TransGlobal Assets, Inc. (OTC: TMSH) Signs Letter of Intent to Acquire Majority Control of M Love Vintage Holdings, Inc., a High-Growth Denim & Heritage Apparel Brand

Rhea-AI Summary

TransGlobal Assets (OTC: TMSH) announced it has executed a Letter of Intent dated December 10, 2025 to acquire majority control of M Love Vintage Holdings, an upscale denim and curated vintage apparel brand. Under the LOI, TMSH intends to acquire all issued and outstanding shares of M Love from Green Rain Energy Holdings (OTC: GREH). Upon closing, M Love is expected to operate as a wholly owned subsidiary of TMSH. The LOI aligns with TMSH’s stated strategy to combine culturally relevant consumer brands with technology platforms focused on AI, emotional intelligence, and fintech.

Positive

- LOI to acquire majority control of M Love dated December 10, 2025

- Plan for M Love to become a wholly owned TMSH subsidiary upon closing

- Strategic fit: merges heritage retail with TMSH AI/EI/fintech focus

Negative

- Acquisition is under LOI and is not yet closed or final

- No transaction value or financial terms were disclosed in the LOI

News Market Reaction

On the day this news was published, TMSH gained 100.00%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers AGFAF, LOWLF, CSTF, GCAN were flat while LVVV gained 75%, indicating TMSH’s 100% move was stock-specific rather than a broad Healthcare or cannabis-adjacent sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Jun 26 | Product launch | Positive | +0.0% | Launch of AI-driven DateGuard emotional compatibility dating app in key cities. |

Prior positive product launch news saw no price reaction, suggesting historically muted trading response to strategic updates.

On Jun 26, 2025, TransGlobal Assets launched DateGuard, an AI-powered emotional compatibility dating app aimed at professional women. Despite exposure to a U.S. online dating market projected at $15.4 billion by 2030, the stock showed a 0% 24-hour reaction, indicating limited immediate trading impact. Today’s acquisition LOI for M Love Vintage adds a consumer brand to the AI/fintech strategy, contrasting with the earlier pure-software launch.

Market Pulse Summary

The stock surged +100.0% in the session following this news. A strong positive reaction aligns with a clearly strategic acquisition narrative, as TMSH moved to add a high-growth heritage apparel brand alongside its AI and fintech positioning. Historically, prior positive updates such as the DateGuard launch saw a 0% move, so a large gain marked a departure from muted trading. Investors had to weigh integration execution and any future capital needs as potential factors limiting the durability of a spike.

Key Terms

letter of intent financial

wholly owned subsidiary financial

artificial intelligence technical

emotional intelligence technical

fintech financial

AI-generated analysis. Not financial advice.

PORTSMOUTH, N.H., Dec. 10, 2025 (GLOBE NEWSWIRE) -- TransGlobal Assets, Inc. (OTC: TMSH), a Wyoming corporation focused on innovation at the intersection of AI, emotional intelligence, and fintech, is pleased to announce that it has executed a Letter of Intent (“LOI”) to acquire majority control of M Love Vintage Holdings, Inc. (“M Love”), an upscale boutique brand specializing in rare American workwear and curated vintage apparel.

Under the LOI, TMSH intends to acquire all issued and outstanding shares of M Love from Green Rain Energy Holdings Inc. (OTC: GREH). Upon closing, M Love will operate as a wholly owned subsidiary of TMSH.

A Strategic Acquisition Aligned With Next-Generation Consumer & Technology Trends

The LOI highlights TMSH’s long-term strategy of merging high-value, culturally relevant consumer brands with technology-driven platforms. TMSH is positioning itself as a leader in the convergence of:

- Artificial Intelligence (AI)

- Emotional Intelligence (EI)

- FinTech innovation

M Love Vintage offers a unique intersection of heritage retail and modern consumer behavior, making it a strong complementary addition to the TMSH portfolio.

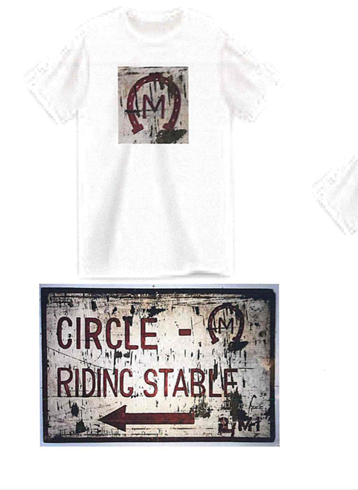

About M Love Vintage Holdings, Inc.

M Love Vintage is a boutique retailer specializing in premium vintage denim and American workwear, featuring brands such as:

- Levi’s

- Wrangler

- Lee

- Hercules

- Big Yank

- Boss of the Road

The brand caters to upscale customers who value scarcity, authenticity, craftsmanship, and personalization.

M Love differentiates itself through:

- Curated high-value vintage garments

- In-store tailoring and custom fits

- A boutique retail experience

- Expansion plans for a proprietary branded apparel line

- Subleasing to complementary services (e.g., tailor, tattoo artist)

Why This Acquisition Matters for TMSH?

The LOI lists several compelling market and strategic advantages:

Strong Industry Tailwinds

Consumers increasingly seek limited-supply, high-story-value goods as an alternative to mass-produced fashion. Vintage denim, like rare collectibles, continues to appreciate due to scarcity.

Synergies With TMSH Technology Strategy

Integrating M Love gives TMSH the opportunity to apply:

- AI-powered inventory intelligence

- Personalized fit and style recommendations

- Enhanced digital engagement tools

- Emotional-intelligence-based consumer insights

- Portfolio Expansion With Immediate Brand Recognition

- M Love brings physical retail presence and a highly engaged niche audience—creating new pathways for TMSH’s tech-driven growth plans.

Proposed Transaction Terms

According to the LOI TMSH will acquire all of M Love through an issuance of Preferred Shares of TMSH.

Terms such as class, conversion ratio, and voting rights will be finalized in the Definitive Agreement.

Upon closing, Christopher A. Villareale, current Vice President of M Love, will become President and Secretary of TMSH and lead brand integration and expansion efforts.

Conditions to Closing

The transaction remains subject to:

- Satisfactory due diligence

- Approval by both companies’ Boards

- Execution of the Definitive Agreement

- Compliance with Wyoming Business Corporation Act, federal securities laws, and applicable OTC Markets requirements

The LOI is non-binding, except for Confidentiality and Governing Law provisions.

Management Commentary

TMSH management issued the following statement:

“This transaction represents a powerful step forward in building a portfolio that blends culture, technology, and high-growth sectors. M Love Vintage offers an authentic, in-demand consumer brand with strong demographic alignment. We believe this acquisition positions TMSH for new verticals in apparel, lifestyle branding, and AI-driven consumer personalization.”

About TransGlobal Assets Inc. (OTC: TMSH)

TransGlobal Assets Inc. is a publicly traded, innovation-driven company dedicated to building technology platforms that solve real-world problems with a human-first approach. By harnessing artificial intelligence, behavioral science, and ethical design, the company is committed to delivering solutions that improve financial wellness, emotional connection, and everyday life experiences.

Learn more at: msgholdings.ai

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, including those regarding TransGlobal Assets Inc.'s business strategy, future operations, financial position, estimated revenues, projected costs, prospects, and plans, and objectives of management, are forward-looking statements.

Forward-looking statements are typically identified by words such as "believe," "expect," "anticipate," "estimate," "intend," "plan," "may," "will," "could," "should," "would," "continue," or the negative thereof or other variations thereon or comparable terminology. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's control, which could cause actual results to differ materially from those described in the forward-looking statements.

Such risks and uncertainties include, but are not limited to: changes in market conditions, the Company's ability to successfully develop and commercialize the Incued platform or other technologies, its ability to generate revenue or secure strategic partnerships, regulatory changes, competition, and general economic, market, or business conditions.

TransGlobal Assets Inc. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Contact us:

info@msgholdings.ai

Follow us on X: https://x.com/mindwellsol

YouTube: https://www.youtube.com/channel/UCaU0PHqGk-7uKGcqYsfZIew

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ab631939-a0ab-40c2-b23c-bea50ce92ce3