University Bancorp 2024 Net Income $10,467,383, $2.02 Per Share

University Bancorp (OTCQB:UNIB) reported strong financial results for 2024, with audited net income of $10,467,383 attributable to common stockholders ($2.02 per share), a significant increase from $5,426,558 ($1.07 per share) in 2023.

The company achieved a 12.5% return on equity in 2024, up from 7.1% in 2023. Shareholders' equity reached $93.59 million ($18.10 per share) by year-end 2024. The board instituted a new dividend policy, including a special $0.20 dividend and quarterly $0.10 payments.

Key highlights include:

- Overall revenue growth of 18.65% in 2024

- Mortgage originations of $1.1 billion in 2024

- Portfolio loans increased to $782.4 million

- Net interest margin exceeded $3 million monthly

- Bank maintained assets under $1 billion to avoid additional regulatory costs

University Bancorp (OTCQB:UNIB) ha riportato risultati finanziari solidi per il 2024, con un utile netto revisionato di 10.467.383 dollari attribuibile agli azionisti ordinari (2,02 dollari per azione), un aumento significativo rispetto ai 5.426.558 dollari (1,07 dollari per azione) del 2023.

La società ha raggiunto un rendimento del capitale proprio del 12,5% nel 2024, in crescita rispetto al 7,1% del 2023. Il patrimonio netto degli azionisti ha raggiunto i 93,59 milioni di dollari (18,10 dollari per azione) a fine 2024. Il consiglio di amministrazione ha introdotto una nuova politica dei dividendi, comprendente un dividendo speciale di 0,20 dollari e pagamenti trimestrali di 0,10 dollari.

Punti salienti principali:

- Crescita complessiva dei ricavi del 18,65% nel 2024

- Origination di mutui per 1,1 miliardi di dollari nel 2024

- Prestiti in portafoglio aumentati a 782,4 milioni di dollari

- Margine di interesse netto superiore a 3 milioni di dollari mensili

- Banca ha mantenuto gli attivi sotto 1 miliardo di dollari per evitare costi regolatori aggiuntivi

University Bancorp (OTCQB:UNIB) reportó sólidos resultados financieros para 2024, con un ingreso neto auditado de 10.467.383 dólares atribuible a los accionistas comunes (2,02 dólares por acción), un aumento significativo respecto a los 5.426.558 dólares (1,07 dólares por acción) en 2023.

La empresa logró un retorno sobre el patrimonio del 12,5% en 2024, frente al 7,1% en 2023. El patrimonio neto de los accionistas alcanzó los 93,59 millones de dólares (18,10 dólares por acción) a finales de 2024. La junta estableció una nueva política de dividendos, que incluye un dividendo especial de 0,20 dólares y pagos trimestrales de 0,10 dólares.

Puntos clave:

- Crecimiento total de ingresos del 18,65% en 2024

- Originación de hipotecas por 1.100 millones de dólares en 2024

- Préstamos en cartera aumentaron a 782,4 millones de dólares

- Margen de interés neto superó los 3 millones de dólares mensuales

- El banco mantuvo activos por debajo de 1.000 millones de dólares para evitar costos regulatorios adicionales

University Bancorp (OTCQB:UNIB)는 2024년 강력한 재무 실적을 보고했으며, 보통주주에게 귀속되는 감사 후 순이익은 10,467,383달러(주당 2.02달러)로 2023년 5,426,558달러(주당 1.07달러)에서 크게 증가했습니다.

회사는 2024년에 자기자본이익률 12.5%를 달성했으며, 이는 2023년 7.1%에서 상승한 수치입니다. 2024년 말 기준 주주자본은 9,359만 달러(주당 18.10달러)에 달했습니다. 이사회는 특별 배당금 0.20달러와 분기별 0.10달러 지급을 포함한 새로운 배당 정책을 도입했습니다.

주요 내용은 다음과 같습니다:

- 2024년 총수익 18.65% 증가

- 2024년 주택담보대출 신규 취급액 11억 달러

- 포트폴리오 대출 7억 8,240만 달러로 증가

- 순이자마진 월 300만 달러 초과

- 추가 규제 비용을 피하기 위해 자산을 10억 달러 이하로 유지

University Bancorp (OTCQB:UNIB) a annoncé de solides résultats financiers pour 2024, avec un revenu net audité de 10 467 383 dollars attribuable aux actionnaires ordinaires (2,02 dollars par action), en nette augmentation par rapport à 5 426 558 dollars (1,07 dollar par action) en 2023.

L'entreprise a réalisé un rendement des capitaux propres de 12,5% en 2024, contre 7,1% en 2023. Les capitaux propres des actionnaires ont atteint 93,59 millions de dollars (18,10 dollars par action) à la fin de l'année 2024. Le conseil d'administration a mis en place une nouvelle politique de dividendes, incluant un dividende spécial de 0,20 dollar et des paiements trimestriels de 0,10 dollar.

Points clés :

- Croissance globale du chiffre d'affaires de 18,65% en 2024

- Originations hypothécaires de 1,1 milliard de dollars en 2024

- Prêts en portefeuille augmentés à 782,4 millions de dollars

- Marge nette d'intérêt dépassant 3 millions de dollars par mois

- La banque a maintenu ses actifs sous 1 milliard de dollars afin d'éviter des coûts réglementaires supplémentaires

University Bancorp (OTCQB:UNIB) meldete starke Finanzergebnisse für 2024 mit einem geprüften Nettogewinn von 10.467.383 US-Dollar, der den Stammaktionären zuzurechnen ist (2,02 US-Dollar je Aktie), was eine deutliche Steigerung gegenüber 5.426.558 US-Dollar (1,07 US-Dollar je Aktie) im Jahr 2023 darstellt.

Das Unternehmen erzielte 2024 eine Eigenkapitalrendite von 12,5%, gegenüber 7,1% im Jahr 2023. Das Eigenkapital der Aktionäre erreichte zum Jahresende 2024 93,59 Millionen US-Dollar (18,10 US-Dollar je Aktie). Der Vorstand führte eine neue Dividendenpolitik ein, die eine Sonderdividende von 0,20 US-Dollar und vierteljährliche Zahlungen von 0,10 US-Dollar umfasst.

Wesentliche Highlights:

- Gesamtumsatzwachstum von 18,65% im Jahr 2024

- Hypothekenneugeschäft von 1,1 Milliarden US-Dollar im Jahr 2024

- Portfoliodarlehen stiegen auf 782,4 Millionen US-Dollar

- Nettozinsmarge überstieg monatlich 3 Millionen US-Dollar

- Die Bank hielt die Aktiva unter 1 Milliarde US-Dollar, um zusätzliche regulatorische Kosten zu vermeiden

- Net income increased 92.9% to $10.47 million in 2024 from $5.43 million in 2023

- Revenue grew 18.65% year-over-year

- Return on equity improved to 12.5% from 7.1%

- Net interest margin increased to over $3 million monthly from under $1 million

- New dividend policy established with quarterly payments

- Strong capital position with $99.7 million Common Equity Tier 1 Capital

- Mortgage origination volume declined to $1.1 billion from $1.2 billion in 2023

- Substandard assets increased to 5.1% of Tier 1 Capital from 4.2%

- Delinquent loans over 90 days reached $1.25 million

- Allowance for credit losses of $674,635 booked as expense

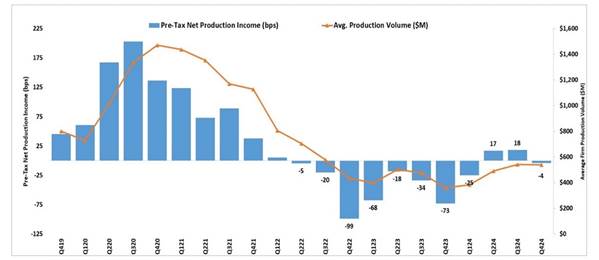

- Low industry-wide profitability in residential mortgage origination (6 basis points)

ANN ARBOR, MI / ACCESS Newswire / April 17, 2025 / University Bancorp, Inc. (OTCQB:UNIB), or ("UNIB") announced that it had audited net income of

For 2024, UNIB had a return on equity attributable to common stock shareholders of

In late 2024, the board of UNIB instituted a new dividend policy and after paying a special

While UNIB's overall revenue grew

Due to a shift in market opportunities, with the yields on mortgage loans rising sharply above the industry's cost of funds, the bank has retained more of its over a billion dollars of annual mortgage originations in recent years (the bank originated

President Stephen Lange Ranzini noted, "Considering the 30-year low in mortgage origination units nationwide, our 2024 results were outstanding. We have put into place several key projects that should result in higher earnings in 2025 and future years. University Bank is now licensed to originate mortgage loans in all 50 states and the District of Columbia, and we have all the compliant document sets built for our whole suite of first mortgage origination products in every state nationwide, except for forward mortgages in Alaska and Hawaii, which we could easily build in a few weeks, and the remaining 7 states for 1 st Mortgage HELOCs, which we are working on rolling out, except for Texas, which has unique legal restrictions. The management team is also working on getting the bank licensed for second mortgages in all 50 states, and is developing a strategy to roll out a second mortgage suite of products for sale to the secondary market.

In 2023 UNIB opted to be designated as a Financial Holding Company, which gives us a greater range of investment and business development options. We used this authority in early 2023 to establish a Captive Insurance Company owned by UNIB, chartered in Washington DC, Crescent Assurance, PCC. This firm was profitable in its first two years of operation, having earned cumulative net income of

University Bank also recently reached definitive agreements with 3 of the 7 other shareholders in Credit Union Trust to increase our ownership of that Trust Company from

Lastly, UIF, UNIB, University Bank and their subsidiaries and divisions have regulatory approval and are finalizing steps to launch additional products and product expansions in 2025.

In addition to the shift discussed above to holding more residential loans in portfolio instead of selling them on the secondary market, results in 2024 were negatively impacted by two items, partially offset by an unusual positive factor which had a net overall positive impact of

Unusual expenses :

1. Management booked an allowance for credit losses of

2. The value of the hedged mortgage origination pipeline fell

Unusual gains :

3. Management booked a valuation gain for our Mortgage Servicing Rights of

Results in 2023 were negatively impacted by two items, partially offset by an unusual positive factor which had a net overall negative impact of

Unusual expenses :

4. Management booked a valuation decline in our Mortgage Servicing Rights of

5. The UNIB securities portfolio incurred a loss of

Unusual gains :

6. The value of the hedged mortgage origination pipeline rose

During late 2022 and early 2023, UNIB issued

In October 2024, UNIB issued

At 12/31/2024 cash & equity investment securities at UNIB, available to meet working capital needs and to support investment opportunities at University Bancorp were

A portion of UNIB's working capital has been invested in a portfolio of publicly traded investments. Towards the end of 2024 we sold most of our long positions.

Three of the remaining investments are large and the remainder are very small. The three largest investments at 12/31/2024 were:

Currency Exchange International (Symbol CURN), a company that specializes in foreign exchange, of which we now own

10.41% of the common stock;Pulsar Helium (Symbol PSRHF), of which we now own

4.99% of the common stock, and is a company developing what appears to be North America's largest deposit of helium. We believe that the helium in their reserves probably has a value between$1 billion and$5 billion .A portfolio of put options on the following indices: S&P500, KRE (S&P 500 Banks) & XLF (S&P 500 Banks, Shadow Banks, Insurance Companies & REITs) as well as on one large regional bank that we have strong concerns about, which if it fails will negatively impact our loan portfolio in Michigan. UNIB's put option portfolio was worth

$1.75 million at 12/31/2024 and has since risen substantially in value with the recent stock market decline.

Due to a conservative credit culture, University Bank has had net recoveries on net loan charge-offs over the past 16 years. Over the past two economic cycles, the following loan provisions and charge-offs (in $'000s) were sustained by University Bank:

Year |

| Provision Expense |

| Net Charge-offs |

2008 |

|

| ||

2009 |

| 1.5 |

| 1.3 |

2010 |

| 0.9 |

| 0.5 |

2011 |

| 0.3 |

| 0.7 |

2012 |

| 1.4 |

| 1.5 |

2013 |

| 0.1 |

| 0.3 |

2014 |

| -0.3 |

| 0.0 |

2015 |

| -0.3 |

| -0.1 |

2016 |

| 0.0 |

| -0.0 |

2017 |

| 153.0 |

| 170.0 |

2018 |

| -226.0 |

| -207.0 |

2019 |

| 285.0 |

| 34.0 |

2020 |

| 3,951.00 |

| -16.0 |

2021 |

| -344.0 |

| -21.0 |

2022 |

| 130.0 |

| -21.0 |

2023 |

| 961.0 |

| 28.8 |

2024 |

| 713.7 |

| 21.9 |

Maximum Since Start of 2008 Financial Crisis |

|

|

| |

Cumulative Since Start of 2008 Financial Crisis |

| $ |

|

University Bank has engaged an outside vendor to perform Stress Testing analysis and these tests assume a severely adverse (depressionary) national economic scenario worse than the most recent business depressions that we have experienced, in which we assume

The Bank currently has

At 12/31/2024, we had the following with respect to delinquent loans (including both delinquent portfolio loans and delinquent loans held for sale):

Delinquent 30 Days to 59 Days,

$4,387,114 ;Delinquent 60 Days to 89 Days,

$431,970 ;Delinquent Over 90 Days & on Non-Accrual,

$1,247,348. There was no foreclosed other real estate owned at year-end.

The allowance for loan losses stood at

Excluding goodwill & other intangibles related to the acquisition of Midwest Loan Services and Ann Arbor Insurance Center, net tangible shareholders' equity attributable to University Bancorp, Inc. common stock shareholders was

Unaudited net income was

Total Assets of University Bank at 12/31/2024 were

The Tier 1 Leverage Capital Ratio at 12/31/2024 was

Common Equity Tier 1 Capital at 12/31/2024 was

Other key statistics as of 12/31/2024:

*Using 2024, 2023, 2022, 2021, 2020, 2019 and 2014 revenue which was

# UNIB only current assets divided by 12-month projected cash expenses.

+ Calculated as: (non-interest expense/(net interest income + non-interest income))

x Based on last sale of

Treasury shares as of 12/31/2024 were 37,381.

The 2024 audited financial statements are available on UNIB's website at: www.university-bank.com/wp-content/uploads/2025/03/2024-University-Bancorp-Inc.-Audited-Financial-Statements-FINAL.pdf .

Shareholders and investors are encouraged to refer to the financial information including the investor presentations, audited financial statements, strategic plan and prior press releases, available on our investor relations web page at: http://www.university-bank.com/bancorp/ . A detailed income statement, balance sheet and other financial information for UNIB and University Bank as of 12/30/2024 is available here: https://www.university-bank.com/wp-content/uploads/2025/03/4Q2024-UNIB-Financials-Preliminary-Unaudited.pdf .

About UNIB

Ann Arbor-based University Bancorp is a Federal Reserve regulated financial holding company that owns:

100% of University Bank, a bank based in Ann Arbor, Michigan;100% of Crescent Assurance, PCC, a captive insurance company licensed in Washington DC; and100% of Hyrex Servicing, a master mortgage servicing firm, based in Ann Arbor, Michigan.

University Bank together with its Michigan-based subsidiaries, holds and manages a total of over

UIF, a faith-based banking firm based in Southfield, MI;

University Lending Group, a retail residential mortgage originator based in Clinton Township, MI;

Midwest Loan Services, a residential mortgage subservicer based in Houghton, MI;

Community Banking, based in Ann Arbor, MI, which provides traditional community banking services in the Ann Arbor area;

Ann Arbor Insurance Centre, an independent insurance agency based in Ann Arbor, MI.

Reverse Mortgage Lending, a reverse residential mortgage lender based in Southfield, MI; and

Mortgage Warehouse Lending, a mortgage warehouse lender based in Southfield, MI.

CAUTIONARY STATEMENT: This press release contains certain forward-looking statements that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements concerning future growth in assets, pre-tax income and net income, budgeted income levels, the sustainability of past results, mortgage origination levels and margins, valuations, and other expectations and/or goals. Such statements are subject to certain risks and uncertainties which could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including, but not limited to, economic, competitive, governmental and technological factors affecting our operations, markets, products, services, interest rates and fees for services. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to update any information or forward-looking statement.

Contact: Stephen Lange Ranzini, President and CEO

Phone: 734-741-5858, Ext. 9226

Email: ranzini@university-bank.com

SOURCE: University Bancorp, Inc.

View the original press release on ACCESS Newswire