Ur-Energy Advances Growth Portfolio in the Great Divide Basin

Rhea-AI Summary

Ur-Energy (NYSE American:URG) reported progress at its Lost Soldier and North Hadsell projects in the Great Divide Basin, Wyoming. Work includes 18 aquifer test wells at Lost Soldier, a planned mineral resource technical report, and a 50-hole North Hadsell drill program with 11 intercepts >0.20 GT.

Results suggest stacked roll-front horizons, proximity to the Lost Creek ISR operation, and continued drilling through March 15, 2026.

Positive

- 18 aquifer test wells installed at Lost Soldier to reduce hydrogeologic risk

- 50-hole North Hadsell drill program initiated, 16 holes completed (16,765 ft)

- 11 intercepts >0.20 GT in North Hadsell indicating significant mineralization

- Proximity to Lost Creek (17 miles) enabling potential infrastructure leverage

- Multiple stacked roll-front horizons identified with depths suitable for ISR (300–800 ft)

Negative

- Drilling program is still early-stage; only 16 of 50 holes completed to date

- Historical drill data for North Hadsell largely unavailable, increasing interpretation uncertainty

- Seasonal sage grouse restrictions pause drilling after March 15, potentially delaying program completion

News Market Reaction

On the day this news was published, URG gained 3.63%, reflecting a moderate positive market reaction. Our momentum scanner triggered 2 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $26M to the company's valuation, bringing the market cap to $756M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Several uranium peers also moved higher, with EU, UUUU, UEC, UROY, and DNN up between 4.06% and 12.04%. URG’s 7.82% gain occurred alongside this strength but peer momentum data still flags the move as stock-specific.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 15 | Convertible notes closing | Negative | -1.5% | Closed US$120M 4.75% convertible notes due 2031 with capped calls. |

| Dec 11 | Notes offering priced | Negative | -8.1% | Priced $100M 4.75% convertible notes with potential $20M upsizing. |

| Dec 10 | Notes offering proposed | Neutral | +0.0% | Proposed $100M convertible senior notes for development and corporate use. |

| Nov 25 | Management transition | Neutral | -1.6% | Announced retirement of long-serving General Counsel and appointment of successor. |

| Nov 03 | Q3 2025 earnings | Positive | -6.4% | Reported Q3 results and construction progress at Shirley Basin plus Basin exploration. |

Recent financings and operational updates often saw flat to negative next-day moves, even on constructive news.

Over the last few months, Ur-Energy focused on balance sheet expansion and project build-out. In Nov 2025, Q3 results highlighted 110,000 lb U3O8 sold for $6.3M revenue and progress at Shirley Basin and the Great Divide Basin. December was dominated by a $100–120M convertible notes financing sequence, which drew mostly negative price reactions. A management transition for General Counsel was also announced. Today’s Great Divide Basin exploration update fits the ongoing narrative of funding and advancing a multi-asset Wyoming pipeline.

Market Pulse Summary

This announcement details technical progress at Lost Soldier and early drilling success at North Hadsell, including 18 aquifer test wells and 11 intercepts above a 0.20 GT threshold. Combined with prior updates on Shirley Basin construction and Great Divide Basin exploration, it underscores an expanding Wyoming project pipeline. Investors may focus on upcoming resource estimates, further drill results, and execution milestones to gauge how these exploration efforts translate into long-term production and cash flow potential.

Key Terms

in situ recovery (isr) technical

roll-front technical

aquifer test wells technical

grade thickness (gt) technical

gamma instrument technical

AI-generated analysis. Not financial advice.

Technical Studies Underway on Lost Soldier Project

North Hadsell Drilling Returns Significant Intercepts

CASPER, WY / ACCESS Newswire / January 28, 2026 / Ur-Energy Inc. (NYSE American:URG)(TSX:URE) (the "Company" or "Ur-Energy"), a U.S. producer of uranium, is pleased to provide an update on work at its Lost Soldier and North Hadsell Projects, located in the Great Divide Basin, Wyoming.

Ur-Energy is off to a strong start in 2026 at both the Lost Soldier and North Hadsell Projects, delivering encouraging results in our work programs that demonstrate the upside potential of these assets. The objectives of our drilling were straightforward and value-driven: first, to gather critical hydrogeologic data at Lost Soldier to reduce risk and support efficient planning and permitting, and second, to identify new uranium roll-front targets at North Hadsell.

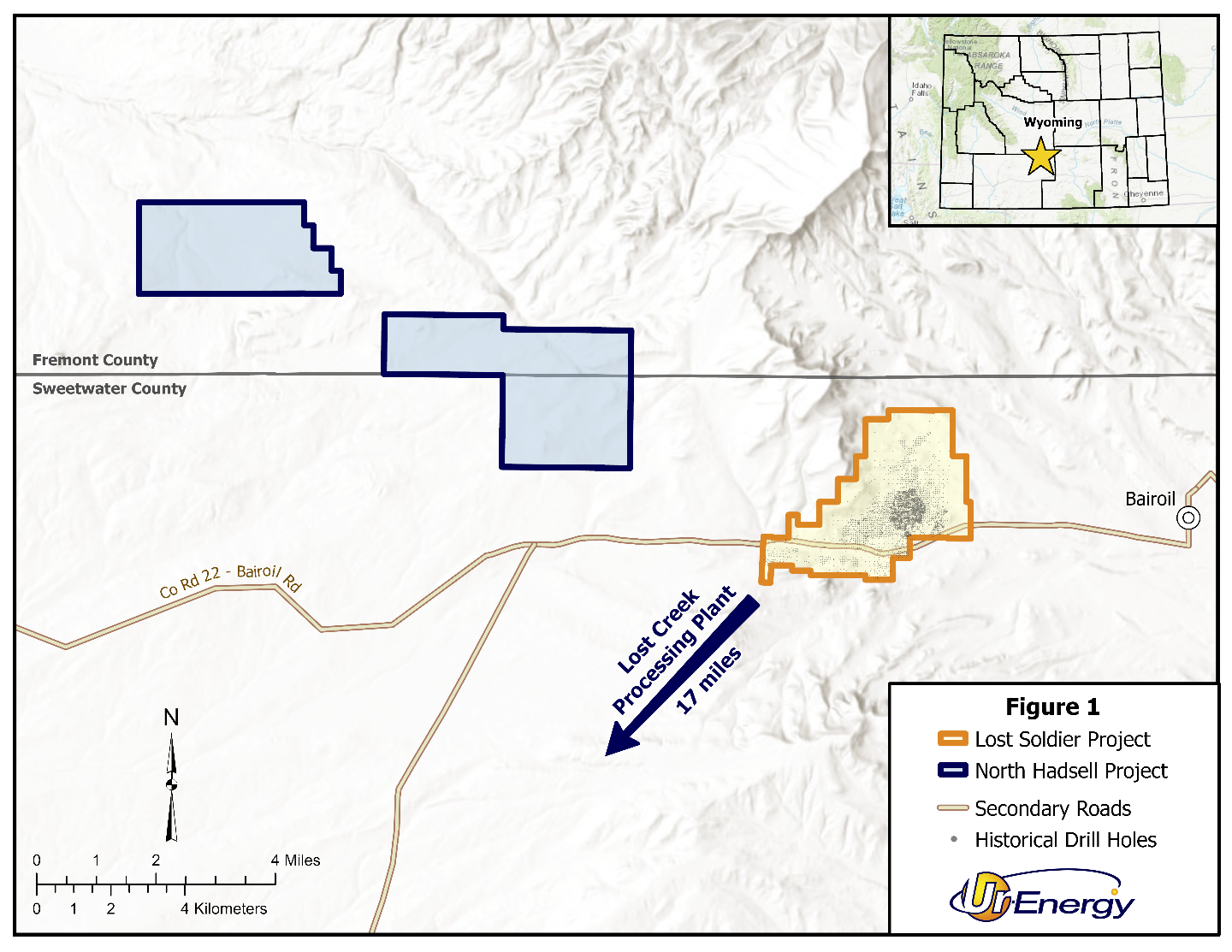

Both projects are located near our producing Lost Creek uranium mine, providing increased potential to leverage existing infrastructure, reduce future development capital requirements, and expand our uranium mineral resource base in Wyoming's prolific Great Divide Basin.

Highlights

Lost Soldier Project

Technical Report: Efforts are underway to define a mineral resource estimate using detailed roll-front mapping which will allow us to more accurately assess the potential for in situ recovery (ISR), a lower cost method than traditional mining, and provide more information for future project planning.

Hydrogeologic Risk Reduction: 18 aquifer test wells have been installed to advance our understanding of local hydrogeology, an essential step in reducing project risk and better optimizing permitting, development assumptions, wellfield design, and future development decisions. Testing is expected to begin in Q1 2026.

Strategic Proximity to Operations: Lost Soldier is a 17-mile drive from the Company's producing Lost Creek ISR mine and processing facility, which may enable capital-efficient development by leveraging established infrastructure and operating expertise.

North Hadsell Project

Early Exploration Success: Initial results from the ongoing 50-hole drill program are encouraging, with 16 deep, wide-spaced holes completed including five holes that intersected significant uranium mineralization, with 11 intercepts greater than 0.20 Grade Thickness (GT).

Multiple Stacked Roll-Front Horizons: Exploration at North Hadsell has confirmed the presence of multiple stacked roll-front horizons with grades and thicknesses similar to the Company's producing Lost Creek ISR mine, supporting confidence in recovery potential.

Project Scale: Two of the most compelling holes exhibit this stacked roll-front mineralization at similar depth horizons and are located approximately 1.5 miles apart, indicating the potential scale of the mineralized system.

Ur-Energy CEO and President, Matthew Gili, commented: "The early success at North Hadsell, combined with our decision to advance technical studies and hydrogeologic work at Lost Soldier, underscores the momentum we are building across our Wyoming growth portfolio. As this work progresses, we see meaningful potential for capital-efficient resource expansion, strengthening Ur-Energy's long-term development pipeline."

Figure 1. Great Divide Basin Exploration Map

Lost Soldier Project

Located approximately 17 miles (27 kilometers) to the northeast of Lost Creek, Lost Soldier has approximately 4,000 historic drill holes defining 14 mineralized sandstone horizons within the lower Battle Spring Formation. We control 105 unpatented mining claims at the property, totaling approximately 1,960 mineral acres.

Recent drilling at Lost Soldier focused on installing 18 aquifer test wells to enhance our understanding of the local hydrogeology. While the geology of the project area is well understood, this additional hydrogeologic characterization will assist our technical teams in optimizing planning, permitting, and potential development activities. Aquifer testing is anticipated to begin in Q1 2026.

Work is also underway to complete a new technical report with the goal of establishing a mineral resource estimate based on detailed roll-front mapping. The new report will combine results from recent work and historical data to produce a mineral resource estimate to facilitate assessment and planning for potential ISR development. The technical report on Lost Soldier is expected to be completed later this year.

North Hadsell Project

The North Hadsell Project is located approximately three miles west of Lost Soldier and 10 miles north of Lost Creek and includes 203 unpatented mining claims covering about 3,970 mineral acres. The Project is underlain by the same uranium-bearing geologic formation as Lost Soldier and Lost Creek. While some historical drilling is known in the area, the related data are largely unavailable.

We commenced a 50-hole drill program in Q4 2025 and have completed 16 wide-spaced framework holes, each approximately 1,000 feet deep, for a total footage of 16,765 feet. Five of these initial drill holes have returned significant mineralization, indicating the presence of a stacked roll-front system containing 11 individual intercepts greater than 0.20 GT (Grade (%eU3O8) times Thickness (ft)). These grades and thicknesses closely resemble the mineralization at Lost Creek, where the Company applies a 0.20 GT cut-off in evaluating economic mineral resources. Preliminary interpretation suggests the potential for up to eight individual roll fronts within a depth range of approximately 300 to 800 feet below surface, ideal for ISR mining, with indications of additional mineralized horizons at depth. Notably, the two most encouraging drill holes to date are located more than 1.5 miles apart with mineralization in similar horizons, suggesting the Project's scalability and resource potential.

Drilling will continue until the 50-hole program is completed or until March 15, when seasonal sage grouse restrictions begin. Any remaining work should resume in the summer.

Table 1. North Hadsell Uranium Project Drill Results

Hole ID | Depth (ft) | Thickness (ft) | Average Grade* | GT (ft*%eU3O8) | |

NH-04-06 | 687.0 | 3.0 | 0.055 | 0.17 | |

693.0 | 2.5 | 0.030 | 0.08 | ||

NH-04-07 | 750.5 | 3.0 | 0.041 | 0.12 | |

805.5 | 2.0 | 0.026 | 0.05 | ||

808.5 | 2.0 | 0.024 | 0.05 | ||

NH-04-08 | 500.0 | 9.0 | 0.025 | 0.23 | |

514.0 | 15.5 | 0.047 | 0.73 | ||

535.0 | 7.0 | 0.043 | 0.30 | ||

547.0 | 3.0 | 0.025 | 0.08 | ||

557.0 | 7.5 | 0.041 | 0.31 | ||

777.0 | 7.0 | 0.051 | 0.36 | ||

NH-04-16 | 686.0 | 2.0 | 0.024 | 0.05 | |

NH-04-20 | 962.5 | 2.5 | 0.030 | 0.08 | |

NH-04-26 | 857.0 | 1.5 | 0.036 | 0.05 | |

NH-04-29 | 150.5 | 4.0 | 0.026 | 0.10 | |

595.5 | 2.0 | 0.027 | 0.05 | ||

NH-32-01 | 643.5 | 7.5 | 0.075 | 0.56 | |

NH-32-02 | Trace | ||||

NH-32-03 | 533.0 | 4.5 | 0.024 | 0.11 | |

543.5 | 12.5 | 0.044 | 0.55 | ||

564.5 | 14.0 | 0.051 | 0.71 | ||

582.5 | 4.0 | 0.027 | 0.11 | ||

604.5 | 13.0 | 0.039 | 0.51 | ||

NH-32-04 | Trace | ||||

NH-32-05 | Trace | ||||

NH-32-06 | 313.0 | 10.0 | 0.056 | 0.56 | |

NH-32-07 | Trace | ||||

NH-32-08 | 353.5 | 2.0 | 0.030 | 0.06 | |

512.5 | 5.0 | 0.038 | 0.19 | ||

520.0 | 2.0 | 0.029 | 0.06 | ||

598.0 | 4.5 | 0.071 | 0.32 | ||

607.5 | 3.5 | 0.051 | 0.18 | ||

690.5 | 4.0 | 0.035 | 0.14 | ||

762.0 | 2.0 | 0.038 | 0.08 | ||

NH-33-05 | Trace | ||||

*Minimum grade cutoff for reporting is ≥ 0.020 % eU3O8. | |||||

Qualified Person

Disclosures of a scientific or technical nature included in this news release, including the sampling, analytical and technical data underlying the information, have been reviewed, verified and approved by John Cooper who is a Registered Member of SME, a Certified Professional Geologist with AIPG, a Wyoming PG, and is a Qualified Person as defined by Regulation S-K, Subpart 1300 as adopted by the U.S. Securities and Exchange Commission and by Canadian National Instrument 43-101. Mr. Cooper is employed as a Senior Geologist with Ur-Energy.

About Ur-Energy

Ur-Energy is a uranium mining company operating the Lost Creek in situ recovery uranium facility in south-central Wyoming. We have produced and packaged over 3 million pounds of U3O8 from Lost Creek since the commencement of operations. Development and construction activities at the Shirley Basin Project, the Company's second in situ recovery uranium facility in Wyoming, are well advanced. Ur-Energy is engaged in uranium recovery and processing activities, including the acquisition, exploration, development, and operation of uranium mineral properties in the United States. The primary trading market for Ur-Energy's common shares is on the NYSE American under the symbol "URG." Ur-Energy's common shares also trade on the Toronto Stock Exchange under the symbol "URE." Ur-Energy's corporate headquarters is in Casper, Wyoming and its registered office is in Ottawa, Ontario.

Contact Information

Valerie Kimball

IR Director

Valerie.kimball@ur-energy.com

720-460-8534

Cautionary Note Regarding Forward-Looking Information

This release may contain "forward-looking statements" within the meaning of applicable securities laws regarding events or conditions that may occur in the future (e.g., whether for Lost Soldier we will be able to more accurately assess the potential for in situ recovery, adequately reduce project risk, optimize permitting, development assumptions, wellfield design, and project decisions, complete aquifer testing, or complete a new technical report; whether for North Hadsell the drilling program will continue, further exploration and analysis will support preliminary interpretations of drilling results, the resource potential will be adequate for ISR mining, or the project will be scalable; or whether either project will be able to leverage existing infrastructure and operating expertise, reduce future development capital requirements, expand our uranium resource base, or have any prospective upside) and are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive risks, uncertainties and contingencies. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans," "expects," "does not expect," "is expected," "is likely," "estimates," "intends," "anticipates," "does not anticipate," or "believes," or variations of the foregoing, or statements that certain actions, events or results "may," "could," "might" or "will be taken," "occur," "be achieved" or "have the potential to." All statements, other than statements of historical fact, are considered to be forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements express or implied by the forward-looking statements. Factors that could cause actual results to differ materially from any forward-looking statements include, but are not limited to, capital and other costs varying significantly from estimates; failure to establish estimated resources and reserves; the grade and recovery of ore which is mined varying from estimates; production rates, methods and amounts varying from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; inflation; changes in exchange rates; fluctuations in commodity prices; delays in development and other factors described in the public filings made by the Company at www.sedarplus.ca and www.sec.gov. Readers should not place undue reliance on forward-looking statements. The forward-looking statements contained herein are based on the beliefs, expectations and opinions of management as of the date hereof and Ur-Energy disclaims any intent or obligation to update them or revise them to reflect any change in circumstances or in management's beliefs, expectations or opinions that occur in the future.

SOURCE: Ur-Energy Inc.

View the original press release on ACCESS Newswire