Vornado Realty Trust to Purchase 623 Fifth Avenue

Rhea-AI Summary

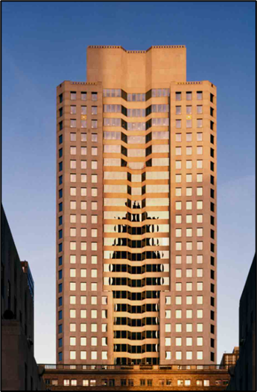

Vornado Realty Trust (NYSE:VNO) has announced plans to acquire the 623 Fifth Avenue office condominium for $218 million. The 36-story building, spanning 382,500 rentable square feet, is situated above the flagship Saks Fifth Avenue department store.

The property, currently 75% vacant, will undergo a complete repositioning and redevelopment to become a premier Class A boutique office building. The acquisition is expected to close in September 2025, with redevelopment completion and tenant delivery scheduled for 2027. The building will complement Vornado's existing Plaza District and Park Avenue portfolio, which includes several prestigious properties.

Positive

- Strategic acquisition in prime Manhattan location with protected views of Midtown

- Opportunity to transform 75% vacant property into Class A boutique office space

- Complementary addition to existing premium Manhattan portfolio

- Relatively quick development timeline with delivery by 2027

Negative

- Significant capital investment required for complete repositioning and redevelopment

- 75% vacancy rate in current building state

- Exposure to interest rate fluctuations and inflation risks

- No immediate revenue generation due to redevelopment period

News Market Reaction

On the day this news was published, VNO declined 0.74%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vornado Realty Trust

623 Fifth Avenue

NEW YORK, Aug. 25, 2025 (GLOBE NEWSWIRE) -- Vornado Realty Trust (NYSE:VNO) announced today that it has entered into an agreement to purchase the 623 Fifth Avenue office condominium, a 36-story, 382,500 rentable square foot building situated above the flagship Saks Fifth Avenue department store, for

The building is currently

Vornado expects to close the acquisition in September 2025 and complete the redevelopment for delivery to tenants in 2027.

Vornado Realty Trust is a fully-integrated equity real estate investment trust.

C O N T A C T

Thomas J. Sanelli

(212) 894-7000

Certain statements contained herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of performance. They represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Our future results, financial condition and business may differ materially from those expressed in these forward-looking statements. You can find many of these statements by looking for words such as "approximates," "believes," "expects," "anticipates," "estimates," "intends," "plans," "would," "may" or other similar expressions in this press release. For a discussion of factors that could materially affect the outcome of our forward-looking statements and our future results and financial condition, see “Risk Factors” in Part I, Item 1A, of our Annual Report on Form 10-K for the year ended December 31, 2024. Currently, some of the factors are interest rate fluctuations and the effects of inflation on our business, financial condition, results of operations, cash flows, operating performance and the effect that these factors have had and may continue to have on our tenants, the global, national, regional and local economies and financial markets and the real estate market in general.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/348c405b-31ea-4fbb-b0c1-f11fa056e59d