USCM Retains Haynes Cobalt Asset in Idaho Amid US Stockpiling and Lack of Domestic Production

U.S. Critical Metals (OTCQB: USCMF) has maintained 100% ownership of its Haynes Cobalt Project in Idaho's Cobalt Belt, adjacent to Jervois Mining's operations. The strategic retention comes as the U.S. Defense Logistics Agency launches a $500 million program to acquire 7,480 tonnes of cobalt for defense stockpiles.

The 470-acre property features historical drilling results including 1.77m of 0.53% cobalt, and recent 2021 sampling revealed significant cobalt grades up to >1.0%. The project's location near the only primary U.S. cobalt mine and historical production from three adits enhances its strategic value, particularly given the U.S.'s >75% dependence on external cobalt sources.

The property also shows potential for Rare-Earth Element (REE) mineralization, with xenotime presence correlating with cobaltite mineralization, presenting an additional exploration opportunity.

U.S. Critical Metals (OTCQB: USCMF) mantiene il 100% della proprietà del progetto Haynes Cobalt nella Cobalt Belt dell'Idaho, confinante con le attività di Jervois Mining. La scelta strategica avviene mentre la Defense Logistics Agency degli Stati Uniti avvia un programma da 500 milioni di dollari per acquistare 7.480 tonnellate di cobalto da destinare alle scorte di difesa.

L'area di 470 acri include risultati di perforazione storici, tra cui 1,77 m al 0,53% di cobalto; campionamenti recenti del 2021 hanno evidenziato tenori significativi fino a oltre l'1,0%. La vicinanza all'unica miniera primaria di cobalto negli USA e la produzione storica proveniente da tre aditi aumentano il valore strategico del progetto, soprattutto considerando che gli Stati Uniti dipendono per oltre il 75% da fonti esterne di cobalto.

La proprietà mostra inoltre potenziale per mineralizzazioni di terre rare (REE), con la presenza di xenotime che si correla alla mineralizzazione di cobaltite, offrendo un'ulteriore opportunità esplorativa.

U.S. Critical Metals (OTCQB: USCMF) ha mantenido el 100% de la propiedad del proyecto Haynes Cobalt en la Cobalt Belt de Idaho, junto a las operaciones de Jervois Mining. La decisión estratégica llega en el marco de un programa de 500 millones de dólares lanzado por la U.S. Defense Logistics Agency para adquirir 7.480 toneladas de cobalto para las reservas de defensa.

La propiedad de 470 acres presenta resultados históricos de perforación, incluyendo 1,77 m con 0,53% de cobalto; muestreos recientes de 2021 mostraron ley de cobalto significativa de hasta >1,0%. La cercanía a la única mina primaria de cobalto en EE. UU. y la producción histórica procedente de tres adits refuerzan el valor estratégico del proyecto, especialmente dado que EE. UU. depende en más del 75% de fuentes externas de cobalto.

El terreno también muestra potencial para mineralización de elementos de tierras raras (REE), con presencia de xenotima que se correlaciona con la mineralización de cobaltita, lo que representa una oportunidad exploratoria adicional.

U.S. Critical Metals (OTCQB: USCMF)는 제르보이스 마이닝(Jervois Mining)의 운영지와 인접한 아이다호 코발트 벨트의 헤인즈 코발트 프로젝트(Haynes Cobalt Project)에 대한 100% 지분을 유지하고 있습니다. 이러한 전략적 보유는 미 국방물자청(Defense Logistics Agency)이 7,480톤의 코발트를 국방 비축용으로 확보하기 위해 5억 달러 규모의 프로그램을 시작한 시기와 맞물립니다.

470에이커 규모의 부지는 1.77m 길이에 코발트 0.53%를 기록한 과거 시추 결과를 포함하며, 2021년의 최근 샘플링에서는 1.0% 이상을 기록하는 유의한 코발트 품위가 확인되었습니다. 미국 내 유일한 1차 코발트 광산과의 근접성 및 세 개의 갱도로부터의 과거 생산 기록은 프로젝트의 전략적 가치를 높여주며, 미국이 코발트 수급에서 75% 이상을 외부에 의존하고 있다는 점을 고려할 때 특히 중요합니다.

해당 자산은 또한 희토류 원소(REE) 광화 가능성을 보이는데, 코발타이트 광화와 상관관계가 있는 제노타임(xenotime)의 존재가 추가적인 탐사 기회를 제공합니다.

U.S. Critical Metals (OTCQB: USCMF) a conservé 100 % de la propriété de son projet Haynes Cobalt dans la Cobalt Belt de l'Idaho, à côté des opérations de Jervois Mining. Cette décision stratégique intervient alors que la Defense Logistics Agency des États‑Unis lance un programme de 500 millions de dollars pour acquérir 7 480 tonnes de cobalt destinées aux stocks de défense.

La propriété de 470 acres comporte des résultats de forage historiques, notamment 1,77 m à 0,53 % de cobalt ; des échantillonnages récents en 2021 ont révélé des teneurs significatives atteignant plus de 1,0 %. La proximité de la seule mine primaire de cobalt aux États‑Unis et la production historique issue de trois adits renforcent la valeur stratégique du projet, d'autant que les États‑Unis dépendent à plus de 75 % de sources extérieures pour le cobalt.

Le site présente également un potentiel de minéralisation en éléments des terres rares (REE), la présence de xénotime étant corrélée à la minéralisation en cobaltite, offrant une opportunité d'exploration supplémentaire.

U.S. Critical Metals (OTCQB: USCMF) hält weiterhin 100% Eigentum am Haynes Cobalt Project im Cobalt Belt von Idaho, angrenzend an die Aktivitäten von Jervois Mining. Die strategische Beibehaltung erfolgt, während die U.S. Defense Logistics Agency ein 500-Millionen-Dollar-Programm startet, um 7.480 Tonnen Kobalt für Verteidigungsreserven zu beschaffen.

Das 470 Acre große Grundstück weist historische Bohrergebnisse auf, darunter 1,77 m mit 0,53% Kobalt; jüngste Probenahmen aus 2021 zeigten Kobaltgehalte von bis zu über 1,0%. Die Lage in der Nähe der einzigen primären Kobaltmine der USA und die historische Förderung aus drei Stollen steigern den strategischen Wert des Projekts, zumal die USA zu über 75% von externen Kobaltquellen abhängig sind.

Die Liegenschaft zeigt zudem Potenzial für Seltenerdelemente (REE), wobei das Vorkommen von Xenotim mit Kobaltit-Mineralisierung korreliert und damit eine zusätzliche Explorationschance bietet.

- Strategic location adjacent to the only primary cobalt mine in the U.S.

- Historical drilling showed promising results with up to 1.77m of 0.53% cobalt

- Recent 2021 sampling confirmed high-grade cobalt presence (>1.0%)

- Additional value potential from rare-earth element mineralization

- Property benefits from existing infrastructure and historical workings

- Aligns with $500M U.S. government initiative for cobalt stockpiling

- Historical drilling data requires further verification by qualified persons

- Some historical drill holes cross property borders, creating uncertainty about mineralization location

- Heavy dependence on future exploration success to determine economic viability

Vancouver, British Columbia--(Newsfile Corp. - September 4, 2025) - U.S. Critical Metals Corp. (CSE: USCM) (OTCQB: USCMF) (FSE: 0IU) ("USCM" or the "Company") is pleased to announce that it has retained its

The U.S. continues to address cobalt needs through imports and releases from the National Defense Stockpile. As noted by the U.S. Geological Survey, only a small portion of supply needs are addressed by domestic production - primarily recycling and byproduct streams, which results in an over

With the U.S. currently holding only limited strategic cobalt stockpiles and very limited domestic cobalt production, USCM views the Haynes Cobalt Project as a potentially key asset in bridging future supply needs for defense, aerospace, and energy transition industries.

Executive Commentary

Darren Collins, CEO and Director of USCM, comments: "Retaining the claims comprising the Haynes Cobalt Project underscores our conviction in the long-term importance of cobalt to U.S. supply chains. We are also encouraged to see increased U.S. government support for critical metals, as evidence by the recent US

Strategic Asset in Premier Cobalt District

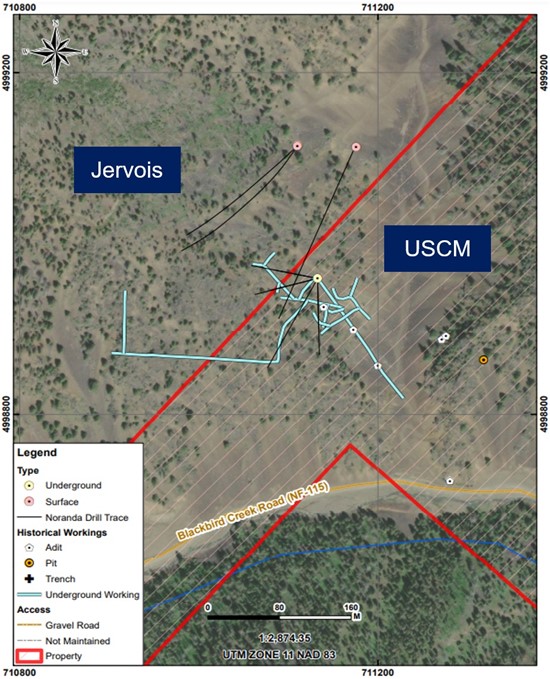

The Haynes Cobalt Property covers approximately 470 acres directly contiguous to Jervois Global's Idaho Cobalt Operations, which is the only primary cobalt mine in the U.S.4. Within past production from three adits, the Property lies within the historic Blackbird Mining District, known for its cobalt, copper, and gold mineralization, and benefits from proximity to established infrastructure. Of particular interest, USCM expects that the mineralization associated with the adjunct property may continue across the Property borders, as indicated in Figure 1 and Figure 2 below, outlining the historic underground workings.

Figure 1. Adit 2 at the Haynes Cobalt Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8837/265124_uscm1en.jpg

Figure 2. Map of Historic Underground Workings

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8837/265124_uscm2en.jpg

The Property was explored by Noranda Exploration Inc. ("Noranda") from 1979 to 1981, and Noranda again further developed the Property near three historical adits, with promising results from surface and underground drilling. Table 3 describes the results of the historical holes, some of which cross the current Property border, and the tenure of the historical information makes it uncertain whether the mineralized interval is on the Property or on the neighboring property5.

Table 3. Historical Noranda Drilling from 1980 and 1981

| Hole ID | Result |

| HS-80-2A | 1.77m of |

| HS-81-3F | 1.52m of |

| HS-81-3G | 1.83m of |

Additional reconnaissance work by Noranda in 1980 defined a two-kilometer trend of tourmaline-bearing breccia rocks on the Property. Tourmaline-bearing breccia is related to cobalt mineralization at the historical workings, and elsewhere in the ICB. Two samples were collected along this trend approximately 1.5 kilometres away from the historical adits and follow-up drilling by Noranda. The two samples are described in Table 4 below6.

Table 4. Historical Noranda Sampling form 1980

| Sample | Cobalt (%) | Description |

| 8583 | 1.0 | 0.61 metre wide tourmalinized breccia, |

| 8592 | 0.1 | Fluidized sediments, adit 12 metres long, abundant erythrite present |

Historical samples from the Property also contain heavy Rare-Earth Element ("REE") mineralization in the form of xenotime and is associated with cobaltite mineralization. This observation of a correlation between REE and cobaltite mineralization has not yet been investigated as an exploration target and represents an intriguing aspect to the Property. A USCM Qualified Person has not done enough work to verify the results of the historical exploration.

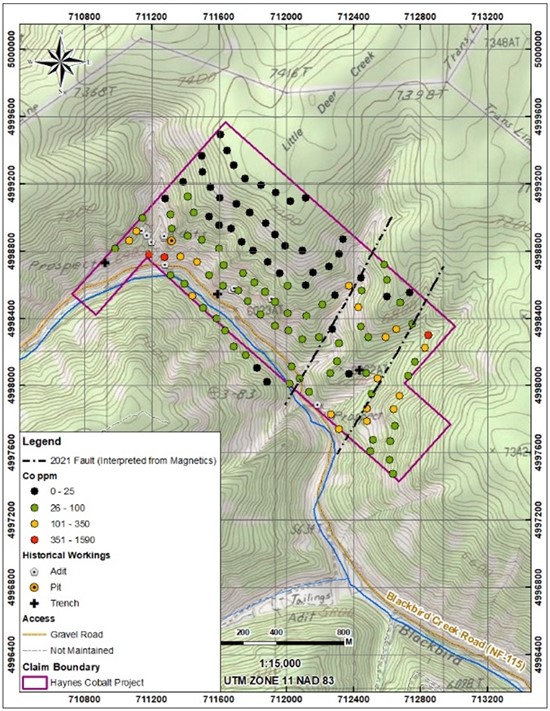

In 2021, USCM collected rock samples from the Property with continued positive results. A total of 76 rock samples were collected from historical workings including pits, trenches and adits, as well as non-mineralized outcrops. Assay results from a select few rock samples collected in 2021 are shown in table and map below. USCM is currently planning its next phase of exploration for the Property7.

Table 5. Summary of 2021 Rock Sample Results with Significant Results

| Sample ID | Rock Type | Co (%) | Au (g/t) | Cu (ppm) | As (ppm) | Y (ppm) |

| HS21SD-006 | Altered Metasediment | 0.219 | 0.276 | 114 | 4230 | 359 |

| HS21SD-007 | Tourmaline Breccia | 0.4 | 0.091 | 605 | 7540 | 69.6 |

| HS21SD-010 | Tourmaline Breccia | >1.0 | 0.908 | 53.8 | > 10000 | > 500 |

| HS21SD-011 | Tourmaline Breccia | 0.502 | 1.28 | 52.8 | > 10000 | > 500 |

| HS21SD-046 | Tourmaline Breccia | 0.238 | 0.44 | 16.4 | 6300 | 90.7 |

| HS21SD-073 | Tourmaline Breccia | 0.415 | 0.017 | 166 | 8740 | 95.7 |

Figure 6. Map Summary of Cobalt Sample Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8837/265124_uscm3en.jpg

Reference 1: U.S. Geological Survey. (2025). Mineral commodity summaries 2025: Cobalt. U.S. Geological Survey. https://pubs.usgs.gov/periodicals/mcs2025/mcs2025-cobalt.pdf

Reference 2: Reuters. (2025, August 21). U.S. Defense Department to buy cobalt for up to

Reference 3: MP Materials - MP Materials Announces Transformational Public-Private Partnership with the Department of Defense to Accelerate U.S. Rare-Earth Magnet Independence. Available at https://investors.mpmaterials.com/investor-news/news-details/2025/MP-Materials-Announces-Transformational-Public-Private-Partnership-with-the-Department-of-Defense-to-Accelerate-U-S--Rare-Earth-Magnet-Independence/default.aspx

Reference 4: Jervois Global. (n.d.). Idaho Cobalt Operations. Jervois Global. Retrieved September 3, 2025, from https://jervoisglobal.com/projects/idaho-cobalt-operations/

Reference 5: Gardulski, A.F., (1982), Exploration Evaluation of The Breccia Systems of The Haynes-Stellite Prospect (0479) Blackbird Mining District, Lemhi County, Idaho., Report for Noranda Exploration, Inc., Belt District.

Reference 6: Ater, P., (1981), A Field Investigation of Tourmalinized Breccias within Sections 1, 2, & 3, T20N, R18E and Portions of Sections 35 & 36, T21N, R18E (No. 0477), Blackbird District, Lemhi County, Idaho., Report for Noranda Exploration, Inc., Cobalt, Idaho.

Reference 7: See NI 43-101 Technical Report on the Haynes Cobalt Project dated January 25, 2022, which is available on the Company's profile on Sedarplus.ca.

The comparable information about other issuers in this press release was obtained from public sources and has not been verified by the Company. Comparable means information that compares an issuer to other issuers. The information is a summary of certain relevant operational attributes of certain mining and resource companies and has been included to provide an overview of the performance of what are expected to be comparable issuers. The comparables are considered to be an appropriate basis for comparison with the Company based on their industry, commodity mix, jurisdiction, and additional criteria. The comparable issuers face different risks from those applicable to the Company. Relevant material concerning any adjacent or comparable properties included in this press release is limited to information publicly disclosed by the owner or operator for such adjacent or comparable property. The Company has relied on the Qualified Persons responsible for such information and has not independently verified such information. The Company cautions that past production, mineral reserves, resources, or occurrences on adjacent or comparable properties are not indicative of the mineralization on the Company's properties. Readers are cautioned that the past performance of comparables is not indicative of future performance and that the performance of the Company may be materially different from the comparable issuers. You should not place undue reliance on the comparable information provided in this press release.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Robert J. Johansing, BSC. geology, MSc economic geology, who is a qualified person as defined in NI 43-101. Mr. Johansing is a consultant of the Company.

About US Critical Metals Corp.

USCM is focused on mining projects that will further secure the U.S. supply of critical metals and rare earth elements, which are essential to fueling the new age economy. Pursuant to investments and option agreements with private Canadian and American companies, USCM's projects include the Long Canyon Uranium and Vanadium Property in Idaho, the Sheep Creek located in Montana, the McDermitt Lithium Property in Nevada, the Clayton Ridge Lithium Property located in Nevada, and the Haynes Cobalt Property located in Idaho. A significant percentage of the world's critical metal and rare earth supply comes from nations with interests that are contrary to those of the U.S. USCM intends to explore and develop critical metals and rare earth assets with near- and long-term strategic value to the advancement of U.S. interests.

For further information please contact:

Darren Collins

Chief Executive Officer & Director

Email: dcollins@uscmcorp.com

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

This news release contains certain information that may be deemed "forward-looking information" with respect to USCM within the meaning of applicable securities laws. Such forward-looking information involves known and unknown risks, uncertainties and other factors that may cause USCM's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking information. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking information contained in this press release may include, without limitation, the exploration plans and expected exploration results at Haynes Cobalt property, results of operations, the expectation that property will be a key asset in bridging future supply needs for defense, aerospace, and energy transition industries and the expected financial performance of the Company.

Although USCM believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by its nature, forward-looking information involves assumptions and known and unknown risks, uncertainties and other factors which may cause our actual results, level of activity, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; adverse industry events; the receipt of required regulatory approvals and the timing of such approvals; that USCM maintains good relationships with the communities in which it operates or proposes to operate; future legislative and regulatory developments in the mining sector; USCM's ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of USCM to implement its business strategies; competition; the risk that any of the assumptions prove not to be valid or reliable, which could result in delays, or cessation in planned work; risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits; the possibility that results will not be consistent with USCM's expectations; as well as other assumptions, risks and uncertainties applicable to mineral exploration and development activities and to USCM, including as set forth in the USCM's public disclosure documents filed on the SEDAR+ website at www.sedarplus.ca.

The forward-looking information contained in this press release represents the expectations of USCM as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While USCM may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265124