Asia Pacific Opportunity Fund is Formed to Accelerate Project APOZ

Rhea-AI Summary

Token Communities (TKCM) announced formation of the Asia Pacific OZ Fund in Texas to advance its APOZ (Asia Pacific Opportunity Zone) project and joined the OZ Insider community.

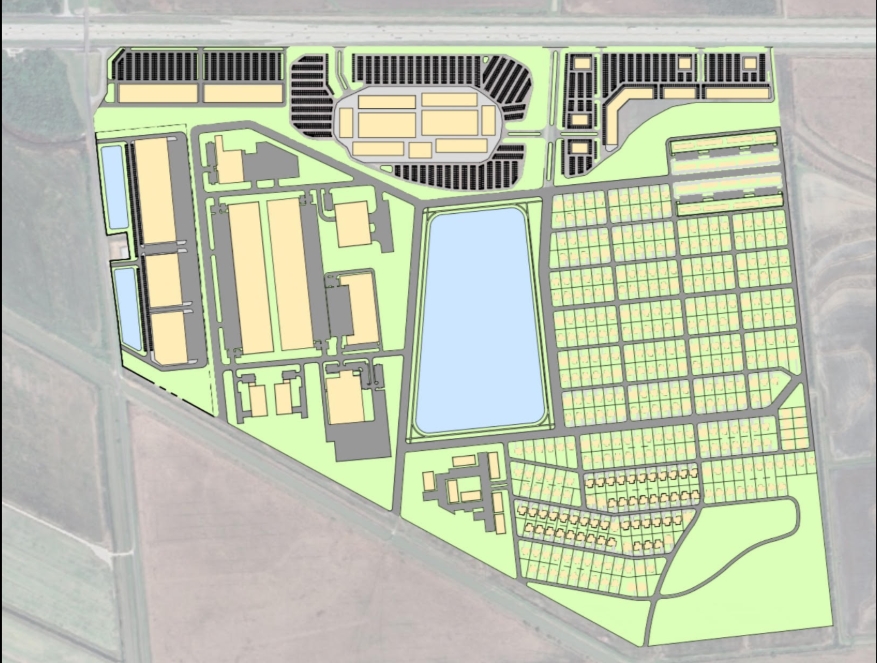

Key dates and facts: APOZ will be presented at an OZ Pitch Day on November 23, 2025. Industry context cited: total Qualified Opportunity Fund capital raised exceeded $120 billion (late 2024) and average tariffs on Chinese products into the U.S. were reported at 155% as of 10/13/2025. APOZ is described as a dual-status FTZ and QROZ business park positioned to attract Asia Pacific manufacturers.

Positive

- Asia Pacific OZ Fund formed in Texas

- APOZ scheduled for OZ Pitch Day on Nov 23, 2025

- Cited industry size: $120B QOF capital (late 2024)

- APOZ described as FTZ + QROZ dual-status

Negative

- Average tariff 155% on Chinese products as of 10/13/2025

- Announcements include forward-looking statements with no performance guarantees

APOZ Project is Ready to be presented to the Opportunity Fund community

HOUSTON, TX, 2654 / ACCESS Newswire / October 14, 2025 / ASC Global Inc. is a wholly-owned subsidiary of Token Communities ( OTC ID / Stock Symbol:TKCM ) has formed Asia Pacific OZ Fund in Texas for its APOZ Project ( Asia Pacific Opportunity Zone ), and joined the OZ Insider as a new member.

According to Mr. David Champ, the president & CEO of the company, OZ Inside is a private, close-door community of high-performing Opportunity Zone executives, professionals and investors. APOZ project will be presented to the entire OZ Insider community of members on November 23rd during an OZ Pitch Day presentation event. As of late 2024, the total Qualified Opportunity Fund ( QOF ) capital raised is estimated to exceed

As the tariff war continues to escalate with China ( as of 10/13/2025, the average tariff on Chinese Products into the U.S. market is

For any further information, please contact Mr. David Champ at (631) 397-1111.

Forward-Looking Statements

Certain information set forth in this presentation contains "forward-looking information", including "future-oriented financial information" and "financial outlook", under applicable securities laws (collectively referred to herein as forward-looking statements). Except for statements of historical fact, the information contained herein constitutes forward-looking statements and includes, but is not limited to, the (i) projected financial performance of the Company; (ii) completion of, and the use of proceeds from, the sale of the shares being offered hereunder; (iii) the expected development of the Company's business, projects, and joint ventures; (iv) execution of the Company's vision and growth strategy, including with respect to future M&A activity and global growth; (v) sources and availability of third-party financing for the Company's projects; (vi) completion of the Company's projects that are currently underway, in development or otherwise under consideration; (vi) renewal of the Company's current customer, supplier and other material agreements; and (vii) future liquidity, working capital, and capital requirements. Forward-looking statements are provided to allow potential investors the opportunity to understand management's beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment.

These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

Although forward-looking statements contained in this presentation are based upon what management of the Company believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management's estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

SOURCE: Token Communities Ltd.

View the original press release on ACCESS Newswire