the 1930's. | Historical MRE is based on surface sampling and sampling of the extensive underground historical working on the Black Mammoth hill. |

| Hooligan | Historical MRE contained within two outcropping mantos of mineralised limestone of 9.7ft thickness and 13.8ft thickness. Hooligan is comprised of the historical Cabin, Manto, Blanket, and Hooligan Mines. | 17 RC drill holes totalling 3,890 ft drilled by New Concept Mining. Additional data came from samples from historical shafts, 16 historical rotary holes drilled in a 25 ft spaced grid of 200 ft x 500 ft. Hooligan has a total of 15 RC drill holes. |

| April Fool | Low sulphidation mineralization hosted in Cambrian sediments and limestones. The geologic understanding at the time of the Historical MRE was poor. | Significant historical underground mining and "widely spaced" drill holes with "significant" gold intercepts reported. At least ten holes have been drilled on this prospect, and details and results are currently being sourced and compiled. |

Mineralization Controls and Exploration Targets

At Manhattan, generally extremely high-grade gold mineralization occurs in structures that are mostly high angle and metres to tens of metres wide. Where these structures intersect adjacent zones of fracture induced permeability it can form breccias or strongly veined mineralised bodies. Similarly, where they intersect receptive, often flat-lying carbonate beds, the gold mineralization can "blow-out" to form breccias or along the beds forming stacked mantos. Surrounding the high-grade structures, there is an envelope of progressively lower gold grades that can extend up to hundreds of metres of the central structural "feeder" zone. The underground mines in the district have historically targeted the high-grade structures and proximal zones, but Scorpio Gold is initially targeting open pit resources that comprise these high-grade zones and the surrounding mineralised envelope, as determined by the cut-off grade used at the time. This has already taken place historically at Manhattan with the West, East, USD, ISP, Keystone and Jumbo open pits all having enveloped older small underground mines.

Historical drilling does not extend beyond a vertical depth of approximately 300 m. The Company believes that there are numerous exploration targets that will be the subject of future exploration. Future, deeper drill holes will explore for high-grade targets where feeders intersect structural intersections, down-dip projections of receptive bed and fold closures.

To date, over 6,000 m has been drilled in 13 diamond drill holes and the Company plans add a RC drill rig to the diamond rig currently operating at the Project in September.

The Company cautions that any future exploration targets identified in these areas will be conceptual in nature; there has been insufficient exploration to define a mineral resource, and it is uncertain whether further work will result in a current mineral resource being delineated.

About the Manhattan District

Manhattan, located in the Walker Lane Trend of Nevada, USA, is road accessible and lies approximately 20 kilometres south of the operating Round Mountain Gold Mine, which has produced more than 15 million ounces of gold. For the first time, the Company has consolidated the district's past-producing mines under a single entity that holds valuable permitting and water rights. Historically, Manhattan has produced approximately 700,000 ounces of gold from high-grade placer and lode operations dating from the late 1890s through to the mid-2000s (Goldwedge Project Technical Report, 2005). The deposit is interpreted as a low-sulfidation, epithermal, gold-rich system situated adjacent to the Tertiary-aged Manhattan caldera in the Southern Toquima Range of Nevada.

Technical Disclosure

Qualified Person

Leo Hathaway, P. Geo, Executive Technical Director of the Company, a Qualified Person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), has approved the scientific and technical information contained in this news release.

Historical Estimates

The Historical MRE was prepared prior to the adoption of the current CIM Definition Standards on Mineral Resources and Mineral Reserves ("CIM Definition Standards") and NI 43-101. The terms used in the source report (e.g., "Resource") may not be consistent with the definitions set out in the CIM Definition Standards, as adopted in NI 43-101, and are therefore not necessarily indicative of mineral resources under these standards.

Specifically, due to lower modern cut-off grades, historical and future open pit resources are expected to be higher tonnage and lower grade (relatively), than the Historical MRE. However, the reader is cautioned that the Historical MRE may overestimate gold grade and therefore total gold inventory for reasons including, but not limited to: (a) the polygonal method distribution of grade spatially, being more liberal than most modern methods, (b) not allowing for internal dilution, and (c) no restriction on the influence of extremely high grade samples, whereas extremely high grades may be restricted in modern estimates, not least because at modern gold prices they represent more value than they did at the date of the Historical MRE. Additionally, some production from Gold Wedge occurred since the date of the Historical MRE. This is believed to be in the region of 40,000oz Au, but this cannot be confirmed from the past production records available.

The Historical MRE uses historical categories and terminology that differ from NI 43-101 categories; the Company provides the historical categories as originally reported.

The Historical MRE was reported in imperial units. For consistency and ease of comparison, the Company has converted the figures into metric units for purposes of this news release. The conversions were made using standard factors and may result in minor rounding differences.

A Qualified Person has not done sufficient work to classify the Historical MRE as a current mineral resource or reserve. The Company is not treating the Historical MRE as current mineral resources or reserves, and they should not be relied upon.

Historical Production

The historical production figures disclosed in this news release are derived from past operator records that pre-date the implementation of NI 43-101. A Qualified Person has not done sufficient work to verify these figures, and the Company is not treating them as current mineral resources or reserves.

About Scorpio Gold Corp.

Scorpio Gold holds a

ON BEHALF OF THE BOARD OF SCORPIO GOLD CORPORATION

Zayn Kalyan, Chief Executive Officer and Director

Tel: (604)-252-2672

Email: zayn@scorpiogold.com

Investor Relations Contact:

Kin Communications Inc.

Tel: (604) 684-6730

Email: SGN@kincommunications.com

Connect with Scorpio Gold:

Email | Website | Facebook | LinkedIn | X | YouTube

To register for investor updates please visit: scorpiogold.com

TSXV: SGN | OTCQB: SRCRF | FSE: RY9

Forward-Looking Statements

This news release contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

Forward-looking statements in this news release include, among others, statements relating the timing, scope and interpretation of assay results; future exploration and development plans including the intended follow-up exploration activities and timing of future disclosures, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company's business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company's securities, regardless of its operating performance.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265978