Viscount Reinforces Silver Expansion Potential at the Kate Deposit with Continuous Silver Corridor

Rhea-AI Summary

Viscount Mining (OTCQB: VLMGF) reported results from a 2025 MMI soil-geochemistry program at the Kate Silver Deposit, part of its 100%‑owned Silver Cliff Project in Colorado. The 549-sample survey across ~1,800 ft2 defined a coherent, high‑grade silver-in-soil anomaly forming a continuous north–south corridor that aligns with structural mapping and historical drilling.

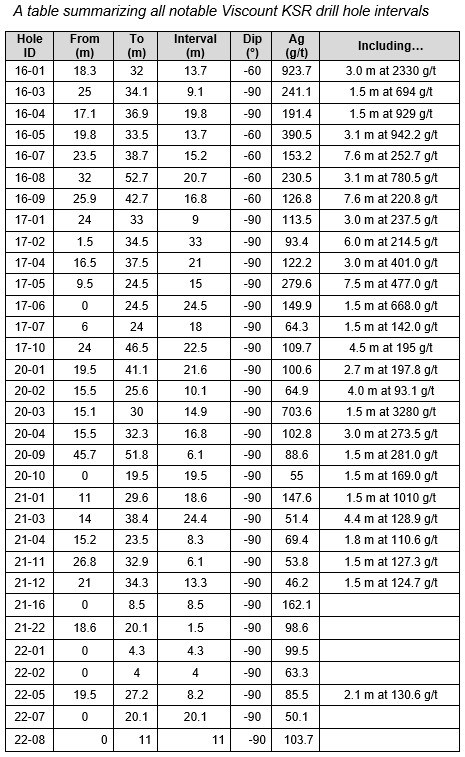

Integration with prior drilling and airborne imagery suggests a near‑surface epithermal system that remains open to the north and northeast. Viscount highlighted historical high‑grade drill results (25 holes with intervals >110 g/t Ag; 10 holes with intervals >400 g/t Ag) and a current NI 43-101 resource estimated at a US$24/oz silver cutoff. No new resource or economic study has been completed. Permitting is underway for a planned 2026 drill program of ~10 holes totaling 500–750 m to test Kate North, Kate Northeast, Ben West, and infill targets.

Positive

- Coherent silver‑in‑soil anomaly defined by 549 MMI samples

- Continuous north–south trend aligns with structural fabric

- 25 drill holes with intervals >110 g/t Ag

- 10 drill holes with intervals >400 g/t Ag

- Planned 2026 program: ~10 holes totaling 500–750 m

Negative

- No new NI 43-101 resource estimate or economic analysis completed

- Existing resource based on a US$24/oz Ag cutoff; reassessment pending future drilling

- 2026 drill program requires permitting, which may affect timing

News Market Reaction – VLMGF

On the day this news was published, VLMGF gained 12.65%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers in Other Precious Metals & Mining (e.g., ACKRF +25.27%, TBXXF +3.27%) show generally positive moves, while VLMGF is flat at 0%, suggesting today’s exploration update is being priced more stock-specifically.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | Exploration update | Positive | +6.9% | Integrated 2025 datasets defined broad copper‑gold corridor and deep MT anomaly. |

| Sep 09 | Program expansion | Positive | +0.3% | Expanded work at Kate and Passiflora, detailing ounces and new exploration plans. |

| Aug 14 | Discovery drill hole | Positive | -27.1% | First deep hole confirmed robust copper‑gold porphyry over entire 843.9 m interval. |

Positive technical exploration news has often led to favorable or mixed price reactions, with one notable selloff despite a strong discovery.

Over recent months, Viscount has repeatedly highlighted the Silver Cliff Project’s potential. On Aug 14, 2025, a major copper‑gold porphyry discovery at Passiflora still saw shares drop 27.08%, showing a tendency for profit‑taking on strong news. Later updates on expanded work programs and integrated datasets on Sep 9 and Dec 9 produced modest to solid gains of 0.27% and 6.91%. The current Kate silver corridor update extends this technical de‑risking narrative at the same Colorado project.

Market Pulse Summary

The stock surged +12.7% in the session following this news. A strong positive reaction aligns with the company’s pattern of using technical results to expand the Silver Cliff story. The continuous silver-in-soil corridor and historic intervals over 400 g/t support perceived resource upside. However, past news saw a 27.08% drop on good results, so enthusiasm could fade if follow-up drilling underdelivers or funding and timelines become concerns.

Key Terms

epithermal technical

MMI soil-geochemistry technical

NI 43-101 regulatory

breccia pipes technical

Qualified Person regulatory

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - December 11, 2025) - Viscount Mining Corp. (TSXV: VML) (OTCQB: VLMGF) ("Viscount" or the "Company") is pleased to provide an updated interpretation of the 2025 soil-geochemistry program at the Kate Silver Deposit ("Kate"), part of the Company's

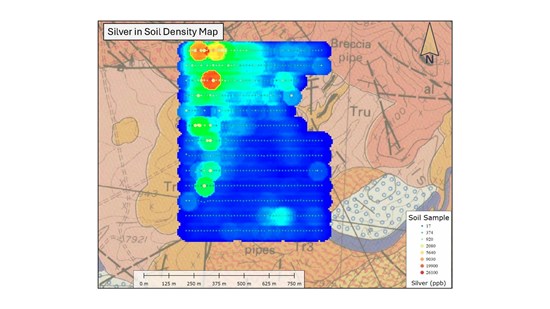

Kate Silver Deposit – Strong Silver Anomaly

The 2025 MMI soil-geochemistry program (549 samples) covering an area of 1800 FT2 defined a coherent and highly developed silver-in-soil anomaly centered directly on the Kate Deposit. This anomaly forms a distinct north–south corridor extending into the Kate North and Kate Northeast target areas and aligns closely with the structural fabric of the known epithermal system. The strength and continuity of the anomaly support the interpretation that silver mineralization extends beyond the current NI 43-101 resource footprint.

Interpretation – Strong Epithermal Silver System Along a Continuous Trend

Integration of soil geochemistry, structural data, historical drilling and prior airborne imagery confirms that Kate hosts a strong epithermal silver system tied directly to the known resource. Mineralization appears to extend along a continuous north–south trend that remains open to the north, northeast. These characteristics are consistent with a larger, near-surface system and provide good guidance for the up-coming drill program.

Silver Expansion Potential

The Kate Deposit is a shallow, silver-rich epithermal system that hosts the current NI 43-101 mineral resource based on US

The 2025 geochemical survey, combined with historical drilling, highlights expansion potential to the north and northeast. Historical drilling by previous operators returned numerous multi-ounce silver intercepts occur along the structural extensions near the Jay Gould breccia pipes, indicating the system remains open.

To the west, the Ben West alignment returned historical multi-ounce silver intercepts along a northeast-trending structure. This may represent a separate mineralized center or an extension of the Kate system. These zones collectively define a cluster of high-priority near-surface targets.

Viscount Past Drill Highlights

Throughout these six drilling campaigns performed at the Kate, fifty-four drill holes were drilled by Viscount. Of these, twenty-five drill holes presented intervals assaying greater than 110 g/t and ten drill holes displaying intervals assaying over 400 g/t.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2736/277332_cadec6fd04836865_002full.jpg

Figure 1: Silver-in-Soil Density Map (MMI Method)

Figure 1. Silver-in-Soil Density Map (MMI Method).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2736/277332_cadec6fd04836865_003full.jpg

2026 Drill Program Planning

Viscount is integrating the 2025 soil-geochemistry results with its 2022–2023 drilling data, structural mapping, historic drill information, and airborne imagery into updated 3D geological models. The 2026 drill program is expected to include 10 drill holes over a total distance of 500M to 750M:

- Step-out drilling at Kate North

- Step-out drilling at Kate Northeast

- Drill testing of the Ben West structural corridor

- Infill drilling within the existing resource envelope to support future technical work and revised NI 43-101

Permitting for the 2026 drill program is underway.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Harald Hoegberg CPG, an independent consulting geologist who is a "Qualified Person" (QP) as such term is defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

About Viscount Mining (TSXV: VML) (OTCQB: VLMGF)

Viscount Mining Corp. is a project generator and mineral exploration company focused on advancing high-quality silver, gold, and copper assets in the Western United States. The Company's portfolio includes the Silver Cliff silver project in Colorado and the Cherry Creek multi-metal district in Nevada.

Silver Cliff Project — Colorado

Silver Cliff is located in the historic Hardscrabble Silver District and comprises 96 lode claims with year-round paved access and established local infrastructure. The project covers a large volcanic caldera system recognized for its silver, gold, and base-metal potential.

The property includes two principal zones of focus:

- Kate Deposit (Silver Resource Area): The Kate hosts a NI 43-101 compliant near-surface silver resource published by an independent QP (details: Measured & Indicated and Inferred silver resources were reported in the Company's technical disclosure; investors are encouraged to review the full technical report available on SEDAR+ for tonnage, grade, and methodology).

- Passiflora Porphyry Target: Historical and modern drilling indicate extensive hydrothermal alteration consistent with a large porphyry system. Recent drilling by Viscount (hole PF-23-03A) intersected 843.9 metres of continuous copper-gold mineralization, which the Company interprets as being on the periphery of a potentially larger intrusive centre. Mineralization remains open in multiple directions.

Cherry Creek Project — Nevada

Cherry Creek covers 219 unpatented and 17 patented claims in a well-known historic mining district approximately 50 miles north of Ely. The property includes more than 20 past-producing mines and hosts several styles of mineralization, including silver-gold veins, carbonate-replacement (CRD) zones, jasperoids, and porphyry-related alteration. The district is

Viscount's strategy is to acquire, explore, and advance high-potential mineral properties through systematic geological work, while continuing to build partnerships that support long-term development.

For additional information regarding the above noted property and other corporate information, please visit the Company's website at www.viscountmining.com.

ON BEHALF OF THE BOARD OF DIRECTORS

"Jim MacKenzie"

President, CEO and Director

For further information, please contact:

Viscount Investor Relations

Email: info@viscountmining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements" within the meaning of applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to Viscount Mining's operations, exploration and development plans, expansion plans, estimates, expectations, forecasts, objectives, predictions and projections of the future. Specifically, this news release contains forward-looking statements with respect to the actual size of the anomaly, feasibility, grade of mineralization and the content of the mineralization. Generally, forward-looking statements can be identified by the forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "projects", "intends", "anticipates", or "does not anticipate", or "believes", or "variations of such words and phrases or state that certain actions, events or results "may", "can", "could", "would", "might", or "will" be taken", "occur" or "be achieved". Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Viscount Mining to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the exploration and development and operation of Viscount Mining's projects, the actual results of current exploration, development activities, conclusions of economic evaluations, changes in project parameters as plans continue to be refined, future precious metals prices, as well as those factors discussed in the sections relating to risk factors of our business filed in Viscount Mining's required securities filings on SEDARPlus. Although Viscount Mining has attempted to identify important factors that could cause results to differ materially from those contained in forward-looking statements, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277332