Key Metrics Demonstrate Upexi’s Proven Shareholder Value Creation

Rhea-AI Summary

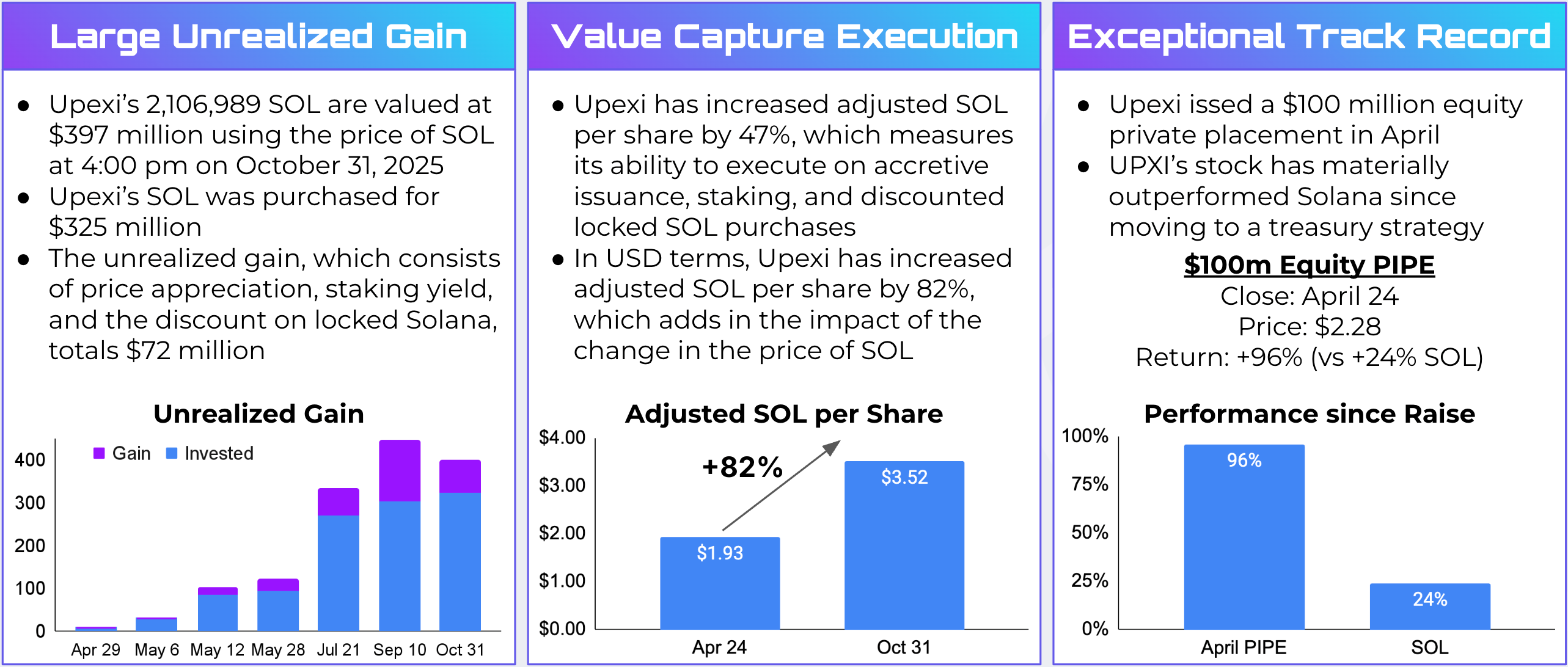

Upexi (NASDAQ: UPXI) provided a periodic update dated Nov 4, 2025 highlighting treasury performance after launching its Solana strategy. As of Oct 31, 2025 Upexi holds 2,106,989 SOL valued at $397 million (SOL price $188.56). The company reports a $72 million unrealized gain versus a $325 million cost basis, adjusted SOL per share of 0.0187 ($3.52) up 47% in SOL and 82% in dollars since the strategy launch, and staking yield of roughly 7–8% (~$75,000/day). Upexi also cited a $100 million April equity raise whose investors saw a 96% return through Oct 31, 2025.

Positive

- 2,106,989 SOL held valued at $397 million as of Oct 31, 2025

- $72 million unrealized gain versus $325 million cost basis

- Adjusted SOL per share up 47% in SOL and 82% in dollars since strategy launch

- Staking yield ~7–8%, generating about $75,000 per day

Negative

- Basic mNAV trading at 0.7x on Oct 31, 2025, indicating a market discount

- Company notes reduced treasury company sentiment as a headwind

News Market Reaction

On the day this news was published, UPXI declined 8.85%, reflecting a notable negative market reaction. Argus tracked a peak move of +2.5% during that session. Our momentum scanner triggered 7 alerts that day, indicating moderate trading interest and price volatility. This price movement removed approximately $22M from the company's valuation, bringing the market cap to $226M at that time.

Data tracked by StockTitan Argus on the day of publication.

Metrics include a

TAMPA, Fla., Nov. 04, 2025 (GLOBE NEWSWIRE) -- Upexi, Inc. (NASDAQ: UPXI), a leading Solana-focused digital asset treasury company and consumer brands owner, today released its periodic update.

“Upexi remains positioned to grow despite reduced treasury company sentiment,” stated Upexi CEO Allan Marshall. “Whether via a large unrealized gain, a substantial increase in adjusted SOL per share, or the strong performance of our stock since embarking on our Solana treasury strategy, we remain committed to creating long-term incremental value for shareholders.”

Brian Rudick, Chief Strategy Officer, added, “Upexi remains well positioned within the treasury space due both to its underpinning by an end-game winning asset in Solana and to our innovation focus, capital markets expertise, risk-prudent strategy, and proven track record. We continue to hold a peer-leading multiple with solid trading volumes and intend to monetize this for our shareholders.”

Below are highlights from the last several weeks.

Treasury Update as of October 31, 2025

- Treasury: Upexi holds 2,106,989 SOL, up

4.4% from the 2,018,419 SOL on September 10, 2025. - Net Asset Value: Using the October 31, 2025, price of

$188.56 per SOL2, the 2,106,989 SOL are valued at$397 million . - Unrealized Gain: The cost of Upexi’s SOL totals

$325 million , or$157.66 per SOL. The unrealized gain, which includes price appreciation, staking rewards, and the discount on locked SOL, stands at$72 million . - SOL per Share: Adjusted SOL per share is 0.0187 or

$3.52 , up47% and82% , respectively, from the launch of the Solana treasury strategy. - Staking: Substantially all the Company’s SOL are being staked, earning a roughly 7

-8% yield. The current daily yield is approximately$75,000 per day in revenue. - Locked SOL: Approximately

42% of the portfolio is locked SOL purchased at a mid-teens discount to the spot price and providing for built-in gains for shareholders. - Valuation: On October 31, 2025, Upexi traded at a Basic mNAV of 0.7x and a Fully-Loaded mNAV of 1.3x.

Business Initiatives

- Advisory Committee: Upexi added SOL enthusiast S◎L Big Brain and options legend Jon Najarian to its Advisory Committee.

- Investor Conferences: Upexi participated in the FT Partners FinTech Conference 2025, A.G.P.'s Digital Asset Treasury Showcase, and the Maxim Growth Summit.

- 2X Long UPXI ETF: REXShares and Tuttle Capital launched the T-REX 2X Long UPXI Daily Target ETF (PXIU).

Upexi Events / Multimedia Recap

- FT Partners FinTech Conference 2025

- A.G.P.'s Digital Asset Treasury Showcase

- Maxim Growth Summit

- Crypto Townhall Podcasts (Sept 22, Oct 15, Oct 28)

- The Wolf of All Streets Podcasts (Sept 24, Oct 12)

Track Record of Shareholder Value Creation

Upexi has a proven ability to create value for shareholders. Management believes the below three metrics demonstrate this, including the efficacy of our treasury management operations and ability to execute on our multiple value accrual mechanisms.

Large Unrealized Gain

The cost of Upexi’s SOL totals

Large Increase in Adjusted SOL Per Share

Upexi has increased its adjusted SOL per share by

Strong Issuance Track Record

Upexi raised a

| Upexi’s Demonstrated Value Creation |

| Source: Company filings. Note: SOL count as of October 31. Treasury value calculated using price of SOL on October 31. Unrealized gain measured as of disclosure dates, with gain from SOL appreciation, staking income, and the discount. See press release dated September 11, 2025 for calculation and disclosures on adjusted SOL per share. Raise returns based on UPXI price as of October 31. SOL performance is from the date of the raise close until 4:00pm EST on October 31 for comparability. |

About Upexi, Inc.

Upexi, Inc. (Nasdaq: UPXI) is a leading digital asset treasury company, where it aims to acquire and hold as much Solana (SOL) as possible in a disciplined and accretive fashion. In addition to benefiting from the potential price appreciation of Solana - the cryptocurrency of the leading high-performance blockchain - Upexi utilizes three key value accrual mechanisms in intelligent capital issuance, staking, and discounted locked token purchases. The Company operates in a risk-prudent fashion to position itself for any market environment and to appeal to investors of all kinds, and it currently holds over two million SOL. Upexi also continues to be a brand owner specializing in the development, manufacturing, and distribution of consumer products. Please see www.upexi.com for more information.

Follow Upexi on X - https://x.com/upexitreasury

Follow CEO, Allan Marshall, on X - https://x.com/upexiallan

Follow CSO, Brian Rudick, on X - https://x.com/thetinyant

Forward Looking Statements

This news release contains "forward-looking statements" as that term is defined in Section 27A of the United States Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations, or intentions regarding the future. For example, the Company is using forward looking statements when it discusses the anticipated use of proceeds. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, the inherent uncertainties associated with business strategy, potential acquisitions, revenue guidance, product development, integration, and synergies of acquiring companies and personnel. These forward-looking statements are made as of the date of this news release, and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward- looking statements. Although we believe that the beliefs, plans, expectations, and intentions contained in this press release are reasonable, there can be no assurance that such beliefs, plans, expectations or intentions will prove to be accurate. Investors should consult all of the information set forth herein and should also refer to the risk factors disclosure outlined in our annual report on Form 10-K and other periodic reports filed from time-to-time with the Securities and Exchange Commission.

Company Contact

Brian Rudick, Chief Strategy Officer

Email:brian.rudick@upexi.com

Phone: (203) 442-5391

Investor Relations Contact

KCSA Strategic Communications

Valter Pinto, Managing Director

(212) 896-1254

Upexi@KCSA.com

—————————————————

1 Unrealized gain values the 2,106,989 SOL using the price of SOL as of October 31 at 4:00pm ET and includes price appreciation, staking yield, and the discount on locked Solana.

2 Price of SOL as of October 31, 2025 at 4:00pm ET quoted on coinmarketcap.com.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/91127819-9b8d-4f65-a62a-dfaab46aeb23