Val-d'or Mining Exploration Update

Val-d'Or Mining Corporation (TSXV: VZZ) has reported significant results from its 2025 diamond drilling program at the Perestroika Prospect in Québec. The $0.84M USD program, operated by Eldorado Gold, completed 12 holes totaling 5,004 metres.

Notable intersections include 4.60m @ 12.35 g/t Au with a high-grade section of 0.50m @ 107.50 g/t Au in hole PE-25-019. The program successfully expanded the mineralized footprint from the 2024 program, with multiple high-grade intersections across several drill holes.

The property is under option to Eldorado Gold, which can earn a 70% interest in the property. Eldorado must incur minimum expenditures of $10.5 million by the fifth anniversary to maintain and exercise its option.

Val-d'Or Mining Corporation (TSXV: VZZ) ha riportato risultati significativi dal proprio programma di trivellazione diamantifera 2025 presso il Perestroika Prospect in Québec. Il programma da $0.84M USD, operato da Eldorado Gold, ha completato 12 forature per un totale di 5,004 metri.

Intersezioni note includono 4.60m @ 12.35 g/t Au con una sezione ad alto grado di 0.50m @ 107.50 g/t Au nel pozzo PE-25-019. Il programma ha ampliato con successo l'area mineralizzata rispetto al programma del 2024, con molte intersezioni ad alto grado su diversi fori di trivellazione.

La proprietà è in opzione a Eldorado Gold, che può ottenere un interesse del 70% nella proprietà. Eldorado deve sostenere spese minime di $10.5 milioni entro la quinta anniversario per mantenere ed esercitare la propria opzione.

Val-d'Or Mining Corporation (TSXV: VZZ) ha reportado resultados significativos de su programa de perforación diamantina 2025 en el Perestroika Prospect en Quebec. El programa de $0.84M USD, operado por Eldorado Gold, completó 12 agujeros que suman 5,004 metros.

Intersecciones notables incluyen 4.60m @ 12.35 g/t Au con una sección de alto grado de 0.50m @ 107.50 g/t Au en el pozo PE-25-019. El programa expandió con éxito la huella mineralizada desde el programa de 2024, con múltiples intersecciones de alto grado en varios agujeros de perforación.

La propiedad está en opción con Eldorado Gold, que puede adquirir un 70% de interés en la propiedad. Eldorado debe incurrir gastos mínimos de $10.5 millones antes del quinto aniversario para mantener y ejercitar su opción.

Val-d'Or Mining Corporation (TSXV: VZZ) 는 퀘벡 주의 Perestroika Prospect 에서 2025년 다이아몬드 드릴링 프로그램의 значительные 결과를 보고했습니다. Eldorado Gold가 운영하는 $0.84M USD 프로그램은 12개 구멍 총 5,004미터를 완료했습니다.

주목할 만한 교차는 4.60m @ 12.35 g/t Au 이며, PE-25-019 구멍에서 고품위 구간 0.50m @ 107.50 g/t Au가 있습니다. 이 프로그램은 2024년 프로그램에서 광물화 영역을 성공적으로 확장했으며, 여러 드릴 구멍에서 고품위 교차가 다수 나타났습니다.

이 자산은 Eldorado Gold에 옵션으로 제공되며, 해당 회사는 자산의 70% 지분을 취득할 수 있습니다. Eldorado는 옵션을 유지하고 행사하기 위해 다섯 번째 기념일까지 $10.5 백만의 최소 지출을 해야 합니다.

Val-d'Or Mining Corporation (TSXV: VZZ) a rapporté des résultats significatifs de son programme de forage diamanté 2025 sur le prospect Perestroika au Québec. Le programme de $0.84M USD, mené par Eldorado Gold, a effectué 12 forages totalisant 5 004 mètres.

Les intersections notables comprennent 4.60m @ 12.35 g/t Au avec une section à haut grade de 0.50m @ 107.50 g/t Au dans le puits PE-25-019. Le programme a réussi à élargir l’emprise minéralisée par rapport au programme 2024, avec plusieurs intersections à haut grade sur plusieurs forages.

La propriété est sous option d’Eldorado Gold, qui peut détenir une participation de 70% dans la propriété. Eldorado doit engager des dépenses minimales de $10.5 millions avant le cinquième anniversaire pour maintenir et exercer son option.

Val-d'Or Mining Corporation (TSXV: VZZ) hat signifikante Ergebnisse aus seinem 2025 Diamond Drill-Programm am Perestroika Prospect in Québec gemeldet. Das von Eldorado Gold durchgeführte $0.84M USD-Programm absolvierte 12 Bohrungen mit insgesamt 5.004 Metern.

Bemerkenswerte Schnittstellen umfassen 4.60m @ 12.35 g/t Au mit einem hochgradigen Abschnitt von 0.50m @ 107.50 g/t Au in Bohrung PE-25-019. Das Programm hat erfolgreich die mineralisierte Ausdehnung gegenüber dem Programm von 2024 erweitert, mit mehreren hochgradigen Schnittstellen über mehrere Bohrlöcher hinweg.

Die Liegenschaft befindet sich unter Option bei Eldorado Gold, die 70% Anteil an der Liegenschaft erwerben kann. Eldorado muss bis zum fünften Jubiläum Mindestausgaben in Höhe von $10.5 Millionen tätigen, um seine Option zu behalten und auszuüben.

Val-d'Or Mining Corporation (TSXV: VZZ) أبلغت عن نتائج مهمة من برنامج الحفر الماسي لعام 2025 في اكتشاف بيرسترويكا في كيبيك. البرنامج الذي تبلغ قيمته $0.84M USD، ويديره Eldorado Gold، أكمل 12 حفرة بإجمالي 5,004 أمتار.

تشمل التقاطعات الملحوظة 4.60m @ 12.35 g/t Au مع قسم عالي الدرجة من 0.50m @ 107.50 g/t Au في الحفرة PE-25-019. نجح البرنامج في توسيع المساحة المعدنية عن برنامج 2024، مع وجود تقاطعات عالية الدرجة عبر عدة حفر.

الممتلكة محالة إلى Eldorado Gold، التي يمكن أن تكتسب نسبة 70% من الملكية. يجب على Eldorado إنفاق مبالغ دنيا بإجمالي $10.5 مليون بحلول الذكرى الخامسة للحفاظ على خيارها وممارسته.

Val-d'Or Mining Corporation (TSXV: VZZ) 已报告其在魁北克Perestroika矿权的2025年钻石钻探计划的显著结果。该由Eldorado Gold运营的$0.84M USD计划完成了12孔,总长5,004米。

值得注意的交叉包括4.60m @ 12.35 g/t Au,在PE-25-019孔中有一段高品位区段为0.50m @ 107.50 g/t Au。该计划成功扩大了与2024年计划相比的矿化范围,在若干钻孔中有多处高品位交叉。

该物业处于Eldorado Gold的选择权下,后者可以获得该物业的70%权益。Eldorado必须在第五个周年前产生最低支出金额为$10.5 million,以维持并行使其选项。

- Multiple high-grade gold intersections including 4.60m @ 12.35 g/t Au and 0.50m @ 107.50 g/t Au

- Successful expansion of mineralized footprint from 2024 program

- $0.84M USD funded drilling program completed with 5,004 metres across 12 holes

- Strong partnership with Eldorado Gold with $10.5M commitment potential

- True widths of mineralization not yet determined

- Results represent only drill indicated intersections along core length

- Additional expenditure and work required to fully define the resource

Perestroika Prospect - Eldorado Gold (Québec) Inc. Option Drill Results Including:

4.60 m @ 12.35 g/t Au from 269.40 m - PE-25-019

Including - 0.50 m @ 107.50 g/t Au from 270.00 m

Val-d'Or, Québec--(Newsfile Corp. - September 26, 2025) - Val-d'Or Mining Corporation (TSXV: VZZ) ("the Company") is pleased to announce on the results from the 2025 diamond drilling program on the Perestroika Prospect. The property is located in Courville Township, Québec, approximately 40 kilometres northeast of Val-d'Or, Québec. This property is under option to Eldorado Gold (Québec) Inc. who may earn a

2025 Diamond Drill Program Outline and Objectives:

The 2025 diamond drilling program was budgeted at

This is a Phase II diamond drilling program, intended to follow-up on promising gold values intercepted in the 2024 program. For specific details on the regional and property geology and the highlighted gold assay intersections from the 2024 drill program, including a drill hole location map and table of assay highlights, the reader is referred to the Val-d'Or Mining Corporation's December 19, 2024 news release.

The objectives of the 2025 drill program were as follows:

To follow-up on DDH GPS-09-01 (3.05m @ 20.69 g/t Au) and PE-24-004 (8.60m @ 4.45 g/t Au (incl. 0.50m @ 18.16 g/t Au and 0.90m @ 12.33 g/t Au.);

To define and delineate the existence of lithological and structural controls (i.e. plunge) on the previously intersected gold mineralized veins; and

To test for additional shear zones and structures elsewhere the property.

Table I: 2025 Diamond Drill Hole Information

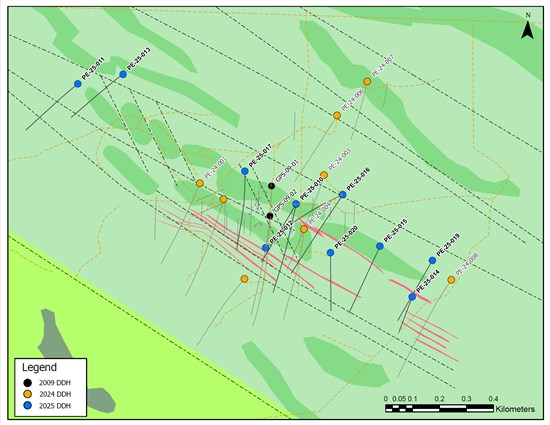

Map I: Perestroika Prospect Drill Plan 2025

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7049/267986_2bed2ca13494ab90_001full.jpg

Assays greater than 1g/t Au - See Table II - Assay Composites Intervals

The drilling results have expanded the mineralized footprint from the 2024 program to the southeast, northwest and south of GPS-09-01 and GPS-09-02, along strike and parallel to the mineralized trend.

Drillholes PE-25-14, PE-25-015, PE-25-019, and PE-25-020 followed up on the results of PE-24-008 (27.60 metres @ 0.53 g/t Au from 240.70 m), over approximately 350 metres (see above map). Wide zones of lower-grade mineralization were intersected, such as 18.40 m @ 1.28 g/t Au (145.60 m - 164.00 m) in PE-25-014, in addition to high-grade vein hosted mineralized zones such as 0.50 m @ 107.50 g/t Au from 270.00 m intersected in PE-25-019.

Immediately south of GPS-09-01 and GPS-09-02, PE-25-020 intersected 0.50 m @ 73.20 g/t Au from 38.10 m and 2.20 m @ 1.97 g/t Au from 56.5 m.

To the northwest along the mineralized corridor, PE-25-013 intersected 1.30 m @ 46.39 g/t Au from 29.70 m, located approximately 750 m northwest of GPS-09-01 and GPS-09-02.

Assays greater than 1g/t Au

---------------------------------------------------------------------------------------------------------------------

- PE-25-10: 0.50 m @ 14.45 g/t Au from 65.50 m - 66.00 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-012: 1.00 m @ 5.51 g/t Au from 44.30 m - 45.30 m

- PE-25-012: 6.20 m @ 1.71 g/t Au from 87.80 m - 94.00 m

- PE-25-012: 0.5 m @ 6.44 g/t Au from 123.70 m - 124.20 m

- PE-25-012: 0.5 m @ 6.70 g/t Au from 126.00 m - 126.50 m

- PE-25-012: 16.30 m @ 4.01 g/t Au from 127.50 m - 143.80 m

- Including - 0.50 m @ 66.30 g/t Au from 128.50 m - 129.00 m

- Including - 0.50 m @ 15.90 g/t Au from 137.20 m - 137.70 m

- Including - 0.60 m @ 10.60 g/t Au from 141.20 m - 141.80 m

- PE-25-012: 1.00 m @ 15.75 g/t Au from 250.50 m - 251.50 m

- Including - 0.50 m @ 27.00 g/t Au from 251.00 m - 251.50 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-013: 1.30 m @ 46.39 g/t Au from 29.70 m - 31.00 m

- Including - 0.80 m @ 39.20 g/t Au from 29.70 m - 30.50 m

- Including - 0.50 m @ 57.90 g/t Au from 30.50 m - 31.00 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-014: 1.20 m @ 3.72 g/t Au from 84.00 m - 85.20 m

- PE-25-014: 0.50 m @ 17.0 g/t Au from 96.00 m - 96.50 m

- PE-25-014: 1.10 m @ 4.51 g/t Au from 105.00 m - 106.10 m

- PE-25-014: 18.40 m @ 1.28 g/t Au from 145.60 m - 164.00 m

- Including - 0.7 m @ 8.43 g/t Au from 152.95 m - 153.65 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-015: 3.00 m @ 7.48 g/t Au from 225.50 m - 228.50 m

- Including - 0.55 m @ 37.00 g/t Au from 226.85 m - 227.40 m

- PE-25-015: 1.30 m @ 5.03 g/t Au from 242.40 m - 243.70 m

- PE-25-015: 5.55 m @ 4.37 g/t Au from 261.00 m - 266.55 m

- Including - 0.55 m @ 15.50 g/t Au from 261.00 m - 261.55 m

- Including - 0.80 m @ 18.45 g/t Au from 265.75 m - 266.55 m

- PE-25-015: 1.25 m @ 2.87 g/t Au from 311.00 m - 312.25 m

- PE-25-015: 2.75 m @ 2.42 g/t Au from 318.00 m - 320.75 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-016: 1.80 m @ 5.65 g/t Au from 293.00 m - 294.80 m

- Including - 0.80 m @ 10.55 g/t Au from 293.00 m - 293.80 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-017: 0.80 m @ 19.65 g/t Au from 130.20 m - 131.00 m

- PE-25-017: 0.50 m @ 9.02 g/t Au from 255.50 m - 256.00 m

- PE-25-017: 0.50 m @ 8.09 g/t Au from 376.20 m - 376.70 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-018: 4.20 m @ 2.16 g/t Au from 423.30 m - 427.50 m

- PE-25-018: 1.75 m @ 3.44 g/t Au from 474.50 m - 476.25 m

- Including - 0.50 m @ 9.64 g/t Au from 475.10 m - 475.60 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-019: 2.00 m @ 3.41 g/t Au from 213.00 m - 215.00 m

- PE-25-019: 4.60 m @ 12.35 g/t Au from 269.40 m - 274.00 m

- Including - 0.50 m @ 107.50 g/t Au from 270.00 m - 270.50 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-020: 0.50 m @ 73.20 g/t Au from 38.10 m - 38.60 m

- PE-25-020: 2.20 m @ 1.97 g/t Au from 54.30 m - 56.50 m

- PE-25-020: 1.00 metre @ 2.85 g/t Au from 146.40 m - 147.40 m

- PE-25-020 : 0.50 m @ 8.32 g/t Au from 218.20 m - 218.70 m

---------------------------------------------------------------------------------------------------------------------

These intersections do not represent true widths. The intersections highlighted in this press release represents drill indicated intersections along the core length.

The mineralization intersected is characterized as mostly being hosted in flat extensional quartz-ankerite veins and veinlets. Gold mineralization is closely associated with fine disseminated pyrite with sericite (white mica) alteration.

The mineralized corridor is located between two third order shear zones and is closely associated with a swarm of felsic tonalitic to intermediate dioritic dykes.

Eldorado Gold (Québec) Inc. Option Agreements:

The Company, Eldorado Gold and Golden Valley Mines & Royalties Inc., as it then was ("Golden Valley") entered into an Assignment Agreement dated January 25, 2023, pursuant to which Golden Valley assigned to the Company all its rights and obligations under an Option Agreement dated October 8, 2021 ("the Option Agreement") between Golden Valley and Eldorado. As the assignee under the Option Agreement, the Company has granted to Eldorado an option ("the Option") to acquire an additional

In order to maintain and to exercise the Option, Eldorado must incur minimum expenditures of

Mr. Glenn J. Mullan, PGeo, President and CEO of Val-d'Or Mining, is the Qualified Person (as that term is defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects) who has reviewed this news release and is responsible for the technical information reported herein.

Eldorado Gold has not approved and is not responsible for the contents of this news release.

About Val-d'Or Mining Corporation

Val-d'Or Mining Corporation is a junior natural resource issuer involved in the process of acquiring and exploring its diverse mineral property assets, most of which are situated in the Abitibi Greenstone Belt of NE Ontario and NW Québec. To complement its current property interests, the Company regularly evaluates new opportunities for staking and/or acquisitions. Outside of its principal regional focus in the Abitibi Greenstone Belt, the Company holds several other properties in Northern Québec (Nunavik) covering different geological environments and commodities (Ni-Cu-PGE's).

The Company has expertise in the identification and generation of new projects, and in early-stage exploration. The mineral commodities of interest are broad, and range from gold, copper-zinc-silver, nickel-copper-PGE to industrial and energy minerals. After the initial value creation in the

For additional information, please contact:

Glenn J. Mullan

2772 chemin Sullivan

Val-d'Or, Québec J9P 0B9

Tel.: 819-824-2808, x 204

Email: glenn.mullan@goldenvalleymines.com

Forward-Looking Statements:

This news release contains certain statements that may be deemed "forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or realities may differ materially from those in forward looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267986