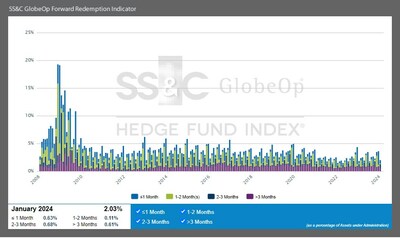

SS&C GlobeOp Forward Redemption Indicator

SS&C GlobeOp Forward Redemption Indicator: January notifications

"SS&C GlobeOp's Forward Redemption Indicator for January 2024 was

The SS&C GlobeOp Forward Redemption Indicator represents the sum of forward redemption notices received from investors in hedge funds administered by SS&C GlobeOp on the SS&C GlobeOp platform, divided by the AuA at the beginning of the month for SS&C GlobeOp fund administration clients on the SS&C GlobeOp platform. Forward redemptions as a percentage of SS&C GlobeOp's assets under administration on the SS&C GlobeOp platform have trended significantly lower since reaching a high of

Published on the 15th business day of the month, the SS&C GlobeOp Forward Redemption Indicator presents a timely and accurate view of the redemption pipeline for investors in hedge funds on the SS&C GlobeOp administration platform. Movements in the Indicator reflect investor confidence in their allocations to hedge funds. Indicator data is based on actual investor redemption notifications received. Unlike subscriptions, redemption notifications are typically received 30-90 days in advance of the redemption date. Investors may, and sometimes do, cancel redemption notices. In addition, the establishment and enforcement of redemption notices may vary from fund to fund.

SS&C GlobeOp Hedge Fund Performance Index

Base | 100 points on 31 December 2005 |

Flash estimate (current month) | |

Year-to-date (YTD) | |

Last 12 month (LTM) | |

Life to date (LTD) | |

*All numbers reported above are gross |

SS&C GlobeOp Capital Movement Index

Base | 100 points on 31 December 2005 |

All time high | 150.77 in September 2013 |

All time low | 99.67 in January 2006 |

12-month high | 130.54 in March 2023 |

12-month low | 124.80 in January 2024 |

Largest monthly change | - 15.21 in January 2009 |

SS&C GlobeOp Forward Redemption Indicator

All time high | |

All time low | |

12-month high | |

12-month low | |

Largest monthly change |

About the SS&C GlobeOp Hedge Fund Index®

The SS&C GlobeOp Hedge Fund Index (the Index) is a family of indices published by SS&C GlobeOp. A unique set of indices by a hedge fund administrator, it offers clients, investors and the overall market a welcome transparency on liquidity, investor sentiment and performance. The Index is based on a significant platform of diverse and representative assets.

The SS&C GlobeOp Hedge Fund Index is available at www.sscglobeopindex.com.

The SS&C GlobeOp Capital Movement Index and the SS&C GlobeOp Forward Redemption Indicator provide monthly reports based on actual and anticipated capital movement data independently collected from all hedge fund clients for whom SS&C GlobeOp provides administration services on the SS&C GlobeOp platform.

The SS&C GlobeOp Hedge Fund Performance Index is an asset-weighted benchmark of the aggregate performance of funds for which SS&C GlobeOp provides monthly administration services on the SS&C GlobeOp platform. Flash estimate, interim and final values are provided, in each of three months respectively, following each business month-end.

While individual fund data is anonymized by aggregation, the SS&C GlobeOp Hedge Fund Index data will be based on the same reconciled fund data that SS&C GlobeOp uses to produce fund net asset values (NAV). Funds acquired through the acquisition of Citi Alternative Investor Services are integrated into the index suite starting with the January 2017 reporting periods. SS&C GlobeOp's total assets under administration on the SS&C GlobeOp platform represent approximately

About SS&C Technologies

SS&C is a global provider of services and software for the financial services and healthcare industries. Founded in 1986, SS&C is headquartered in

Additional information about SS&C (Nasdaq: SSNC) is available at www.ssctech.com.

Follow SS&C on X, LinkedIn and Facebook.

SOURCE: SS&C

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ssc-globeop-forward-redemption-indicator-302042535.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ssc-globeop-forward-redemption-indicator-302042535.html

SOURCE SS&C