United States Antimony Reports First Zeolite Mineral Reserve Technical Report

Rhea-AI Summary

United States Antimony (NYSE American:UAMY) has released its first mineral reserve technical report for its Bear River Zeolite (BRZ) subsidiary in Preston, Idaho. The report reveals substantial reserves of 5.127 million short tons of high-grade zeolite with an average grade of 146.2 CEC meq/100g.

The company has invested over $3.5 million in facility improvements between 2021-2024. The BRZ property spans 994 acres of federal claims and 320 acres of leased private land. Based on current production rates, the proven and probable reserves could support operations for over 400 years, or 20+ years if production increases 20-fold.

Under new management, USAC completed an extensive drilling program in June 2024, comprising 80 successful vertical holes totaling 6,713 feet of drilling. The company aims to double sales through existing and new customers with minimal additional capital expenditure.

Positive

- Extensive proven and probable reserves of 5.127 million short tons of high-grade zeolite

- Extremely long reserve life of 400+ years at current production rates

- Significant facility improvements with $3.5 million investment (2021-2024)

- Potential to scale up production 20x while maintaining 20+ year reserve life

- Minimal additional capital expenditure needed to double sales

- Strategic location near Salt Lake City with year-round mining capability

Negative

- Historical underutilization of asset capacity requiring significant facility repairs

- High capital expenditures over past years ($3.8 million from 2021-2024)

- Current production rate appears relatively low compared to reserve size

News Market Reaction

On the day this news was published, UAMY declined 3.49%, reflecting a moderate negative market reaction. Argus tracked a trough of -3.1% from its starting point during tracking. Our momentum scanner triggered 17 alerts that day, indicating notable trading interest and price volatility. This price movement removed approximately $14M from the company's valuation, bringing the market cap to $398M at that time.

Data tracked by StockTitan Argus on the day of publication.

"The Critical Minerals and ZEO Company"

~ Antimony, Cobalt, Tungsten, and Zeolite ~

DALLAS, TX / ACCESS Newswire / July 24, 2025 / United States Antimony Corporation ("USAC," "US Antimony," or the "Company"), (NYSE American:UAMY)(NYSE Texas:UAMY), announced today final completion of its first mineral reserve technical report on its zeolite deposit located in Preston, Idaho. The zeolite division is run under a wholly-owned subsidiary with the name of Bear River Zeolite Company ("BRZ").

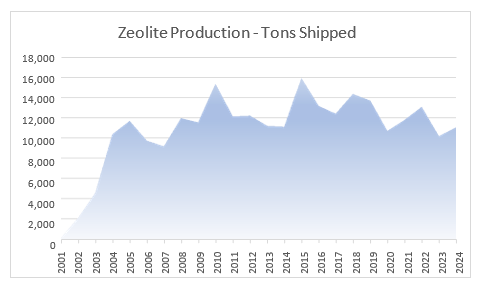

USAC originally acquired BRZ in June 2000. Shortly after acquisition, BRZ began construction of a processing plant on the property. Commercial mining of zeolite at the location commenced in 2001, 24 years ago, and has proven historically to be feasible year-round. The BRZ property is located in Franklin County Idaho, approximately seven miles east of Preston, Idaho and approximately 100 miles north of Salt Lake City, Utah.

The BRZ zeolite project is situated on a combination of federal unpatented placer mining claims administered by the U.S. Bureau of Land Management ("BLM") and privately owned leased lands. The property comprises 50 contiguous unpatented federal placer claims, each representing approximately 20 acres, covering a total of approximately 994 acres. In addition, BRZ holds a long-term lease agreement (minimum of 10 years with automatic renewals) with a private company representing family interests in the area. This lease covers approximately 320 acres of private land. Operations to-date have been conducted exclusively on the leased lands.

After new management took over USAC several years ago, in June 2024, a drilling contractor was commissioned to conduct a drilling program using a percussion rock drill equipped with a hydraulically powered dust collection system. The rig drilled 82 vertical holes with a diameter of 3.5 inches, reaching a maximum depth of 84 feet each. Of these attempts, 80 holes were successfully completed, totaling 6,713 feet of drilling. The drill holes were spaced approximately 100 feet apart.

Mineral Reserve Estimate

As of May 22, 2024, the BRZ Project is estimated to contain the following in-situ Mineral Reserve, reported above a cutoff grade of 100 meq/100g CEC (Cation Exchange Capacity). These estimates are based on validated drill data and block modeling of zeolite-bearing tuffs, incorporating all drilling, sampling, and technical data available. At current average annual production rates, the Proven and Probable Reserve could theoretically support operations for more than 400 years. This extended mine life reflects the modest scale of current throughput relative to the size of the reserve. Should production be scaled up significantly - e.g., by a factor of 20 - the Reserve would still support operations for over 20 years, demonstrating the project's flexibility and longevity under a range of development scenarios.

Classification | Tonnage | Grade | Recovery(%) | Saleable Product |

Proven | 2,267,000 | 147.0 | 100 | 2,267,000 |

Probable | 2,860,000 (*) | 145.5 | 100 | 2,860,000 |

Total | 5,127,000 (*) | 146.2 | 100 | 5,127,000 |

(*) The Probable category has been adjusted downward to reflect approximately 12,600 tons of material mined between the date of topographic survey (May 22, 2024) and the report effective date (May 31, 2025). All mined material was sourced from the Probable category.

Capital Expenditures

Year | Total Capital Cost |

2021 | |

2022 | |

2023 | |

2024 | |

2025 (Est.) | |

2026 (Est.) |

Commenting on the announcement today, Mr. Gary C. Evans, Chairman and Chief Executive Officer of USAC, stated, "Over the last several years, BRZ has undergone a significant transformation. We immediately brought on new highly qualified management, spent over

Source of SEC Technical Report Summary

Bear River Zeolite Project

Franklin County, Idaho, United States

Effective Date March 31, 2025:

Barbara Carroll, CPG, RM

Patrick J. Hollenbeck, CPG

Randall K. Martin, RM

L. Joseph Bardswich, P.E.

About USAC:

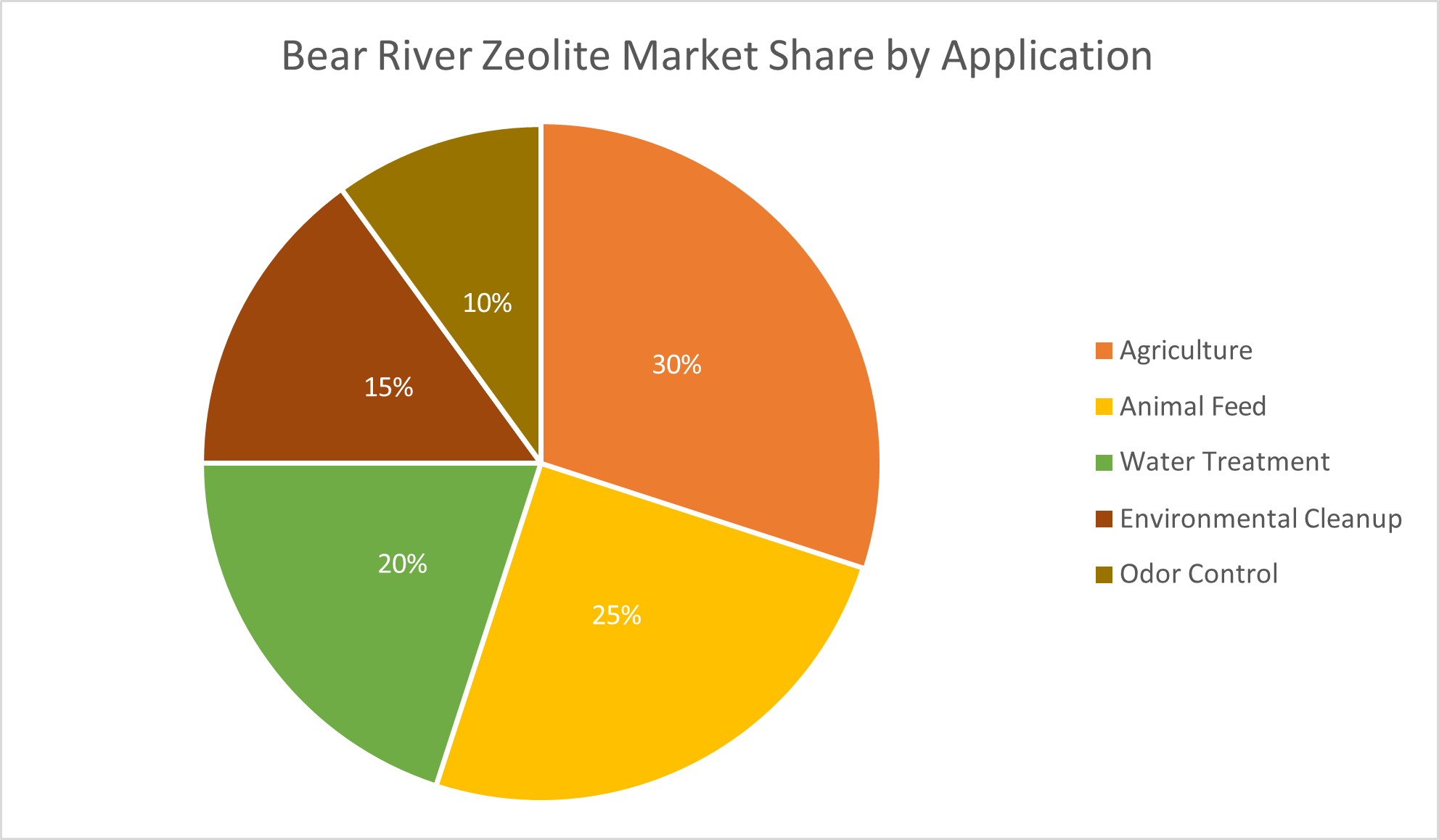

United States Antimony Corporation and its subsidiaries in the U.S., Mexico, and Canada ("USAC," "U.S. Antimony," the "Company," "Our," "Us," or "We") sell antimony, zeolite, and precious metals primarily in the U.S. and Canada. The Company processes third party ore primarily into antimony oxide, antimony metal, antimony trisulfide, and precious metals at its facilities located in Montana and Mexico. Antimony oxide is used to form a flame-retardant system for plastics, rubber, fiberglass, textile goods, paints, coatings, and paper, as a color fastener in paint, and as a phosphorescent agent in fluorescent light bulbs. Antimony metal is used in bearings, storage batteries, and ordnance. Antimony trisulfide is used as a primer in ammunition. The Company also recovers precious metals, primarily gold and silver, at its Montana facility from third party ore. At its Bear River Zeolite ("BRZ") facility located in Idaho, the Company mines and processes zeolite, a group of industrial minerals used in water filtration, sewage treatment, nuclear waste and other environmental cleanup, odor control, gas separation, animal nutrition, soil amendment and fertilizer, and other miscellaneous applications. The Company acquired mining claims and leases located in Alaska and Ontario, Canada and leased a metals concentration facility in Montana in 2024 that could expand its operations as well as its product offerings.

Forward-Looking Statements:

Readers should note that, in addition to the historical information contained herein, this press release may contain forward-looking statements within the meaning of, and intended to be covered by, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based upon current expectations and beliefs concerning future developments and their potential effects on the Company including matters related to the Company's operations, pending contracts and future revenues, financial performance and profitability, ability to execute on its increased production and installation schedules for planned capital expenditures, and the size of forecasted deposits. Although the Company believes that the expectations reflected in the forward-looking statements and the assumptions upon which they are based are reasonable, it can give no assurance that such expectations and assumptions will prove to have been correct. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties. In addition, other factors that could cause actual results to differ materially are discussed in the Company's most recent filings, including Form 10-K and Form 10-Q with the Securities and Exchange Commission.

Forward-looking statements are typically identified by words such as "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "pro forma," and other similar words and expressions. Forward- looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in the forward-looking statements and future results could differ materially from historical performance.

Contact:

United States Antimony Corp.

4438 W. Lovers Lane, Unit 100

Dallas, TX 75209

Jonathan Miller, VP, Investor Relations

E-Mail: Jmiller@usantimony.com

Phone: 406-606-4117

SOURCE: United States Antimony Corp.

View the original press release on ACCESS Newswire